Brycia James

Many stocks that were top performers in 2020 and 2021 have significantly underperformed throughout 2022. Key trends, such as more significant domestic investments (home upgrades, etc.), have also reversed as people reduce spending. The GDP has declined for two quarters in a row, traditionally signaling a recession. Although there has been no substantial rise in unemployment, real wages are falling, and savings rates have slipped as rising prices strain spending levels.

Many companies that saw stellar revenue growth over recent years will likely see sales decline or slow over the coming year. At the same time, rising prices and interest rates are creating new margin pressures, resulting in potential top and bottom-line losses. Investors and traders may be able to hedge against these key market risks by looking for opportunistic short opportunities. I believe the home retailer Williams-Sonoma (NYSE:WSM) may be a great short opportunity today as I expect the company’s earnings will fall significantly due to macroeconomic strain.

Economic Downturns Have Consequences

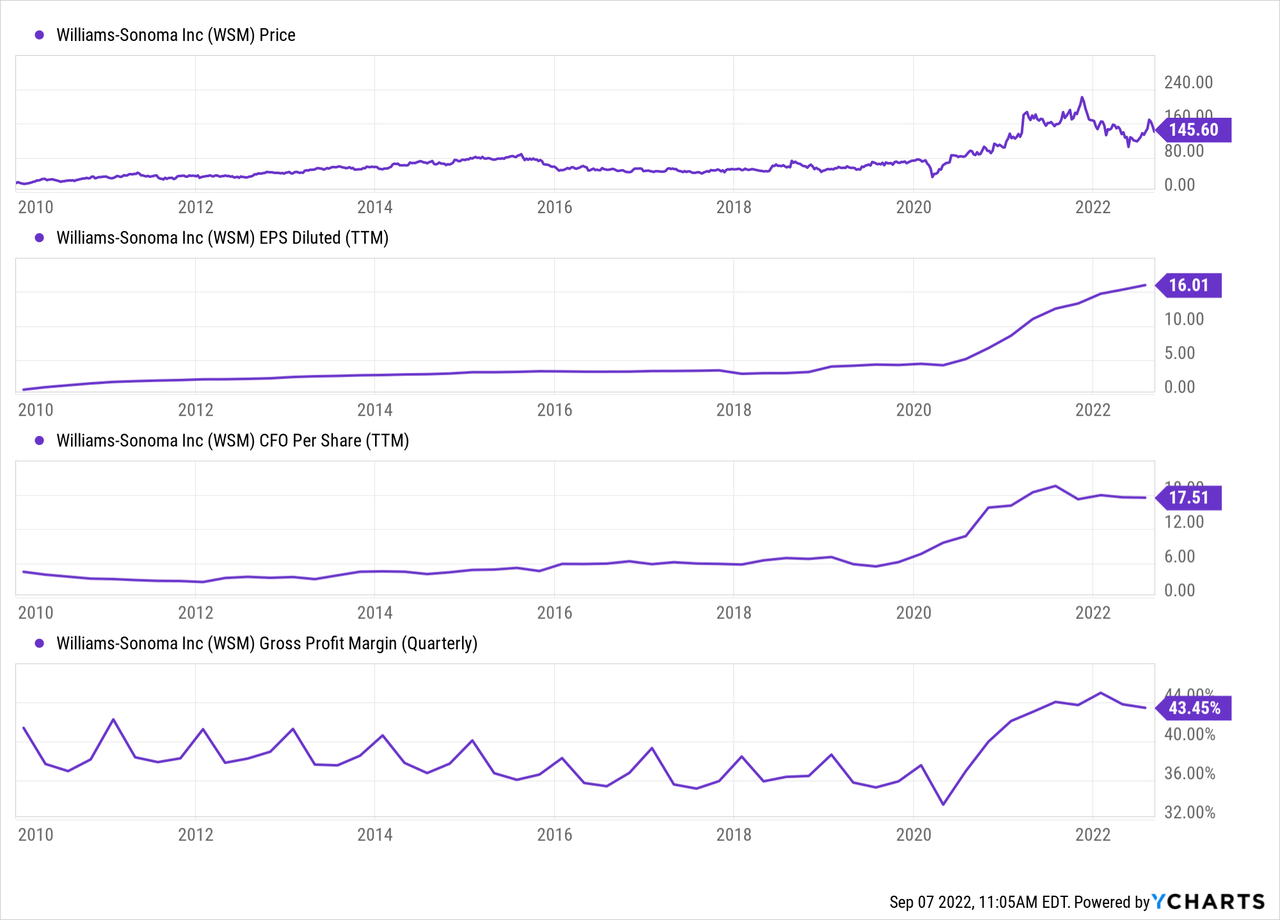

During Williams Q2 conference call, the company made it clear that it was aware of growing economic risks, including rising costs and slowing retail demand. While managers focused on its strong past performance and market share, I believe Williams-Sonoma has undeniably extensive economic exposure, as do all furniture companies. However, even without a recession dynamic, investors should not expect Williams profit levels to remain as high as they have been since 2021. The company’s earnings, cash flow, and gross margins spiked dramatically over the past two years after being flat (or declining) prior. See below:

The primary driver of the firm’s earnings expansion was the sharp rise in its gross profit margins. There has been a slight decline in its “operating expense to revenue” ratio as employee overhead costs fall, but the rise in net unit prices (or item prices) appears to be the critical factor. As stated in its last earnings call, the company’s gross margins have risen due to an end to site-wide promotional discounts. Though, its gross margins have begun to slip due to increasing freight costs.

Gas prices have declined during Q3, so that we may see a slight increase in gross margins during the quarter. However, I doubt the company will manage to maintain its top line without promotional discounts (or at least lower inflation-adjusted net sales prices). During 2020 and 2021, many more people were at home, and savings rates soared, causing many people to invest in home furniture or other expensive at-home items. Today, far fewer are at home while savings rates are meager, meaning fewer people can afford to make such investments. Further, many people purchased such items over the past two years, so they likely have limited need for further purchases.

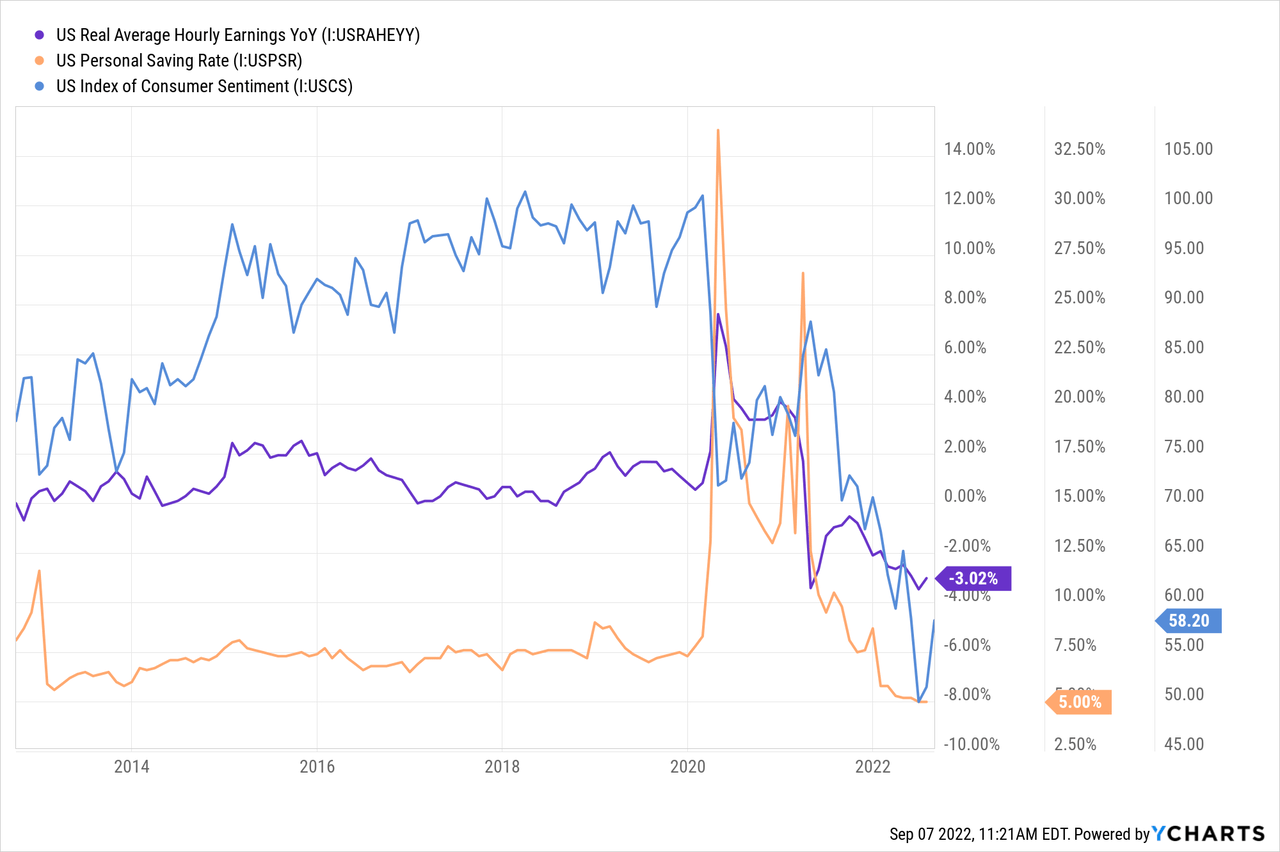

The macroeconomic trend facing the consumer discretionary sector is undeniable; real wages, savings, and consumer sentiment have all decreased dramatically over the past year. See below:

The spike in real wages and savings during 2020 offset the initial economic shock of lockdowns and spurred a boom in discretionary goods sales. Today, rising living costs have created an apparent reversal as real hourly pay slips, causing people to save far less money each month and straining sentiment.

The company’s B2B business may seem safe due to its considerable growth. Still, its B2B sales may be booming as companies look to make CapEx investments to reduce taxes on skyrocketing profits. Most companies appear economically stronger than households, temporarily supporting Williams B2B segment, but it is rare for corporate earnings to continue to rise while people race to reduce spending. Thus, I do not believe the B2B segment significantly reduces its economic risk exposure.

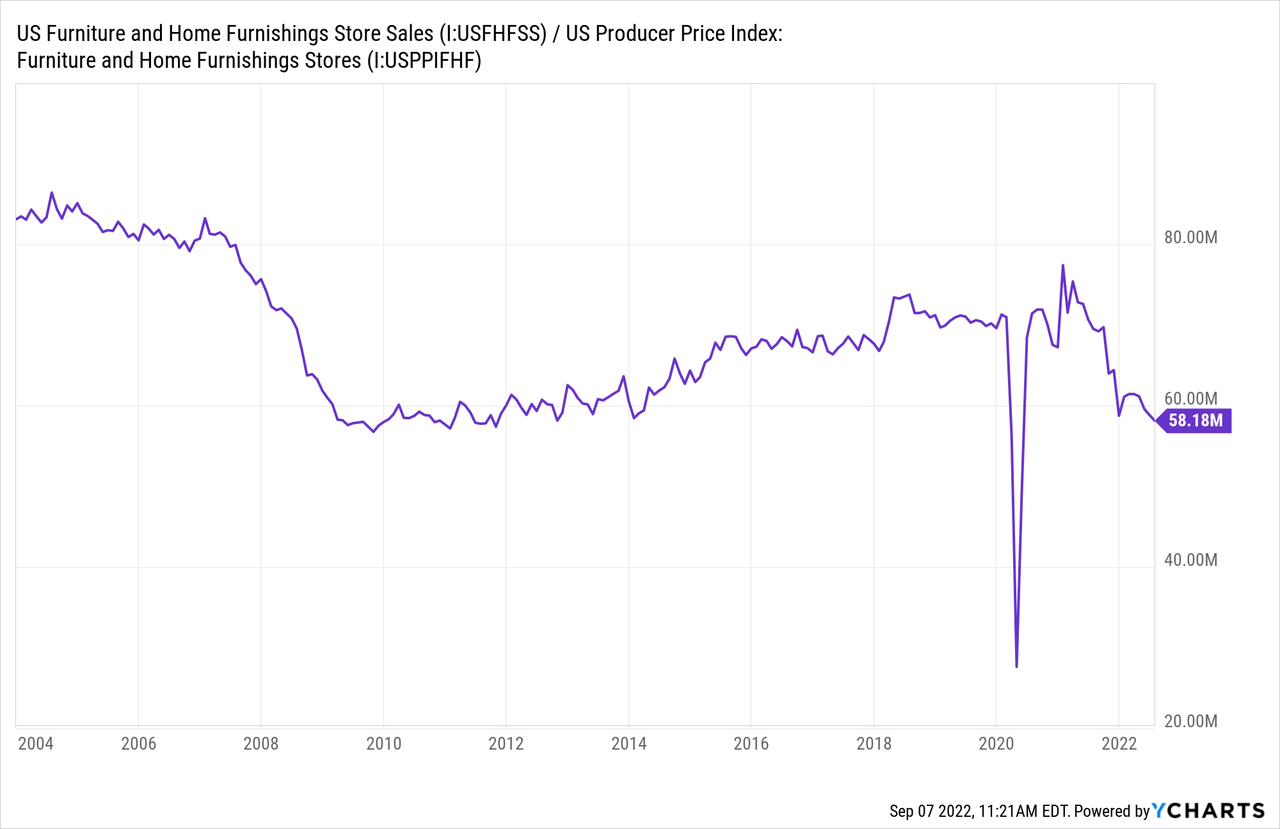

Overall “home furniture sales” have been flat since 2021, but adjusting for their PPI, it is clear that unit sales (number of items sold) levels are plummeting:

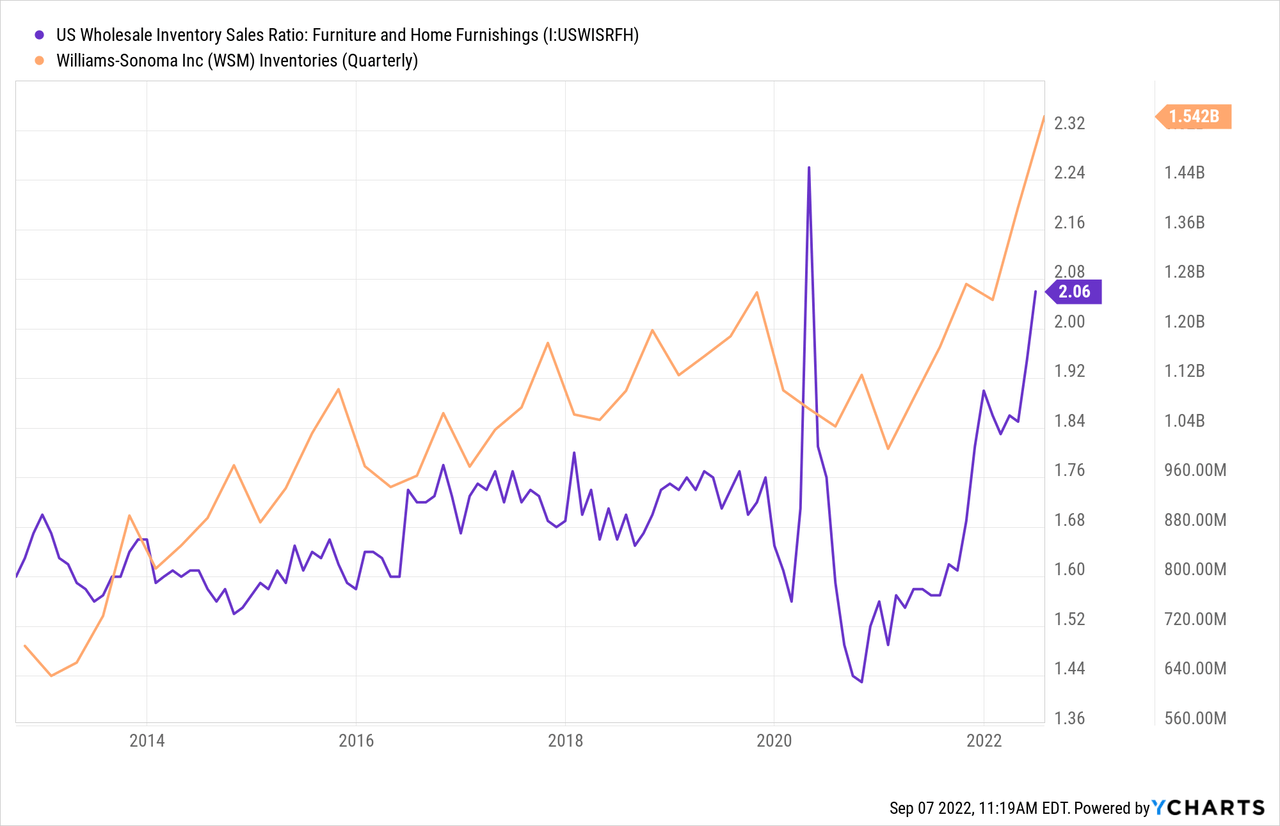

The decline in estimated unit sales today is similar to 2007 and is relatively consistent each month. In my view, this is a solid indication that the furniture and home furnishing industry is in a significant downturn that will spur lower sales and greater price-cutting competition. While Williams-Sonoma may keep its unit sales levels strong, it is difficult to avoid price-cutting competition as inventory levels rise. After falling during 2020, the inventory-to-sales ratio for the Furniture and Home Furnishings industry has dramatically increased this year, and Williams inventory has also increased. See below:

The sharp rise in both Williams inventory and the industry’s inventory ratio indicates that unit sales are slowing. Eventually, this trend should result in a decline in unit prices, likely causing Williams gross margins and earnings to decline dramatically.

I believe these trends will be lasting and consistent since it is driven both by an unwind in the 2020-2021 retail sales boom and the growing inflationary economic strain. Additionally, consumer financing on expensive furniture will likely become more costly and less attainable. At the least, I expect Williams-Sonoma’s earnings to decline to pre-spike levels of $4-$6, as it seems highly unlikely the company will continue to manage without site-wide promotions. That said, as in past recessions, the firm may see its earnings decline toward or below zero if sales slow sufficiently under economic strain.

What is WSM Stock Worth?

Williams-Sonoma’s stock is currently priced at $146 and has a forward “P/E” ratio of 8.5X based on an estimated forward EPS of $16.6. In my opinion, it is doubtful the company will maintain this EPS level as it seems its earnings spike was driven by one-off market dynamics (stimulus checks, work from home, savings rise), which are no longer in effect. I do not believe the company has made any sufficient fundamental changes over the past year that will allow it a permanent advantage.

The growth of its e-commerce business certainly gives it a temporary advantage, but most of its major competitors have followed suit. Price competition is also much more prominent on the internet since it is far easier for customers to compare. Even if brick & mortar retailers cannot easily access the online market, large retailers may cut prices toward zero profits.

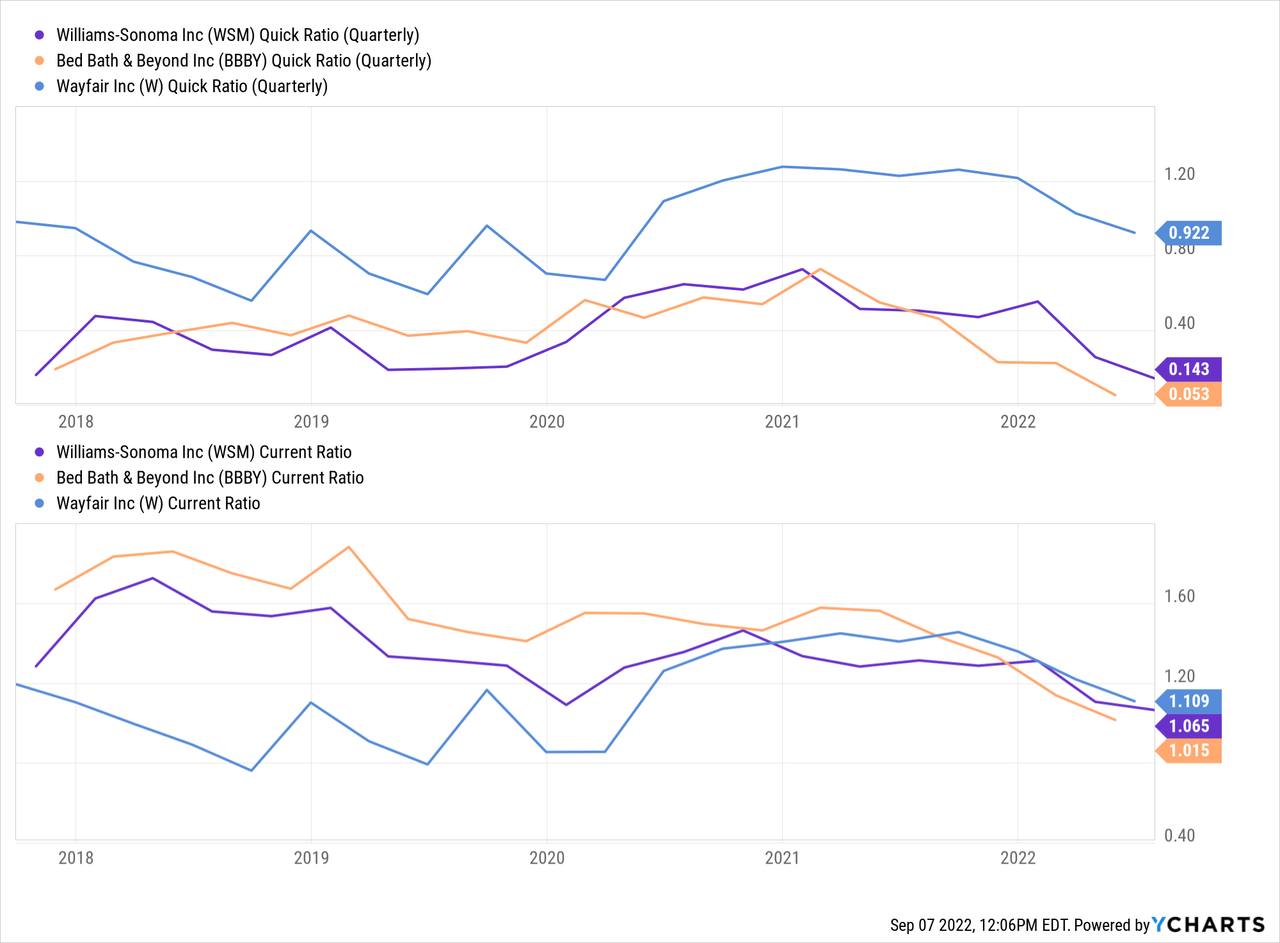

Williams does not have any long-term financial debt but does carry some financial risk if its inventories continue to rise. The company’s competitors, Bed Bath & Beyond (BBBY) and Wayfair (W), have all seen their current ratios grow and decline over the past three years. This pattern indicates the industry is seeing short-term liabilities begin to mount over current assets. The trend is particularly alarming if we remove inventories by looking at the quick ratio. See below:

Bed Bath & Beyond had an extremely low quick ratio of 0.05 in Q1, implying the firm had almost no cash compared to current liabilities. Given its peers saw current ratio declines during their last reports, it seems likely that Bed Bath & Beyond has as well, signifying a fair amount of bankruptcy risk. Williams-Sonoma is not far behind, with a quick ratio of only 0.14. The company has had such a quick ratio in years past. Still, given the state of the retail economy and inflation, Williams may struggle to remain afloat without aggressive price cuts that improve sales and shore up cash.

I believe WSM is worth closer to $40-$60 per share today based on my view that its EPS will quickly return to pre-pandemic levels as the “boom” wears off. WSM was trading at such levels before 2020, relating to a fair “P/E” of 10X given a $4-$6 annual EPS estimate. Indeed, I would not be surprised to see the stock eventually fall below such levels as it may need to take more substantial actions to improve cash by selling inventory faster into a slowing market.

The Bottom Line

Overall, I am very bearish on WSM and believe the stock is a short opportunity at its current price. Of course, short-selling WSM is not without risks, particularly a short squeeze, as we’ve seen in Bed Bath and Beyond. WSM has become a target to short-sellers with a short interest level of 19%, giving it a relatively high short-squeeze risk. This risk can be mitigated by buying put options or call option hedges on short positions. However, WSM options are not cheap, given their 46% implied volatility. A sizeable short squeeze would be far more likely to occur after the stock has declined by a greater degree, as was the case in Bed Bath and Beyond.

Fortunately, the short-interest fee on WSM shares is nearly zero, and its dividend is low (and liable to be cut), so the carry cost is minimal. Of course, it is also possible that WSM’s prospects recover if the economic strain on consumption definitively reverses and personal savings levels rise. Even then, it seems WSM’s margins have some risk from an inevitable growth in e-commerce competition. Despite the relative decline in fuel prices, I do not believe inflation’s strain on the economy will end soon. As such, it seems WSM is likely to face larger earnings revisions during Q3 and Q4, and I expect it to be trading much lower by year-end.

Be the first to comment