Young couple doing online Christmas shopping Marko Geber/DigitalVision via Getty Images

What’s the most surefire strategy to build generational wealth? I would argue that the answer is to allocate capital to dominant stocks in industries with a lengthy growth runway ahead.

Global e-commerce is undoubtedly a promising industry. This is supported by the fact that analysts anticipate total e-commerce sales will rise from $5.5 trillion in 2022 to $7.4 trillion by 2025.

Williams-Sonoma (NYSE:WSM) is one quality stock that derives a significant majority of its sales from e-commerce. That’s why the stock price has nearly quadrupled, and its dividend has doubled since making it the first position within my dividend growth stock portfolio in 2017.

But I believe there is quite a bit of capital appreciation and dividend growth left in Williams-Sonoma’s future. I’ll discuss a few reasons for my strong buy rating and go into the major risks facing the stock.

A Robust Dividend Growth Reputation That Should Continue

Williams-Sonoma boasts an impressive five-year annual dividend growth rate of 11.9%. But can the stock keep such a rapid dividend growth rate going?

Williams-Sonoma’s 1.89% dividend yield is more than double the specialty retail industry average of 0.84%. While this can signal that a dividend may be at risk, it doesn’t always give the complete story.

Williams-Sonoma generated $14.85 in adjusted diluted EPS during 2021 while it paid out $2.42 in dividends per share during that time. This works out to an adjusted diluted EPS payout ratio of just 16.3%.

And the average analyst estimate is $14.59 in adjusted diluted EPS for 2022 (which I think will prove to be too low since Williams-Sonoma has a history of handily beating analysts’ estimates). Compared to the $3.05 in dividends per share that are slated to be paid this year, that is equivalent to a 20.9% adjusted diluted EPS payout ratio.

Williams-Sonoma’s dividend payout ratios leave room for the company to grow its dividend moderately ahead of earnings for the foreseeable future. Coupled with the fact that analysts are predicting 11%-plus annual earnings growth over the next five years, I believe an 8.25% annual dividend growth rate is a reasonable expectation for the stock.

Williams-Sonoma’s Fundamentals Remain Strong

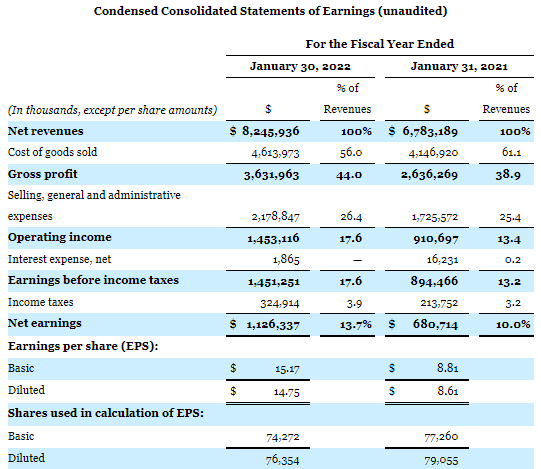

Williams-Sonoma Q4 2021 Earnings Press Release

Williams-Sonoma executed flawlessly in 2021, which is what allowed the company to report tremendous earnings results for shareholders during the year.

The company recorded $8.25 billion in net revenue in 2021, which was good enough for a 21.6% growth rate against the year-ago period (data sourced from Williams-Sonoma’s Q4 2021 earnings press release). What drove this incredible net revenue growth for Williams-Sonoma?

As President and CEO Laura Alber noted in her opening remarks during the company’s recent earnings call, a record-high 60% of Williams-Sonoma’s 2021 sales came from cross-brand customers. This is significant because Alber went on to point out these customers generate 3x to 4x more revenue than the single brand customer.

This helps to explain how Williams-Sonoma’s comparable brand revenue growth surged 22% higher year-over-year (figure according to Williams-Sonoma’s Q4 2021 earnings press release).

What’s more, the company’s adjusted diluted EPS skyrocketed 64.3% higher year-over-year to $14.85 in 2021 (details per Williams-Sonoma’s Q4 2021 earnings press release).

This is because Williams-Sonoma’s higher revenue base led to a 370-basis point year-over-year expansion in net margin to 13.7%. And a 3.4% reduction in the company’s outstanding share count to 79.1 million was the other piece of the puzzle that propelled adjusted diluted EPS higher (data sourced from Williams-Sonoma’s Q4 2021 earnings press release).

Looking ahead, the company reiterated its guidance of mid-to-high single-digit annual net revenue growth to $10 billion by the fiscal year 2024. With operating margins expected to be in line with 2021 and a $1.5 billion share repurchase program recently authorized by the company, low-double-digit annual earnings growth should continue over the medium-term (all figures according to Williams-Sonoma’s Q4 2021 earnings press release aside from the share repurchase authorization amount).

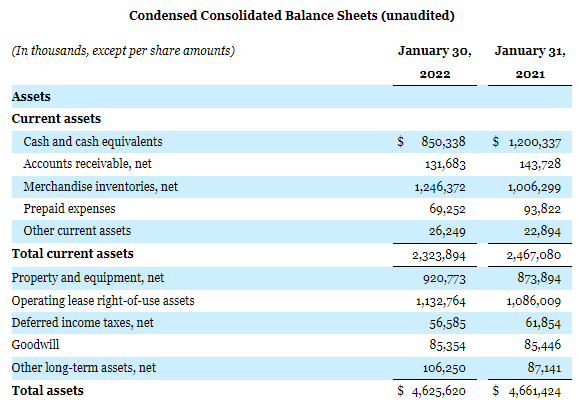

Williams-Sonoma Q4 2021 Earnings Press Release

Aside from Williams-Sonoma’s encouraging growth outlook for the next few years, the company also possesses an unblemished balance sheet.

Williams-Sonoma had an $850 million cash balance at the end of its fiscal year against no long-term debt. For context, $850 million is approximately 7% of the stock’s $12 billion market cap. Since the balance sheet is overflowing with cash, I expect that Williams-Sonoma will return tons of capital to shareholders through dividend raises, potential special dividends, and share buybacks.

These attributes make the stock a great buy for long-term investors if the valuation paid is sensible.

Risks To Consider:

Because Williams-Sonoma is a stock, it’s essential to realize that it comes with its fair share of risks. That’s why I will be going over several major risks as outlined in the stock’s 10-K from last year (the one for this year won’t be coming out for approximately another two weeks.

The first risk to Williams-Sonoma is that the company’s future results depend on its ability to adapt to changing consumer preferences (pages 12-13 of last year’s 10-K). Williams-Sonoma has done a masterful job of getting out ahead of the curve concerning providing customers with an engaging shopping experience both in-person and online.

But there are no guarantees that the company will continue to outperform its competitors. If Williams-Sonoma drops the ball at any point, the competitiveness of its industry almost guarantees someone else will seize the moment and take market share from the company.

Another risk to Williams-Sonoma is one that large-cap stocks especially have to be careful with during the information age, which is the potential for a major cyber breach to occur (pages 19-20 of last year’s 10-K).

Williams-Sonoma’s IT networks contain treasure troves of confidential customer and vendor data, which could be enticing to possible hackers. And even with the company taking all the necessary steps to prevent these cyber breaches, such an event could still happen.

A significant cyber breach could result in sizable lawsuits against Williams-Sonoma and damage its reputation among customers. This could do irreversible damage to the brand and break the investment thesis in a worst-case scenario.

The final risk to Williams-Sonoma is that approximately 65% of its merchandise purchases are concentrated from vendors in Europe and Asia (pages 21-22 of last year’s 10-K).

This is critical to know because pandemics, natural disasters, or geopolitical instability in these regions could materially disrupt Williams-Sonoma’s business. An inability to secure merchandise elsewhere in a pinch could also harm the company’s financial results and brand if it isn’t able to meet the demand of its customers.

While I have gone over a few key risks facing Williams-Sonoma, this isn’t an exhaustive discussion of its risks. I’d encourage readers to check out pages 9-29 of Williams-Sonoma’s most recent 10-K and my prior articles on the stock for a more complete discussion of its risk profile.

A Wonderful Stock Priced At A Deep Discount

Williams-Sonoma’s overall quality as a dividend growth stock makes it one that just about every investor should consider for their portfolio. But even for great stocks, there’s a fine line between overpaying and getting a deal.

This is why I’ll employ two valuation models to approximate the fair value of shares of Williams-Sonoma.

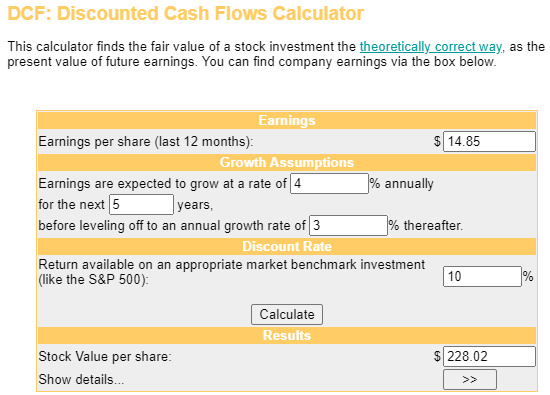

Money Chimp

The first valuation model that I will use to estimate the fair value of Williams-Sonoma’s shares is the discounted cash flows model or DCF model, which consists of three inputs.

The first input for the DCF model is the last twelve months of earnings. This amount is $14.85 in adjusted diluted EPS for Williams-Sonoma.

The next input into the DCF model is growth assumptions. The DCF model is only as valid as to its growth assumptions, which is why it’s important to err on the side of caution in my opinion.

That’s why I will assume a 4% five-year annual growth rate in Williams-Sonoma’s adjusted diluted EPS and deceleration to a 3% annual growth rate beyond that time frame.

The final input for the DCF model is the discount rate, which is simply the annual total return rate that an investor requires on their investments. I use 10% because I think that’s a fair return for my efforts.

I come out at a fair value output of $228.02 a share. This means that shares of Williams-Sonoma are priced at a 27.6% discount to fair value and offer a 38.2% upside from the current price of $165.00 a share (as of March 19, 2022).

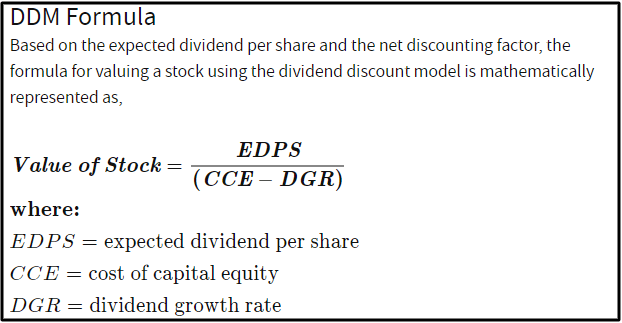

Investopedia

The second valuation model that I’ll utilize to value Williams-Sonoma’s shares is the dividend discount model or DDM, which involves three inputs.

The first input for the DDM is the expected dividend per share, which is the annualized dividend per share. The new annualized dividend per share is $3.12.

The second input into the DDM is the cost of capital equity, which is the required annual total return rate. I’ll again use 10% for this input.

The third input for the DDM is the long-term annual dividend growth rate or DGR.

Unlike the first two inputs into the DDM that require data retrieval to retrieve a stock’s annualized dividend per share and subjectiveness to set an annual total return rate, accurately forecasting the long-term dividend growth rate requires an investor to consider numerous variables: These include a stock’s payout ratios (and whether those payout ratios are positioned remain the same, contract, or expand in the future), future annual earnings growth, industry fundamentals, and the state of a stock’s balance sheet.

Given that Williams-Sonoma is likely to generate low-double-digit annual earnings growth over the medium term, I don’t believe it’s a stretch to assume an 8.25% annual dividend growth rate for the stock.

These assumptions into the DDM are how I arrive at a fair value of $178.29 a share. This implies that shares of Williams-Sonoma are priced at a 7.5% discount to fair value and can provide 8.1% capital appreciation from the current share price.

When I average these two fair values out, I compute a fair value of $203.16 a share. This suggests that Williams-Sonoma’s shares are trading at an 18.8% discount to fair value and offer a 23.1% upside from the current share price.

Summary: A Dividend Grower With Healthy Annual Total Return Prospects

Williams-Sonoma’s 9.9% increase in its quarterly dividend to $0.78 per share extended its dividend growth streak to 16 consecutive years, which makes the stock a Dividend Contender. Despite the Great Recession and the COVID-19 pandemic, the stock has continued to grow its dividend. And this growth isn’t showing any signs of stopping anytime soon.

For one, the stock’s estimated adjusted diluted EPS payout ratio of barely 20% for this year gives the company flexibility to keep upping the payout.

Secondly, Williams-Sonoma is a winner in an e-commerce industry that’s set to keep winning. This should drive revenue and earnings growth higher to support a growing dividend.

Third, the stock has no long-term debt and $850 million in cash on its balance sheet to allow for generous capital returns to shareholders via dividends, special dividends, and share buybacks.

And even with all of these enviable characteristics of Williams-Sonoma as a stock, I estimate that its shares are trading at a 19% discount to fair value. Lumping all of these traits together, Williams-Sonoma is about as close to a “perfect” dividend growth stock as you could imagine. That’s why I rate the stock a strong buy at this time and intend to add to my position with my next round of available investment capital.

Be the first to comment