AlexSecret/iStock via Getty Images

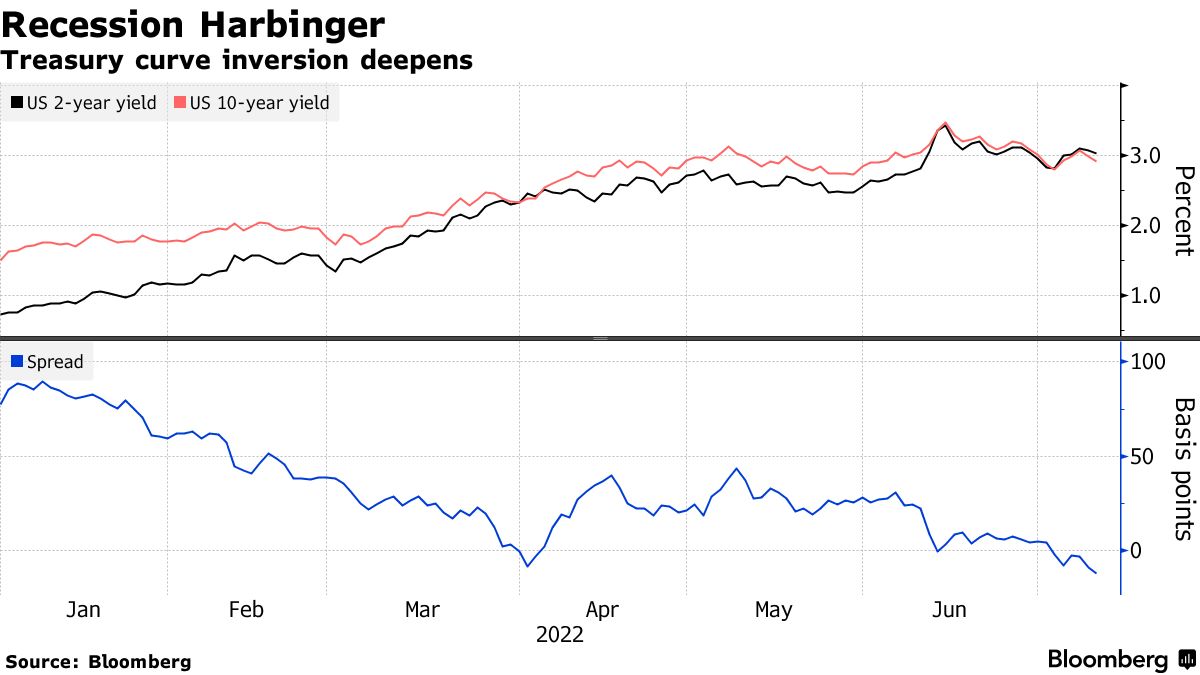

Stocks sold off broadly at the end of yesterday’s trading, as concerns about this morning’s inflation report loom large. The worry is that the headline inflation number, influenced by the price food and energy, will peak at a new high of 8.8% for June. In turn, that will encourage the Fed to be even more aggressive in tightening monetary policy. As a result, the Fed will inevitably cause a recession in the U.S. economy, which is being confirmed by the recent inversion of the yield curve with the 2-year Treasury yield falling below the 10-year yield.

Finviz

The problem with that line of thinking is that the Fed does not drive monetary policy in the rear view mirror. It is far more focused on inflation expectations than what the rate was a month ago, especially since the food and energy prices that fueled inflation’s rise in June have plunged over the past month. That should result in a much lower reading for this month. The good news in this morning report should come from the core rate of inflation, which is expected to show a third consecutive monthly decline from its March peak of 6.5% to 5.7%. As for the yield curve inversion, one that last days or weeks has no reliable track record in predicting recessions, as it typically lasts months before it becomes a reliable indicator. That is unlikely as the consensus realizes that the Fed will not have to raise short-term rates to the extent that the market is now predicting during the second half of this year.

Bloomberg

I know I sound like a broken record, but investors need to remember that bull markets begin in the midst of really bad news, and the news doesn’t get much worse than it is today. We have monetary policy tightening into a rapid economic slowdown with multi-decade highs in the rate of inflation combined with a war in Ukraine, political dysfunction at home, and a pandemic that won’t abate in China. Consumer and investor sentiment are abysmal. This stew of discouragement continues to weigh on the global supply chain, which has slowed the progress in taming inflation.

All that said, we don’t invest in companies based on what they have been through over the past year or are experiencing today. We invest in them based on what they will accomplish over the coming 2-3-year period. That’s because stocks typically discount events 6-12 months from now. Therefore, if there is light at the end of the tunnel with respect to what is really bad today, then the companies that will benefit should start to see their stocks respond in a positive way, as what is bad today gets better tomorrow. Note that I did not say good, but less bad to better, because markets respond to rates of change.

In addition, the economic backdrop is far better than the pessimistic consensus is willing to admit, which means that any economic downturn that does occur this year or next should be brief and shallow. We need to recognize that consumers and corporations have used years of historically low interest rates to refinance debt balances that were previously a great concern. This has led to the decline in debt servicing costs as a percentage of disposable income to historically low levels for consumers. Full employment, strong wage gains, sustainable home equity, and $2 trillion in excess savings further buttress the consumer balance sheet.

The most notable improvement in rates of change as of late is the decline in the price of oil over the past month, which has wiped out nearly all of the gains that followed Russia’s invasion of Ukraine. That is hugely important, as gasoline prices should realize a similar decline in the weeks ahead, followed by innumerable other transportation and input costs. It doesn’t stop with oil.

Real Money

The price of wheat, corn, and soybeans have plunged more than 25%. Copper has plunged 30%. Used cars are down nearly 10% over the past six months. Home prices look like they have peaked, while rents in some of the hottest markets in the country are starting to decline. These price drops have more to do with overshoots and reversions to the mean than some pending economic disaster awaiting us.

For these reasons, I have been steadfast in my expectation for a much better second half of this year. History is on my side, as the S&P 500 has produced outsized returns in the second half of every year that it declined more than 15% during the first six months.

Real Money

Be the first to comment