deepblue4you

Dear readers,

Water companies – these businesses are some of the safest around. I often write about companies like York Water (YORW), and I invest in companies in Europe that have water exposure. These businesses are some of the most fundamental you can find, and they share a lot of similarities with companies such as utilities or even telecommunications.

What I mean by this is that we’re talking about non-optional expenses that people need to be paying without fail – similar to paying a mortgage.

Let’s look at what this specific water company has to offer you.

California Water Services – What the company does

California Water Services (NYSE:CWT) is, as the name suggests, a water company. What the company does is simple. It delivers water to both private and commercial customers across its service area. In this case, the service area we’re looking at covers around half a million connections across the state. This isn’t massive – we’re not talking a state-covering sort of business. But it’s nonetheless a company providing services to California – as well as a number of other geographies through its structure.

Areas the company covers include Dixon, East Los Angeles, Bakersfield, Travis, Stockton, and areas in the vicinity. Structurally speaking, CWT is a holding company with seven specific subsidiaries – California Water Service Company (Cal Water), New Mexico Water Service Company (New Mexico Water), Washington Water Service Company (Washington Water), Hawaii Water Service Company, Inc. (Hawaii Water), TWSC, Inc. (Texas Water), and CWS Utility Services and HWS Utility Services LLC (CWS Utility Services and HWS Utility Services LLC being referred to collectively in this annual report as Utility Services). So, plenty of geographies – despite the name.

When investing in water, you really have to moderate your expectations. At least unless you’re really investing in the company, luckily enough, at a massive undervaluation. But this is extremely rare for a water company. Most water companies trade at extreme premiums, reflecting their high operating safety.

The companies in such segments share a lot of similarities with utilities. Their income is essentially guaranteed through regulation, and their income is decided and adjusted through rate cases with the responsible regulators. This caps the upside – but it makes any downside somewhat limited in its scope. Not saying it doesn’t exist – Pinnacle West (PNW) is a good example of this. But it’s limited – because the customers will keep paying the business.

To specify the company’s business, its production, purchase, storage, treatment, testing, distribution, and sale of water for domestic, industrial, public, and irrigation uses, and the provision of domestic and municipal fire protection services. These are of course crucial business segments.

This also means that the company’s products or services don’t really change – and often haven’t changed for a very long time. Oh, technologies change – but the company provides water. That is what it does – and really nothing/very little else.

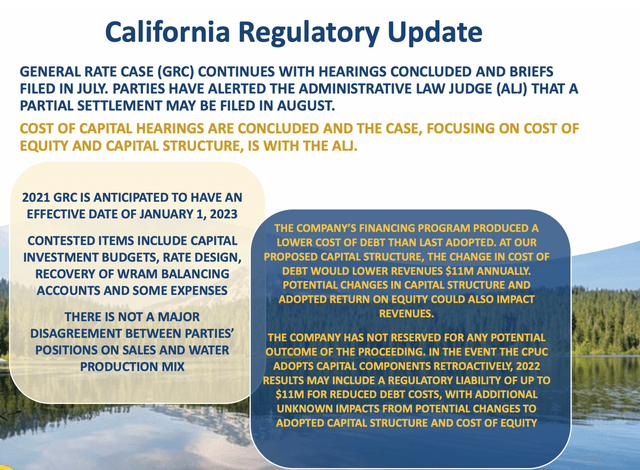

The company’s various subsidiaries are subject to oversight by regulators. For California, this is the California Public Utilities Commission (CPUC). However, every subsidiary, provided that it operates in a different geographical area, is bound to be subject to a different regulator. That means that the rate cases, which decide what the company is able to earn, are going to differ, because the geographical circumstances, weather patterns, and infrastructures shift from state to state.

The company does have some non-regulated business segments, but these are rare – typically leasing agreements on the company’s property or agreements that are outside the purview of state regulation. This area, with leasing agreements, is also where the company has the potential for growth. Other opportunities for growth are extremely limited for a company like this.

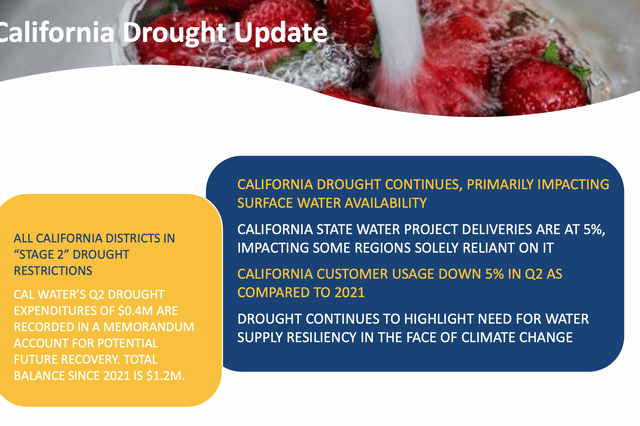

Going into California water, we of course need to talk about the elephant in the room. Depending on how you view this, it can either be a massive advantage of interest, or one of the biggest risks.

Obviously, water and California is a tricky subject. The area sees very little rain, and recent years have really started to see the pressure on the region’s aquifers and reservoirs, with water rationing not exactly being rare anymore.

Here is what the company has to say about some of that.

As of December 31, 2021, the State of California snowpack water content during the 2021- 2022 water year is 51% of long-term averages (per the California Department of Water Resources, Northern Sierra Precipitation Accumulation report). The northern Sierra region is the most important for the state’s urban water supplies. The central and southern portions of the Sierras have recorded 58% and 55%, respectively, of long-term averages.

(Source: CWS, 10-K)

For the time being, the company believes that the aquifers and reservoirs will be able to meet customer demands even beyond 2022 – but there will of course come an inflection point here at some time. Going into this would take articles on its own as a question – so let’s move on to fundamentals.

CWT does not have a credit rating – but I argue it really doesn’t need one, owing to its fundamentals. It doesn’t really have worrying debt, and when it needs to make infrastructure investments outside the usual CapEx, it applies for these within the framework of a rate case.

Exposures in a company like this can come from unexpected CapEx cost increases – such as the environment we’re in now. CapEx is up 6% YoY so far – this is very impressive given the overall pressures from the supply chain as things stand right now. The company’s general rate increased by almost $7M, but this increase was mostly offset by wages, D&A and interest costs, which are up as expected.

EPS is actually not looking all that great on an overall YoY basis. While Revenue was up, the combined factors of increased OpEx, D&A, Interest costs, unbilled revenues (which are essentially used but not yet billed amounts of water), Mark-to-market effects, and others, caused an overall EPS decline pushing the 2Q22 EPS down to around half of the YoY level.

The same trend can be seen on a YTD YoY basis, with more or less the same effect. Regulations/rate cases for the California geography continue.

The company, of course, acknowledges the aforementioned elephant in the room in the form of the overall ongoing drought – though it’s an important fact to mention that the primary impact is surface water – not aquifers.

Issues to keep an eye on with CWT is capital spending – with expectations being for it to be on track, but due to cost increases not yet part of rate cases or income, there’s some higher-than-usual elevated risk here. There’s also the question of how stringent or hard regulators are going to be. The company is also reserving close to $7M for some bad debt related primarily to nonpayment.

The regulatory process has recently allowed for starting to shut off water supply for nonpayment. Shutting off power or water is always a sensitive question because it puts the residents in an extremely vulnerable situation – but it needs to be done, and the experience from other states here has been positive as it pertains to the amount of bad debt – meaning people pay once collection activity starts.

Here is what the company expects in terms of its rate case.

Positive and perhaps a bit too positive for my liking. I’m impairing this by 10% each year going forward to make it a more conservative case.

All in all, CWT is a safe company to invest in. Most of the adverse effects from unbilled revenue were due to comparison effects and timing of meter reads – not something that will actually change the thesis. There are also some unrealized valuation headwinds, droughts, fire seasons, and the issues of delinquent balances in California – still, I expect some of these to be solved. What we’re left with is a company that yes – is exposed to riskier geography than say, some of the central states, but also one of the most populated and highest-income areas in the nation.

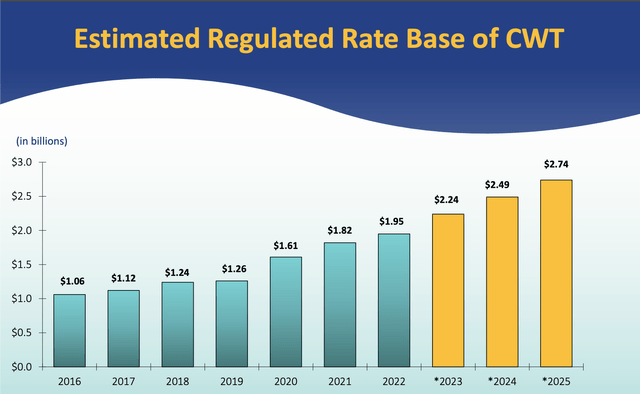

Growth opportunities for this business remain very robust.

Let’s move into the company’s actual main issue – as with most water companies, this actually is its valuation.

California Water Services – The valuation

As I mentioned, California Water is a water business, and these tend to combine the least appealing qualities we know when looking at dividend stocks – at least in terms of returns. Their yield and growth is usually extremely low. Below 2% yield is the “rule”, and below 5% growth as well, looking at annual EPS growth.

The entire reason for investing in water businesses, unless they’re at massive undervaluation, is the unparalleled safety of their income streams and the nature of their business.

This can go a long way towards making an investment case, but I would also argue that you want some undervaluation – otherwise you’re locking in 5-7% returns, which really isn’t something I would want.

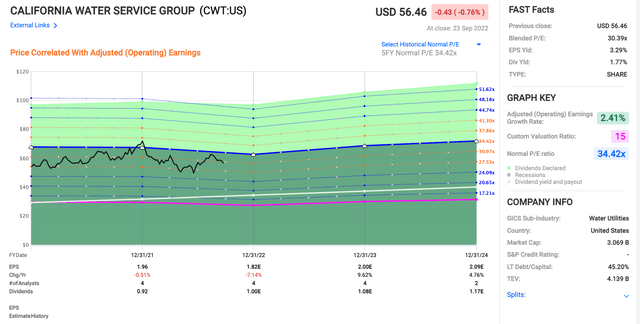

So, being clear here – CWT is only mildly undervalued, and that’s looking to a significant premium of 34-35x P/E. This in itself isn’t an unfair valuation when looking at water company peers – at least not in the US.

CWT Valuation (F.A.S.T Graphs)

However, it’s still a hard road to hoe for many investors. You’re being asked to invest at a premium, and you’d have to expect that 34-35x P/E to hold to garner double-digit returns. In this case, around 13.5% annually to a 2024E P/E of 35x, coming to a total RoR of close to 34%. The reason I’m writing up this article is just this – that 35x forward P/E generating above 12% annualized RoR. Because while forecast accuracy isn’t perfect, there’s little doubt to my mind that this company will manage the headwinds it faces, continues to deliver water to residents in their respective areas, and that the market in times like these will continue to demand premiums for these businesses.

While not “everything” will continue as usual, and while CWT does come with risk factors not found in the same sense in say, YORW, it’s still a solid company. Peers come in the shapes of other water companies such as American Water Works (AWK), American States Water (AWR), and others. I would also argue that the peer group includes ancillary service companies such as Finnish business Uponor (OTCPK:UPNRY), my primary choice for investing in water. Important to note though that Uponor lacks the comps regulatory characteristics, and is more of an industrial.

From a peer perspective, CWT is not the cheapest regulated water business – but it’s among the cheaper ones, going by an NTM P/E (Source: S&P Global). 3 analysts follow the company – and 1 considers the company a buy, despite an average PT of $61.6, implying an upside of nearly 10%. I would carefully agree with the potential of such an upside, while at the same time cautioning that premium upsides always come at a downside risk.

I do not see the company have the same downward volatility as a tech or pure growth business – but I do say that there is potential for the company to drop to around 20-25x P/E, which should imply some taking care here.

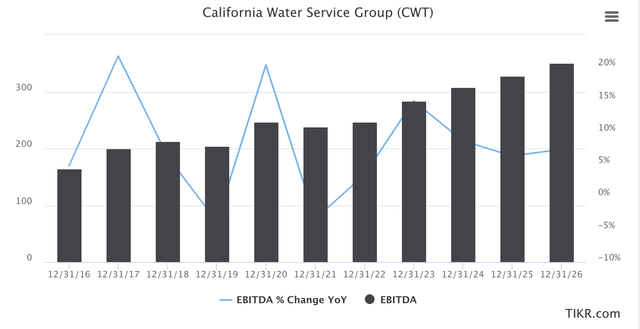

Still, my own forecasts call for the company’s earnings, and EBITDA growth rate, to average around 3-5% going forward, and I consider S&P Global analyst estimates for the 2023-2026E period to be accurate, given the company’s current and seeming near-term trends.

CWT Earnings forecast (TIKR.com/S&P Global)

In the end, I will consider CWT a “BUY” at anything below a 30x P/E, even if it’s not my first pick for investment. The current blended P/E of around 30.5x means that I would want it to drop a bit more – though it’s important to note that S&P global consider It having an NTM P/E multiple of 27.5x – I tend toward historical rather than NTM multiples, as historicals are more certain than future, not-yet realized numbers.

So for that reason, I’ll keep a “HOLD” for now – though I do consider this company worth a look.

Thesis

My thesis for California Water is as follows:

- Water companies are among the greatest in terms of safety, rivalling and exceeding even utilities. I follow many of them and invest in several. I do not yet own CWT, but I’m looking at establishing a position in the company going forward.

- In order to invest in the company, I want a sub-30x P/E on an LTM or blended historical basis. We’re currently slightly above 30x.

- For that reason, I’m a “HOLD” here, but I may move to a “BUY” within a relatively short timeframe.

Remember, I’m all about:

-

Buying undervalued – even if that undervaluation is slight, and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

-

If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

-

If the company doesn’t go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

-

I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside based on earnings growth or multiple expansion/reversion.

Be the first to comment