da-kuk/E+ via Getty Images

Transcript

Treasury yields have sprinted higher, hitting three-year highs last week in the face of higher inflation. This created market angst about equities.

Higher discount rates make future cash flows look less attractive now. We believe fears about a further downdraft in equities are overblown, even if yields rise further.

Why?

1. Central banks to normalize policy

First, we see central banks rapidly raising short-term rates to neutral levels to fight higher inflation. Though we don’t see them going beyond that, as it would hurt growth and employment.

So we expect the sum total of rate hikes to stay at historically low levels even as we see inflation settling at levels higher than pre-Covid.

2. Tilting towards equities?

Secondly, long-term yields could rise further as investors demand higher compensation for holding them amid higher inflation. This could trigger a shift away from bonds into other assets like equities.

3. Company earnings revised up

Thirdly, company margins have held up during the pandemic, helped by the powerful economic restart.

First-quarter earnings in the U.S. and Europe were revised up, driven mainly by the energy sector. And estimates for the rest of this year are also positive, though we see risks to European margins.

All this means we take risk in equities and stay underweight bonds. We favor U.S. and Japan equities over Europe stocks.

________________

Bond yields have sprinted higher on ballooning inflation and hawkish comments by central banks. Yield spikes have often spelled trouble for stocks, but we believe the past is an imperfect guide in a world shaped by supply shocks. We see central banks normalizing quickly – but not slamming the brakes on the economy. This should keep real yields low and underpin equity valuations. The inflationary backdrop and growth momentum led by the U.S. also favors stocks, we believe.

Historically low rates ahead

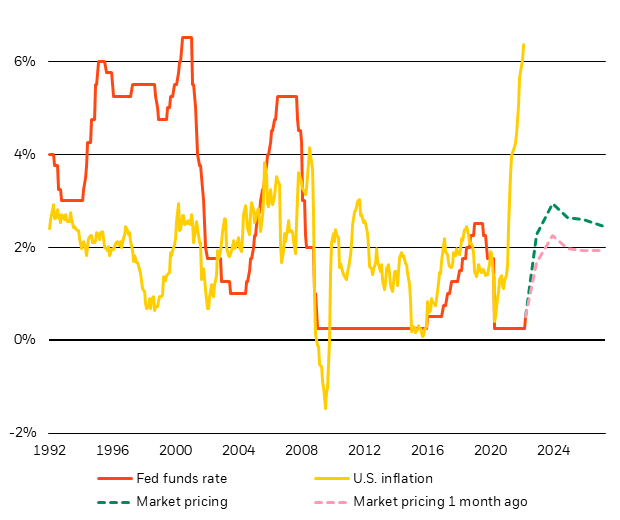

Fed Funds Rate And U.S. Inflation, 1992-2027 (BlackRock Investment Institute, with data from Refinitiv, April 2022)

Past performance is not a reliable indicator of current or future results. Indexes are unmanaged and not subject to fees. It is not possible to invest directly in an index. Notes: The chart shows the path of U.S. interest rates (Federal Funds Target rate) and annual U.S. personal consumption expenditure price inflation since 1992. The dashed line shows forward market pricing of U.S. policy rates based on interest rate swaps.

Yields on benchmark 10-year U.S. Treasuries hit three-year highs last week, after data showed inflation was still running at levels not seen since the early 1980s. This understandably created angst about equities, especially about stocks of fast-growing tech companies. Higher discount rates make future cash flows less attractive. We believe fears about a further downdraft in equities are overblown. The rate hikes we expected are happening faster, but we don’t see central banks raising policy rates beyond neutral levels that neither stimulate or restrain the economy. Markets have priced in a rapid rise of the Fed funds rate to 3% in the next year, followed by a leveling out to 2.5% in five years’ time (the green dotted line in the chart). That’s markedly higher than a month ago (dotted pink line), just before the Fed raised rates and started to talk tough on inflation. We don’t see the Fed going this high. Even if it did, the level would still be historically low compared with previous hiking cycles (red line) and the level of inflation (yellow line).

The big picture

Markets have swiftly brought forward a rise in policy rates in the past year, and now are pricing in a steep lift-off. Yet, it’s the sum total of rate hikes that matters for equities, in our view, not the timing and speed. Why? We use the cumulative rate for determining future corporate cash flows, not the current rate or bond yields. And the higher the peak rate in this cycle, the bigger the impact because of the compounding effect over time. As a result, we believe equities can thrive when the end destination of policy rates is historically low. Central banks will be forced to live with inflation, in our view, to avoid destroying growth and employment. We see inflation settling higher than pre-Covid levels because of the supply shocks triggered by the restart of economic activity and the horrific Ukraine war. This means real yields, or inflation-adjusted yields, should remain low and underpin equity valuations. We could see long-term yields rising further as investors demand higher compensation for holding them in the inflationary backdrop. This is not necessarily bad news for equities, as it could trigger a re-allocation away from bonds into equities.

How about equity fundamentals? Three things jump out at us as first-quarter results get underway this week. First, the powerful restart is providing a growth cushion for developed markets (DM economies), especially in the U.S. Second, record-high profit margins bear close watching. DM companies have been able to pass on increased input costs to consumers and kept labor costs in check – so far. Third, we see the economic fallout of the Ukraine war cutting into earnings, even as analysts have been revising up estimates across the board. We expect estimates for European companies to come down in particular as analysts start factoring in the war’s effects. Companies in the MSCI Europe index are export-oriented and derive just half of their revenues domestically, we calculate, softening the impact a bit. A weaker euro helps, too. All in all, this led us to reduce our overweight in European equities earlier this month. We prefer U.S. and Japanese equities instead.

What are the risks? First, central banks could trigger a recession by raising rates too high in an effort to contain inflation. Second, inflation expectations could become de-anchored from central bank targets and cause them to slam the brakes. Third, companies could see margins shrink amid escalating input costs and upward wage pressures.

The bottom line

We prefer DM equities in the inflationary backdrop of the restart’s momentum and a historically low sum total of rate hikes. We could see long-term yields rising further as investors demand a higher term premium, or extra compensation for holding them amid high inflation and debt levels.

Market backdrop

Yields of 10-year U.S. Treasuries hit new three-year highs last week, and stocks fell. We believe long-term yields can rise further and could see short-term bonds outperforming because market expectations for rate increases have become overly hawkish. The European Central Bank confirmed our view it will normalize slowly and gradually. It’s set to end asset purchases in the third quarter and raise its policy rate “some time” thereafter.

We are focusing on sentiment data this week as investors gauge the economic impact of the war in Ukraine. Supply shocks caused by the conflict and pandemic will hit European activity, in our view, while U.S. activity should stay robust. China GDP data will give an early read on growth amid concerns around the impact of renewed lockdowns amid a spike in Covid cases.

Be the first to comment