MicroStockHub

Both Ares Capital Corp (NASDAQ:ARCC) and Owl Rock Capital Corp (NYSE:ORCC) have investment grade (BBB- Stable from S&P) credit ratings and also pay out very high dividend yields. While some investors prefer to invest in both and some even prefer ORCC given that it pays out a higher dividend yield and also trades at a cheaper valuation multiple relative to NAV, we currently own ARCC instead of ORCC. In this article we share three reasons why.

#1. Superior Track Record

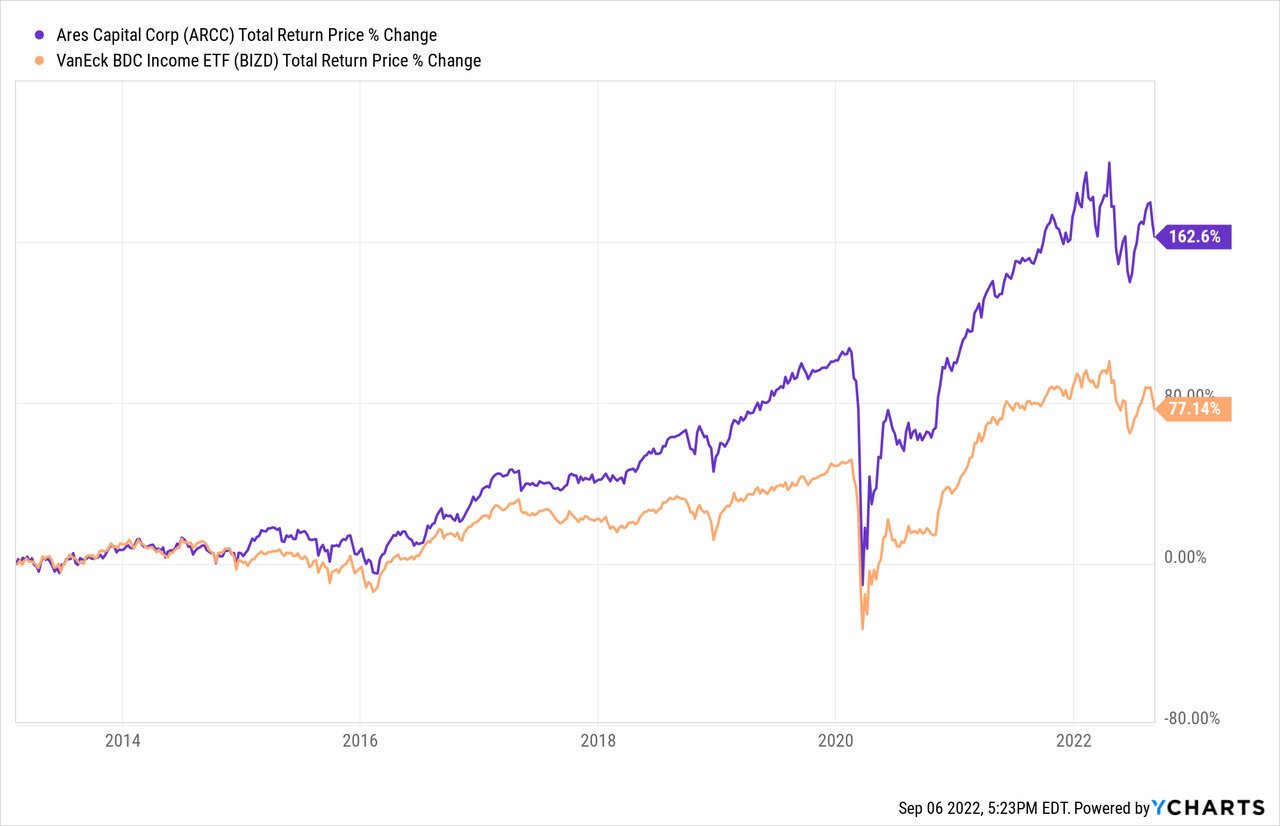

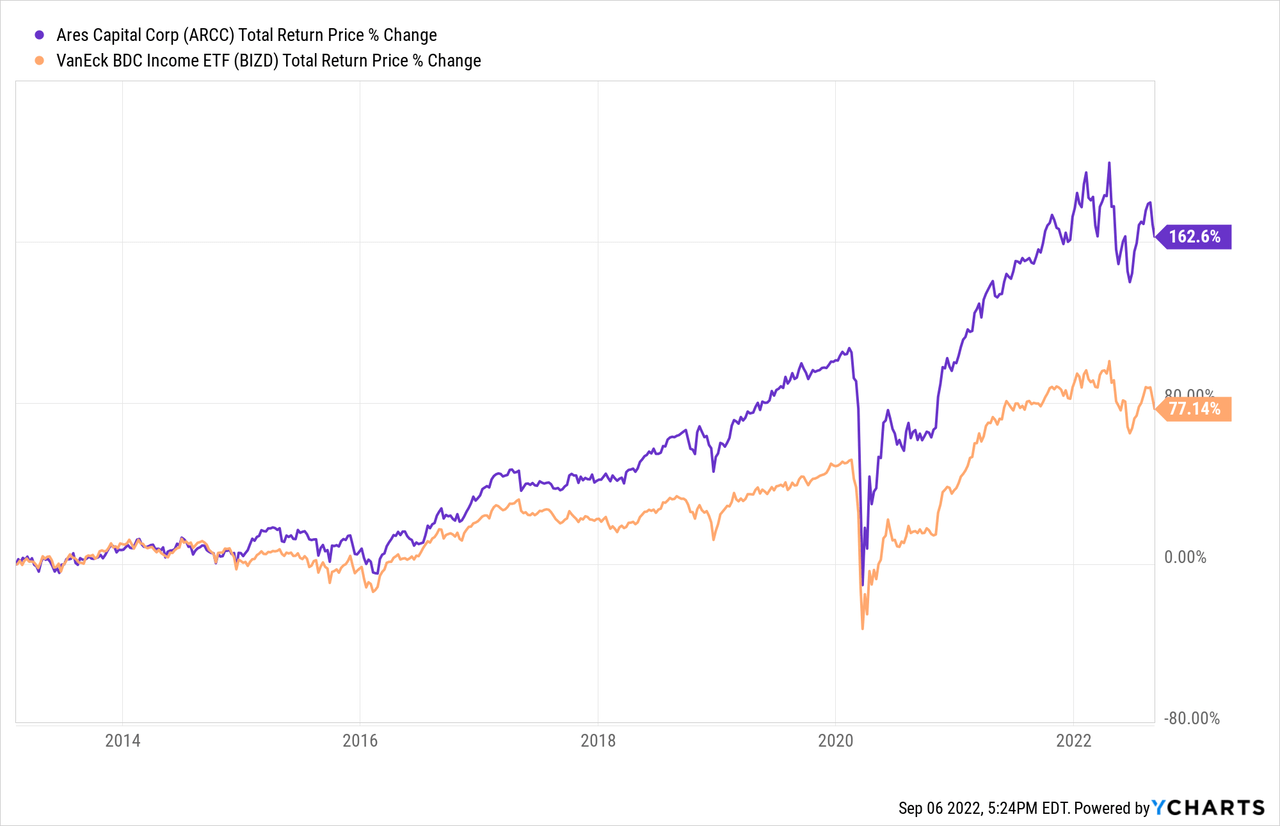

The biggest reason why we are putting our hard-earned capital into ARCC instead of ORCC right now is because – given the significant macroeconomic and geopolitical uncertainty and risk surrounding us today – we want to be able to sleep well at night. While ORCC’s management certainly seem competent and have strong underwriting performance thus far, they have also not weathered a severe and prolonged recession. In contrast, ARCC’s management weathered the Great Financial Crisis and have put up very impressive numbers over the years, crushing the S&P 500 (SPY) and broader BDC sector (BIZD) in the process:

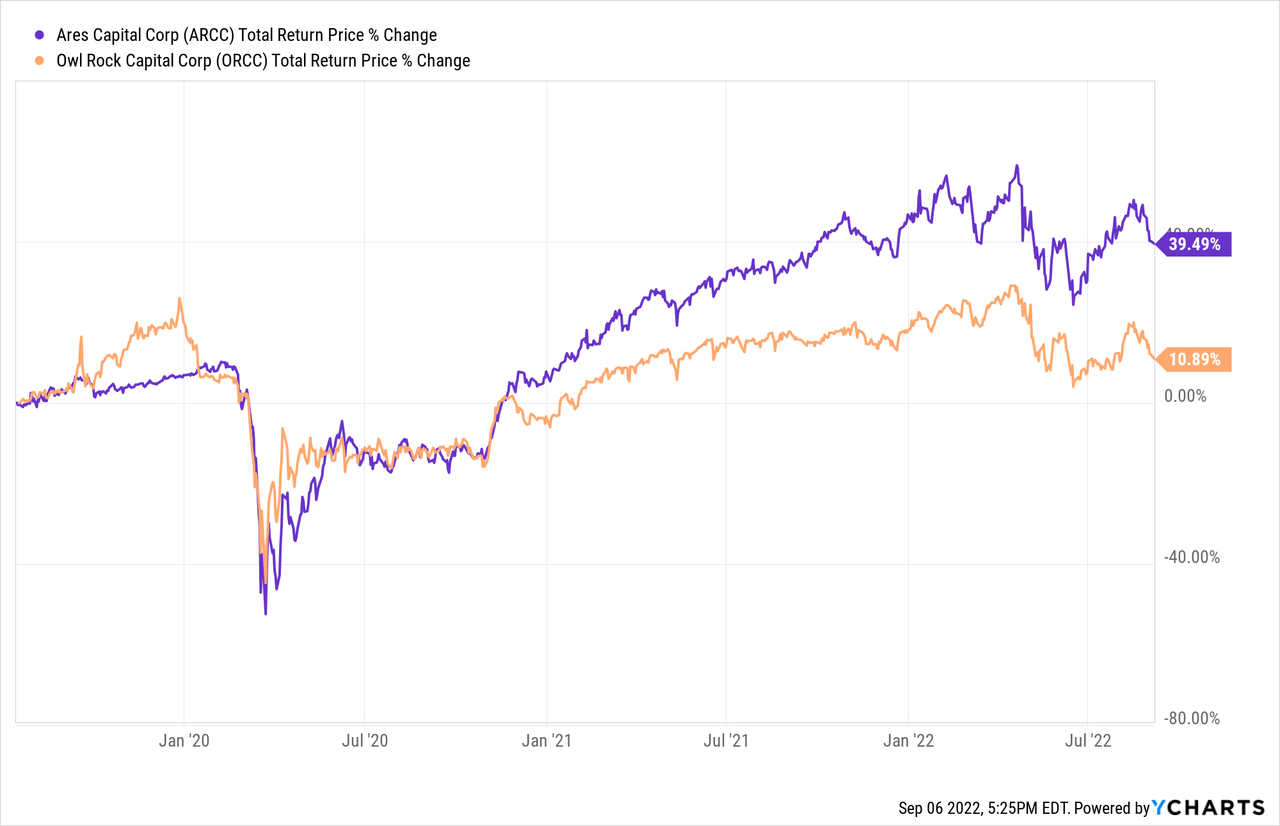

This tells us that ARCC’s management clearly has superior capital allocation ability and is able to navigate changing market environments with skill. In contrast, we have no way of truly knowing how ORCC’s management will navigate a severe recession. Furthermore, since ORCC went public right before COVID-19 hit a few years ago, ARCC has meaningfully outperformed ORCC, further cementing our conviction in its management team:

#2. Greater Dividend Safety

Another reason why we prefer ARCC relative to ORCC at the moment is its superior dividend safety. BDCs are primarily income instruments, so while the size of the yield is important, the safety of that yield through periods of market turbulence is arguably just as important.

ARCC hiked its dividend in Q2 by 2.4% to $0.42. This fact alone says a lot about the company’s dividend safety, as the saying goes: “the safest dividend is the one that has just been raised.” On top of that, its Q2 net investment income of $0.52 easily supported its quarterly dividend with a 1.24x coverage ratio. As a result of its very strong quarterly results, ARCC declared a special $0.03 per share dividend as well. Moving forward, the dividend should continue to be quite safe, and possibly even continue growing, as ARCC is well positioned to benefit from rising interest rates.

Finally, ARCC has a lot of spillover income, which would likely support the current dividend level for a while, even if the economy turned south and nonaccruals piled up, leading to lower net investment income. As management stated on the Q2 earnings call:

[W]e felt highly confident in our ability to increase the dividend this quarter. And I’ll couple that by saying we’ve also built a pretty substantial amount of spillover income, as you’re aware of the company. And I don’t feel the need, frankly, to add any more to that number. I could argue that number might even be a little bit high, which is why we’ve been using it to pay a special dividend throughout this year. So we feel good about the earnings trajectory, and we feel good about the dividend where it is today and potentially growing from here.

In contrast, ORCC’s dividend coverage ratio in Q2 was much tighter. Net investment income came in at $0.32 on a per share basis, barely covering its $0.31 dividend payout. On top of the tight coverage, ORCC lacks the substantial spillover income that ARCC has and management refused on the earnings call to guide for continued dividend growth nor special dividend payouts in the near term, whereas ARCC has implied that it will continue to pay out a special dividend for the remainder of fiscal 2022 at a minimum.

#3. Valuation Gap Is Not As Wide As It Appears

While ORCC is cheaper relative to NAV than ARCC is (ORCC trades at an 11.12% discount to NAV, whereas ARCC trades at a slight premium of 2.60% to its last reported NAV), this gap is not as wide as it first appears. First and foremost, ARCC’s expense ratio is slightly lower than ORCC’s (5.32% on a non-leveraged basis for ARCC relative to 5.55% on a non-leveraged basis for ORCC), its cost of leverage is lower at 3.44% for ARCC relative to 3.82% for ORCC, and its cost of capital is also cheaper.

Furthermore, it is able to issue shares at a slight premium to NAV and combine the equity with much cheaper debt and reinvest the proceeds on a very accretive basis, whereas ORCC cannot issue equity without diluting shareholders and its cost of capital is meaningfully higher.

Last, but not least, ARCC’s dividend yield is actually much more attractive when taking into account the special dividends it has been paying out. Assuming its fourth quarter dividend payment is the same as the Q3 dividend, its total 2022 dividend payout including special dividends will be $1.82, good for a 9.5% yield relative to the current share price. Meanwhile, ORCC’s payout for 2022 (assuming no change in the quarterly dividend for Q4) will be $1.24, equating to a 9.7% yield relative to the current share price. For a mere 20 basis point difference, the much stronger safety and greater growth potential that come with ARCC are definitely worth it in our view.

Investor Takeaway

ORCC certainly has a lot going for it: a low non-accrual rate, support from a large alternative asset manager in Blue Owl Capital (OWL), a double-digit discount to NAV, a conservatively positioned portfolio relative to many of its peers, and a near 10% dividend yield.

However, all of those things (except for the discount to NAV) can be said for ARCC. On top of that, its management and underwriting methodology have been proven through the fire of the Great Financial Crisis and the company has compounded shareholder wealth at a market-crushing rate across cycles. On top of that, its dividend is very well supported at the moment.

In contrast, ORCC has meaningfully underperformed ARCC since going public and its dividend is only narrowly covered by net investment income at present. When taking all of that into account, ORCC’s 20 basis point lead in terms of dividend yield seems rather small. As a result, we feel much better allocating our capital to ARCC than ORCC during these troubled times.

Be the first to comment