LifestyleVisuals/E+ via Getty Images

Recently, I spent a lot of time studying old annual shareholder letters and meetings of Berkshire Hathaway (NYSE:BRK.A) (NYSE:BRK.B) in order to better understand why Warren Buffett doesn’t buy rental properties. In short, we found that there are 5 main reasons why he stays away from real estate for the most part:

-

Reason #1: It is outside his circle of competence.

-

Reason #2: Berkshire Hathaway is at a major tax disadvantage when competing with REITs.

-

Reason #3: The management of real estate is complicated and difficult to scale unless you are an expert.

-

Reason #4: Real estate is unlikely to be as severely mispriced as regular stocks.

-

Reason #5: REITs offer many other advantages over rentals and have historically generated higher rates of returns with lower risk.

Picture of a rental property owned by Invitation Homes (INVH):

Rental property investment (Invitation Homes)

For these reasons, he generally favors REITs over rental properties when investing in real estate.

They allow him to gain exposure to real estate without all the issues mentioned above. REITs also enjoy professional management, important tax advantages, easy scalability of capital, and more frequent mispricings.

He has in the past invested in several names, including Seritage Growth Properties (SRG), Vornado (VNO), General Growth Properties (now part of BAM), and even Tanger Factory Outlet (SKT).

But his largest and most famous current REIT investment is a company called STORE Capital (STOR).

In today’s follow-up article, we take a closer look into STORE Capital to gain an even better understanding of why Warren Buffett favors such REITs over rental properties. As you will see, we think that STORE is expected to generate higher returns with lower risk than most rental properties.

STORE Capital vs. Rental Properties:

Why Warren Buffett Favors REITs like STORE

For context, Warren Buffett first invested in STORE through Berkshire back in 2017, and later doubled down in 2020, buying a total of 24,415,168 shares, worth over $750 million at today’s share price. He probably would have bought even more shares but he must keep his holding under 10% of the total ownership due to federal regulation and reporting rules:

Warren Buffett invests in STORE Capital (STORE Capital )

As noted earlier, there are many issues that explain why Buffett tends to stay away from rental properties, but STORE solves all of these:

Benefits of an Expert Management Team

Unlike most other investors, Warren Buffett is very realistic about his circle of competence. He understands that he cannot be an expert in everything and jacks of all trades rarely achieve exceptional results.

Since his main circle of competence isn’t in real estate, he seeks to partner with experts to manage this portion of his portfolio for him.

STORE Capital is arguably the best-managed REIT in its property niche: net leases. It was co-founded by Chris Volk, who is a pioneer of net lease property investing, and the REIT follows an investment strategy that 99% of investors simply couldn’t execute.

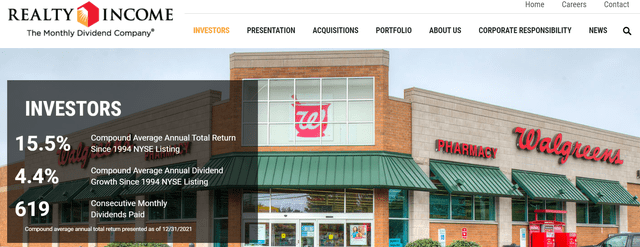

For those of you who aren’t familiar with net lease properties, these are mainly single-tenant freestanding retail properties that are typically leased to service-oriented companies like Walgreens (WBA) pharmacies, Dollar General (DG) grocery stores, or even McDonald’s (MCD) restaurants. These properties are unique in that the lease is typically very long at ~15 years, the tenant is responsible for all property expenses, including the maintenance, and the rent is hiked annually by a pre-agreed escalation rate. Historically, they have not only been some of the most rewarding real estate investments but also some of the most stable and resilient during times of crisis. The biggest and oldest net lease REITs like Realty Income (O) have consistently compounded investors’ returns at 15% per year for decades:

Realty Income historic performance (Realty Income)

In theory, almost anyone could enter the net lease space, including Warren Buffett through Berkshire, and build a diversified portfolio.

However, in practice, it is very complicated and companies like STORE Capital have major advantages in their expertise, scale, and management that most couldn’t rival.

To give you an example: instead of targeting properties in the open market, STORE is able to generate 80% of its acquisitions through direct-calling efforts to real estate owners and direct relationships with its tenants.

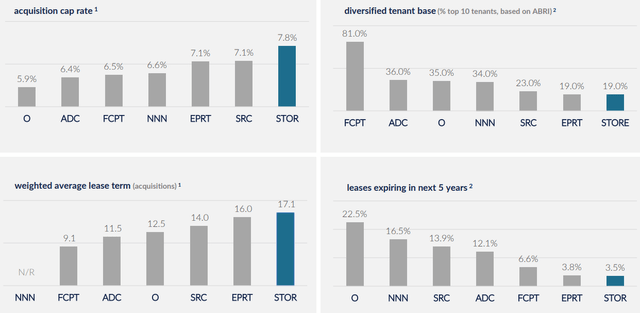

This allows it to get far better deals with higher cap rates, lease escalations, and longer lease terms. Its scale and expertise give it major advantages that Berkshire wouldn’t enjoy if it tried to compete with STORE:

STORE Capital’s competitive advantages (STORE Capital)

They are able to buy net lease properties with an ~8% cap rate, 15-20 year leases, and >2% annual rent hikes. Add some leverage to that, and its properties are earning ~15% annual total returns with relatively little risk.

In this case, paying for professional management is well worth it because Buffett couldn’t achieve that on his own.

Highly Tax-efficient Returns

REITs are often portrayed as tax-inefficient by investors who poorly understand the many tax advantages of REITs.

In the case of Berkshire as an example, Buffett pays way fewer taxes by investing in STORE than he would if he directly bought net lease properties.

That’s because:

For one, REITs pay no corporate income tax.

For two, they distribute only 60%-70% of their cash flow, which means that 30%-40% isn’t taxed at all.

For three, a portion of the distribution is “return of capital,” which isn’t taxed.

For fourth, the portion that’s taxed enjoys a 20% deduction.

And finally, and perhaps most importantly, REITs are more growth-oriented real estate investments, and therefore, more than half of the total return is tax-deferred appreciation.

STORE, as an example, pays a 5% dividend yield, but it also grew its cash flow per share by 12% in 2021. The 12% growth results in substantial appreciation and this isn’t taxed unless you sell. As a result, over 2/3 of the return is not taxed, which makes it very tax-efficient for Berkshire.

In comparison, most private real estate investments generate a larger portion of their total return from income, which is taxed more heavily, especially within a C-corp such as Berkshire.

Easy Scalability of Capital and Management

Investing in a REIT like STORE is simple and efficient. Whether you invest $1,000, $10,000, $1 million, or $100 million, the process is the same.

You can buy and sell shares in the open market, allowing you to gradually invest your capital as it becomes available over time.

In comparison, investing in rental properties is complex, inefficient, and costly. New opportunities need to be identified, negotiated, financed, etc. each month, and then also comes the management, which only gets harder as you grow, especially if you aren’t an expert in real estate investing.

This is very important for a large investment firm like Berkshire, but it is also important for individual investors. You can invest your capital every month as soon as it becomes available which results in even stronger compounding over time.

More Frequent Mispricings Boost Returns

Buffett is a value investor and he wants to get a bargain when investing in real estate. However, as he explains:

“Under most conditions, it is difficult. It is a very competitive world. Real estate is more accurately priced most of the time.”

But because REITs are traded on the stock market, they will often become mispriced, which allows Buffett to invest in real estate at a discount to fair value.

In the case of STORE, Buffett first invested in the company back in 2017 after its share price dropped from $30 to the low $20s without any good reason. STORE was producing solid results, but when the sentiment for retail-exposed stocks deteriorated, STORE’s share price collapsed as well.

Shortly after, it recovered, resulting in a large and quick profit, which he likely wouldn’t have realized if he had invested in private real estate investing.

That’s one of the major advantages of investing in REITs. They are quite volatile in the near term, which can improve your returns if you are long-term oriented.

The Overall Package is Far Superior

Finally, each investment decision comes down to what value you are getting for your money as compared to investment alternatives.

In the case of STORE, you are getting the potential for ~15% annual total returns with much lower risk, passive management, tax efficiency, and easy scalability of capital.

In the case of a rental property, you are getting the potential for likely lower returns with much higher risk, intense management, complicated taxation, and poor scalability of capital.

Studies confirm this:

REITs outperform private real estate investments (EPRA REIT study)

I think that the decision is quickly made for Buffett and that’s why he invests heavily in STORE, but not rentals.

Unlike most other investors, Buffett recognizes that he is unlikely to perform better investing in real estate than professionals that have dedicated their lives to it. That’s the case of STORE, which was co-founded by pioneers of the sector.

Bottom Line

As usual, Buffett’s reasoning for favoring REITs over rental properties makes a lot of sense. He is thinking very rationally and not falling for the temptation of becoming a landlord, despite potentially having the resources to do so.

He is better off investing in REITs like STORE, often at bargain prices, and that’s what we are doing as well at High Yield Landlord.

Since the inception of my REIT Portfolio, I have managed to compound capital at a ~20% average annual return. Could I have achieved that by investing in rental properties? I highly doubt it.

Be the first to comment