naphtalina/iStock via Getty Images

High Yield Stock Watchlist Criteria

The companies listed on this watchlist are stable with a track record of paying and raising their dividends consistently. Each of the companies listed below has a market cap of at least $3 billion. The companies must also have an S&P Capital IQ Earnings and Dividend Ranking of A-, A or A+. This filter helps to establish the company has achieved and should continue to achieve lower price volatility when compared to the broader market.

Next, the current annual dividend yield of the companies on this watchlist is at least 3%. While there could be some debate as to what qualifies a company as “high yield,” 3% is sufficient for me. In addition to the 3% yield, a 10-year dividend growth rate of at least 4% is the next filter used.

Companies I invest in for income should be growing their dividend at least at the rate of inflation and the United States inflation rate has not exceeded 4% in more than 30 years (until 2021). Lastly, a company must be able to maintain a growing dividend for me to consider investing in it, so a trailing twelve-month payout ratio of less than 90% is used as the final filter.

I use dividend yield theory to determine if a stock is potentially undervalued or overvalued. This simple idea suggests a company’s yield should revert to the mean over time. An example below is American Electric Power (AEP), the current yield is 3.49% while its five-year average is 3.28%. The difference is 21 basis points or approximately 6%. It is worth noting I consider any stock that is overvalued or undervalued by 5% to be approximately fairly valued, see Bank of Hawaii Corp (BOH) below.

| Company | 10 Year DGR | Dividend Yield (2/28/22) | Div. Yield(5 Yr Avg.) | Overvalued / Undervalued |

| American Electric Power Company Inc (AEP) | 4.95% | 3.49% | 3.28% | -6% |

| ALLETE Inc (ALE) | 3.54% | 4.15% | 3.30% | -26% |

| Amgen Inc (AMGN) | 28.81% | 3.42% | 2.74% | -25% |

| Avista Corp (AVA) | 4.39% | 3.96% | 3.37% | -18% |

| Bank of Hawaii Corp (BOH) | 4.29% | 3.23% | 3.07% | -5% |

| Evergy Inc (EVRG) | 5.00% | 3.66% | 3.03% | -21% |

| Fidelity National Financial Inc (FNF) | 12.51% | 3.69% | 3.13% | -18% |

| General Mills Inc (GIS) | 6.08% | 3.00% | 3.60% | 17% |

| Intel Corp (INTC) | 5.92% | 3.06% | 2.50% | -22% |

| Life Storage Inc (LSI) | 9.88% | 3.07% | 3.16% | 3% |

| 3M Co (MMM) | 10.41% | 3.96% | 2.96% | -34% |

| NorthWestern Corp (NWE) | 5.59% | 4.18% | 3.78% | -11% |

| Omnicom Group Inc (OMC) | 10.65% | 3.32% | 3.47% | 4% |

| Old National Bancorp (ONB) | 7.18% | 3.03% | 2.97% | -2% |

| Principal Financial Group Inc (PFG) | 13.30% | 3.57% | 3.85% | 7% |

| Pinnacle West Capital Corp (PNW) | 4.23% | 4.72% | 3.40% | -39% |

| Portland General Electric Co (POR) | 4.87% | 3.39% | 3.14% | -8% |

| Simon Property Group Inc (SPG) | 5.27% | 4.72% | 5.03% | 6% |

| Spire Inc (SR) | 4.84% | 4.14% | 3.50% | -18% |

| Southwest Gas Holdings Inc (SWX) | 8.47% | 3.59% | 2.79% | -29% |

| T Rowe Price Group Inc (TROW) | 13.29% | 3.30% | 2.46% | -34% |

| UGI Corp (UGI) | 23.13% | 3.56% | 2.62% | -36% |

| US Bancorp (USB) | 13.15% | 3.21% | 2.83% | -13% |

| WEC Energy Group Inc (WEC) | 6.93% | 3.20% | 2.33% | -37% |

Goal

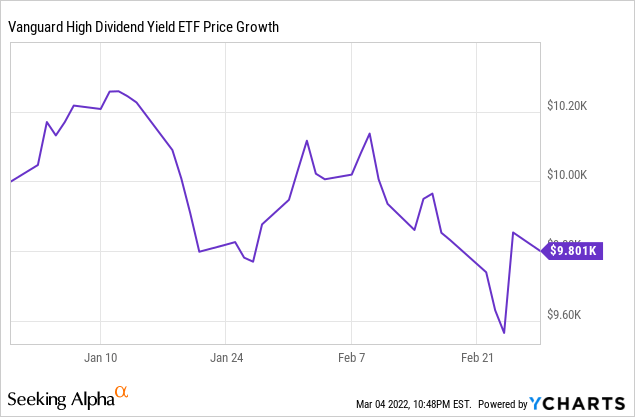

The goal of my high yield watchlist is to discover companies to add to my dividend growth portfolio in an attempt to consistently exceed the market return of the Vanguard High Dividend Yield ETF (VYM). Through February 2022, an equally weighted portfolio of these 24 stocks mentioned above would have underperformed the VYM by 1.58%. VYM is down 1.99% year to date while the stocks above have lost 3.57%.

| Symbol | February Returns | YTD Return through Feb. |

| AEP | 1.15% | 2.78% |

| ALE | -0.35% | -4.14% |

| AMGN | 0.57% | 1.54% |

| AVA | 1.41% | 6.12% |

| BOH | 0.94% | 3.72% |

| EVRG | -3.93% | -9.04% |

| FNF | -5.38% | -8.70% |

| GIS | -1.82% | 0.82% |

| INTC | -1.55% | -6.67% |

| LSI | -6.19% | -16.77% |

| MMM | -9.57% | -15.48% |

| NWE | 4.06% | 5.81% |

| OMC | 11.32% | 14.49% |

| ONB | -0.27% | 0.88% |

| PFG | -3.31% | -2.34% |

| PNW | 1.75% | 1.57% |

| POR | -3.37% | -4.06% |

| SPG | -6.55% | -13.90% |

| SR | 1.81% | 2.90% |

| SWX | 4.99% | 2.19% |

| TROW | -6.39% | -26.48% |

| UGI | -15.24% | -16.27% |

| USB | -2.84% | 0.66% |

| WEC | -5.60% | -5.63% |

| VYM | -1.47% | -1.99% |

New Options

Amgen Inc appeared for the first time on the watchlist and is currently undervalued by about 25%. AMGN is one of the few stocks on the watchlist with a positive return in February and year to date returning 0.57% and 1.54% respectively. Amgen has the highest 10 year dividend growth rate on the watchlist at nearly 29%, although the prior four years its averaged a still respectable 10%.

T. Rowe Price Group Inc. is also new to the watchlist but is down more than 26% year to date already. According to dividend yield theory the stock is undervalued by 34% after its rough start to the year. It does boast a 13.29% 10 year dividend growth rate, which exceeds the watchlist average by more than 4%. Lastly, TROW has a payout ratio just north of 33%, still leaving ample room for future dividend growth.

The last new company to appear on the watchlist for this month is Life Storage Inc. Similarly to TROW, LSI has taken a beating thus far this year down nearly 17% through February. However, its last two dividend announcements have been increases; the company announced a 16% dividend increase in October of last year, followed by a 16% increase in January of this year.

Final Thoughts

This high yield dividend watchlist is used to identify companies worthy of further research. Stock prices fluctuate continuously, and although there are legitimate reasons for an increase or decrease, occasionally there are times the market is just overreacting to a short-term issue. I believe if you can identify the reason(s) and determine for yourself if a decline in stock price is justified, you can minimize risk in your portfolio by purchasing a company’s stock when their yield is higher than normal.

Be the first to comment