Sundry Photography

Introduction

“We purchased a stake in Otis (NYSE:OTIS) to replace our stake in KONE (OTCPK:KNYJF),” with these words Terry Smith’s Fundsmith commented its main change to the portfolio for the month and the quarter, as dataroma confirms.

In this article, I would like to dig into this choice Terry Smith made in order to see if there is an opportunity to profit from by investing in the largest elevator and escalator company in world.

This article is thought as the second step of a mini-series, whose first step was assessing Finnish elevator company Kone.

But before we move to Otis, I feel it is important for SA readers to have a clear understanding of Terry Smith’s investing philosophy and why Otis fits into it.

Terry Smith’s investing philosophy

Terry Smith has run Fundsmith for more than a decade with an annualized return since inception of 15.5%. His strategy is simply stated: buy high-quality companies, don’t overpay, do nothing. In Fundsmith’s owner manual, we are told that Terry Smith looks for businesses whose return on operating capital employed is high. These are the manual’s words:

we are not just looking for a high rate of return. We are seeking a sustainably high rate of return. An important contributor to this is repeat business, usually from consumers. A company that sells many small items each day is better able to earn more consistent returns over the years than a company whose business is cyclical, like a steel manufacturer, or “lumpy”, like a property developer. […] We only invest in companies that earn a high return on their capital on an unleveraged basis. The companies may well have leverage, but they don’t require borrowed money to function.

The key word here is “repeat”. Mr. Smith looks for companies that have recurrent revenue and are thus less affected by cyclicality. So, why did Terry Smith buy a big stake in a company that is within the industrial machinery industry, one of the most cyclical ones? Once again, Fundsmith’s owner manual gives us the answer:

[Our] approach rules out most businesses that do not sell direct to consumers or which make goods which are not consumed at short and regular intervals. Capital goods companies sell to businesses; business buyers are able to defer purchases of such products when the business cycle turns down. Moreover, business buyers employ staff whose sole raison d’être is to drive down the cost of purchase and lengthen their payment terms. Even when a company sells to consumers, it is unlikely to fit our criteria if its products have a life which can be extended. When consumers hit hard times, they can defer replacing their cars, houses and appliances, but not food and toiletries. However, not all companies which sell capital goods or which sell to businesses are outside our investible universe. A business service company may have a source of consistent repeat business, and some capital goods companies earn much of their revenue, and sometimes more than all their profits, from the provision of servicing and spare parts to their installed base of equipment. These can satisfy our criteria.

There are companies that do sell capital goods, such as Otis, but that have a consistent portion of their revenues from repeat business. In the elevator and escalator world, the few companies that are present do know that, together with selling new devices, a big part of their revenues comes from service, maintenance, and modernization.

Elevator purchases, in addition, can’t be deferred at the customer’s will, as if they were a car. They are linked to the construction schedule and nowadays they are required to be in every building.

So, as boring as elevators and escalators may be, they are a very profitable business that provides manufacturers with recurrent revenue for many years.

Lastly, the industry is very consolidated and it is a real oligopoly with three major players: Otis, Kone and the Swiss Schindler Holding (OTC:SHLRF)

Summary of previous coverage

In the article on Kone, we went over Terry Smith’s investment, that, in any case, generated an 88% return during the time Fundsmith held on to these shares. However, there are some reasons that may push Mr. Smith to finding a better opportunity in this industry right now. In fact, since Kone is very exposed to China, a market where it is the leader, the overall results for the company were a bit low as China zero-Covid policy is hindering the economy and the housing market. In addition, it seems Kone has been rather slow at addressing the issues inflationary pressure poised to the company and it just recently reported rapidly shrinking margins that plummeted from 12% down to 8%.

In my opinion, as I tried to show in my previous research, Kone is a very good company. However, its future seems a bit more at peril due to its exposure to China, where margins are lower and the political environment is sometimes unpredictable. It also seems like Kone’s new installation in the country will slow down. Therefore, my understanding of Terry Smith’s choice is that he considers the industry very profitable, but he needs to choose another pick where the future prospects are more promising.

And here we get to Otis.

The industry

Now, though boring, the elevator industry is very attractive for investors. First of all, as we have already said, it is highly concentrated with very big players that dominate the market.

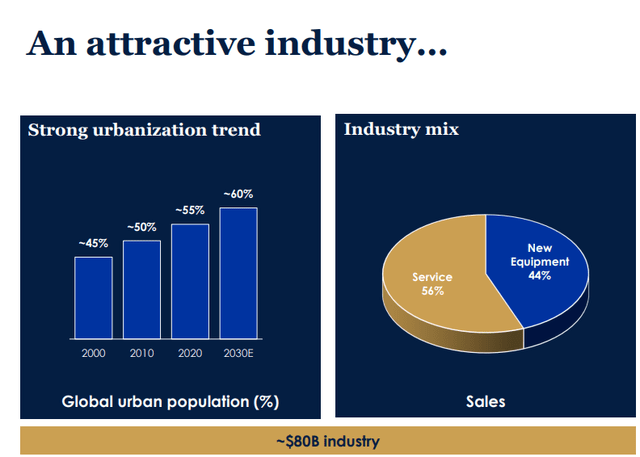

Secondly, it has a big tailwind from the strong urbanization trend that is seeing the global urban population increase by 5 percentage points per decade since 2000. In a certain sense, elevators are like a modern commodity, it is necessary and many buildings can’t go without one. In addition, every elevator installed generates a recurrent revenue that comes from maintenance and, in many cases, from future modernization requirements.

This is what Otis itself points out in this slide from its 2022 investor presentation, where it outlines that the industry mix is actually made up for more than half by services. Not bad for an $80 billion industry, whose companies that are considered to be capital goods manufacturers.

Otis 2022 Investor Presentation

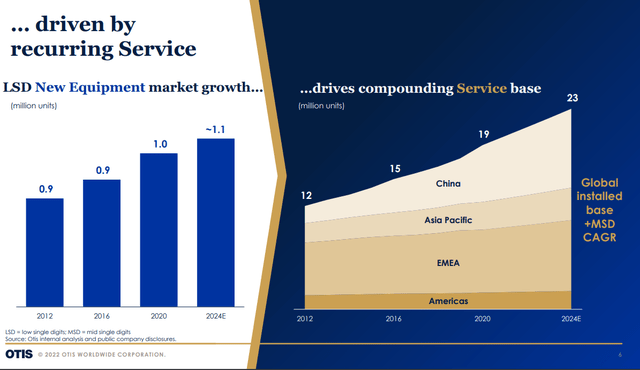

The more the installed base grows, the more recurring service grows too and it actually compounds, as shown from the two graphs below.

Otis 2022 Investor Presentation

Having understood this, we can now move to Otis.

OTIS: a look at the company

Otis was spun off from United Technologies on April 3, 2020. This alone may explain why Terry Smith didn’t own the company previously: it simply wasn’t possible to have it as a stand-alone company. Now,

In hindsight, the timing of the spin-off was perfect as it was able to enjoy the incredible bull-market we saw from April 2020 to last November. Otis ipoed at $45 and peaked in August 2021 at $92, which means that in just a little bit more than a year, it doubled in price. Since then, the stock has traded down to $64 and in the recent rally it is up once again, trading around $78.

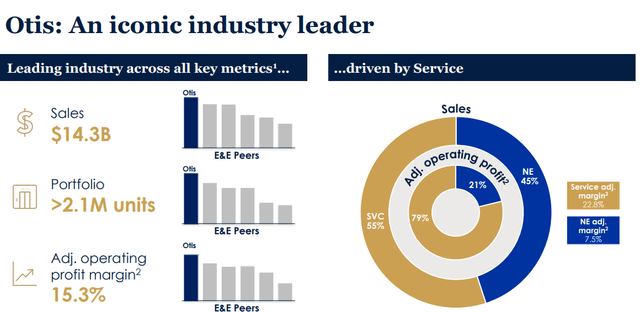

Otis is the largest manufacturer of elevators with a yearly revenue of $14.3 billion, against Kone’s $12 and Schindler’s $12.3.

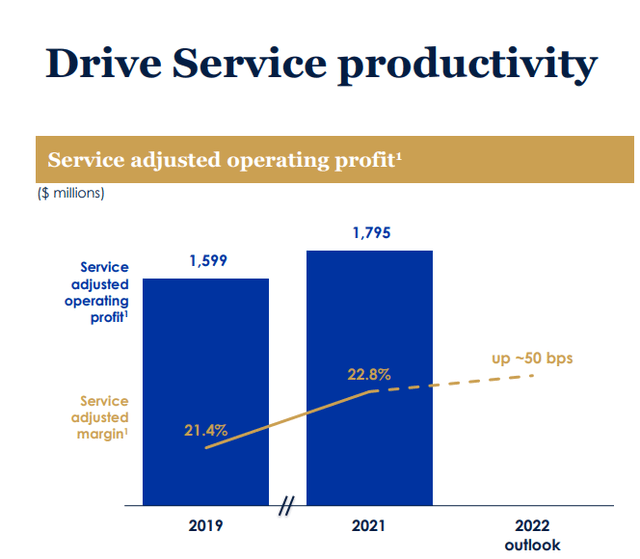

Its portfolio has more than 2.1 million units and in terms of profitability Otis leads the industry as well, with a 15.3% operating profit margin. Please look carefully at the graph on the right. It shows that though services account for 55% of total sales, they generate 79% of the total operating profit since the margin here is at 22.8% against the 21% of total operating profit generated by new equipment sales, that usually have a margin of 7.5%.

Otis 2022 Investor Presentation

Otis also reports that its average service contract length is 4 years and most contracts are also inflation adjusted. Its service and maintenance portfolio is worth around $6.5 billion and it is seeing very high stickiness, as the retention rate is at 94%.

Geographic diversification

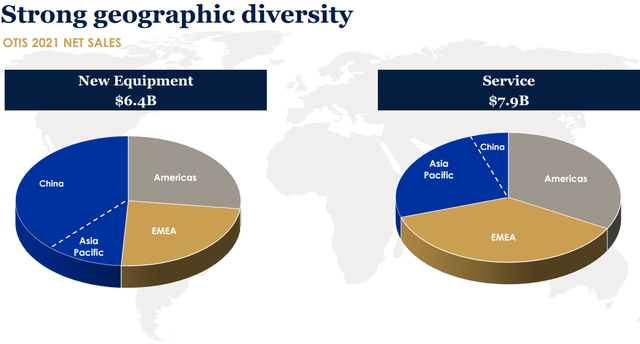

We have already mentioned that Kone is the leader in China. Otis is not idle in the country, however, as we can see from the two pie charts below, Americas and EMEA make up a little bit more than half of total new equipment sales. In addition, while China is still buying new equipment, in terms of service it is still making up a very low percentage of the total. Of course, as the installed based grows and ages, China will make up a bigger portion of service revenues. The exposure to the Americas is important: in fact, while in the recent quarterly report Otis reported a 6.7% decrease of new equipment orders in Asia, the Americas grew by 3.3% YoY and EMEA by 11.2%.

Otis 2022 Investor Presentation

Market share

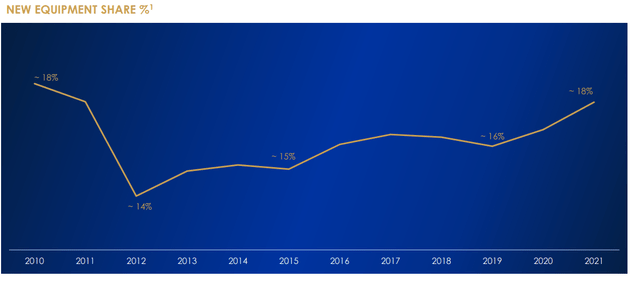

While Otis was part of United Technologies, it went through a tough period where it lost market share. Since 2012 it has clawed back to its previous highs, but I honestly expect that, after the spin-off, the company can perform even better since it is now clearly focused on the elevator and escalator business.

Otis 2022 Investor Presentation

Profitability

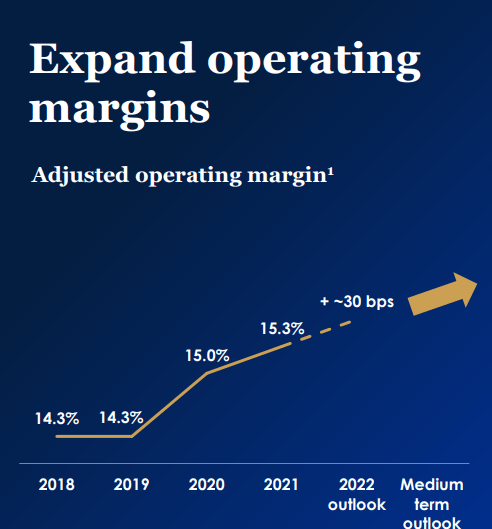

As we have seen, Otis is highly focused on service growth and this is part of the reason why its operating margins are going up, the other being a strict control over SG&A costs.

As we see from the graph below, we have to acknowledge that Otis has been performing quite well, taking advantage of the post-pandemic recovery to increase its pricing and manage its inventory in a proper way. As a consequence, while back in 2019 Otis’ operating margins was 14.3%, they are now a full percentage point higher while many big industrial companies have witnessed margin compression, like Kone itself has.

Otis 2022 Investor Presentation

Let’s consider that a big contribution to these margins comes from the service division, where margins are higher. Here Otis has seen a margin expansion from 21.4% in 2019 to 22.8% last year. The outlook for the full year is even higher and it should breach the 23% barrier.

Otis 2022 Investor Presentation

It is important to consider all these aspects because Terry Smith invests in highly profitable companies that can keep their margins high. In addition, he wants to find companies that have a high return on the capital employed. Here, with the help of the profitability page on Seeking Alpha, we find a company whose overall rating is an A and whose return on total capital reaches 55%.

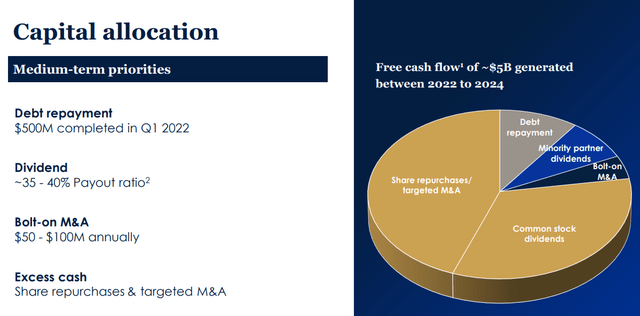

Furthermore, the company is committed to returning excess cash to its shareholders via dividends and or buybacks. In this way, Otis has paid down $500 million of debt and has spent $300 million on share repurchases in the past quarter, with the addition of $121 million paid for the quarterly dividend.

Use of capital

Otis 2022 Investor Presentation

Q3 Results

Though Otis reported higher margins, net sales were down for the quarter by 7.6%, though the main reason for this is FX. Organic sales were in fact up 0.8% YoY. Overall, the results were somewhat mixed, with new equipment sales down 13.9% YoY (or -8.1% when adjusted) and even service net sales down by 2.2% (though FX adjusted it would be a +6.5%).

However, Otis’ management revised a bit downwards its full-year outlook targeting a growth of 2.0 to 2.5%, and adj. EPS of $3.11 to $3.15 and free cash flow of $1.5 to $1.6 billion. This is mainly because of the situation in China. Nonetheless, the company feels confident about its cash flows and it has thus announced that it will increase its share repurchase target to $850 million.

Part of the reason why sales declined was that Otis still wasn’t able to fulfill all its orders due to supply chain bottlenecks that hit the manufacturing process. However, the company reported that new equipment backlog is increasing 12% at constant currency with growth in all regions, including China. So, we can reasonably expect Otis future quarters to achieve results pretty much in line with the past quarters, showing that Otis can be a $14 billion company.

Key takeaways and valuation

I think that it is clear that Otis, at the moment, has an advantage over Kone due to its geographic diversification. In addition, the company seems to keep its margins high, whereas Kone was hardly hit by inflationary pressure.

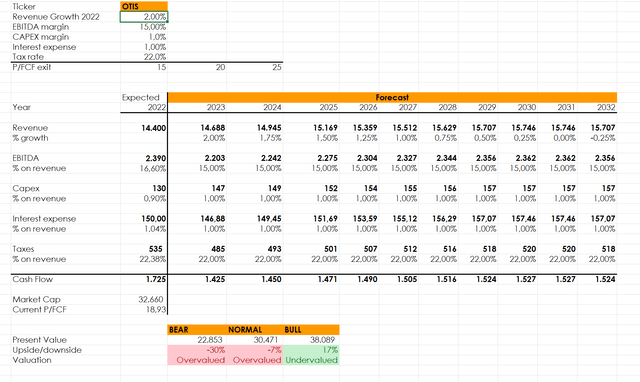

I plugged in some numbers in my simple discounted cash flow model. By using a 2% YoY growth in revenue the company seems a bit overvalued at the moment. True, we should factor in a premium since it has 55% of its revenue as recurrent. However, I think that, even though the business is very interesting, at today’s price there is not a very high margin of safety.

Author, with data from Otis guidance

Here is what I will do. I will keep the company on my watchlist and I will monitor it in case future drops in price take place. I believe that below $70 we are in buy territory and I plan on making my first purchase in that area.

Be the first to comment