MichaelGordon1/iStock Editorial via Getty Images

Investment Thesis

T-Mobile (NASDAQ:TMUS) is the leading pure play mobile internet company. The business has shown strong core EBITDA growth. We’re seeing a decline in expenses related to their merger with Sprint. I believe T-Mobile is set to return strong free cash flow to shareholders.

In the long term, I think T-Mobile is a great way to invest in the shift to 5G. The company is also leading a broad transformation away from legacy internet companies. This, combined with their relatively cheap valuation, makes me bullish on the company.

Strong guidance and growth plans

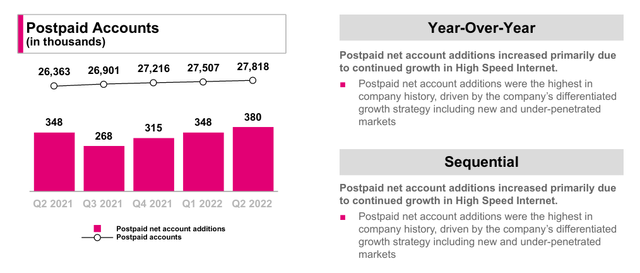

T-Mobile’s most recent quarterly results were very strong. The company added a record number of customers to its postpaid plans. Management raised guidance across the board, boosting both their revenue and profitability outlook.

It was a strong quarter for T-Mobile’s subscriber services. The business added a net of 1.7 million postpaid customers, including 723 thousand wireless phones. The company then raised its subscriber growth guidance by over 10%. 2022 postpaid customer growth is now projected to be 6 to 6.3 million subscribers. On their earnings call, management pointed out that T-Mobile added more quarterly postpaid customers than AT&T (T) and Verizon (VZ) combined.

T-Mobile Postpaid Account Growth (T-Mobile Q2 2022 Investor Factbook)

T-Mobile’s postpaid service revenues grew by 9% year over year. Core adjusted EBITDA was up 10% year over year. These results demonstrate that T-Mobile is generating solid growth. This is especially impressive in an industry with a slower total growth rate. I like T-Mobile’s position as a pure play mobile internet company. This strategy allows leadership to effectively focus on adding customers across market segments.

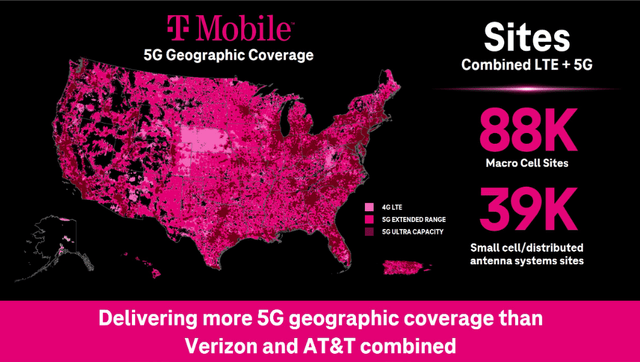

T-Mobile is positioned as the leader in the 5G space. According to market data collected by Ookla, T-Mobile has the highest 5G availability. Their 5G speeds are also faster than both AT&T and Verizon. Management has consistently described T-Mobile’s service as two years ahead of its competitors.

T-Mobile 5G Geographic Coverage (T-Mobile Q2 2022 Investor Factbook)

But by itself, T-Mobile’s earnings release wasn’t great. Revenue slightly missed expectations, and EPS showed a net loss of $0.09. The company attributed $1.00 per share of this loss to merger related costs. There was also a $0.29 per share impairment of Sprint’s wireline assets and a $0.23 per share expense related to a cyberattack settlement. Fortunately, most of these special charges won’t have long term effects on the company.

Increasing incremental revenue

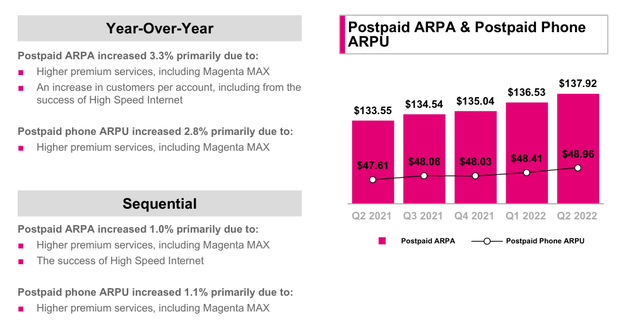

I find T-Mobile’s incremental revenue growth compelling. The company is driving solid per user revenue increases without direct price hikes. The company’s postpaid average revenue per account increased 3.3% year over year. Their postpaid average revenue per user increased by 2.8% year over year. Postpaid ARPA is expected to increase 3% for the full year. T-Mobile has committed to keeping prices steady for the time being. Most of this growth is from extra purchases of premium or value add services.

T-Mobile Postpaid ARPA and ARPU Growth (T-Mobile Q2 2022 Investor Factbook)

I think there are some risks to this strategy. As inflation increases, it may make it difficult for T-Mobile to keep up top line growth. The company is trying to capitalize on its lower cost, fixed rate pricing to generate new business. This may make it difficult to grow if industry churn decreases. But I don’t see much evidence of this happening right now. So far, these headwinds seem manageable.

New markets in broadband internet

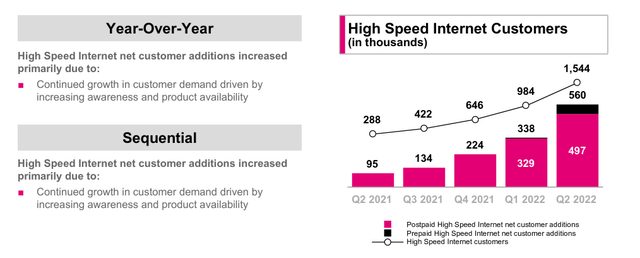

In addition to strong results in its core business, T-Mobile’s newer products are performing very well. The company’s high speed internet service posted especially strong results.

The company’s internet services are an important component of T-Mobile’s growth strategy. They add a separate service outside of the company’s mobile phone offerings. It’s an opportunity to generate extra incremental revenue from existing customers in exchange for a useful service.

This creates the potential for T-Mobile to grow much faster than the industry. It’s also an opportunity to compete with traditional internet providers. Legacy internet companies typically have low customer satisfaction and the space is open for disruption.

T-Mobile High Speed Internet Customer Growth (T-Mobile Q2 2022 Investor Factbook)

T-Mobile added 560 thousand new customers to their internet service during the quarter. The company now has 1.54 million customers, a 436% year over year increase. It’s the company’s third consecutive quarter leading the industry in net adds. I think this is a great opportunity and T-Mobile is making the most of it.

The final stages of the merger

T-Mobile continues to make solid progress integrating Sprint’s assets into their business. The company now expects Sprint’s network to be fully shut down by the end of next quarter. Management even raised their merger synergies guidance by $200 million.

Ongoing merger costs have been the primary headwind for T-Mobile’s earnings. But these expenditures are in their final stages. Almost all of Sprint’s customers are on T-Mobile’s network. Management discussed the last steps on their latest earnings call.

And speaking of network, we just hit some major integration milestones. Just over two years since we closed the merger, we have successfully shutdown most of the Sprint network. As of the end of the quarter, we had cumulatively decommissioned nearly two-thirds of the 35,000 targeted sites and can now report that we will be substantially complete by the end of Q3 this current quarter, remarkable work by the team to deliver these milestones ahead even of our recent year-end target and more than one year earlier than our original merger plan… Merger-related costs, which are not included in core adjusted EBITDA and are expected to be between $4.7 billion and $5.0 billion before taxes, primarily representing network activities. With Q2 being the peak quarter, we expect that Q3 will be closer to Q1 levels, and then taper off in Q4.

As with most large scale transformations, there’s some execution risk in these sorts of plans. I think T-Mobile’s management has done a good job of transitioning legacy customers while building out their 5G network. Based on management’s commentary, it seems they’ve been mostly unaffected by industry headwinds such as inflation and chip shortages.

The valuation is reasonable

I think T-Mobile’s shares are very cheap when compared to the business’s strong results. The company is trading at 6 times core adjusted EBITDA. Adjusting for debt, the company is trading at an EV to adjusted EBITDA of just over 10. I believe this is very cheap for a company that can grow its earnings by 10% year over year.

I usually avoid adjusted metrics. But in this case, I feel that T-Mobile’s core adjusted EBITDA metrics help reflect the underlying reality of the business. Right now, the company’s GAAP metrics are depressed due to merger costs. But I think we’ve already hit the peak. On their first quarter earnings call, T-Mobile’s CEO described 2022 as “the peak capital year in our business plan”.

Set to generate returns for shareholders

Capital expenses and merger costs are likely to slow down over the next few years. I think T-Mobile is poised to generate strong free cash flow as this happens.

The company has maintained the potential for an up to $60 billion buyback between 2023 to 2025. This is equal to nearly 36% of the company’s shares outstanding. The details of this are speculative right now. But I think it’s clear that management is looking to return funds to shareholders.

Final Verdict

T-Mobile is a strong company with solid potential for expansion. There is some execution risk and uncertainty regarding pricing and the economic environment. But I think the company has a clear path to sustainable growth. The broadband market provides an opportunity for T-Mobile to generate sustainable revenue growth. I think the shares are at a decent price to start a position.

Be the first to comment