porcorex

Net lease REITs remain one of my favorite asset classes, due to their high margins and simplistic business model. These are key reasons for why most, if not all, weathered through the past couple of years with their dividend track records intact. More recently, concerns around interest rates have pushed down their valuations, and I’ve taken the opportunity to buy the dip.

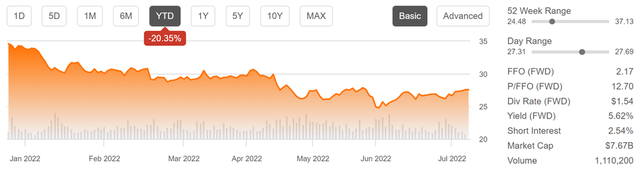

This brings me to STORE Capital (NYSE:STOR), which is now trading well below its 52-week high, and as seen below, has fallen by 20% since the start of the year. In this article, I highlight what makes STOR a solid buy for income and growth, so let’s get started.

Why STOR?

STORE Capital is one of the bigger net lease REITs out there, after seeing fast growth since its IPO. It’s internally-managed and focuses on owning profit centers that are leased to middle-market and larger companies across the U.S.

This is a rather large and fragmented segment that offers attractive cap rates, and the profit-center nature of the real estate means that tenants are less likely to default on the leases (as opposed to cost centers). This segment comprises a staggering 2 million locations that represent a $3.9 trillion addressable market, thereby giving STOR plenty of growth runway ahead to consolidate this sector.

The vast majority of STORE’s locations are subject to unit-level financial reporting. This benefits STORE in that it gives management the opportunity to quickly identify any financial issues that may pop up with a tenant location and plan an appropriate course of action.

Moreover, management focuses heavily on strong unit-level profitability, as reflected by a portfolio average 4.7x rent coverage, and develops close relationships with its tenant base, as one-third of new business comes from existing tenants seeking growth capital.

At present, its portfolio consists of 2,965 properties leased to 573 tenants in 49 states. It enjoys a high occupancy rate of 99.5%, which is close to the same as the 99.6% and 99.5% that it saw in 2021 and 2020, respectively. It also has a long-weighted average lease term of 13.3 years, which is longer than the ~10 years for most retail focused net lease REITs.

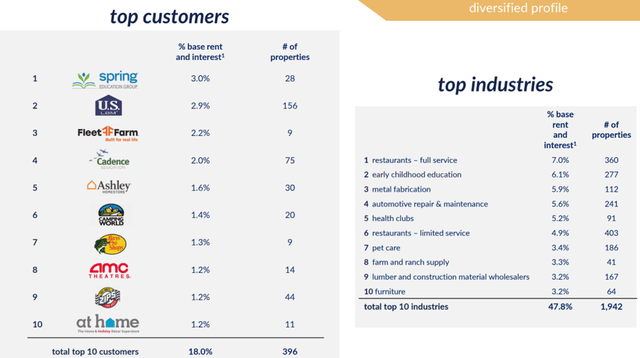

As shown below, no one tenant represents more than 3% of total base rent, and the primarily service-oriented nature of its tenant industries makes STOR’s properties relatively immune to the effects of e-commerce.

STOR Tenant Mix (Investor Presentation)

Meanwhile, STOR continues its growth trajectory, having acquired $513 million in profit center real estate during the first quarter, the highest first quarter volume in its history. The acquisitions came with an attractive 7.1% initial cap rate, with average annual lease escalations of 1.8%.

It also benefits from a strong balance sheet with an adjusted debt to EBITDA ratio of 5.7x, and has plenty of retained capital to fund growth with a 67.5% dividend payout ratio. This makes STOR less reliant on capital markets to fund growth compared to peers that have higher payout ratios.

Factors that could drive STOR’s share price down include higher interest rates which could drive up the cost of debt, and inflation which could make perceived “bond-like” REITs less appealing. Nonetheless, looking forward, STOR maintains healthy internal and external growth characteristics, as noted by management during the recent conference call:

We also have strong internal growth of 5% between our annual rent escalations, which average 1.8% on the portfolio, our retained cash flow from our low dividend payout ratio, which was 67.5% this quarter, and proceeds from dispositions.

The financing flexibility that we have built over the last decade positions us well to fund our growing pipeline of acquisitions with both debt and equity options, which allow us to optimize our cost of capital to generate attractive spreads. We have 3 primary sources of debt financing. Our Store Master Funding facility, investment-grade unsecured debt and unsecured bank debt as well as access to the equity market, usually through our ATM program.

While interest rates are rising, just last week, we were able to issue term debt financing at an attractive fixed rate of 3.68%. We are extremely pleased with this execution and the broad participation from all 13 banks in our bank group. In light of these key differentiators, we feel STORE is well positioned to execute on our objectives for the year.

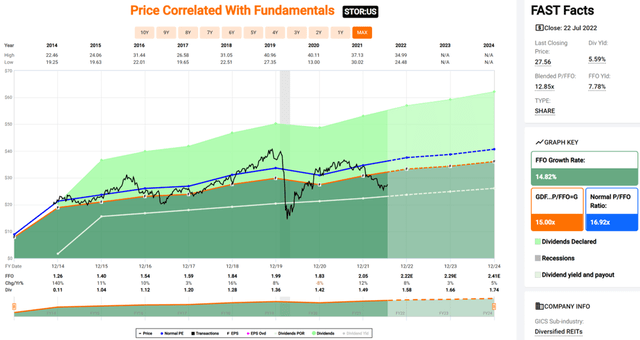

I see value in STOR at the current price of $27.56 with a forward P/FFO of just 12.7, sitting well below its normal P/FFO of 16.9. The share price weakness has driven the dividend to an attractive 5.6%, and the dividend has grown at a 5.8% 5-year CAGR with 7 years of consecutive growth. Sell side analysts have an average price target of $30.55, implying a potential one-year 16% total return including dividends.

Investor Takeaway

STOR is a high-quality net lease REIT with a portfolio of service-oriented tenants that are relatively immune to e-commerce. It’s also maintained strong occupancy over the past 2 years, and has a long weighted average lease term of 13.3 years. Looking forward, it has strong internal and external growth prospects, and pays a growing dividend while retaining plenty of capital to fund growth. I see value in STOR at the current valuation for its income and growth.

Be the first to comment