IGphotography/E+ via Getty Images

I covered Simon Property Group, Inc. (NYSE:SPG) right before the new year, explaining that I thought it was the best option available to investors in the mall REIT sector. I also mentioned that I planned to sell my shares because I thought other opportunities were more attractive. My sale turned out to be good timing, as shares are down 40% YTD. Today’s article will be comparing it to The Macerich Company (NYSE:MAC), another mall REIT that is down nearly 50% YTD.

Investment Thesis

The mall REIT sector has had a rough go the last couple of years. Simon Property Group has held up better than Macerich, but shares of both REITs have been weak in 2022. The valuation is cheap on both, with a price/FFO of 4.5x for Macerich and 8.1x for Simon. Both REITs carry juicy dividends, with Simon yielding 7.1% and Macerich yielding 6.7%. Macerich has several red flags that investors should be aware of before buying shares. Simon is larger with a market cap of $36B, while Macerich has a market cap of $2B. Both REITs focus on high end properties in large markets.

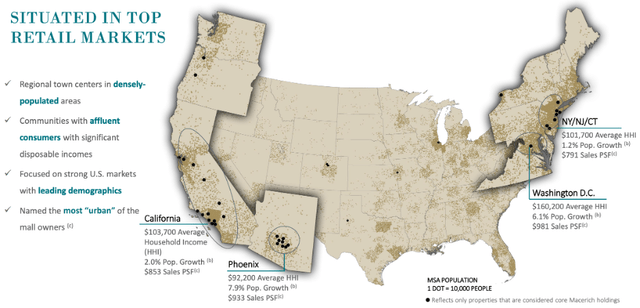

Macerich Properties (macerich.com)

The properties aren’t the issue with Macerich. A lot of their properties are in attractive markets with good demographics. Macerich has several other issues with the balance sheet and the dividend that I detail more below. The biggest reason some investors are bullish on Macerich is the cheap valuation.

Valuation

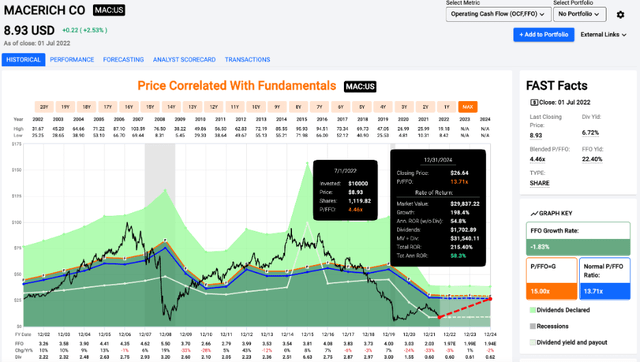

Macerich is about as cheap as they come for a REIT. The current price/FFO of 4.5x has got to be one of the cheapest multiples I have seen in the last couple years. However, it is cheap for a reason, and with the share count exploding in the last year, recent equity issuances have come at very low multiples. While I have problems with Macerich that prevent me from being bullish, I think shares are still a hold simply because of how cheap they are today. The average multiple over the last two decades is 13.7x, so if you think shares will eventually trade at a higher multiple, returns could be impressive from here.

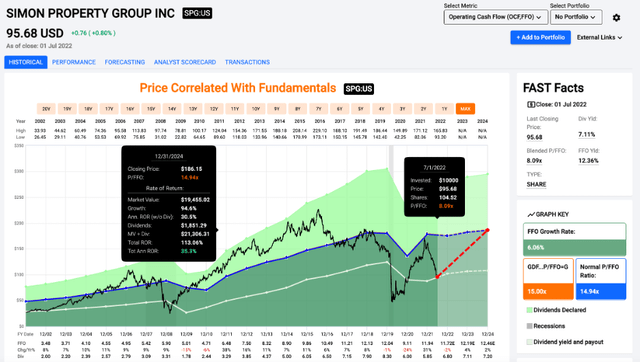

I wouldn’t be counting on multiple expansion with Macerich, but I think that we could see some with Simon. Shares now trade for 8.1x price/FFO, which is well below the average multiple just under 15x. While this isn’t quite as cheap as Macerich’s valuation, I think there is significant upside ahead for investors in Simon. I exited my position earlier this year, but I might buy shares again in my Roth account once I make my contributions for the year. I think shares are a solid buy below $100, and you can collect a large dividend that is likely to grow if recent history is any indication.

Simon might be more expensive relative to Macerich, but that makes sense to me given the larger size, better management, and much better balance sheet of Simon. This brings me to the biggest reason I prefer Simon, which are the red flags with Macerich.

The Red Flags With Macerich

While Macerich has carried a large debt load for years, they have paid off a significant chunk in the last couple years. Their balance sheet is in better shape than it was, but it still is not comparable to Simon’s. One of the other red flags for Macerich is the rapid increase in shares outstanding. Using Q1 numbers, shares outstanding increased by more than a third from 158.6M in 2021 to 214.8M in 2022. Simon’s shares outstanding have also increased in the last couple years, but not nearly the same way as Macerich’s share count. Simon also has a $2B buyback program that will run until May of 2024. My guess is that they will be buying back shares fairly aggressively below $100.

Both REITs had to cut their dividend in 2020, but that is where the similarities end for the dividends of these two mall REITs. Macerich was paying a $0.75 dividend heading into the COVID lockdowns in 2020. They cut to $0.50 for the next quarter, followed by a cut to $0.15, where the dividend has remained since then. Simon cut their quarterly dividend from $2.10 to $1.30, but they have hiked four times since then. Their quarterly dividend is now $1.70, so they are halfway back to their pre-COVID dividend.

Conclusion

Macerich might be cheap, but there are a lot of red flags to consider. The debt load, while smaller than it was in 2020, is still considerable. The dividend cut in 2020 is an obvious red flag, and the ballooning share count is enough to keep me away. It is possible that the worst is behind us for Macerich, but Simon has better management, and it is also cheap. Simon’s forward dividend is 7.1%, while Macerich’s is 6.7%. The question I will leave readers with is this: why own Macerich when you can own Simon Property Group instead?

Be the first to comment