CloudVisual/iStock via Getty Images

Introduction

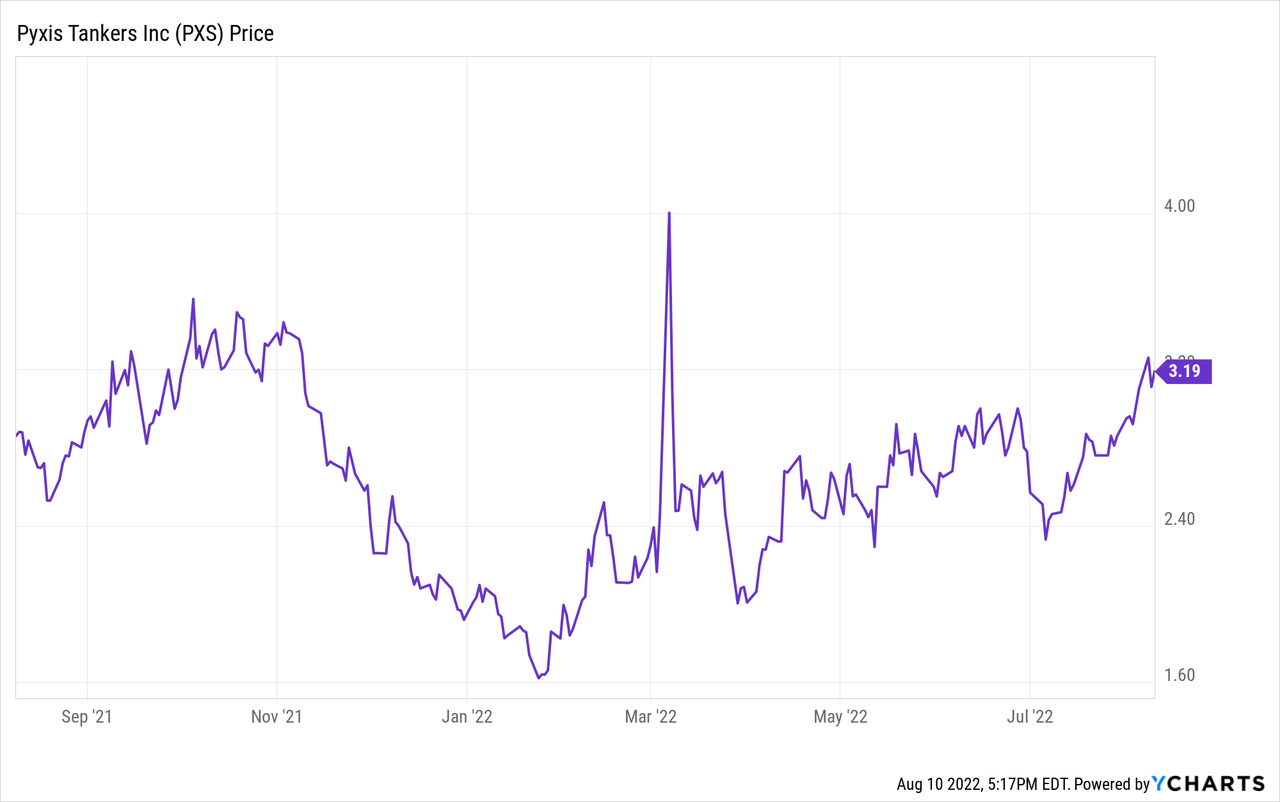

About eighteen months ago, I though the preferred shares of Pyxis Tankers (NASDAQ:PXS), trading with (NASDAQ:PXSAP) as ticker symbol offered an interesting opportunity. Charter rates for MR tankers were low at the time so it was my ‘safer’ bet on increasing charter rates. It took longer than I expected but the past few months, the charter rates for the vessels owned by Pyxis have tripled. Which means the company is now making money again. This helps to fully fund the preferred dividend and improve the asset coverage ratio level of the preferred shares.

In this article, I will mainly focus on the improved situation for preferred shareholders. For an excellent recent overview of Pyxis’ fleet, I’d like to refer you to Henrik Alex’s May article. In May, Henrik estimated the fair value of the fleet to be approximately $114M, lending credibility to the book value used by Pyxis.

Please note: Pyxis Tankers is a micro-cap with a market capitalization of just under $35M and therefore the stock falls in the higher-risk category. Although the stock is very liquid, limit orders are strongly recommended to avoid any negative surprises. This article is an update on an article published in April 2021.

A look at the Q2 results, and how this impacted the balance sheet

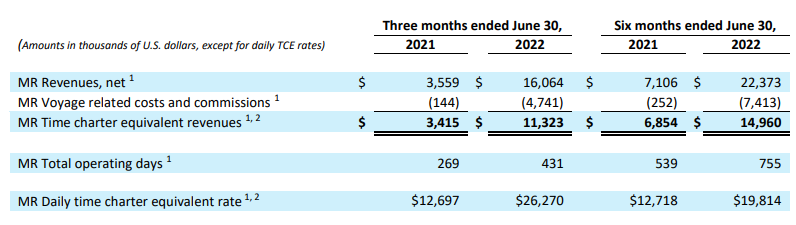

Pyxis Tankers had already signalled its Q2 results would show a substantial improvement so the strong results shouldn’t really come as a surprise. During the second quarter of this year, Pyxis Tankers reported a TCE rate of in excess of $26,000 per vessel per day which is more than twice the charter rates in the same quarter of last year.

Pyxis Tankers Investor Relations

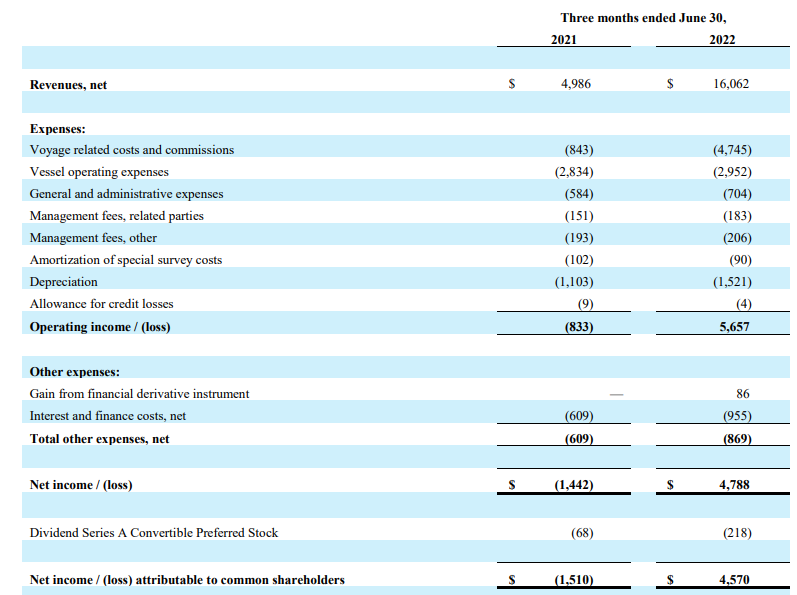

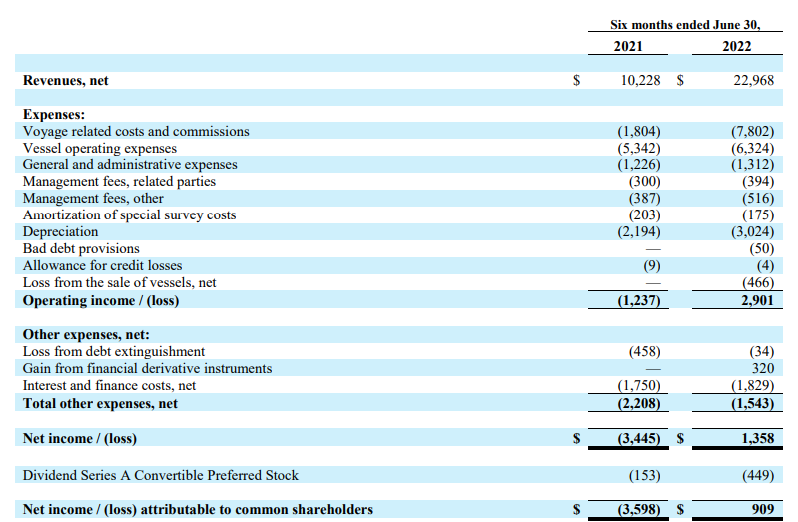

This immediately boosted the revenue to $16M (as the fleet now consists of five MR vessels) resulting in an operating income of almost $5.7M. That is a massive improvement compared to the operating loss of $0.8M in Q2 2021. After deducting the interest expenses and the preferred dividends, the net income attributable to the common shareholders of Pyxis Tankers came in at $4.6M for an EPS of $0.43.

Pyxis Tankers Investor Relations

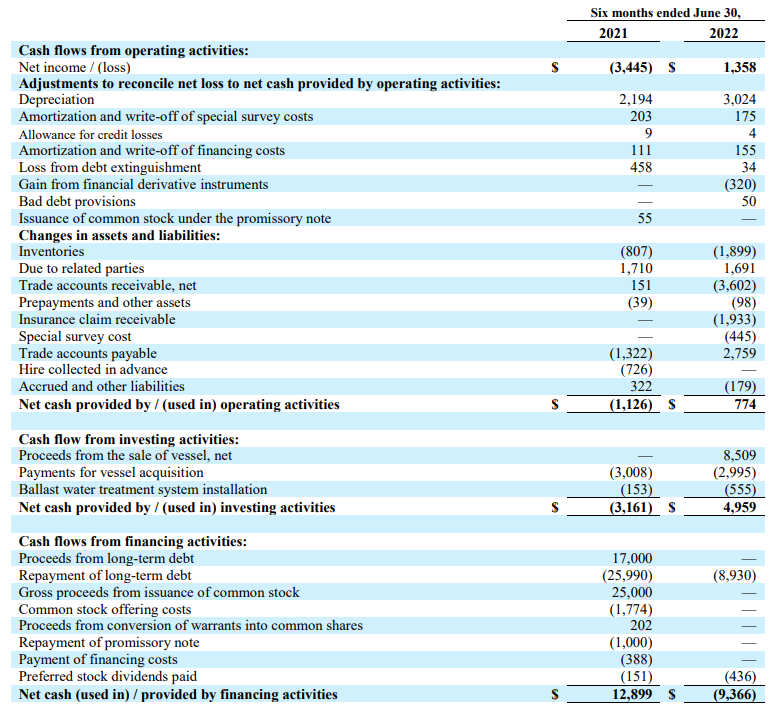

The strong net income obviously also boosted the cash flows and in the first six months of the year the reported operating cash flow came in at $774,000 and after adding back the changes in the working capital position, the adjusted operating cash flow was $4.1M (including the payment of the preferred dividends.

Pyxis Tankers Investor Relations

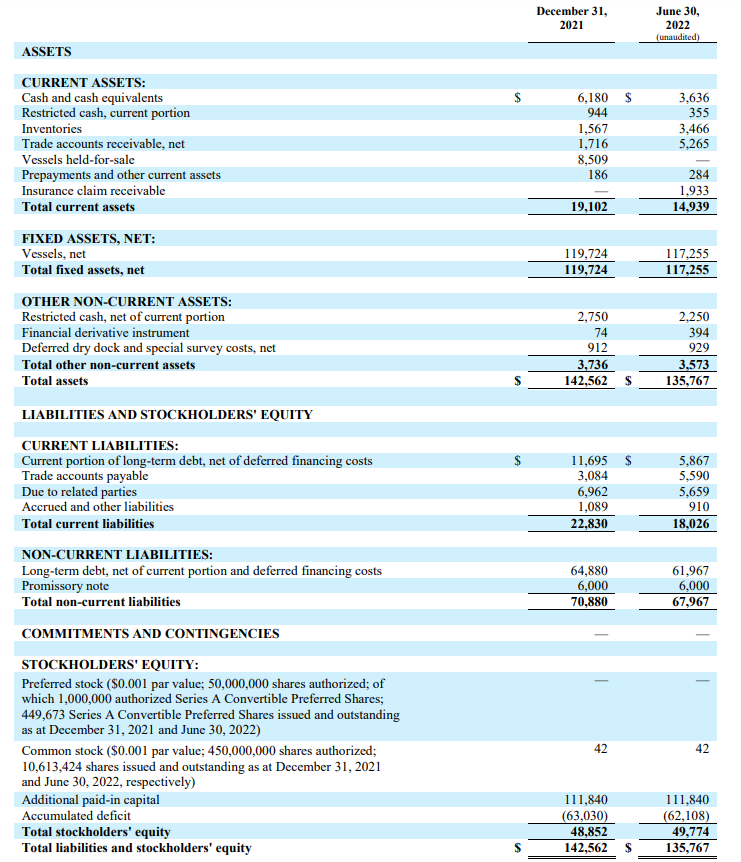

We also know the adjusted operating cash flow in the first quarter of this year was a negative $2.1M which means the Q2 adjusted operating cash flow exceeded $6.5M. This helped the balance sheet as the net debt decreased to approximately $73.3M (including the restricted cash) down from almost $80M as of the end of 2021. And as the company didn’t generate a positive operating cash flow or free cash flow in the first quarter, pretty much the entire net debt decrease came from the Q2 performance.

So using an average day rate of just over $26,000, Pyxis Tankers is generating approximately $26M per year in operating cash flow. And as of August 5, almost 57% of the available days in Q3 were already booked at an average of $30,500/vessel including three vessels at just $25,000/day with two MRs in the spot market raking it in with day rates of in excess of $40,000/day.

This means odds are Q3 will at least be as strong, and likely better than the second quarter. Which also means the net debt will likely continue to decrease to less than $70M while it is now also realistic to aim for a net debt of just around $60M by the end of this year although this will obviously also depend on working capital changes and perhaps aiming to reach that debt level halfway Q1 2023 is more realistic.

The preferred dividends are now covered, and the asset coverage level is strongly improving

For a detailed overview of the terms and details of the preferred shares, I’d like to refer you to my April 2021 article. These preferred shares can be converted into common shares but that’s not an item right now as the stock would have to quadruple before this feature comes into play. So, for now, I am just looking at the preferred shares from an income perspective as these preferred shares pay $1.9375 per share per year, in twelve monthly installments of $0.161458. At the current share price of just under $20, the preferred dividend yield is approximately 10%.

Thanks to the substantial increase of the net income in the second quarter, the preferred dividend is now handsomely covered. As there are just 449,673 preferred shares outstanding, Pyxis only has to pay $218,000 per quarter in preferred dividends. This represents less than 5% of the net income in the second quarter.

Even if we look at the H1 2022 results which use an average charter rate of just under $20,000/day which is perhaps a good long-term point of view, the net income was $1.36M and only $449,000 was needed to pay the preferred shares.

Pyxis Tankers Investor Relations

Note how the $1.36M in net income includes a $0.5M loss on the sale of vessels while the total interest cost was just over $1.8M and the rapid reduction in the net debt should result in lower interest expenses. In any case, based on a charter rate of just under $20,000/day, Pyxis tankers needed just 25% of its net income (adjusted for the loss on the vessel sale) to cover the preferred dividend. That’s good enough for me.

Moving to the asset coverage ratio, the net debt reduction is obviously helping to protect the value of the preferred shareholders.

Pyxis Tankers Investor Relations

As you can see in the image above, the equity value increased to just under $50M. The 449,673 preferred shares have a value of $11.2M which means about $38.5M in equity is ranked junior to the preferred shares. It is also interesting to see the vessels have a book value of $117M. In Henrik Alex’ May article, he estimated the value of the vessels to be approximately $114M. While that was correct at the time, the recent increase in charter rates has also pushed the value of secondhand vessels higher. So based on the current market situation, I’d argue the market value of the vessels is higher than the book value.

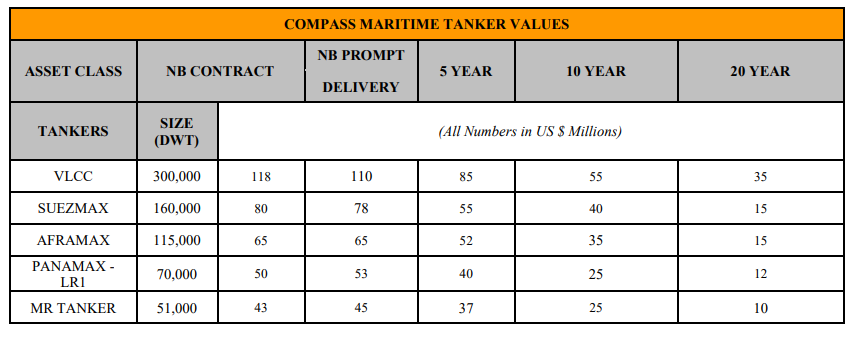

Just to give you one example. The recent purchase of a 2017-built vessel of $32M was rather expensive as per Alex’s article. However, recent quotes for a 5-year-old MR-size tanker are pointing towards a fair value of $37M per vessel. A similar observation can be made for the 2013 built vessels. Back in May, these vessels had a value of $20.5-21M. But right now, a 10 year old MR tanker (slightly older than these 2013 built vessels) changes hands for $25M as per Compass Maritime (below) and Lloyd’s List.

Pyxis Tankers Investor Relations

This means that for these three vessels alone, the market value is about $13M higher than the book value. And that provides additional protection (albeit hidden) for the preferred shareholders.

Investment thesis

The main question right now is how long these good times will last. Q2 was good, Q3 will likely be even better. But the visibility remains relatively limited although the longer-term charter rates for MR vessels appear to hold the $20,000+ per day rate but it remains to be seen what Pyxis can lock in for its vessels. So I’m enjoying the cash flows while it lasts and I am happy to see that just two quarters of strong cash flows will already make the balance sheet much safer.

I have a small speculative long position in the common shares but I have a larger long position in the preferred shares in Pyxis. As those rank senior to the common equity, they are safer than the common shares but of course Pyxis needs to keep its balance sheet in good shape and continue to reduce its net debt. I would be interested in buying more of Pyxis’ preferred shares, but it is imperative to keep an eye on the charter rates and the value of secondhand vessels.

Be the first to comment