Lingbeek/E+ via Getty Images

The market downturn that began since the start of the year has created many bargains to choose from. As such, this is indeed a good time to be a value investor, considering that nearly all sectors have seen a correction.

This brings me to PPG Industries (NYSE:PPG), which is a moat-worthy company that’s now trading well below its 52-week high of $177 achieved just earlier this year. In this article, I highlight what makes PPG a solid value buy amidst the market rubble, so let’s get started.

Why PPG?

PPG has been around for nearly 140 years and became the world’s largest producer of coatings, after its purchase of selected Akzo Nobel assets. Its products are sold to a wide variety of end users, including the automotive, aerospace, construction, and industrial markets.

The company has a global footprint in over 75 countries, with less than half of sales coming from North America in recent years. This is exemplified by its Comex acquisition, which expanded PPG’s coatings and specialty products into emerging regions. Last year, PPG generated $16.8 billion in total sales.

PPG’s stock price has traded rather weakly since the start of the year, sitting well below the $177 mark achieved in January. As shown below, shares have fallen by nearly 31% since the start of the year.

PPG Stock (Seeking Alpha)

Of course, lots have changed for the global economy, with supply chain concerns, inflation, and global economic unease coming to the forefront. This is reflected by the fact that PPG has seen a 25% increase in raw material costs along with elevated energy and transportation costs.

However, PPG has been able to pass along some of this cost inflation in the form of price increases, with selling prices rising by 10% YoY marking the 20th consecutive quarter of higher selling prices, and this helped to drive 7% organic sales growth in the first quarter. Moreover, PPG has been able to maintain above-market sales volume performance in several of its leading end use markets, including automotive refinish and PPG-Comex architectural coatings.

Looking forward, PPG should see some supply chain and sales benefits from an easing of COVID restrictions in China, while Europe may still remain challenged given the continuing unrest there as a result of the war in Ukraine.

However, I see reasons to be optimistic, as PPG has a larger than normal order backlog of $180 million, primarily in automotive refinish and aerospace coatings as demand for air travel continues to surge. PPG is also positioned to weather higher global energy prices with real-time pricing relative to inflation, and management expects cash flow generation to match prior year end trends.

Moreover, PPG is managing costs, with SG&A as a percentage of sales decreasing by 40 basis points compared to last year, and expects an additional $15 million in cost savings from recent restructuring programs and acquisition synergies. As such, PPG should continue to see cost benefits as it consolidates the coatings sector while divesting from non-core businesses, as noted during the recent conference call:

Strategically, on April 1, we completed the acquisition of Arsonsisi’s Powder Coatings business, continuing our focus on growing our powder coatings manufacturing capabilities. In addition, we divested some architectural coatings businesses in Africa as we continue with our legacy evaluating all regional businesses and product lines to ensure that they continue to have strategic value and meet our financial hurdles.

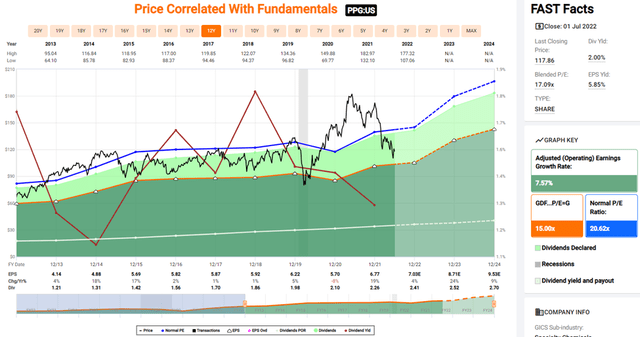

Meanwhile, I see value in PPG after the recent drop. At the current price of $117.86, PPG carries a forward PE of 16.8, sitting well below its normal PE of 20.6 over the past decade.

It also maintains a strong BBB+ rated balance sheet. While the 2% dividend yield isn’t particularly high, it does come with a low 37% payout ratio, a 5-year CAGR of 8.1%, and 49 years of consecutive growth, putting PPG close to achieving Dividend King status.

PPG Valuation (FAST Graphs)

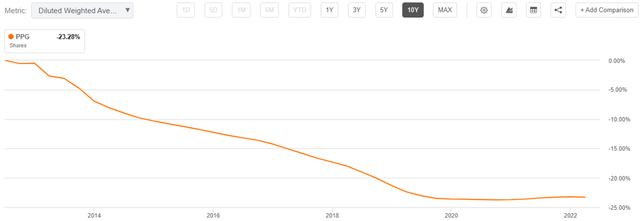

PPG should also be regarded as a total return story, as it’s retired 23% of its shares over the past decade. While share buybacks have moderated since 2020, I would expect for it to resume after more economic certainty.

PPG Shares Outstanding (Seeking Alpha)

Lastly, analysts expect 21-42% EPS growth over 5 quarters starting in Q3 of this year, with growth tapering off to the mid to high teens thereafter. They have a consensus Buy rating with an average price target of $152.52, implying a potential 31% total return including dividends.

Investor Takeaway

PPG is a well-positioned global coatings leader that should continue to benefit from an increase in M&A and divestitures, higher selling prices, cost synergies, and share repurchases with more economic certainty. PPG is attractively valued with a forward PE that sits well below its normal PE, and analysts forecast strong future EPS growth. As such, PPG looks like a Buy for long-term investors seeking to add a high-quality global leader with an attractive total return profile.

Be the first to comment