TonyBaggett/iStock via Getty Images

The Next Gold Prices Are Unlikely to Encourage Investment in Publicly Traded Gold Mining Companies

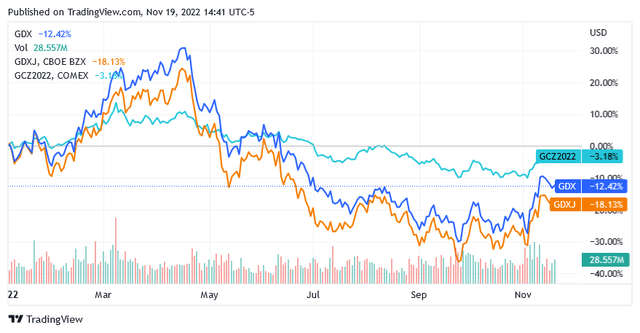

Gold stocks underperformed over the year as the price of gold fell.

Indeed, the Gold Futures – Dec 22 (GCZ2), used as a proxy index for gold prices, fell 3.18%, while the VanEck Gold Miners ETF (GDX) and the VanEck Junior Gold Miners ETF (GDXJ), proxy indexes for the gold stocks fell by 12.42% and 18.13%, respectively, below chart illustrates.

Osisko Development Corp. (NYSE:ODV) (ODV.V) is one of the stocks that investors may want to reduce as the stock appears to be highly exposed to the risk of a depreciation in the price of gold.

The risk also stems from mining projects lagging behind the company’s project to become a medium-sized producer.

The Role of Osisko Development Corp. In The Gold Mining and Exploration Industry

Based in Canada in the city of Montreal in the province of Quebec, Osisko Development Corp. is engaged in the gold mining industry as an explorer and developer of precious metal resources.

Osisko Development Corp is also an appraiser of these mineral properties.

The principal project the company is working on is called the Cariboo Gold Project and is located in the province of British Columbia, Canada. Osisko Development Corp owns 100% of this asset.

In addition, Osisko has mineral interests in the Sonora province of Guerrero, specifically in an area hosting a project called the San Antonio Gold Project.

Osisko’s portfolio is completed by the Trixie gold test mine for exploration and production of the precious metal in Utah, USA.

From The Third Quarter of 2022

Let’s look at the operating and financial results for the most recent quarter that ended September 30, 2022.

Osisko said total revenue for the third quarter of 2022 was CA$22.8 million, reflecting nearly 6x growth from CA$3.9 million in the prior year’s quarter. CA$ stands for Canadian dollars.

Higher proceeds came from the acquisition of 100% of the Trixie gold test mine in Utah for a total consideration of CA$178 million, of which 33% was paid in cash and the remainder through the issuance of approximately 12.05 million shares.

But the sharp increase in sales hasn’t yet allowed Osisko to avoid a net operating loss of $111.9 million, which was worse than the net loss of $40.5 million in the same quarter last year.

Net loss increased from $31.7 million in the third quarter of 2021 to $103.7 million in the third quarter of 2022.

The San Antonio Project in Mexico

The deterioration of the operating loss and of the net loss followed an $81 million asset impairment reported at the Sapuchi mine, one of five deposits along with California, Golfo de Oro, High Life, and Calvario that make up the San Antonio project located in the Mexican province of Sonora.

Stockpile processing operations continue at Sapuchi Minera’s leach platform, which is loaded with one million tons of mineral, which is expected to sort 0.58 grams of gold per ton of ore. In the third quarter of 2022, the San Antonio Gold Project produced 7,358 ounces of gold from the heap leach pad operation, accounting for 67% of the total ounces of gold, about 10,958 ounces, sold during the period.

The entire area, including the other 4 deposits, is transitioning from historical copper production to gold production where precious metal mining will take place via heap leach. With the range regularly reviewed in the economic coefficients used to determine future cash flows from gold sales, this time it was Sapuchi’s turn to face the negative consequences translating into asset impairment charges.

It must be said that Osisko Development Corp. is currently processing Sapuchi Minera’s stockpiles with increased uncertainty about gold recovery and operating costs as the company cannot count on the utility of a feasibility study or the reliability of the resources, which are only indicated and not proven or probable.

Indicated resources of the San Antonio project include approximately 576,000 ounces of gold grading 1.2 grams per ton of mineral and 1.37 million ounces of silver grading 2.9 grams per ton of mineral, both contained in 15 million tons of mineral.

Historically, this area of the San Antonio project appears to have been characterized by a high risk of commercial and technical failure, which of course weighs on expectations for future results from related projects.

The Bonanza Ledge Project in Canada and the Trixie Test Mine in Utah

To some extent, results from the Bonanza Ledge II project within the broader Cariboo mining camp in British Columbia and operations at the Trixie Test Mine in Utah also impacted the operating results.

With regard to the Bonanza Ledge project, a mineral resource estimate released earlier this year indicates that Bonanza’s resources have a higher cut-off grade of 3.5 grams of gold per ton of mineral [g/t] than the cut-off grade of 2 g/t for the other 7 deposits [Cow, Valley, Shaft, Mosquito, KL, Lowhee, BC Vein] of the Cariboo Gold Project.

As a result, the Bonanza Ledge project must consider mining material at a significantly higher grade than the rest of the property. Otherwise, the nature of the material would be such that waste separation would lead to higher costs and the mineral asset would not be operated according to the criterion of economic efficiency. This operational issue could result in lower than expected gold production.

The revaluation of the cut-off value has led to an impairment, which affected the operating result, among other things.

Not to mention that the resources associated with the Bonanza Ledge Project’s measured resources are, in terms of reliability, the best mineral data available to shareholders of the entire Cariboo Gold Project.

The Bonanza Ledge project has 8,000 ounces of gold in measured resources to be developed from a total of 47,000 metric tons of mineral grading 5.1 g/t. The entire Cariboo gold project hosts 3.463 million ounces of gold in Indicated Mineral Resources to be developed from 27.055 million tons of material averaging 4 g/t gold.

During 2021 and from Q1 2022 to October 2022, Osisko Development’s exploration team conducted drilling activities at the Cariboo Gold Project as part of a program in support of a feasibility study expected to be completed later this quarter.

The study aims to develop the Cariboo project in a way that reduces the risk of over-reliance on debt and lays the foundation for converting the asset into a full-fledged mining camp capable of exploiting multiple deposits and increasing margins.

To have a concrete idea of what the Cariboo Gold Project will be, shareholders have to wait for the feasibility study. But project development activities outlined in the technical study will not begin until late 2023 when the final approval from the Canadian government is expected.

In the third quarter of 2022, the Trixie test mine produced 3,600 ounces of gold from the operation, accounting for 33% of the total ounces of gold, about 10,958 ounces, sold during the period.

Osisko’s interest is not limited to the Trixie Test Mine, as it includes more than 17,000 acres of mineral claims in the Tintic Mining District, an area of central Utah that has historically piqued the interest of prospectors.

Trixie’s gold assets consist of mining activities in an underground ore deposit and exploration activities to further increase the production capacity of the deposit.

The deposit appears to be characterized by significantly lower levels of metal in the mineral compared to the average for the company’s entire asset base.

Currently, annual gold production is expected to be between 14,500 ounces and 14,700 ounces of gold recovered using vat leach processing techniques where the solids are immersed in a tank in a leach solution.

The company is developing underground operations and the first phase of this process is expected to be completed sometime in the first quarter of 2023. The results of this phase could impact the share price, but gold market sentiment must also be supportive in the event of a significant and positive operational update. The probability of a supportive gold price is low.

The Company’s Mid-Tier Gold Producer Target Vs. Current Projects Status and Financial Conditions

Objectively speaking, it’s not easy to create great expectations when looking at this company’s projects.

The company aims to become a mid-sized gold producer, but this means increasing from its current 45,000 ounces of gold to about 550,000 ounces and more per year to reach that goal.

Achieving the goal will take time, and the countdown won’t start until early 2024 when the company’s main project will receive all the necessary permits.

In addition, it will require financial resources, which will be significant given the magnitude of the goal that Osisko Development Corp. wants to achieve.

The company cannot rely on cash flow from operations [CFO] as this item generates a deficit [CFO was around -$44 million in the last 12 months to Q3 2022]. While the cash available on hand totaled less than $100 million as of Sept. 30, 2022.

The company will likely need to borrow, but the financial cost will be higher due to tight interest rate policies from the US Federal Reserve and the Reserve Bank of Canada. This could result in significant financial costs to the balance sheet, posing a risk that conflicts with the way the company intends to develop Cariboo’s lead project.

Low Price May Get Lower in The Upcoming Period

In the past year, the shares of Osisko Development Corp. traded as follows: under the symbol ODV shares have lost 62.32%, while under the symbol (TSXV:ODV:CA) shares have lost 60.13%.

Under the symbol ODV shares were trading at $4.68 per unit as of this writing, significantly below the long-term trend of the 200-day simple moving average line of $6.9346.

This stock has a 52 Week Range of $3.84 to $13.38 and a market cap of $353.971 million.

Under the symbol ODV:CA shares were trading at CA$6.22 per unit as of this writing, significantly below the long-term trend of the 200-day simple moving average line of CA$8.92.

This stock has a 52 Week Range of CA$4.49 to CA$15.87 and a market cap of CA$470.449 million.

In both the US and Canadian market, the stock has a very low market value after the crash, but that doesn’t mean the stock should be bought. Indeed, investors may want to consider selling shares.

While these prices are low, they don’t mitigate the investment risk for two main reasons.

First, the scale of the growth project aimed at transforming the company into a medium-sized gold producer, such as IAMGOLD Corporation (IAG) or Yamana Gold Inc. (AUY) or Eldorado Gold Corporation (EGO), seems too ambitious for the company’s existing project potential and available financing options.

Second, analysts are forecasting that future gold prices will be lower in the upcoming period, which will not help the stock price. This is because the stock price is positively correlated with the commodity and a lower gold price is unlikely to help the company raise the capital needed to fund the transformation.

Lenders are likely to downgrade gold as an investment vehicle to protect against headwinds from inflation and bearish market sentiment as investors favor fixed-income assets and the US currency to take advantage of higher interest rates and a stronger US dollar.

The yellow metal ounce is expected to drop to $1,687.66 by the end of 2023, or down 4% from current levels.

What could change the cards is the price of gold in the sense that it should have a new significant bull market. This means that the central bank has to switch monetary policy back to a low-interest rate policy.

However, as long as inflation remains well below the 2% target, monetary policy will aim to raise interest rates rather than support the economy as central banks wait for signs of recession.

In October, annual inflation was 7.7% in the US, 10.6% in the Euro zone, 6.9% in Canada and 11.1% in the UK.

Country Risk

North American countries are guided by center-left politics that are ecologically and environmentally sensitive, and this can be reflected in much stricter procedures for obtaining permits for drilling activities and mineral development.

Mexico is very rich in natural resources but has the disadvantage that many areas are exposed to high seismic risk and high crime rates. The second risk category leads to social problems that could potentially have consequences for the business and the industrial operations.

Conclusion – There Are Significant Downside Risks to This Stock

There is a lot of risk in this stock given the modest size of the projects and the expected lower gold price. The company’s goal of becoming a medium-sized gold mining company seems too ambitious for the company’s operational and financial possibilities.

Given the macroeconomic conditions and their probable trajectory, gold will most likely trade lower over the next few months, which will not help build positive expectations for this stock.

Be the first to comment