Khanchit Khirisutchalual

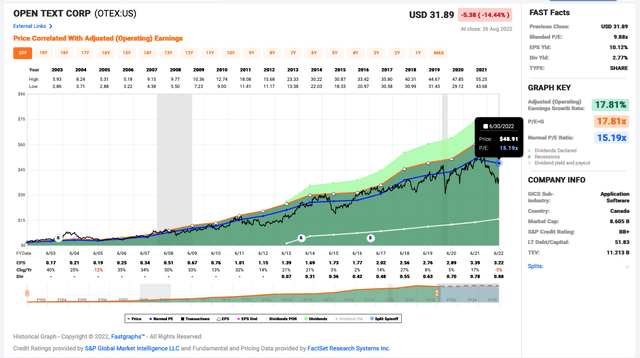

Open Text (NASDAQ:OTEX)(TSX:OTEX:CA) has a long-term track record of shareholder value creation through M&A and juicing out synergies from integrations. Recently, it has stumbled on growth, which may have partly to do with higher inflation and rising interest rates that have dampened consumer and business spending.

[US dollars is used in this article unless otherwise noted.]

Open Text ended the fiscal year on June 30, 2022 with revenue growth of 3.2% to $3.49 billion and adjusted EBITDA, a cash flow proxy, drop of 3.8% to $1.26 billion. However, it still generated substantial free cash flow of $888.7 million that was 9.4% higher year over year.

The information management solutions company ended the quarter with approximately $1.7 billion in cash and a net leverage ratio of 2.0x. On such a solid balance sheet, the market was probably expecting a meaningful acquisition.

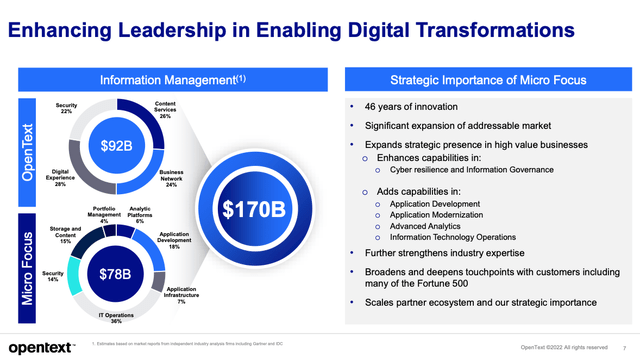

It looks like the tech company surprised the market with a larger-than-expected acquisition. The stock fell off a cliff – 14% in one day on Friday, August 26 – after it announced its acquisition of U.K.-based Micro Focus [LSE:MCRO] for an enterprise value (“EV”) of about $6 billion (about 46% smaller than OTEX’s EV of $11.2 billion at market close of August 26).

This acquisition is large, greatly expands Open Text’s target market by about 85% to $170 billion, and expands its capabilities, which represents a more complex integration than usual.

Where there’s risk, there’s opportunity. If the company is able to spur growth with the support of this acquisition, the undervalued stock could deliver outsized total returns over the next 3-5 years.

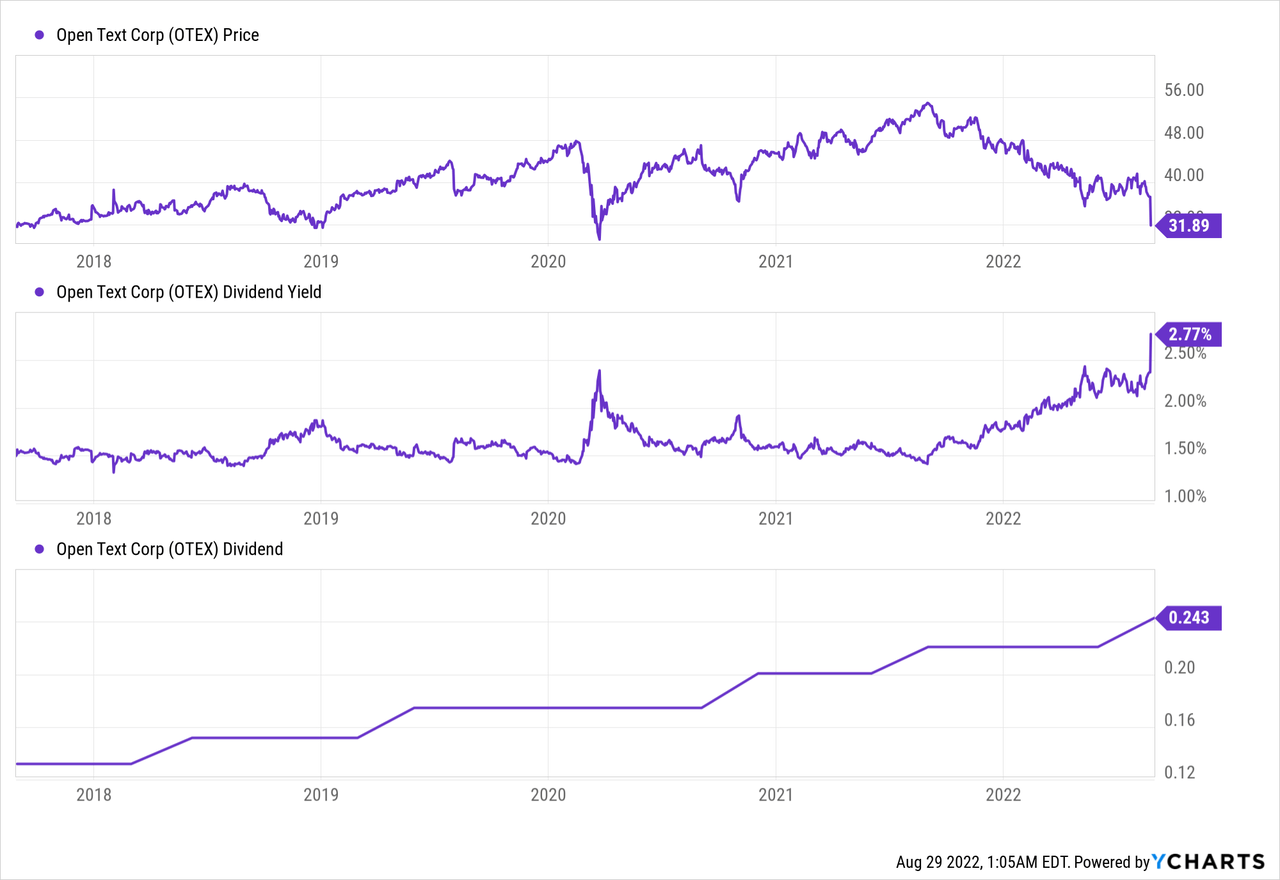

YCharts

The stock trades at the pandemic market crash levels now. Given its track record of stockholder value creation, we’re inclined to believe that the company can make it.

Other than the integration, new capability, and net market/customer risks mentioned, the company is also taking on $4.6 billion of new/committed debt combined with its cash on hand and existing revolver debt to finance this large acquisition. Greater debt means higher interest expenses, especially in a rising interest rate environment.

Rapid deleveraging is preferred. Thankfully, OTEX is a free cash flow generating machine. It plans to optimize the business within 6 quarters and reduce its net leverage ratio to less than 3x within 8 quarters.

Open Text’s payout ratio is sufficiently low that it raised its quarterly dividend by 10% earlier this month, which marks its 10th consecutive year of dividend increase. For reference, its 5-year dividend growth rate is 13.1%. It now yields over 3%.

OTEX’s 10-year operating cash flow per share increased by 12.8% and had a normal multiple of close to 13. Assuming a growth rate of 10% and target multiple of 12, its 3-5 year total returns would be 19-24% per year.

Be the first to comment