Evgenii Mitroshin

To listen to the pundits, betting on an explosive up move in oil prices is a sure bet right now. But as any experienced investors knows, one-way bets often become self-defeating in the financial marketplace. Here we’ll look at the driving forces of the crude oil market and what it will take for prices to fulfill the bull’s expectations. I’ll also share my near-term expectation for crude, which is decidedly less sanguine than what the bulls see coming.

After the recent decision of OPEC+ to cut oil production by two million barrels a day starting in November, investors have begun to fear a sharp increase in oil prices lies immediately ahead. An observation by the Wall Street Journal reflects what many traders are thinking in regard to OPEC’s decision, namely “a move likely to push up already-high global energy prices…”

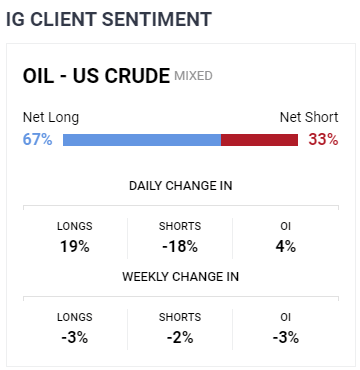

Retail traders have been leaning bullish on oil of late, as most of the news headlines pertaining to oil would seem to support higher prices ahead. According to the latest poll conducted by DailyFX, sentiment for WTI and Brent crude oil prices is mostly optimistic, with 68% of clients favoring a long position in oil, versus only 32% short.

DailyFX

The oil bulls can hardly be blamed for their buoyant expectations, however. Oil giants Exxon (XOM) and Chevron (CVX) stated in their Q3 reports that they expect production in the Permian Basin to slow this year. This, according to an OilPrice.com report, is enough to suggest “industry problems are indeed serious enough to hold back production growth” in the United States’ most productive petroleum deposit. The diminished production rates are expected to persist into 2023.

Between the OPEC+ and Permian production cuts, there would appear to be enough of a supply constraint to warrant higher oil prices. But while supplies may be tight, demand is diminishing as the global economy weakens.

China, the world’s second-biggest oil consumer, has seen a big demand drop this year as a combination of its weak real estate market and zero-Covid policies have restricted industrial output. On Monday, Reuters reported that Saudi Arabia is considering cutting oil prices for its Asian customers in December as weaker oil consumption (in part due to China’s Covid strictures) dampen regional demand.

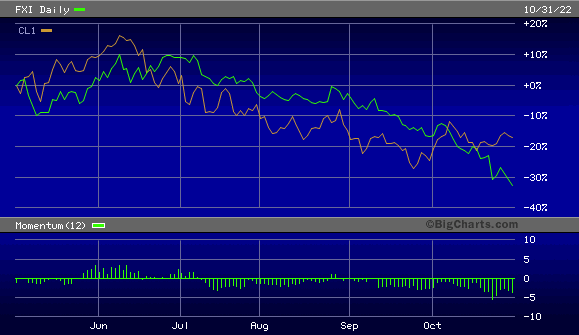

Along those lines, there has been a (admittedly somewhat loose) correlation between the direction of U.S.-listed China stocks and oil prices. Here you can see the recent progression of the iShares China Large-Cap ETF (FXI), which is one of my favorite China stock trackers, and the WTI crude oil front-month futures price. While the relationship between both markets sometimes becomes disconnected, the historical tendency is for China stock market weakness to precede-or at least coincide with-weak oil prices.

BigCharts

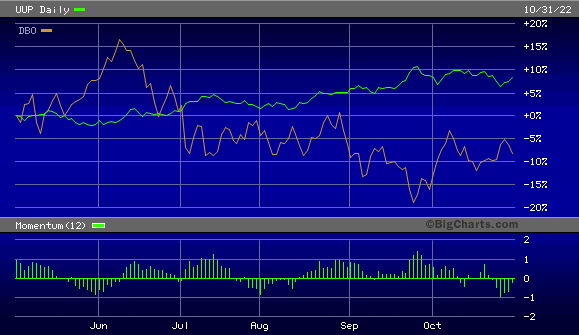

Another sign suggesting oil prices aren’t yet ready for another extended upside run is the U.S. dollar index. As oil is priced in dollars, the greenback’s relentless strength this year to date has acted as a headwind against the crude market. The following chart illustrates oil’s weakness vis-à-vis the dollar via the Invesco DB Oil Fund (DBO) compared with the Invesco USD Index Bullish Fund (UUP). As long as the dollar remains firm, I don’t expect oil prices to perk up.

BigCharts

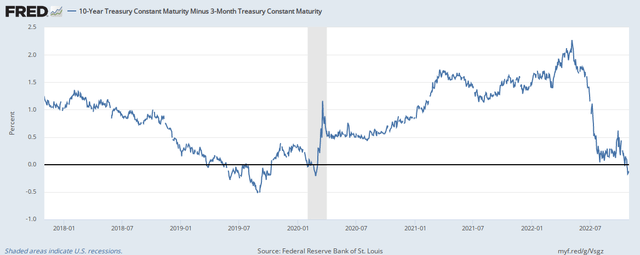

Another indication that global oil demand could weaken further in the near term is the following graph, which shows the spread between the 10-year Treasury bond yield and the 3-month Treasury.

For the first time since late 2019, the 10-year minus 3-month Treasury yield spread has turned negative, as you can see here. This is a potentially negative sign for the intermediate-term economic outlook. In fact, whenever this particular yield curve inverts-as it just did-a recession has followed at some point in the six-to-12 months ahead. (The last inversion of this yield curve preceded the recession of 2020.) The heightened recession risk obviously doesn’t bode well for the oil demand outlook.

With all of that said, what could be a catalyst for pushing oil prices significantly higher? The most salient factor influencing oil is the onset of war-which is always useful for dramatically increasing demand in a short period of time, resulting in stratospheric price gains. Either war itself, or wartime-like levels of spending (such as we saw in 2020), are needed to create the conditions necessary for the type of market the oil bulls are expecting.

A much bigger, or more active, commitment on the Pentagon’s part in the ongoing war in eastern Europe could easily fulfill this condition. But short of war or a massive U.S. dollar dump on the part of foreign investors, I believe participants can expect to see a stable oil market and crude prices fluctuating between roughly $80 and $100 a barrel in the next few months.

And while the oil bulls’ day may well come at some point later next year, the bulls will likely have to wait as global economic weakness continues to weigh on demand in the near term.

Be the first to comment