David Ramos

Microsoft (NASDAQ:MSFT) is scheduled to submit its FQ1’23 earnings sheet on October 25, 2022, and the software firm, I believe, has the best shot of all the major technology companies to out-perform earnings estimates. This is because Microsoft operates in segments that are not affected by the PC market downturn, such as the Cloud business, which is Microsoft’s growth engine. Additionally, I believe the outlook for FY 2023 will be confirmed by Microsoft, and the software company is likely to continue to generate material free cash flow in the coming quarters!

PC market remains a weakness

Advanced Micro Devices, Inc. (AMD) and NVIDIA Corporation (NVDA) have both issued profit warnings lately due to an accelerating down-turn in the PC market. All major PC vendors, from Lenovo to Apple, have seen major declines in PC and laptop shipments in the third calendar quarter due to weakening consumer demand after the pandemic. According to consulting firm Gartner, PC shipments are estimated to have declined almost 20% in Q3’22, strongly indicating that the downturn in the PC market is gaining momentum.

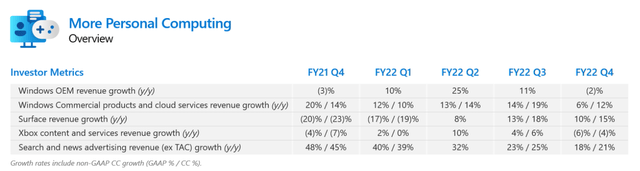

In the short-term, this downturn could lead to some headwinds in Microsoft’s Personal Computing business, which includes hardware sales as well as revenues generated from Windows OEM. In the last fiscal quarter, Microsoft reported $14.4B in revenues in the Personal Computing segment, showing 2% year-over-year growth. Windows OEM revenues, which are already under pressure from a cooling PC market, declined 2% year-over-year in the last quarter. Production shutdowns as well as a slowing PC market resulted in a $300M revenue headwind for Microsoft in Q4’22 in the Personal Computing segment.

Outlook

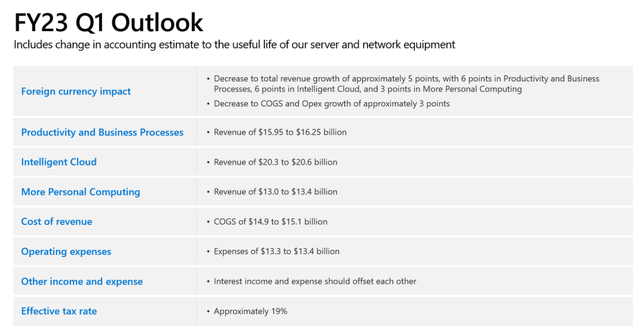

Microsoft expects revenues of $49.25B to $50.25B in FQ1’23 which implies about 10% year-over-year growth on a mid-point basis. The strong USD is still a major concern for the software company and is expected to take about 5 PP off of Microsoft’s revenue growth.

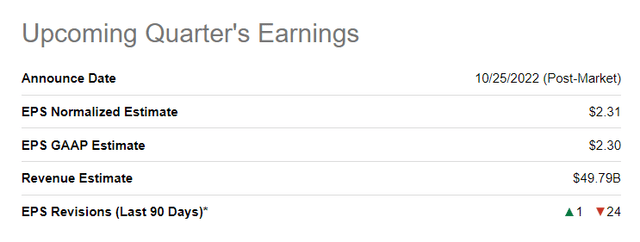

Estimates for Microsoft’s FQ1’23 call for EPS of $2.31 and revenues of $49.8B. EPS revisions to the down-side outnumbered up-ward revisions by 24:1. Based on consensus revenue estimates, analysts expect 10% revenue growth year over year. Since Microsoft has very limited exposure to the PC market downturn and expectations have been driven very low, I believe Microsoft has the best chance of all large-cap technology companies to beat estimates next week and confirm its outlook for FY 2023.

Seeking Alpha: Microsoft FQ1’23 Estimates

For FY 2023, Microsoft sees double-digit revenue and top line growth, despite a challenged hardware market, growing economic risks and a strong USD. Due to Microsoft’s more diversified business model and insulation from the downturn in the digital advertising market that is inflicting wounds on companies like Alphabet (GOOG, GOOGL) and Meta Platforms (META), I believe Microsoft could crush expectations for FQ1’23.

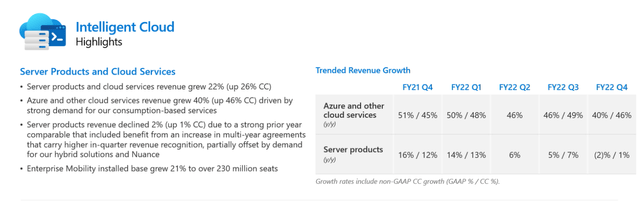

Intelligent Cloud: Microsoft’s growth engine

Microsoft expects to generate $20.3B to $20.6B in Intelligent Cloud revenues in the first fiscal quarter of FY 2023, which on a mid-point basis, translates to 20% year-over-year growth. In the year-earlier period, Microsoft generated revenues of $17.0B in segment revenues, and Intelligent Cloud will likely remain the fastest-growing business within the software company. In FQ4’22, Microsoft’s server products and cloud services grew revenues 22% due to strong customer adoption of Azure, Microsoft’s Cloud platform. Azure and cloud services grew revenues 40% year over year in FQ4’22 and Azure is likely to have seen strong growth in the last quarter as well.

Why would you want to own Microsoft?

Besides the diversified business model that protects Microsoft from declining PC/laptop shipments and a downturn in the ad market, Microsoft earns an unreal amount of free cash flow that stabilizes both the company and its stock. In the last quarter, Microsoft generated $17.8B in free cash flow which calculated to a free cash flow margin of 34.2%. In FY 2022, Microsoft’s free cash flow margin was 32.9%.

|

$billions |

FQ4’22 |

FQ3’22 |

FQ2’22 |

FQ1’22 |

FQ4’21 |

Y/Y Growth |

|

Revenues |

$51,865 |

$49,360 |

$51,728 |

$45,317 |

$46,152 |

12% |

|

Cash Flow From Operating Activities |

$24,629 |

$25,386 |

$14,480 |

$24,540 |

$22,710 |

8% |

|

Capital Expenditures |

($6,871) |

($5,340) |

($5,865) |

($5,810) |

($6,452) |

6% |

|

Free Cash Flow |

$17,758 |

$20,046 |

$8,615 |

$18,730 |

$16,258 |

9% |

|

Free Cash Flow Margin |

34.2% |

40.6% |

16.7% |

41.3% |

35.2% |

– |

(Source: Author)

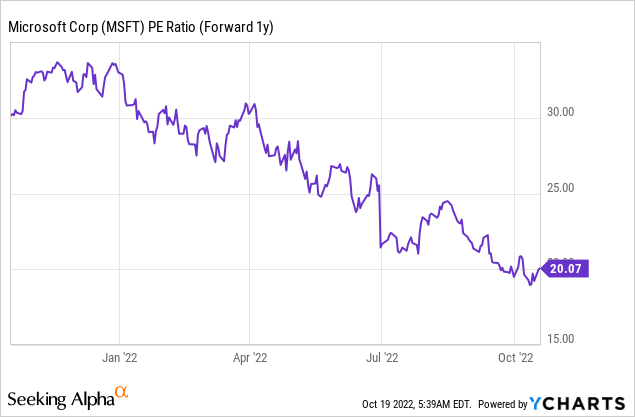

Microsoft’s free cash flow remains attractively valued. Microsoft is expected to generate $250B in revenues in FY 2024. Applying a 30% free cash flow margin translates to $75B in free cash flow. With a market cap of $1.78T, Microsoft trades at a P-FCF ratio of 23 X. Based off of earnings, Microsoft trades at a P-E ratio of 20 X.

Risks with Microsoft

Microsoft’s biggest risk is slowing top line growth, but this could be said for nearly any company at the moment. I believe, however, that Microsoft, due to its growing reliance for growth on the Cloud business, has the best chance of all the large-cap technology companies to perform very well during a recession. If Microsoft, however, would see a major decline in its growth prospects that also translates to lower (weaker) free cash flow (margins) than I could see myself changing my opinion on Microsoft.

Final thoughts

Microsoft could crush expectations for its FQ1’23 (because EPS estimates are low) and the firm’s earnings sheet could stand out from the reports of other technology companies as Microsoft offers a more diversified business model and has less exposure to the slumping PC/advertising markets. Microsoft’s Intelligent Cloud business is set for a reasonably strong quarter and I expect the software company to confirm its revenue and operating income outlook for FY 2023. While the strong USD is a challenge short-term as well, Microsoft’s free cash flow prowess is the real reason why investors would want to own the firm’s shares!

Be the first to comment