ferrantraite/E+ via Getty Images

Corporacion America Airports (NYSE:CAAP) operates 54 airports around the world. This makes it the single largest private owner globally based on the number of facilities held. The company handled 84 million passengers in 2019, which is roughly equal to the number of passengers going through Los Angeles International “LAX” in that same year to give a sense of perspective.

CAAP’s primary airport holdings are in Argentina, where it operates both main Buenos Aires airports along with a host of smaller regional facilities around the country. It also owns airports in Brazil, Italy, Ecuador, Uruguay, and Armenia.

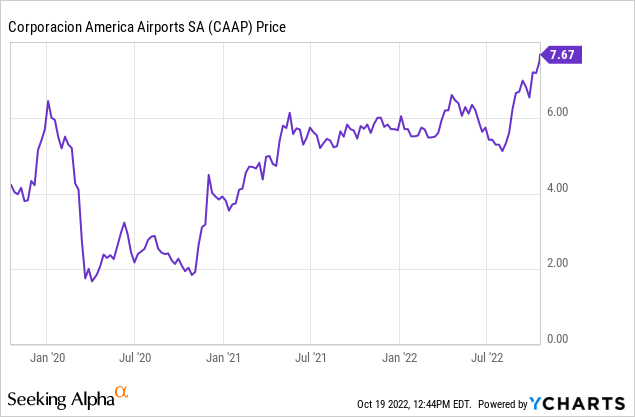

CAAP shares came public in a 2018 IPO and opened trading around $16. They fell to $6 by the time the pandemic started thanks to unfavorable political developments in Argentina. They then got slashed from $6 to $2 during Covid-19 as investors feared that the company would run out of cash to keep operating.

I entered the mix in October 2020, saying CAAP’s liquidity position was better than people realized and that the company had a good chance of surviving. Mere survival would ensure a large upside, given that the company was valued at a fire sale price. Shares are now up 280% from my prior recommendation.

It might be tempting to claim victory and sell at this point. After all, the company has now fully recovered from its pandemic-induced losses and is back up to a share price not seen in more than three years.

However, there’s no reason to stop flying with CAAP stock at this time. Rather, I see a transition for the thesis.

The run from $2 to $6 was based on CAAP surviving. The ensuing move that we see from $6 up to the double-digits, and quite possibly $20, will be thanks to CAAP starting to thrive. Don’t forget that this is a company that went public with a share price around $16. Today’s $7.75 quotation may seem fully valued based on its recent history, but shares were drastically undervalued prior to Covid-19 starting, and there are several catalysts today that will cause shares to reach a more appropriate valuation.

Improving Balance Sheet

CAAP’s first order of business was staying in business. Going into the pandemic, Corporacion America Airports had more than a billion dollars of debt and suddenly had no revenues at all with virtually all commercial air traffic being suspended in 2020.

CAAP was able to overcome this seeming liquidity crunch for several reasons. One, various governments in regions where it operates gave it very low interest loans. Some offered more direct assistance such as relief on employee compensation.

Most crucially, the Argentine government gave CAAP a 10-year extension on its airport leases in Argentina. Previously, these leases were set to expire in 2028 and had been a key limitation on the company’s value. Folks weren’t going to assign much value to assets that had less than a decade of remaining time on them. Now, the leases run until 2038, giving CAAP a far longer cash flow trajectory off its most important holdings.

CAAP has now started generating significant operating cash flow again and has even returned to GAAP profitability. Meanwhile, there are no meaningful near-term debt maturities to worry about. So, any concerns about the balance sheet and near-term access to cash are now taken care of.

CAAP Is Starting To Generate Cash Flow & Profits

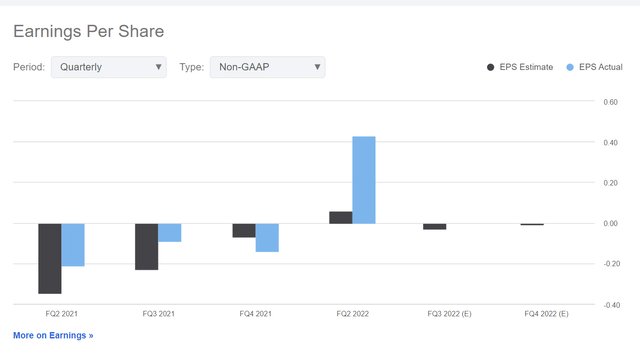

The company’s second-quarter earnings were the turning point in its narrative. In the second quarter, CAAP earned 43 cents per share, which was light years ahead of analyst expectations of 6 cents:

CAAP Earnings Estimates (Seeking Alpha)

As you can see, this was the first profitable quarter for the company since Covid-19 struck. Also, analyst forecasts remain much too downbeat on the company. They seem to think Q2 was a one-off quarter and that CAAP will operate around breakeven in the near future.

However, I believe this view is mistaken. The thing that made Q2 so impressive is that Corporacion America Airports reported a record quarter of earnings and more than 90% of pre-pandemic EBITDA on just 75% of its pre-crisis passenger volumes. In other words, the company’s newfound profitability is being driven by sharply higher profit margins, rather than just pure top-line revenue growth. Argentina, in particular, was at just 70% of pre-Covid traffic levels in Q2 and yet the company is already back to delivering strong financial results.

If you annualize 43 cents a quarter of profits, you get $1.72 of EPS going forward. With the stock in the $7s, this gives us a P/E ratio of around 4.0. There’s more to valuing the company, as we’ll see in a minute, but that gives a quick sense of the deep value that remains in the stock today.

Passenger Volumes Are Now Surging

Q2 earnings were based around CAAP being at about 75% of its 2019 passenger levels. We’re now seeing a positive step change in traffic. For September 2022 traffic, for example, CAAP is now at 85% of its 2019 levels. Argentina, in particular, is now up to 85% of prior levels versus just 70% last quarter. This is a huge move toward regaining full pre-pandemic activity levels.

This is not an unreasonable target either. In Mexico, for example, passenger volumes at publicly traded airports are now far above 2019 levels. Guadalajara, Puerto Vallarta, and Cabos owner Grupo Aeroportuario del Pacifico (PAC) is now reporting 127% of prior peak traffic levels at its airports.

While CAAP has been slower to recover thanks to longer-lasting Covid-19 restrictions in markets such as Argentina and Italy, it is now posting robust traffic growth and should surpass 2019 traffic levels by 2024 if not sooner.

Meanwhile, margins are up substantially, meaning CAAP will make far more money as it reaches its prior passenger levels. Much of this is contractual. CAAP gets paid in U.S. Dollars for international passengers flying to Argentina. The tariff recently increased from $51 to $57 per passenger, which adds more than 10% top-line per-passenger revenue growth on one of CAAP’s key income streams.

And, notably, since its Argentine international use fees are metered in dollars, you don’t have to worry about the notoriously weak Argentine Peso eroding profitability. This makes CAAP a unique asset for getting Argentine exposure, in that you get an upside when the market rises without facing debilitating FX losses during periodic bouts of hyperinflation in that country.

CAAP Stock: How Much Upside?

The long-standing question with this business is how to value it. There aren’t a whole lot of publicly-traded airports. Notably, there are none at all in the United States, so most American investors aren’t too familiar with the asset class. There are a handful of publicly-traded airport operators in Europe, Asia, and Oceania, however, most of these aren’t great comps to CAAP since CAAP operates primarily in emerging markets.

Also, airport operators should generally be valued on EV/EBITDA rather than just P/E. This is because airport operators have very different starting points in terms of what they paid to get their airport concessions. As a lease runs, it is depreciated, however, amortizing the cost of a long-ago paid-for concession doesn’t affect earnings or cash flow today. In other words, if you buy an airport stock today, you don’t care what price the operator paid for the concessions or improvements therein 10 or 20 years ago. EV/EBITDA gives a better apples-to-apples comp across the industry.

So, what is the right EV/EBITDA multiple? Developed market airports, such as in Europe, often trade around 20x. Private takeovers tend to occur at or above that threshold as well. However, Argentine airports simply aren’t going to trade at a French or German airport multiple given the political risk.

So what else is out there? Airports of Thailand (OTCPK:AIPUY) has tended to trade at a huge multiple despite being in an emerging market. Shares were above 20x EV/EBITDA for a while prior to the pandemic. However, I believe those shares were overvalued and we shouldn’t use that as the baseline for CAAP either.

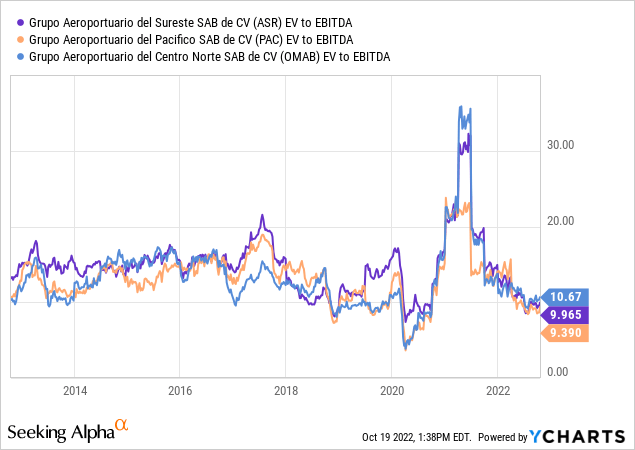

This leaves the Mexican airport operators as the closest comps. There are three Mexican-based airport holding companies, with operations primarily in Mexico, but also with holdings in Puerto Rico, Jamaica, and Colombia. This is a good comp stack for CAAP’s extensive holdings in Latin America.

Aside from the pandemic, when EBITDA dropped and distorted the ratios, the three Mexican firms have typically averaged a roughly 15x EV/EBITDA multiple. Nowadays, they are closer to 10x. I believe this is much too low, given the rapid traffic and free cash flow growth and a bullish outlook for Mexico. But that’s an article for another day.

We’ll assume the market’s current pessimism is correct and Latin American airports are currently worth around 10x EV/EBITDA though they should be closer to 15x in normal market conditions.

Where does that put CAAP?

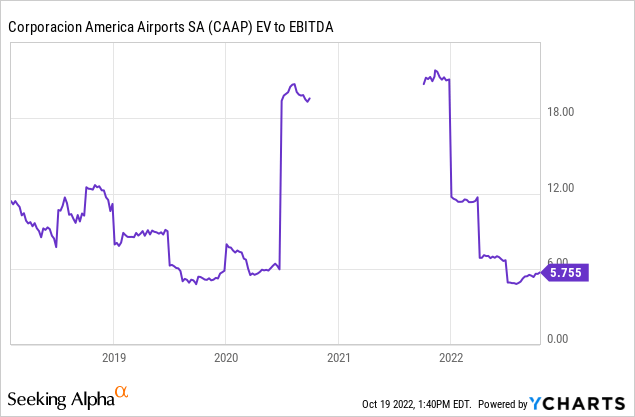

CAAP is currently selling for less than 6x EBITDA, which is also around where it was trading prior to the beginning of the pandemic:

Assuming CAAP goes to a 10x EV/EBITDA multiple like its LatAm airport peers, shares should nearly double from here, right?

But wait, there’s more. CAAP uses a significant amount of leverage. Right now, there’s around $1.2 billion of net debt and a market cap also of $1.2 billion, for a total EV of $2.4 billion.

CAAP’s EBITDA should be in the $350-$400 million range for 2022 and $500 million for 2023. And I previously calculated that $500 million estimate based on lower traffic figures from this summer, we’re edging closer to $550 million based on the current trajectory. But let’s stick to $500 million to be conservative.

We’re currently at sub-5x forward EV/EBITDA. To get to 8x EV/EBITDA and $4 billion of EV, that requires a market cap of $2.8 billion which gets you a target price of $17.50. If we assume CAAP can trade up to 10x EV/EBITDA, that gets us a market cap of $3.8 billion and a stock price of $23.

The usual skeptical response at this point would be, “But the airports are in Argentina. Why are they worth even a Mexican airport multiple?” That’s a fair statement. Argentina is historically one of the most unstable economies in Latin America. Its assets have deservedly traded at discounts to those of stronger peers such as Chile.

So why should CAAP trade at a 10x EV/EBITDA multiple, closer to its LatAm peers? For one, 40% of the business is not in Argentina. Italy and Brazil both makeup more than 10% of EBITDA and then the other three countries round out its business.

The Italian airports in particular (Florence, Pisa) are high-quality properties. European tourism assets garner a high multiple. These are definitely in the group of European airports that would normally get a 20x multiple. CAAP is also doing major expansions at one of those Italian airports, which will permit more takeoffs and landings per day and greatly increase income.

Overall, CAAP’s non-Argentine airports are going to generate about $200 million in EBITDA next year. If you assign a conservative 10x multiple to those, you get a $2.0 billion valuation for non-Argentine holdings. That would mean investors are paying $400 million, or 1.3x Argentine EBITDA, for the core Argentina holdings at today’s $7.75 price. I don’t care what political risk and structural discount you assign to Argentina, that’s a silly multiple.

Furthermore, I’d note that CAAP is a holding company and financing is done at the subsidiary level. This means that all debt is tied to individual airports rather than the parent. If any one CAAP country’s airports run into trouble, CAAP can jettison them and the rest of the company is not impacted. This makes it especially relevant that the company’s Italian, Brazilian, etc. airports are trading at such a low valuation. Even if you doubt Argentina, you can easily get to the full value of CAAP’s stock price today just off its other holdings.

The Bottom Line

If you’re at all bullish on emerging markets, CAAP stock remains a slam-dunk holding. Thanks to rising demand and prices for goods such as grains, meat, metals, and energy, economies like Brazil and Argentina should have stronger economic activity. That leads, in turn, to more traffic and spending at CAAP’s airports.

The company has already returned to significant profitability far sooner than analysts had forecasted. And the current forward estimates are much too low, as you can verify for yourself with a quick look at the company’s slimmed-down cost structure and rapidly rebounding passenger traffic.

I haven’t even mentioned politics much, but there’s a plus there too. Argentina’s current left-wing government mishandled Covid-19 and now also faces crippling inflation. This sets the stage for the right wing to make tremendous gains in the upcoming 2023 elections. This has set off a solid rally in key Argentine assets such as the oil company YPF (YPF).

As elections draw closer, I expect the “Argentina returning to capitalism” narrative to pick up steam, adding a further tailwind for that country’s assets, including its airports. That’s just icing on the cake though.

Simply getting CAAP to a still dreary 8x EV/EBITDA multiple more than doubles the share price from here. The market has incredibly low expectations for CAAP stock, making it a fantastic way to get exposure to multiple positive trends including rising commodity prices, rebounding international travel, and an improving political outlook in Argentina.

Be the first to comment