MarsBars

Even in today’s bear market, investors could be hard-pressed to find moat-worthy companies that sport a very strong credit rating, pay a solid and growing dividend yield, and are trading well below a 15 PE. Yet, these opportunities exist in the financial and pharmaceutical sectors, and the latter category is far more recession resilient.

This brings me to the pharmaceutical giant, Merck (NYSE:MRK), which has held up well amidst market volatility, and remains a decent value stock. In this article, I highlight what makes MRK worth buying at present for potentially strong long-term returns, so let’s get started.

Why MRK?

Merck is one of the largest global pharmaceutical companies, with specialty drugs in the fields of oncology, cardiometabolic disease and infections. MRK also has a substantial vaccine business that treats HPV, Shingles, Hepatitis B, and pediatric diseases. Merck has been around for over 130 years and generated $54 billion in total revenue over the trailing 12 months, about half of which came from the U.S. and the rest internationally.

Merck has largely done a good job of developing new drugs to offset patent losses on its older medicines. This includes its blockbuster oncology drug, Keytruda, which has gained strong market traction as one of the first immunotherapy drugs to treat non-small cell lung cancer. Plus, unlike smaller players, Merck benefits from its strong platform, which includes many years of accumulated research and economics of scale to develop newer drugs.

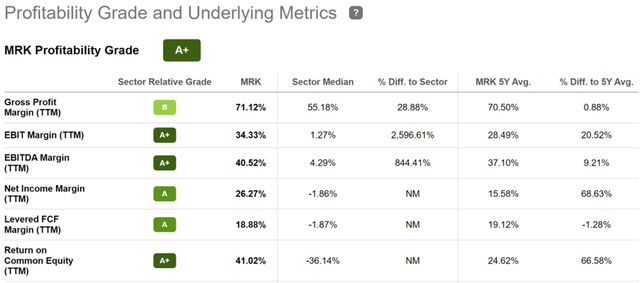

As shown below MRK scores an A+ for profitability with sector leading EBITDA and net income margins of 40.5% and 26%, respectively. It also generates a very strong return on equity of 41%, which factors in its history of share repurchases, including the 8% reduction in outstanding shares over the past 5 years alone.

MRK Profitability (Seeking Alpha)

Meanwhile, Merck has continued to demonstrate strong growth, with sales soaring by 50% YoY to $15.9 billion in the first quarter. This was driven in part by Lagevrio, which is the anti-viral drug that Merck developed to stop the coronavirus from replicating in the body. Excluding Lagevrio, top-line growth was still an impressive 19%, driven by Merck’s blockbuster Keytruda and Gardasil drugs, whose sales grew by 23% and 59%, respectively.

While it’s unknown for how long Lagevrio’s momentum may last, the recent surge in the Omicron variants should give a boost to Lagevrio’s sales at least in the near term. Moreover, its sales should provide key funding for Merck’s new drug development and potentially M&A down the line. Speaking of which, Merck’s pipeline currently has 8 potential new approvals by the year 2030.

Moreover, Merck is expanding the efficacy of its existing drugs through clinical trials for new indications, as noted by management during the recent conference call:

Along with AstraZeneca (AZN), positive results were presented at the American Society of Clinical Oncology Genitourinary Cancer Symposium for the PROPEL trial evaluating Lynparza in combination with abiraterone as a first-line treatment for patients with metastatic casted resistant prostate cancer with and without mutations and a group of homologous recombination repair gene.

At a planned interim analysis, results showed an improvement in radiographic progression-free survival versus the standard of care. These early results also showed a trend towards improved overall survival. The trial will continue to assess these key secondary endpoints when we plan to engage with health authorities to discuss the findings with the aim of bringing this important option to appropriate patients.

Prostate cancer represents a significant unmet need, and we are continually gaining important insights into the biology of the tumor. We are keen on making an impact for patients with late-stage disease.

Risks to Merck include the expensive nature of drug development, which costs an estimated $800 million to bring a new drug to market. In addition, additional indications for Merck’s existing drugs may not work out, as evidenced by setbacks that Keytruda has seen in its phase 3 study for head and neck cancer.

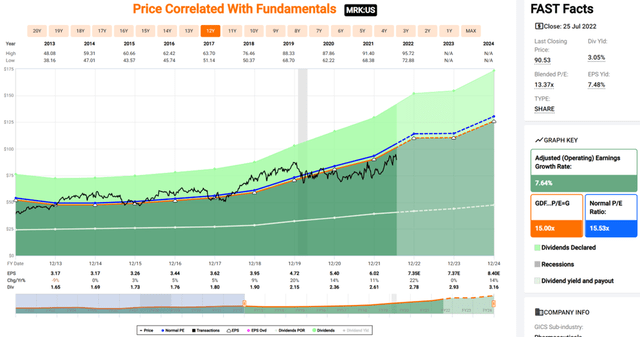

Nonetheless, I see value in Merck at the current price of $91.29 with a forward PE of 12.4, sitting well below its normal PE of 15.5 over the past decade. It also maintains an A+ rated balance sheet, and it also pays a well-covered 3.0% dividend yield.

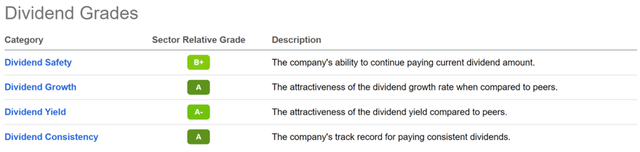

The dividend comes with a low 38% payout ratio, an 8.8% 5-year CAGR, and 12 years of consecutive growth. As shown below, MRK scores A and B+ grades relative to its sector for yield, consistency, growth, and safety.

MRK Dividend Grades (Seeking Alpha)

Seeking Alpha’s Quant assigns a Strong Buy rating on MRK stock, and sell side analysts have a consensus Buy rating with an average price target of $99. Should MRK return to its normal PE valuation of 15.5, it could see a potential 28% total return (including dividends) due simply to its reversion to the mean.

Investor Takeaway

Merck is a very strong pharmaceutical company that has seen commercial success with its blockbuster drugs. It also recently developed Lagevrio, an anti-viral drug that has shown efficacy in treating the coronavirus, and this momentum may last for the foreseeable future with stubbornly high infection rates related to the latest Omicron variants. The company’s strong balance sheet, growth prospects, dividend history, and current valuation make it an attractive investment for long-term investors.

Be the first to comment