Spencer Platt

Introduction

Philip Morris International Inc. (NYSE:PM) is one of the best companies in the tobacco industry and is underrated compared to its competitor Altria Group (MO). In particular, Philip Morris has a lower risk profile and stronger financials. While investors may see a slowdown in the growth or a cut in Altria’s dividend, investors in Philip Morris are likely to be rewarded with higher yields in the future financed by increasing cash flow. This is the main idea why Philip Morris is a better investment than Altria. Below are the reasons that support why I am accumulating shares and I encourage others to take a look at the company.

Brief Explanation of the Business

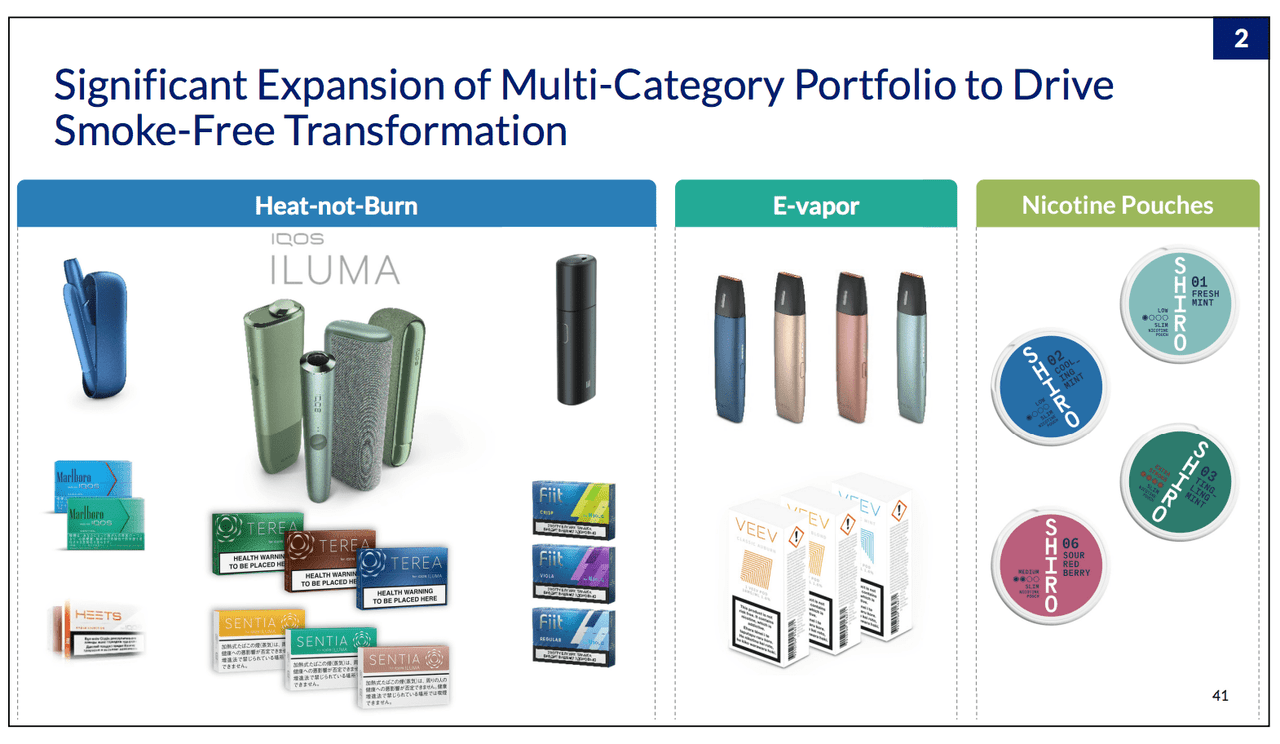

Philip Morris operates in two major segments and one small “other” segment. Combustible products are cigarettes, while reduced-risk products include nicotine pouches, E-vapor, and Heat-not-Burn categories. The “other” category includes revenue from recent pharmaceutical investments and a recently formed health company that treats asthma with inhalers. This is part of an industry-wide transition away from cigarettes to more sustainable products. Images pertaining to the May 2022 investor information can be seen here.

PM May 2022 Investor Information

Lower Combustible Dependency

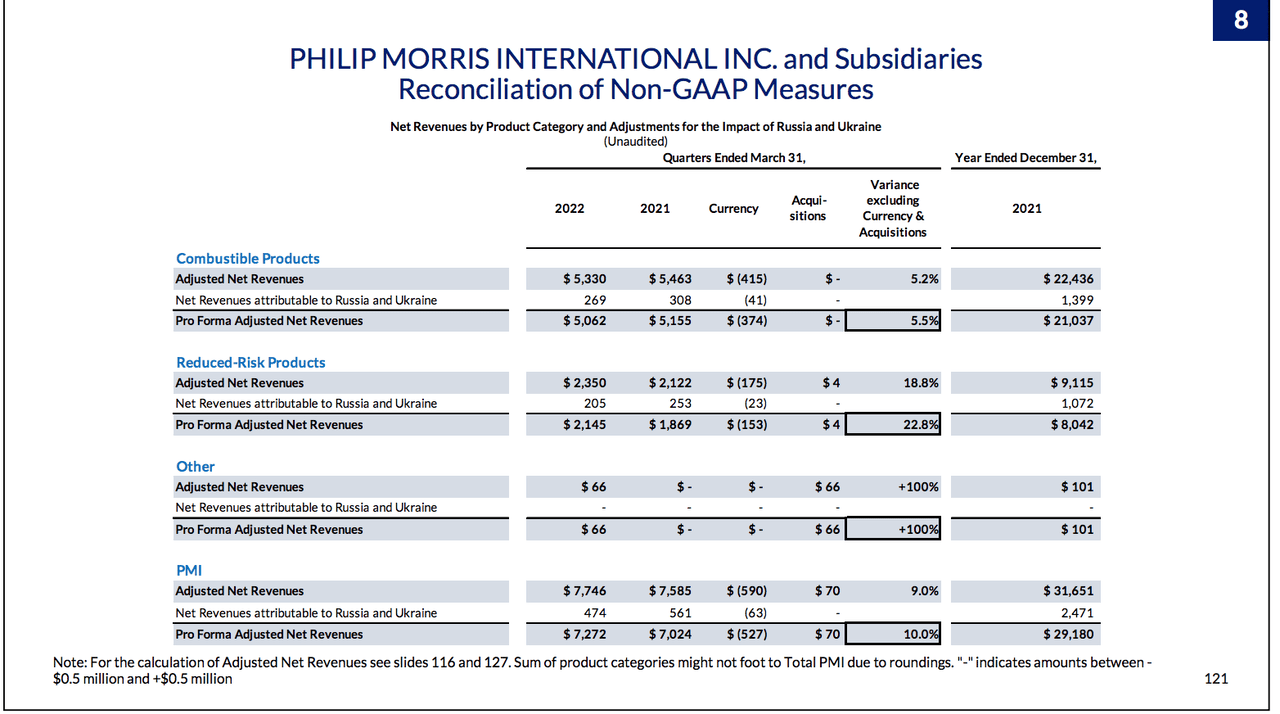

A significant advantage Philip Morris has is that the company is less dependent on combustible products compared to Altria. Combustible products will continue to see declines in usage and increased government scrutiny over the damages it causes to society. Combustible revenues accounted for 72.1% of the total net revenues in 2021. For comparison, Altria’s combustibles accounted for 87.9% (Pg. 82). Also, Philip Morris is benefiting from the transition to HTU (Heated Tobacco Unit) as the products have higher gross margins. It’s a win-win-win for Philip Morris as it de-risks from regulation and declines in usage while pivoting to a higher-margin product.

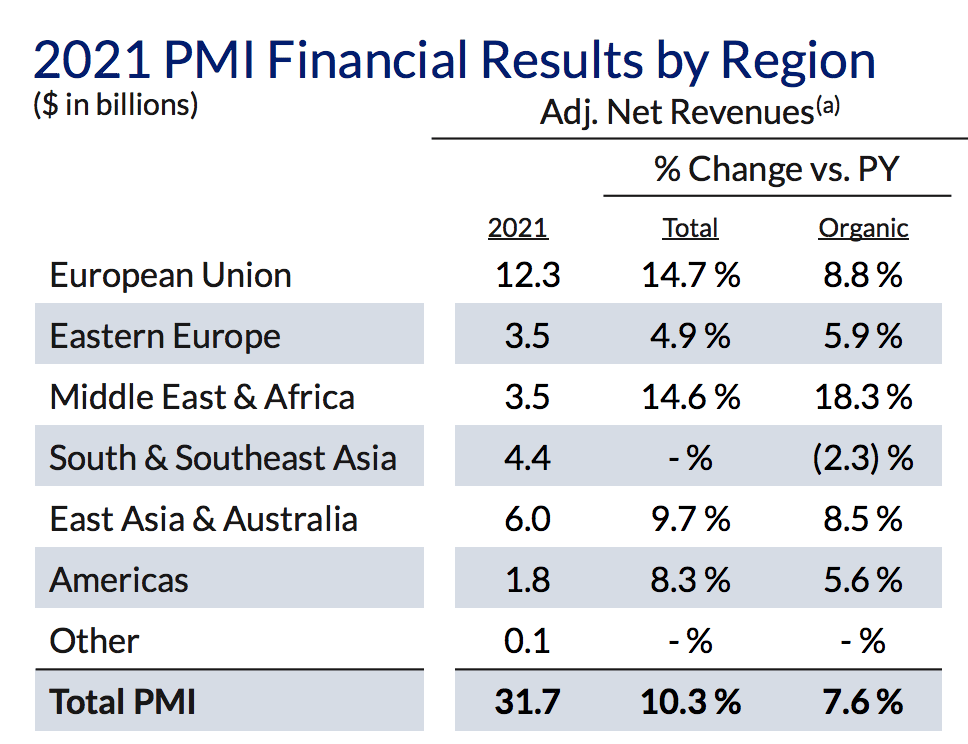

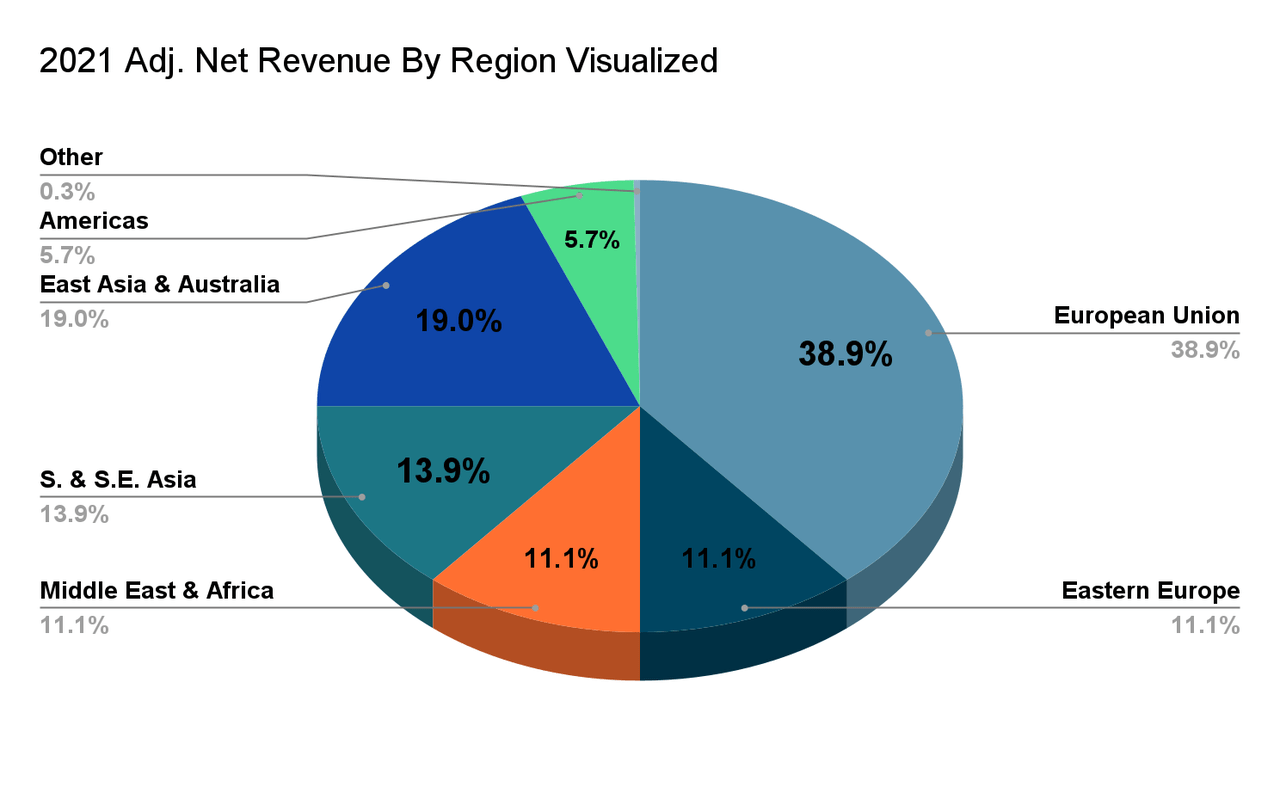

Philip Morris Net Revenues by Segment (PM May 2022 Investor Information) Philip Morris Net Revenues by Region 2021 (PM May 2022 Investor Information) 2021 Adj. Net Revenue by Region (PM May 2022 Investor Information)

Lower Risk of Regulation due to Geographic Spread

Philip Morris sells products in a wide range of geographic regions contributing to its low-risk profile. Traditionally, it focused on consumers outside of the United States. However, with the recent acquisition interest in Swedish Match, Philip Morris will gain a foothold in the United States markets. The wide-reach approach is attractive for investors as government regulation risk is diversified. Even if one government were to crack down on Philip Morris, the company has many alternatives for steady revenue. On the other hand, Altria is confined to the United States, and one decision can have a significant impact on the company. The ban on Juul vapes is an example. Geographic diversity gives Philip Morris an extra cushion that Altria lacks.

Cash flow Growth

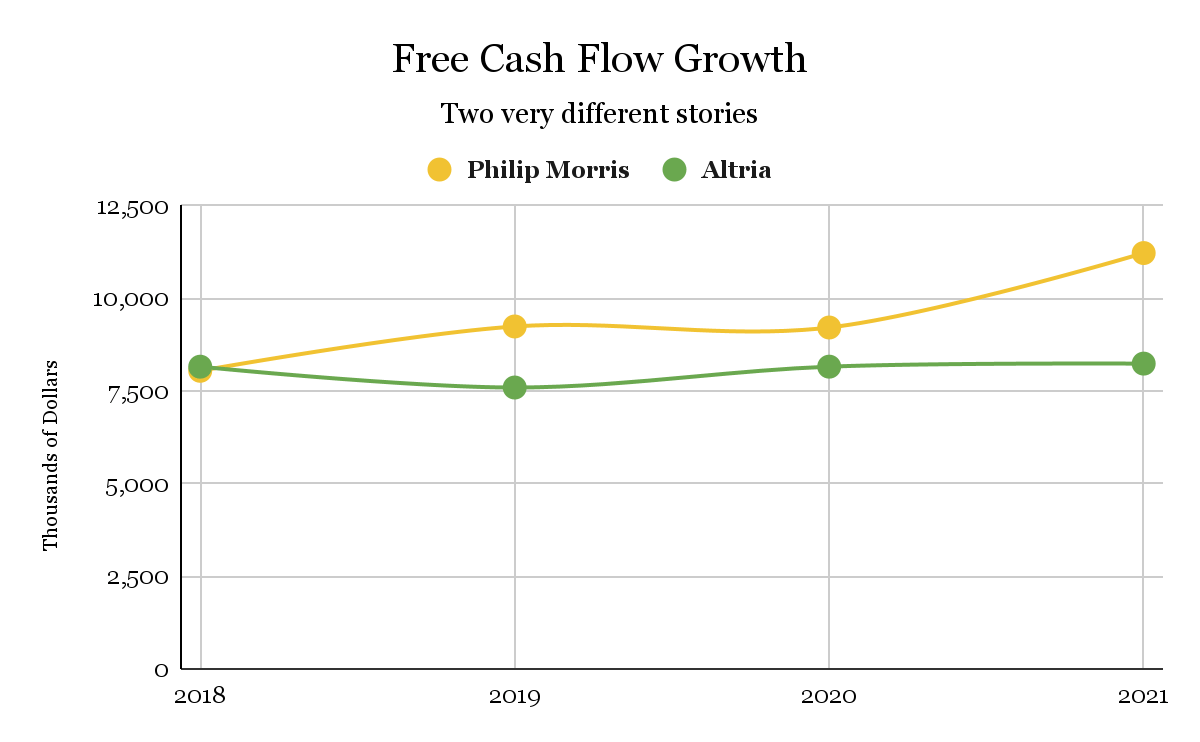

Philip Morris and Altria’s Free Cash Flow Compared (Data taken from company’s cash flow statement, chart created by author)

The chart above shows the past four years yielded an 8.68% free cash flow CAGR at Philip Morris. This increase in cash flow contributed to higher dividend payments, debt repayment, and the pending acquisition of Swedish Match for $16 billion. If this trend continues, Philip Morris may be able to obtain $12 billion in free cash flow. Altria, however, has experienced stagnant free cash flow yields over the past 4 years. This may cause more problems in the future with their more debt-leveraged business.

PM’s Free Cash Flow Dividend Payout Ratio is Healthier

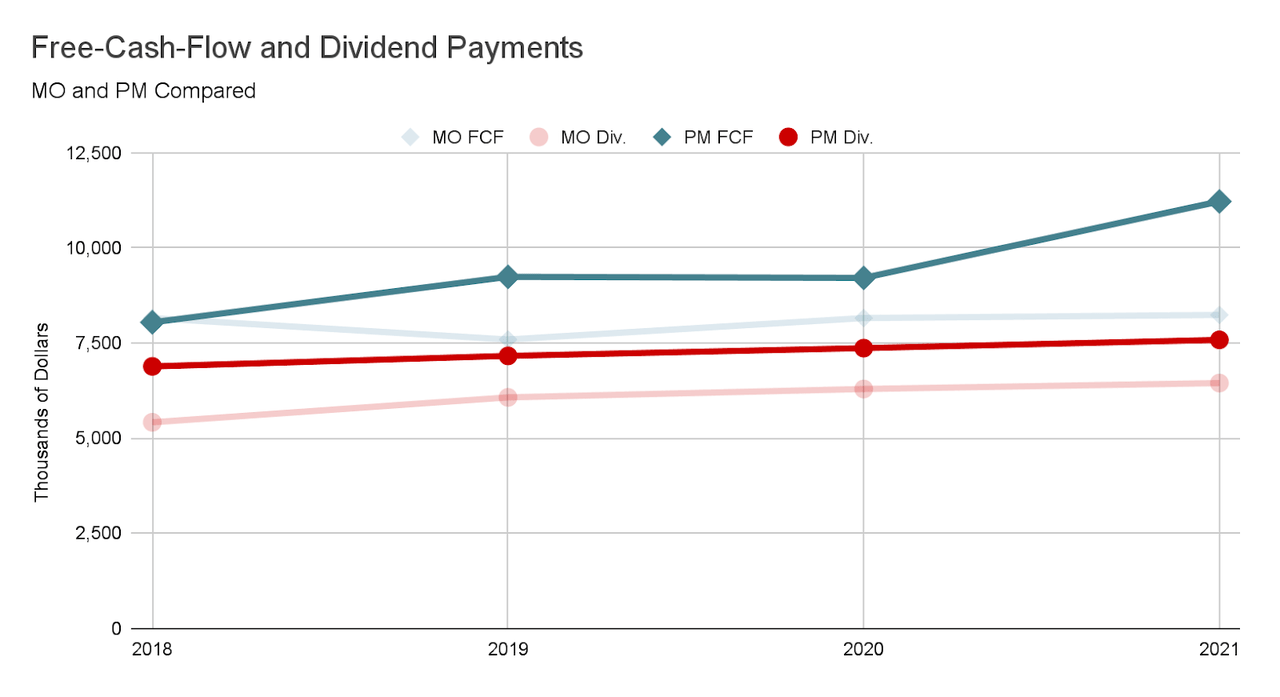

Comparison of MO and PM’s Free Cash Flow and Dividend Payments (Data taken from company’s cash flow statement, chart created by author)

This graph adds dividend payments as an additional variable to visualize the free cash flow payout ratio. Philip Morris is exhibiting a much healthier payout ratio supported by the increase in free cash flow. While Altria continues to increase dividends at a faster rate shortening the gap with free cash flow. Although Philip Morris investors are receiving smaller dividend increases, the payout ratio is sustainable. If this trend continues, PM investors will be able to receive a dividend pay raise, while Altria investors may see a slowdown or cut. This depends on the severity of free cash flow stagnation. As it stands, Philip Morris is superior when it comes to the statement of cash flows.

Gross Margins Supported by HTU

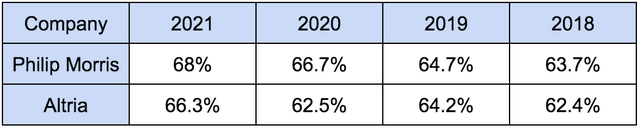

Gross margins of Philip Morris and Altria from the Past 4 Years (Data taken from income statement)

The above chart shows the strength of each company’s income statement and why the tobacco industry is so lucrative. Both companies have excellent gross margins that continue to expand due to pricing strength. Philip Morris is slightly ahead of Altria, and as HTU continues to gain popularity, PM should be able to continue growing margins at a faster rate than Altria.

Balance Sheet and Debt Repayment

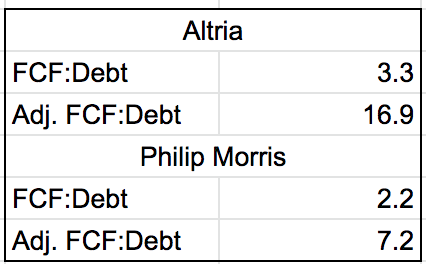

A Table Comparing Free Cash Flow and Long-Term Debt (Data taken from balance sheet and cash flow statement)

This data shows how many years it would take for each company to completely pay off long-term debt using last year’s free cash flow. Philip Morris could pay off their debt in 2.2 years, while Altria could in 3.3 years.

The adjusted free cash flow is created by subtracting last year’s dividend payment. Since Altria’s dividend requires much more funds, the amount of time it takes to pay off all debt is over twice as long as Philip Morris. This data highlights that Altria is plagued with more debt and has less ability to pay it off without a dividend cut. If both companies were to be under distress, Philip Morris would be better prepared to manage the downturn. Financial statement data can be seen here.

Company Valuation Compared to History

In the last 5 years, Philip Morris has traded between a 10.8-21.0 P/E ratio. Today, the company is trading at a 16.3 P/E ratio, indicating that it is fairly valued. However, the company’s growth in free cash flow can easily support debt repayments and future stock repurchases after the integration of Swedish Match. This would enhance the already beautiful balance sheet. The payout ratio target created by Philip Morris’ management is 75% and the company will likely not increase the dividend dramatically until after 2024. The company uses adjusted diluted earnings for its target.

Risks to Thesis

Philip Morris has two global concerns going forward for the company. The first is the ongoing conflict between Russia and Ukraine. The company had a significant market share in both countries, so revenue will be slightly depressed in those areas. If a larger global conflict were to occur, Philip Morris’ stock price would be significantly affected. The second is the appreciation in the US dollar and the subsequent devaluation in foreign currencies. Although the company will typically hold the foreign currency to fund growth in those countries, it will appear on the income statement negatively. One example of this is the Japanese yen losing 25% of its value against the dollar compared to last August.

The Fall in Yen’s Value Compared to the US Dollar Inverted (Trading Economics)

Price Target and Conclusion

Investors are paying a premium for quality. Philip Morris is likely to outperform its competitors with its approach to a safe dividend payout and a focus on decreasing debt while increasing free cash flow. Deleveraging risk is crucial for the tobacco industry. Although the company is fairly valued compared to historic P/E ratios, the free cash flow growth outweighs the P/E. I recommend to investors that want to gain exposure to the tobacco industry to take a look at Philip Morris, as it is the best in class. I am continuing to buy the stock to form a larger allocation in my portfolio. It’s a great opportunity to buy a company that will not go bankrupt and will be able to recover to its former highs when market sentiment changes.

My price target is $110 which should be fully realized after recession fears pass. This indicates there is a 14.8% upside plus a 5.20% current dividend. Depending on the severity of the recession, it may take 2 years to fully reach $110. Including dividends, this investment would yield about 12.6% per year. This is a great yield that more than accounts for the risk tradeoff.

Be the first to comment