Wang He/Getty Images News

Investment thesis

Nearly every day I receive new articles on Alibaba (NYSE:BABA) in my email inbox. There is no lack of coverage with both authors and commentators proclaiming their views.

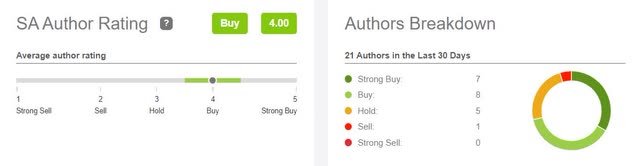

As of 14th June, there were clearly more bulls from authors, than those that are outright bearish.

Alibaba – SA authors ranking

Let us examine why I bought BABA.

Alibaba’s 12 months Financial Results – as of 31st March 2022

We have witnessed significant uncertainties in the Chinese economy. The national retail sales reported negative year-over-year growth in March and April. The online sales of physical goods also reported a historical decline year-over-year.

Despite this, BABA’s revenue for its financial year grew 19% from the year before and came in at RMB 853 billion. However, income from operations was down 22% from RMB 89.7 billion to RMB 69.6 billion.

In the previous year, BABA took a hit to earnings of RMB 18.2 billion as they paid a fine to the PRC Government. This last year they took a write-down of goodwill to the tune of RMB 25.1 billion. Share-based compensation expenses were cut in half from RMB 50 billion to RMB 24 billion.

EPS was only RMB 2.48 which based on 8 shares per ADS gives us RMB 22.74 or equivalent to USD 3.44 per ADS. Based on the recent share price of USD 105.23 we get a 12-month trailing P/E of 30.6.

Analysts have a more favorable forward P/E of 14.8 based on earnings per ADS of 7.4.

Alibaba – EPS and PE

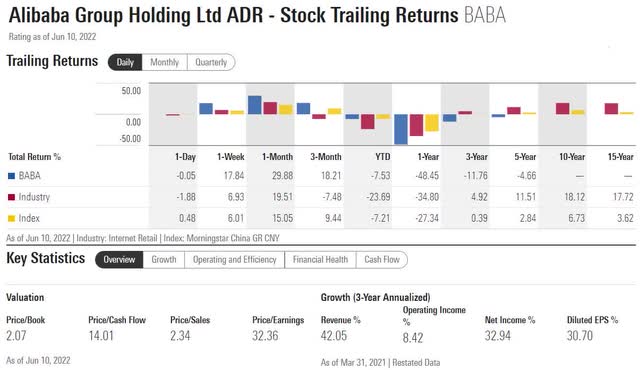

BABA Stock Valuation

When it comes to valuing a company there seem to be different approaches for those stocks that are considered value stocks and for those that fall into the growth category.

BABA clearly falls into the growth sector, similar to Amazon (AMZN), which is probably the closest comparison of the many technology companies out there.

Alibaba returns and key metrics (Morningstar)

Amazon returns and key metrics (Morningstar)

When we compare these two companies, BABA is priced more favorably.

Does AMZN deserve a market capitalization of $1.18 trillion when BABA’s market capitalization is only $294 billion? That is for the readers to decide.

When we are on the topic of size, BABA has 1,300 million active consumers against AMZNs in excess of 200 million Prime subscribers as of 2021. The total number of customers is not crucial. Spending per customer is.

I found it interesting to note that BABA serves the largest and the highest quality consumer base in China with its two platforms Taobao and Tmall. Among their 1 billion active customers in China, as many as 124 million consumers spend more than RMB 10,000, which equals about $1,500 annually on Taobao and Tmall. Ninety-eight percent of those consumers continue to stay effective in the following years.

I think it is hard to use the traditional way of measuring the value of growth companies.

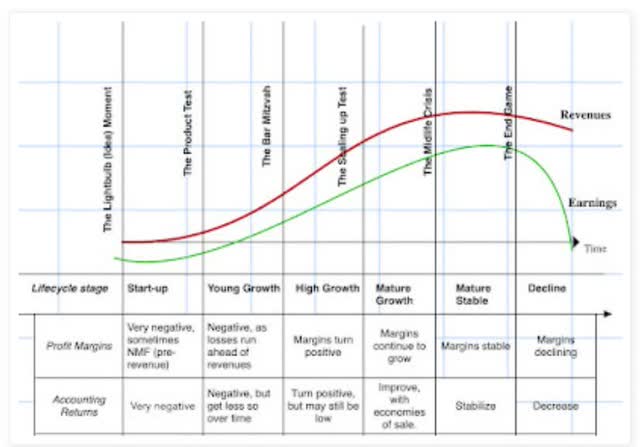

We can all learn much from the esteemed Prof. Aswath Damodaran as he kindly shares his wisdom here on SA. In his article dated February 28th, 2022, titled “Data Update 5 – Bottom Line”. In it, he looks at the profitability of various sectors through the business cycles. This will determine how management allocates capital. It is especially the company’s life cycle that he describes, which might give us some indication as to where in the cycle BABA is.

Company Life Cycle by Prof. Damodaran

Unfortunately, the graph is not very clear even in the article by Prof. Damodaran. Check out the article from the link above. The idea is that these lifecycles can be divided into six stages. This graph does not give any indication as to how long time a company can remain in one stage before moving on to the next. However, it would seem that BABA is in the fourth stage.

I believe that growth will continue for many years to come. We look at this under their business prospects.

Alibaba’s Business Prospects

I believe BABA will grow this business well over the coming years. Last year marked the first year that this division completed its first profitable fiscal year. They are also a market leader in the cloud business in China.

If we look at AMZN, they generate much of its profits from its cloud infrastructure platform AWS.

Management of BABA has communicated their optimistic belief in good growth from the cloud as there are many untapped opportunities for this in their markets.

BABA’s GAAP revenue reached RMB 74.6 billion during the last financial year with 23% year-on-year growth.

The digitalization of many industries in China is just starting and I believe BABA has good reasons to be bullish about this segment. Cloud computing and data intelligence services are fundamental to every business in every sector undergoing digital transformation.

During the conference call with analysts on the 26th of May, their Chairman and CEO Danial Zhang said that according to industry estimates China’s cloud market size will reach RMB 1 trillion, by 2025.

-

Continued growth in South East Asia

The number of users in China is unlikely to grow at the same high percentage as it did in the past.

However, there are about 680 million people living in South East Asia. Some of them already use Alibaba’s platforms, but there is still room for growth, especially in a country like Indonesia. In 2016, BABA bought Lazada and use this affiliate to spearhead its growth in South East Asia.

Revenue from Malaysia, Vietnam, and Thailand achieved higher growth last year.

The bulk of their revenue from international commerce retail business comes from Lazada. This was up 25% from 2020 to 2021.

-

Working with the government brings mutual benefits.

I believe that many investors put too much emphasis on regulations and oversight from the government without taking into account all the positive things that the “new economy” is bringing to China.

They should look at all the positive benefits it creates to society there, as I am sure the government is very well aware of. In 2015, BABA had 8.5 million active sellers, of whom a vast majority reside in China. They have to my knowledge not published numbers on active sellers since, but I assume that it too has grown. These are often small enterprises and entrepreneurs who use BABA’s platform to reach out to people they otherwise would be able to do business with.

In addition to this, China does have a gargantuan task of creating jobs for the young entering the job market. According to the South China Morning Post, Chinese colleges and universities pumped out about 9 million fresh graduates into the job market in 2021 and another 10 million will graduate this summer, putting huge employment pressure on the world’s second-largest economy.

The tech sector in China is a popular choice for many of the young, but their hiring has slowed down recently due to uncertainties. It is one more reason for the government to accommodate this sector’s continued growth.

Diversification

Throughout my entire journey as an investor, I gravitated toward value. It is natural that we, as Howard Marks often says; look to purchase assets when they are priced considerably below their value leaving investors with some safety margin.

As such, my only other investment in tech was in Microsoft (MSFT), which I, unfortunately, lost patience with and sold way too early. Since then, I had not bought any tech stocks as I did not find any of them to meet my criteria.

Nevertheless, when we look at how much the top growth components have gone up, it is not wise to totally neglect this. As investors, we do need to be humble and accept that our methodology, in fact, could be wrong.

Therefore, I did decide to put a small percentage of my portfolio into technology.

BABA was interesting because it looked cheap even last year, so it first came on my watch list at that time. I bought my first tranche of shares on Hong Kong Stock Exchange at a price of around HKD 110 and averaged down giving me an average price in the mid-HKD 90s.

At present, it constitutes 2.6% of my equities.

Risks to thesis

Delisting in the US. This is unlikely but I would not rule it out. If the regulators in the U.S. do not think investors there get the proper information from auditors and the accounts, it could take place. Although this is obviously not an ideal situation, it is not the end of BABA. As an example, China Mobile is doing well being listed in Hong Kong and no longer in the U.S. There is plenty of trading volume in BABAs Hong Kong listing.

More regulations and restrictions from authorities. They rightfully will keep up their checks and balances to keep all the tech companies’ activities under some control. This is not necessarily a bad thing. Many in the west have hoped the same would take place with the likes of Facebook, Twitter, Google, and so forth. When BABA wanted to list Ant Financial, you should ask yourself, why should they be under less stringent control than other financials like the banks?

A slowing economy and slowing growth. The economic impact of the zero COVID strategies in China has been worse than what most countries experienced. However, there are some signs of improvement. I believe the worst is over and we will see consumer confidence returning in the second half of this year.

Costs and spending. This is a real threat to most of the tech companies that I have looked into. There seem to be almost no limits to what they will throw money at. BABA has communicated that this is an area where tighter control will come. Danial Zhang did mention that they will focus even more on cost control and continue to improve their operating efficiency In the current fiscal year. This includes streamlining unprofitable businesses, improving cash cycles, and enhancing investment efficiency in personnel, fixed assets, and other areas.

Corporate structure. Some are also concerned that BABA is a Variable Interest Entity, which means that shareholders are technically owners of shell companies in the Cayman Islands rather than the Chinese enterprises that they think they own. I do not think it matters all that much.

Conclusion

I often remind my readers that it is not a good idea to make your investments based on hopes, prayers, and wishes. However, there are many factors that will determine the outcome of all of our activities that are outside our own control.

So, it is with my stake in BABA too, but I am cautiously optimistic that the shares will be worth more five to ten years down the road than what it is now.

Will it be a good yearly return on the investment, only time will tell?

I do think that the risk-reward based on BABA’s fundamentals looks promising.

Hence, my stance is also a Buy, as the majority of my fellow SA authors also have concluded.

Be the first to comment