GoodLifeStudio/iStock Unreleased via Getty Images

Investment Thesis

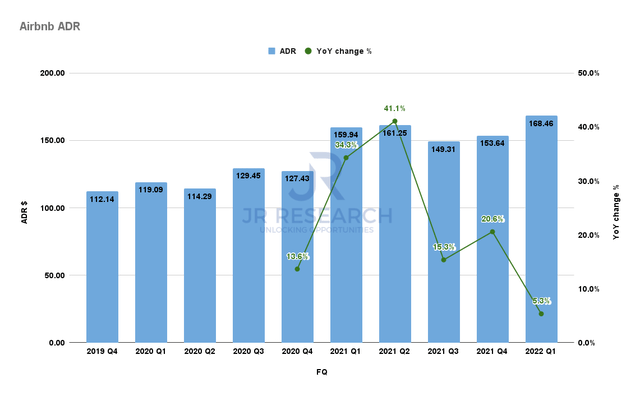

We turned cautious on Airbnb, Inc. (NASDAQ:ABNB) stock in our April article after our bullish calls in November 2021 and February 2022. We realized that ABNB stock had struggled to gain momentum, despite its solid underlying performance. We were also concerned that its ADR tailwinds could be wearing off by the end of 2022, impacting its revenue and profitability growth.

Furthermore, ABNB stock was still priced at a steep premium that we thought couldn’t justify its potential ADR headwinds. As a result, despite robust FQ1 results, the stock fell steeply in May before consolidating at its near-term support.

Our valuation analysis suggests that ABNB stock is no longer overvalued and seems pretty fairly priced. However, our price action analysis has not indicated a potential bear trap reversal signal. Furthermore, its recovery momentum remains tentative, hindered by its near-term resistance.

Notwithstanding, we believe the risk/reward profile has improved markedly with its deep retracement in May. As a result, we think it bodes well for a medium-term recovery, even though its near-term price action remains tenuous.

Accordingly, we revise our rating on ABNB stock from Hold to Cautious Buy.

Why Did Airbnb Stock Drop In May?

Airbnb ADR (Company filings)

Airbnb posted an average daily rate (ADR) of $168.46 in FQ1, up 5.3% YoY. However, its growth has decelerated from previous quarters, as it lapped a strong recovery in 2021. Furthermore, management guided for tepid improvement on its ADR for Q2 as cross-border and city travel accelerates. In addition, due to the mix shift, its ADR will be impacted. CFO Dave Stephenson guided (edited):

ADRs will be relatively flat with Q2 of FY21. And so that will give you a sense that ADRs were remaining elevated, both due to mix and due to price appreciation. We think that they will likely moderate throughout the back half of the year as mix continues to adjust more towards cities, more cross border, which have lower average daily rates, but price appreciation has remained high and stickier. And so I think the level of decrease in ADR, I think, may be lower than what we anticipated at the beginning of the year. (Airbnb FQ1’22 earnings call)

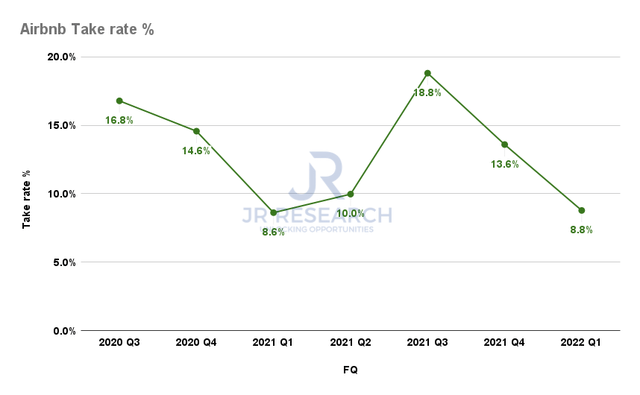

Airbnb take rate % (Company filings)

Furthermore, its take rate has also moderated to 8.8% in FQ1, as seen above, despite the rise in ADR. Therefore, we believe the market has turned its focus to Airbnb’s bottom-line resilience, given the potential recessionary impact.

Can Airbnb Stock Recover?

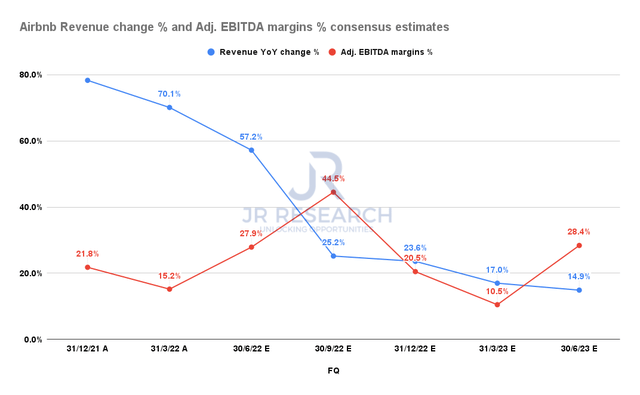

Airbnb revenue change % and adjusted EBITDA margins % consensus estimates (S&P Cap IQ)

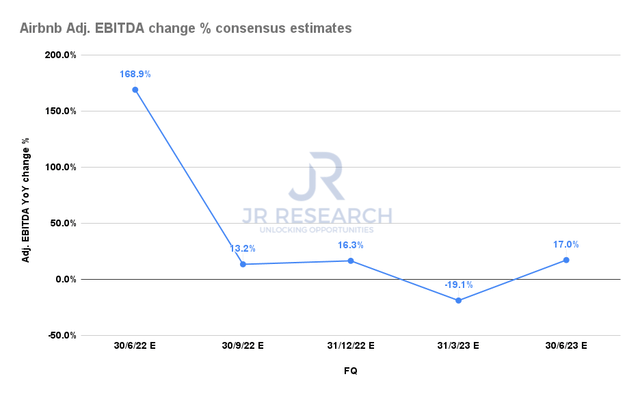

Airbnb adjusted EBITDA change % consensus estimates (S&P Cap IQ)

Despite the significant moderation in its estimated revenue growth, Airbnb’s adjusted EBITDA margins are estimated to remain robust moving forward. Therefore, the company is still on track to improve its operating leverage, as noted by management on the earnings call.

Notwithstanding, we believe that the market is pricing in for potential margin deterioration in FY23, as seen above. Notably, its adjusted EBITDA growth is also expected to decline in FQ1’23.

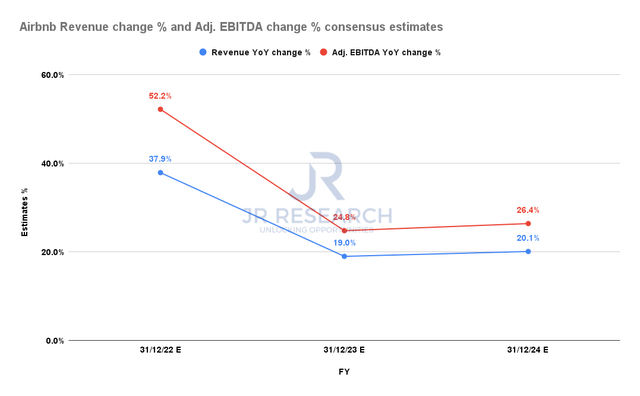

Airbnb revenue change % and adjusted EBITDA change % consensus estimates (S&P Cap IQ)

Investors can also observe the impact on a FY basis, as seen above. Therefore, we believe the market has astutely priced in FY23’s weakness ahead of time, given challenging comps.

However, we believe the valuation reset is justified, as ABNB stock is priced much more reasonably at the current levels to help stage a potential medium-term recovery.

ABNB Stock Key Metrics

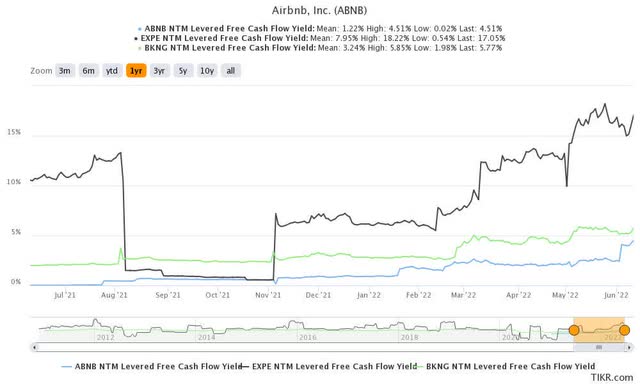

ABNB NTM FCF yields % (TIKR)

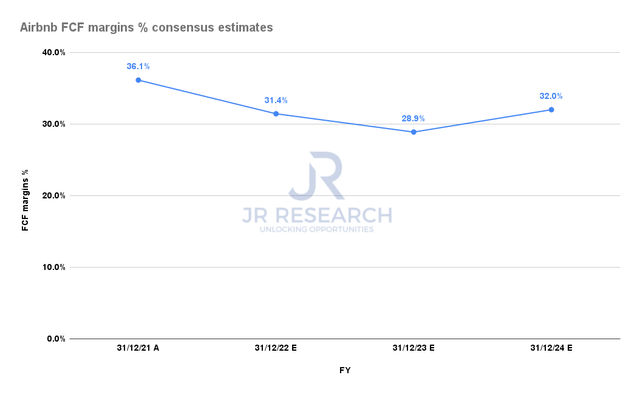

Airbnb FCF margins % consensus estimates (S&P Cap IQ)

Airbnb is a highly FCF profitable company and is expected to turn GAAP profitable in FY22. Notwithstanding, its FCF margins are also expected to fall before reaching a nadir in FY23. Therefore, we believe that the market has attempted to price in the potential lowering of its FCF margins profile in FY23.

However, due to the steep sell-off, ABNB last traded at an NTM FCF yield of 4.5%, closing the gap with Booking’s (BKNG) 5.77% FCF yield. Therefore, we think the valuation reset has already occurred.

| ABNB reverse cash flow valuation model (Data source: S&P Cap IQ, author) | |

| Current market cap | $69.32B |

| Hurdle rate (CAGR) | 13% |

| Projection through | FQ1’26 |

| Required FCF yield in FQ1’26 | 4.5% |

| Assumed FCF margins in FQ1’26 | 32% |

| Implied TTM revenue by FQ1’26 | $15.89B |

Based on reasonable parameters, we believe that ABNB stock seems fairly priced at the current levels. The consensus estimates suggest Airbnb could post revenue of $11.81B in FY24. Hence, we believe that our requirement of a TTM revenue of $15.89B by FQ1’26 is achievable. If the company can deliver better than expected metrics moving forward, ABNB stock is likely to be re-rated.

Is ABNB Stock A Buy, Sell, Or Hold?

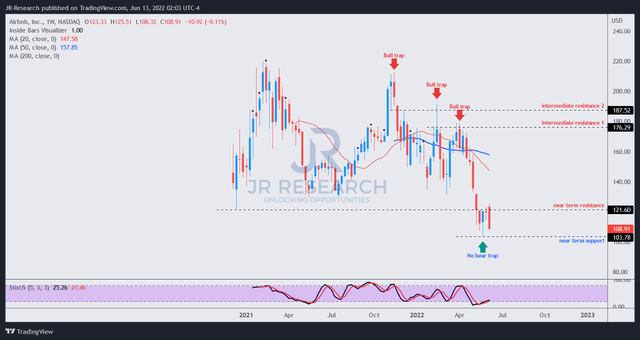

ABNB price chart (TradingView)

ABNB stock is at a near-term bottom, having consolidated over the past four weeks. However, that doesn’t indicate that its near-term support could hold. Furthermore, there wasn’t any bear trap price action that could undergird the resilience of its near-term support.

Moreover, the stock met stiff resistance as it failed to retake its near-term resistance. As a result, ABNB stock could potentially be in a consolidation pattern or could even break newer lows before staging a reversal.

Given the lack of a bear trap price action, we revise our rating on ABNB stock from Hold to Cautious Buy.

We urge investors to layer in accordingly and, if necessary, execute an appropriate stop-loss risk management strategy if the bottom becomes untenable. We will reassess our rating if we observe a material change in its price action.

Be the first to comment