xijian/E+ via Getty Images

Some people see the glass half full. Others see it half empty. I see a glass that’s twice as big as it needs to be.”― George Carlin

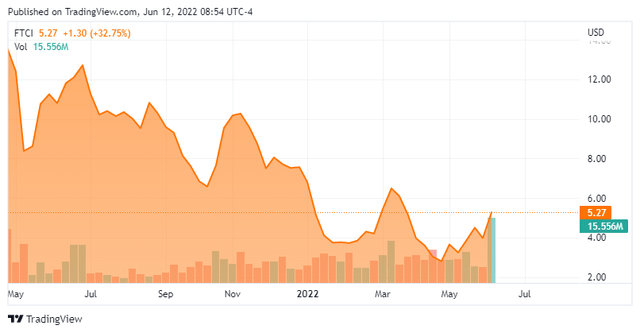

Today, we put a small cap solar concern in the spotlight for the first time. The shares came in mid-2020 when enthusiasm around this space was much higher. The stock now finds itself in ‘Busted IPO‘ territory. Is the equity now oversold or still an avoid for investors? We attempt to answer that question via the analysis below.

Company Overview

FTC Solar Inc. (NASDAQ:FTCI) is based out of Austin, Texas. The company provides solar tracker systems, technology, software, and engineering services to clients in the solar industry. One of its core products is called Voyager. This is a two-panel in-portrait single-axis tracker solution. It also offers a variety of software solutions which includes SunPath, that help enhance energy production. The stock currently trades just above five bucks a share and sports an approximate $550 million market capitalization.

First Quarter Results:

On May 10th, the company posted first quarter numbers. FTC Solar had a non-GAAP loss of 20 cents a share as revenues fell nearly 25% on a year-over-year basis to just south of $50 million. Both top and bottom line numbers missed analyst expectations. FTC Solar’s GAAP net loss was $27.8 million or $0.28 per share in the quarter. Leadership guided to just $30 million to $35 million of revenues in the second quarter, primarily due to solar module availability.

| GAAP | Non-GAAP | |||||||||||||||

| Three months ended March 31, | ||||||||||||||||

| (in thousands, except per share data) | 2022 | 2021 | 2022 | 2021 | ||||||||||||

| Revenue | $ | 49,553 | $ | 65,707 | $ | 49,553 | $ | 65,707 | ||||||||

| Gross margin percentage | (18.7 | %) | 0.2 | % | (17.8 | %) | 0.3 | % | ||||||||

| Total operating expenses | $ | 18,491 | $ | 8,138 | $ | 11,177 | $ | 6,851 | ||||||||

| Loss from operations(A) | $ | (27,778 | ) | $ | (8,019 | ) | $ | (19,965 | ) | $ | (6,664 | ) | ||||

| Net loss | $ | (27,793 | ) | $ | (7,442 | ) | $ | (20,284 | ) | $ | (6,676 | ) | ||||

| Diluted loss per share | $ | (0.28 | ) | $ | (0.11 | ) | $ | (0.20 | ) | $ | (0.10 | |||||

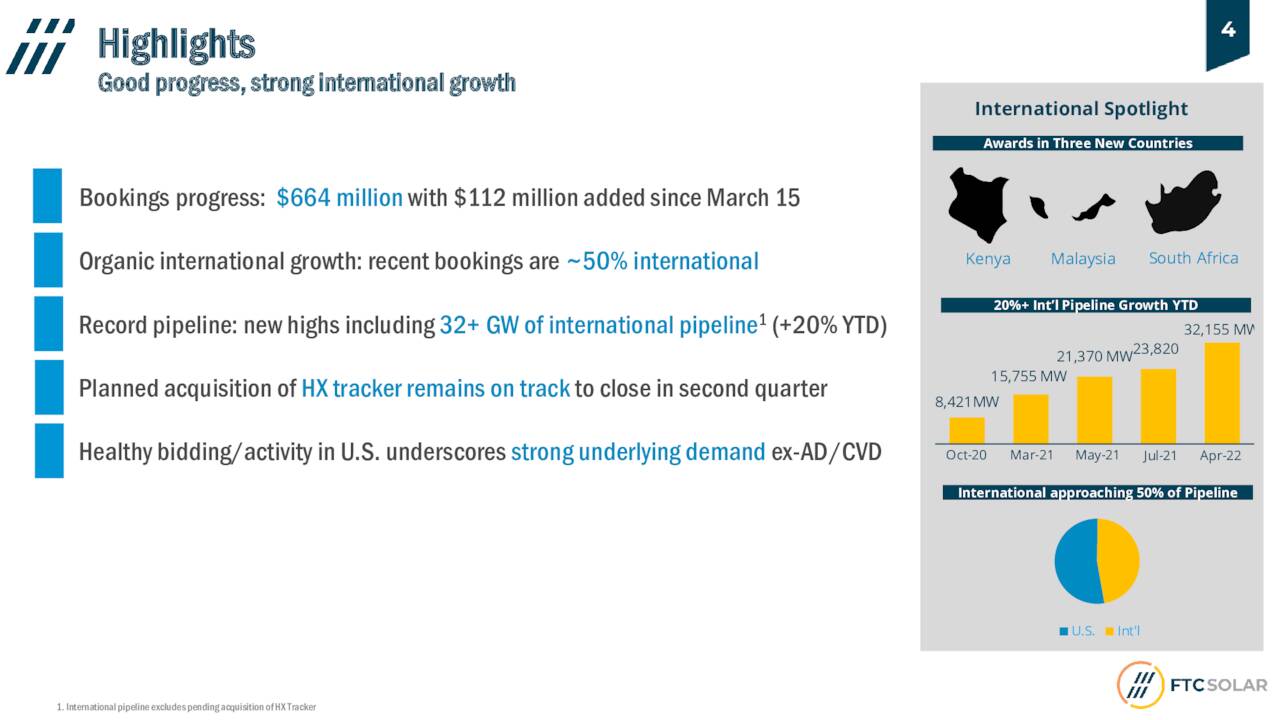

Despite that, there were some positives from the quarter. The company was awarded its first projects in Kenya, South Africa and Malaysia as its international project pipeline now stands at 32+ Gigawatts, an all-time record. Leadership also noted on its press release that FTC Solar had garnered $112 million worth of executed contracts and awarded orders (half international orders) since March 15. Which brings this amount to $664 million. The company also noted that its acquisition of HX Tracker, an emerging China-based supplier of 1P tracker systems, is on track. This should accelerate FTC Solar’s international expansion further once completed.

May Company Presentation

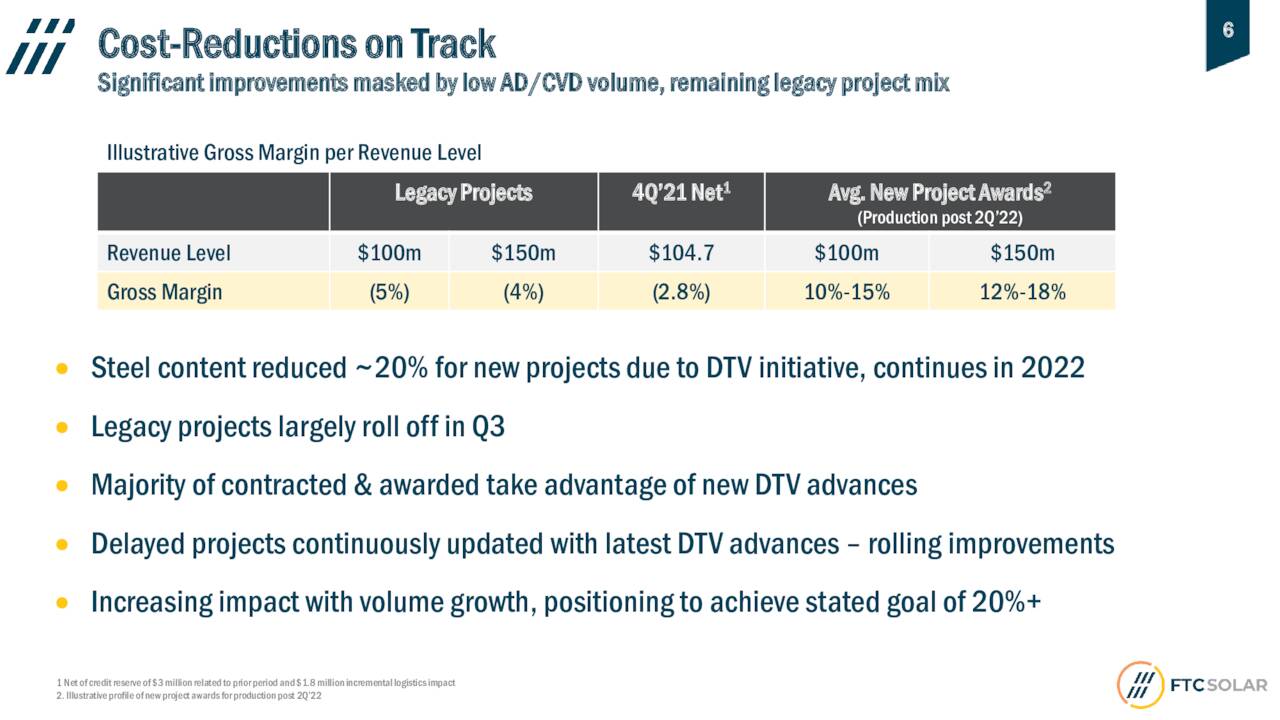

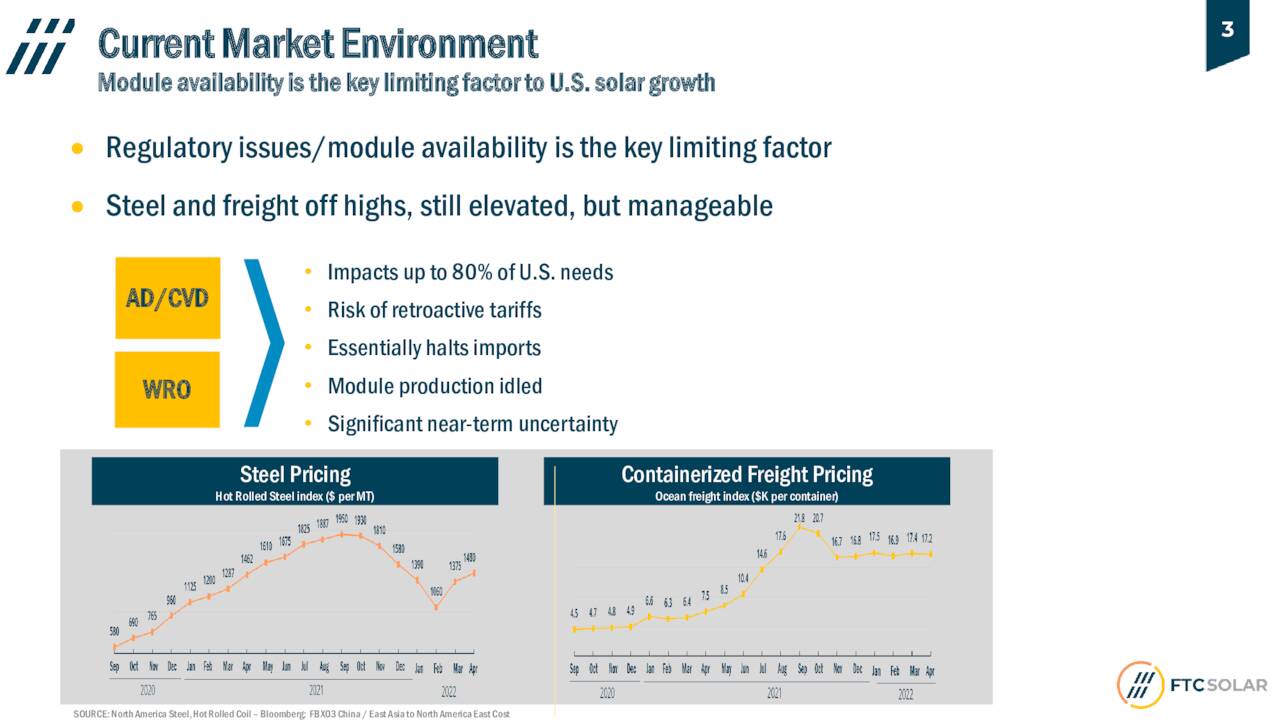

The challenge FTC Solar has had is that because of soaring cost for commodities like steel as well as global supply chain issues including module availability, most of its legacy contracts have turned out to be unprofitable. The company is taking steps to improve margins and legacy contracts should be mostly off the books by the end of the third quarter.

May Company Presentation

The company did get some good news last week as the administration, via the Defense Production Act, declared a two-year exemption from solar panel tariffs as well as other moves to spark U.S. solar panel production. In mid-May, the European Union put out a plan to cut red tape for solar and wind installations. This is part of a concerted effort to reduce EU reliance on Russian energy imports.

May Company Presentation

Analyst Commentary & Balance Sheet

Since first quarter earnings hit, five analyst firms including JPMorgan & Cowen & Co. have reissued Buy or Outperform ratings on the stock, albeit almost all with downward price target revisions. Price targets proffered range from $6 to $8 a share. In addition, Roth Capital upgraded the shares to Buy from Neutral with a $8 price target and Northland Securities initiated the shares as a new Buy with a $7 price target.

Approximately 10% of the shares are currently sold short. A director did buy 375,000 shares in mid-May in the low $3s. However, as the stock has bounced off that post earnings low, other insiders have sold approximately 500,000 shares in aggregate at higher prices.

The company ended the first quarter of this year with nearly $50 million in cash and marketable securities against negligible long-term debt.

Verdict

The current analyst consensus has the company losing over 50 cents a share and sales contract by nearly 20% in FY2022 to just under $220 million. Analysts do see big growth in FY2023 when the company is projected to swing to a profit of 35 cents a share as revenues soared over 140% to some $530 million. It should be noted this is the consensus estimate and both profit and sales estimates are in quite wide ranges at the moment.

The company, like most in the industry, is going through a rough patch. Things are projected to turn around significantly in FY2023 based on analyst projections and the company has a large and growing backlog. Recent regulatory actions in Europe and the U.S. should be positives. Given the extent of recent quarterly losses, FTC Solar may need to bolster its balance sheet.

With both the domestic and global economy experiencing a noticeable slowdown in growth, I tend towards the cautious side despite positive analyst opinion on FTC Solar. I would wait to digest second quarter results before even committing to a small ‘watch item‘ holding in this small cap concern.

A truly great book should be read in youth, again in maturity and once more in old age, as a fine building should be seen by morning light, at noon and by moonlight.”― Robertson Davies

Be the first to comment