andresr/E+ via Getty Images

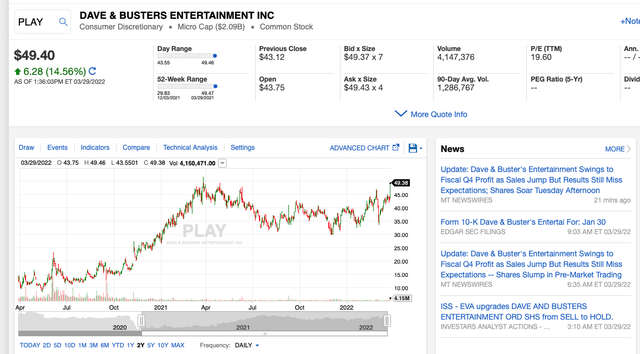

I was asked why shares of Dave & Buster’s (NASDAQ:PLAY) broke out today. After all, conventional wisdom was that PLAY missed consensus estimates for Q4 FY 2021 and stocks trade based on results relative to consensus estimates. Lo and behold, the devil’s always in the details and the reason why Dave & Buster’s shares broke out today was twofold:

1) The conference call was amazing.

2) The Q4 FY 2021 miss, at least relative to consensus estimates, was due to the Omicron surge, which coincided with how PLAY’s Q4 calendar fell (November 2021 – January 2022).

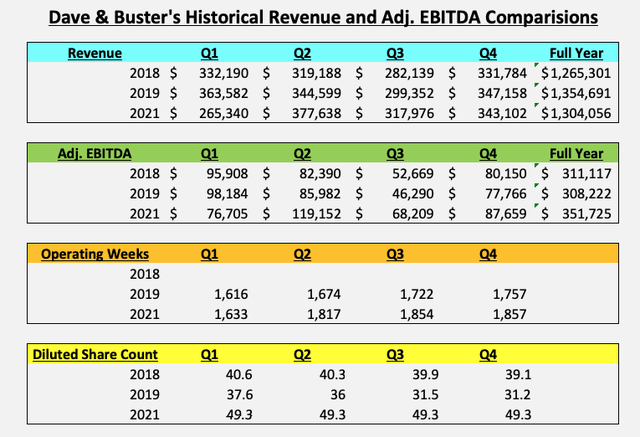

Also, for perspective, D&B’s FY 2021 Adj. EBITDA reached an all-time high, so it wasn’t like Q4 FY 2021 Adj. EBITDA was a big miss.

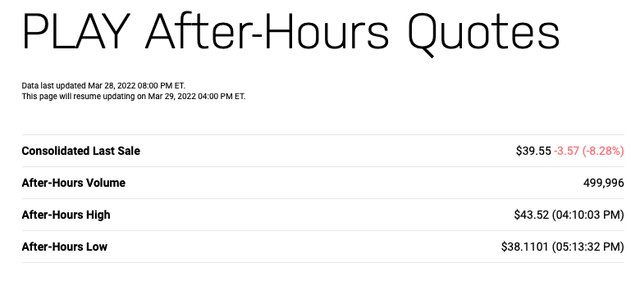

And before we get more granular and I explain the nine super bullish reasons for today’s breakout move, look at the knee-jerk reaction, last night, during after-hours trading. As you can see, PLAY shares closed at $39.55, down 8% and 500K shares changed hands.

The Nine Super Reasons Including Highlight From D&B’s Q4 FY 2021 Conference Call Highlights:

(All quoted materials and excerpts are from the Dave & Buster’s Q4 FY 2021 conference call unless otherwise noted.)

1) Look at the cadence of Q4 FY 2021 comps. A very good November 2021 (+7.5%) and then down sharply in December 2021 (-14.9%) and January 2022 (-8.4%). Clearly, Omicron caused lower traffic, and the PLAY’s food and beverage (F&B) business was down 24% compared to 2019.

Our walk-in sales continued to post positive comps at 2.1%, although our Special Events business continued to lag at negative 58% compared to 2019. By month, our overall comps were positive 7.5% in November, negative 14.9% in December and negative 8.4% in January, which highlights the timing of when the Omicron variant hit. Our walk-in comps, which excluded the impact of our lagging Special Events business during a seasonally strong holiday party season were positive 13.9% in November, negative 4.1% in December and negative 0.9% in January.

Regarding sales mix, amusements and other had a positive 7% comp and with 65% of our overall mix compared with 56% of our mix in 2019. This is mainly due to minimal discounting and a continued shift to higher denomination Power Cards. F&B had a negative 24% comp compared with 2019, a substantial portion of which was due to the Special Events business.

2) As Omicron has faded, and despite higher gas prices, the last five-week (Q1 FY 2022) comp was +13%!

That tells you, inside those numbers, the power will go in before the breakout of Omicron. Then when you do the same sort of mathematics in the first quarter, in the first, I think it was three weeks, we were down 8.3% and then once that all becomes – subsided and we went back to business, our last five weeks have been up 13%. So you can really fully understand that we – other than the Omicron, this business is on fire, and just the beginning of it. We’ve got so many things that we’ve talked about on other calls that we’re starting to shape to drive demand.

3) Management thinks its stated goal of 200 Bps Higher Adj. EBITDA margins relative to FY 2019 is sustainable despite elevated food and labor inflation.

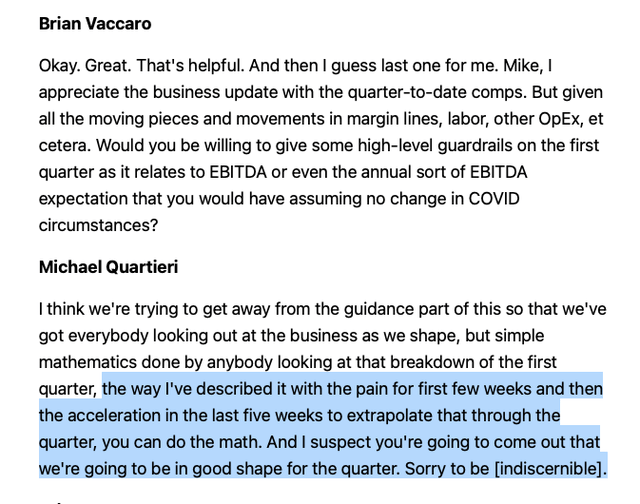

The sell side question:

PLAY’s Q4 FY 2021 Conference Call

Management’s response:

PLAY’s Q4 FY 2021 Conference Call

4) D&B’s special events revenue was down 72% in FY 2021 compared to FY 2019. As the economy continues to open up, this is a big tailwind and driver of comp strength.

Let me end with these thoughts. We came very close to reporting record fourth quarter revenue despite being significantly impacted by Omicron. We are starting to see a recovery in our Special Events business, which was down by 72% on an annual basis in 2021 compared to 2019.

5) The Store Managers Have A New and Major Incentive Plan To Grow Organic Comps at a +3% CAGR to be in the money.

PLAY’s Q4 FY 2021 Conference Call

6) New store growth and a smaller store format should give the company access to dense urban areas that can drive strong unit economics. On today’s call, management guided to eight new stores in FY 2022.

PLAY’s Q4 FY 2021 Conference Call

7) The stock is on the cusp of breaking out to a fresh two year high. This is bullish from a technical perspective.

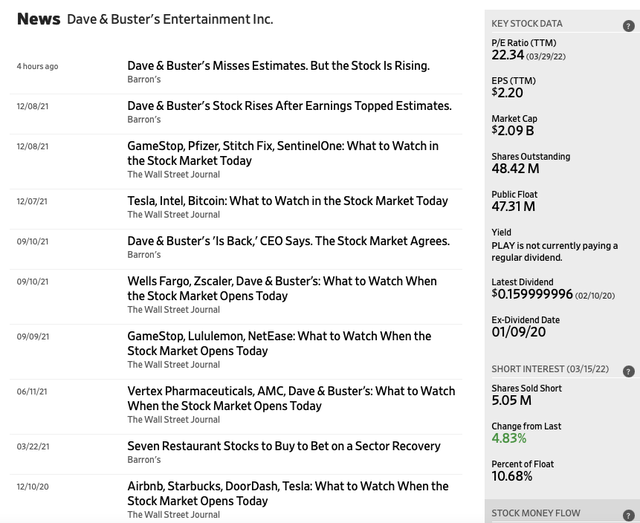

8) Arguably, the short thesis is now broken and there were 5 million shares sold short, as of March 15, 2022.

9) Management’s bullish commentary about Q1 FY 2022

PLAY’s Q4 FY 2021 Conference Call

Valuation

At fiscal year end, PLAY has $26 million in cash and debt of $440 million. The company had to issue a $550 million 7.625% 2025 bond, in late October 2020, to survive the COVID-forced lockdowns and closures. They have made two $55 million pre-payments on the bond, at a price of $103.

PLAY has 49.3 million diluted shares. At $49 per share, this translates to a market capitalization of $2.42 billion and enterprise value of roughly $2.84 billion.

So it comes down to what’s the right multiple to Adj. EBITDA to pay for this business. As we don’t have formal FY 2022 guidance and you only think it is 8X FY 2021 numbers then PLAY’s equity should be worth $48.15.

However, based on management’s super bullish conference call, one could argue that FY 2022 Adj. EBITDA could be $375 million to $400 million. The only hard comparison that PLAY faces is during Q2 as the company was lapping stimulus payments. That said, PLAY has a lot of momentum and a big natural tailwind of lapping a down 72% special events comps.

If you are bullish, like me, and we put a 9X multiple on $400 million of pro-forma FY 2022 Adj. EBITDA, this translates to stock price of about $65, net of current net debt. In FY 2022, as D&B is planning to spend $200 million in CAPEX and interest expense is only about $34 million, the company should also generate solid free cash flow.

Putting It All Together

Dave & Buster’s delivered an excellent FY 2021. The company generated record Adj. EBITDA and the business has a lot of momentum. The knee jerk reaction was for market participants to sell the stock based on the Q4 miss relative to guidance. However, on today’s 8:30 a.m. conference, management clearly explained the miss was due to the surge in Omicron.

On the call, management noted that comps were +13%, over the past five weeks, as Omicron case counts are way down. The new management incentive structure is really smart, as this empowers store managers to unleash their entrepreneurial ingenuity. Post COVID, PLAY’s senior management understands the market’s perception that organic comp growth is the key metric and managers are now fully aligned and have strong incentive to achieve these type of results.

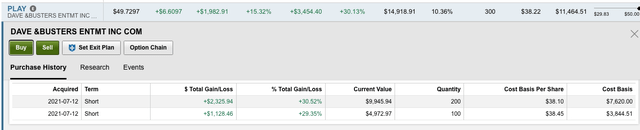

And as you can see, in one of my account, I still own some shares from July 2021.

Be the first to comment