JuSun

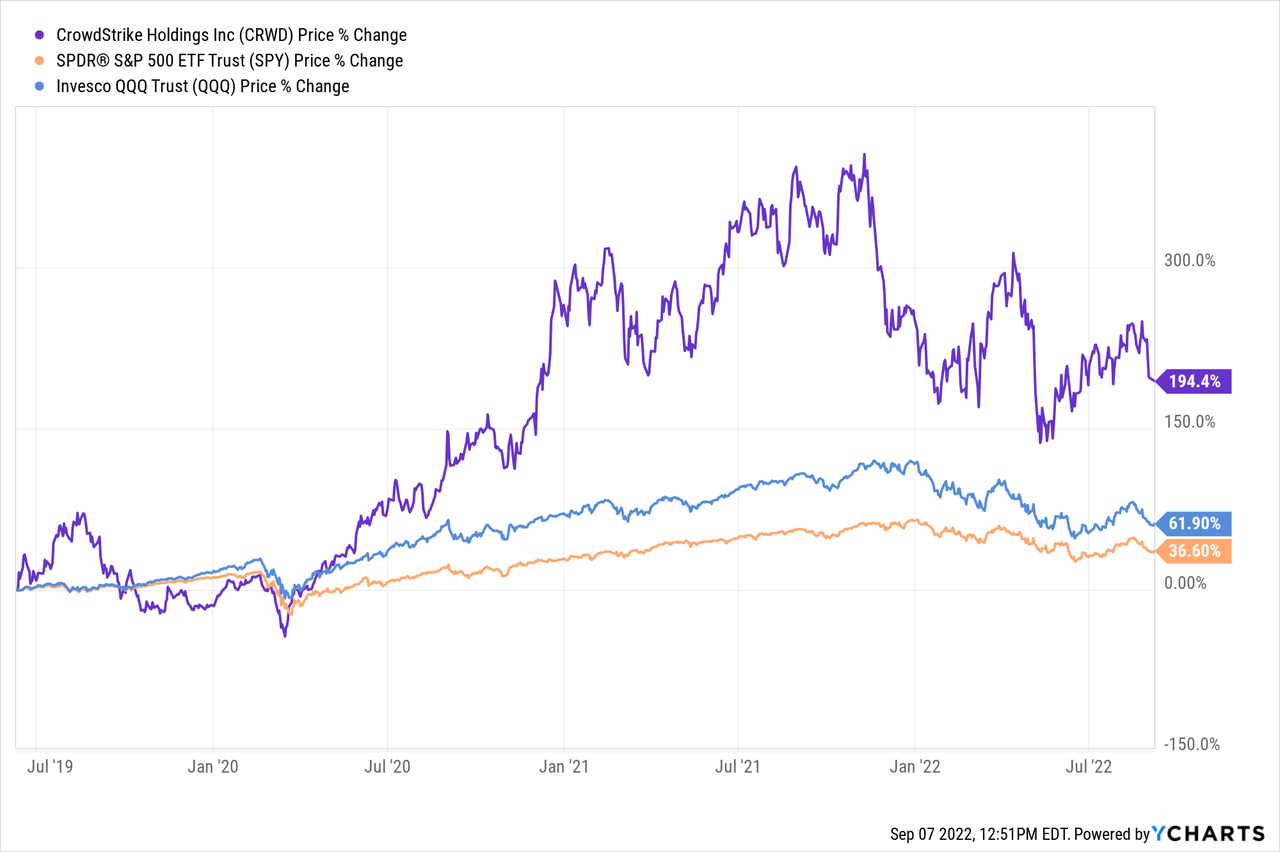

CrowdStrike (NASDAQ:CRWD) went public in June 2019 and has been a stellar performer.

No matter the benchmark, it has delivered tremendous alpha for investors. The company beats Wall Street’s expectations like clockwork, and the stock has tripled in the past three years.

Before you call CRWD grossly overvalued, consider that you could invest at a valuation of 45 times trailing revenue in 2019 and still triple your money in the following three years.

Multiple compression and strong stock price performance are not mutually exclusive. It all comes down to the performance of the underlying business, something too many observers overlook.

When discussing CrowdStrike as an investment, most objections focus on valuation or stock-based compensation, so I’ll address both in this article.

CrowdStrike was the Stock Idea of June 2020 when I introduced it to App Economy Portfolio members, and it has been a strong market beater since then. As a result, it was upgraded to Starter Stock status last year.

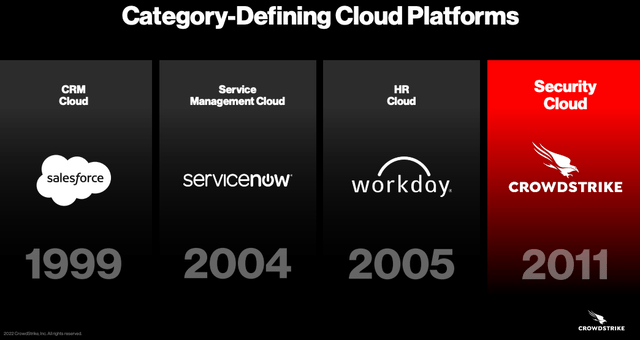

The company is pioneering cloud endpoint security, comparing itself to other category-defining cloud-based leaders:

- Salesforce (CRM) for CRM cloud

- ServiceNow (NOW) for service management cloud.

- Workday (WDAY) for HR cloud.

What makes the company unique? Why do I believe it’s a buy today?

Let’s dive in!

Category-Defining Cloud Platforms (Company Earnings Presentation)

CrowdStrike – A Market Leader

CrowdStrike’s mission is straightforward: “We Stop Breaches.”

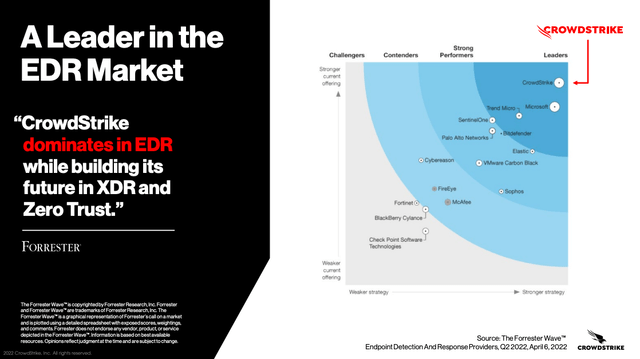

The company was named a Leader in Endpoint Detection and Response Providers by Forrester, well ahead of competitors like Microsoft (MSFT) and SentinelOne (S).

Endpoint Detection (Forrester Wave)

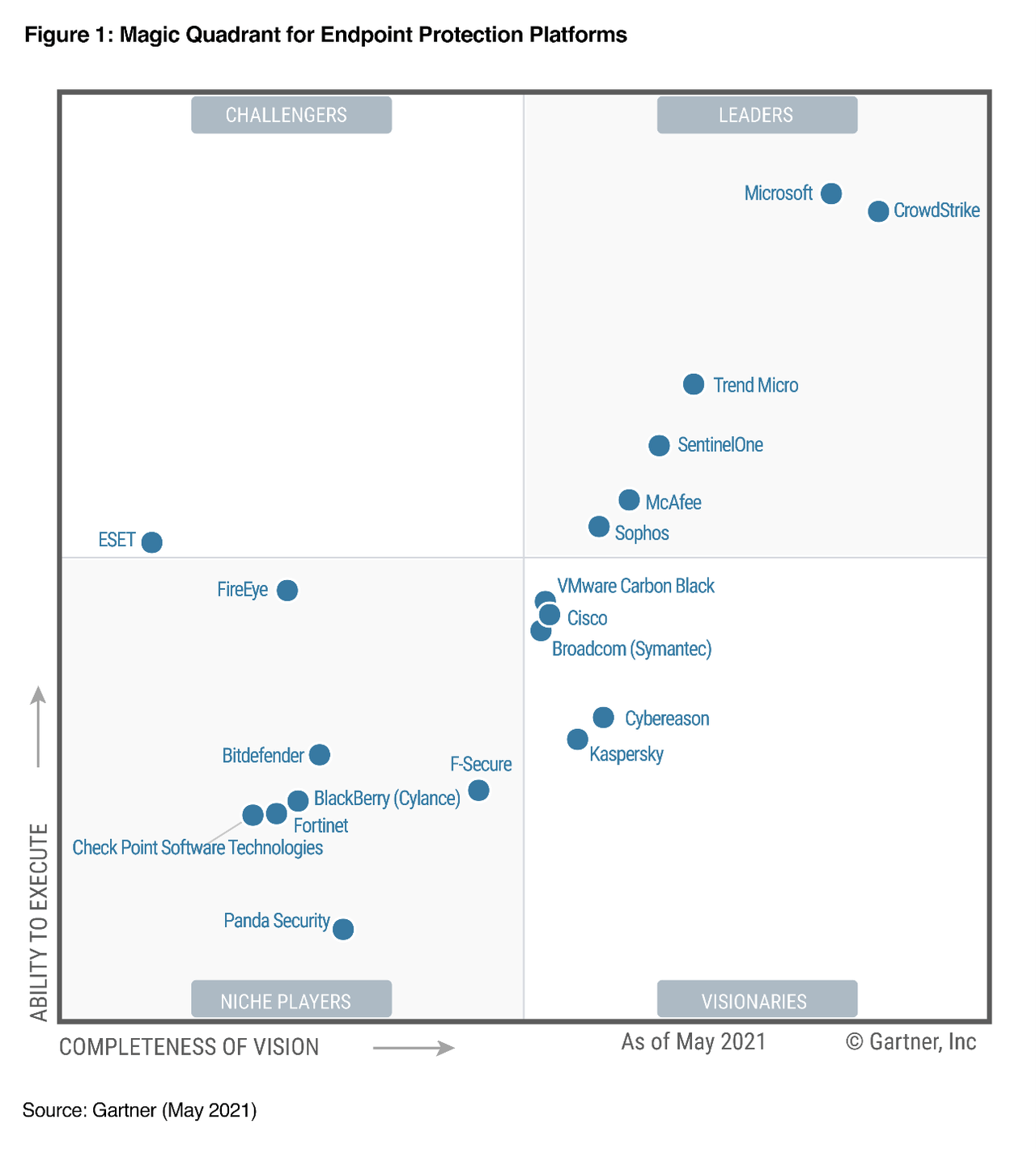

CrowdStrike is recognized as a clear leader in Gartner’s Magic Quadrant for Endpoint Protection Platforms alongside Microsoft.

Endpoint Protection Platforms (Gartner Magic Quadrant)

What is endpoint protection, you may ask?

It’s a cybersecurity technology that monitors “endpoints” connected to the Internet (a smartphone, a laptop, or any smart device. They are all potential threats. So making sure these threats have the proper detection and response has become mission-critical.

The company has been celebrated for its leadership and culture and has collected awards and accolades over the years. We are looking at a best-of-breed business.

CrowdStrike Reviews (Glassdoor)

New Product Milestones

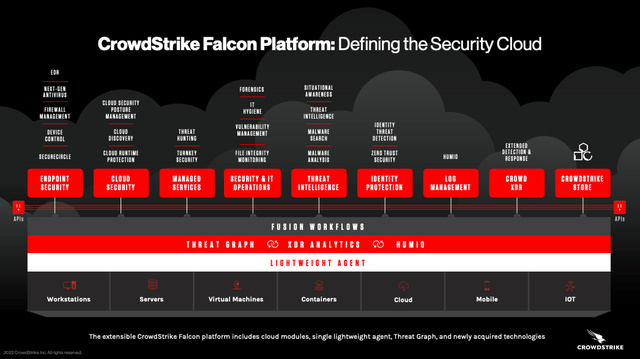

CrowdStrike secures critical areas of enterprise risk. To do so, it leverages real-time indicators via its Falcon Platform.

Falcon uses sophisticated artificial intelligence/machine learning tools to protect all customers when it discovers new cyberattacks. In addition, everyone benefits as the platform gets smarter, creating powerful network effects.

A vital feature of the platform is the new solutions it has added over the years:

- 2012: Threat intelligence module.

- 2013: Threat hunting module.

- 2017: AV, IT hygiene, malware search, and sandbox modules.

- 2018: Device control module, FedRAMP authorization.

- 2019: CrowdStrike store launched with an ecosystem of 3rd party apps.

CrowdStrike Falcon Platform (Investor Presentation)

CrowdStrike’s capacity to add new features to its platform through innovation and acquisitions shows the company’s optionality.

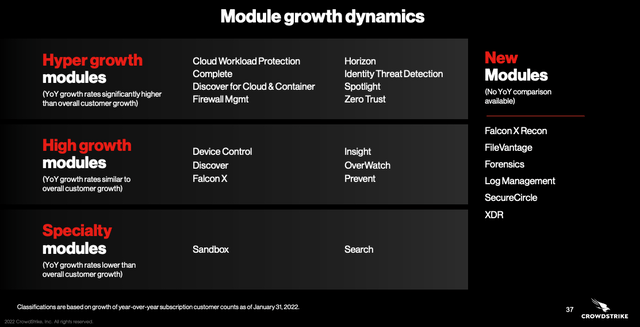

The modules driving most of the growth in 2022 center on firewall management, zero trust, and identity threat.

Module Growth (Investor Presentation)

The company has seen exceptional growth in new modules in recent quarters:

- Discover & Spotlight: > 75% ARR Growth in Q4 FY22.

- Identity modules: > 350% ARR Growth in Q4 FY22.

- Humio (log management) > 400% ARR Growth in Q4 FY22.

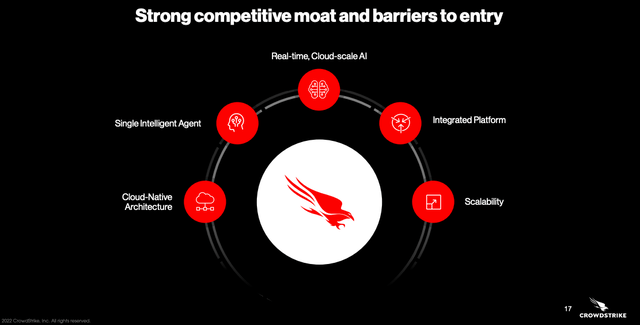

Overall, with an integrated cloud-native platform that improves and scales over time with added features, CrowdStrike sees a widening moat that could become increasingly difficult to replicate for competitors.

Competitive Moat (Investor Presentation)

A Growing Opportunity

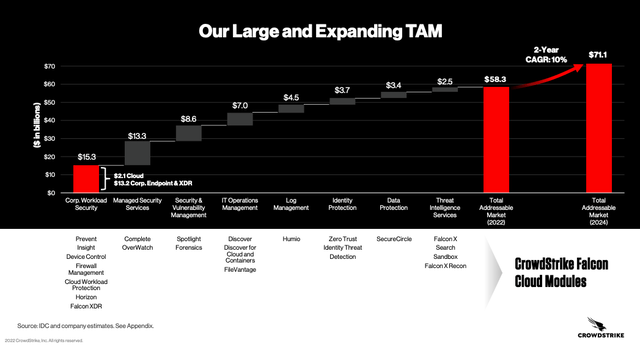

CrowdStrike keeps adding new cloud modules to its Falcon platform, giving the company optionality and potential for expanding its addressable market.

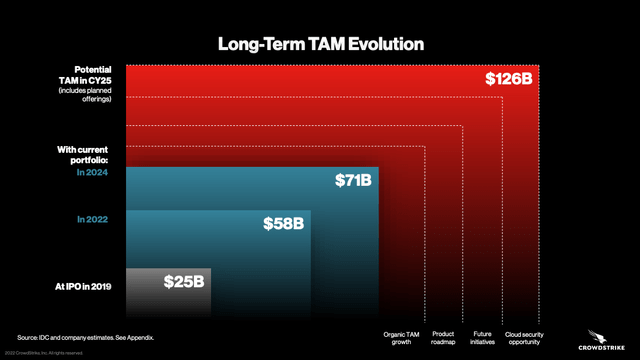

Over time, they added tools such as log management (Humio), identity protection (Zero Trust), data protection (SecureCircle), and more. As a result, the total addressable market expanded from $58B in 2022 to $71B by 2024.

Expanding TAM (IDC via Investor Presentation)

Through additional modules, management expects the TAM to expand to $126B by 2025. Given its $2B ARR, the opportunity is gigantic.

Expanding TAM (Investor Presentation)

The runway ahead is particularly long outside of the enterprise segment:

- Enterprise: 35% estimated market penetration.

- Mid-market (< 75,500 employees): 3% estimated market penetration.

- SMBs (< 250 employees): <1% estimated market penetration.

- Public sector: <1% estimated market penetration.

Increasing Multi-Product Adoption

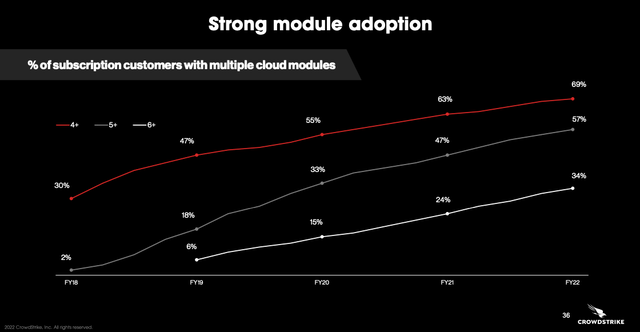

Over time the percentage of subscription customers using multiple cloud modules has steadily improved, illustrating that the platform strategy is successful.

Subscription customers with multiple cloud module subscriptions in Q2 FY23:

- 5+ modules: 59% (+6pp Y/Y).

- 6+ modules: 36% (+7pp Y/Y).

- 7+ modules: 20% (new).

The success of the platform strategy shows in the chart below with the percentage of customers with multiple cloud modules.

Multi-Product Adoption (Investor Presentation)

The average module count for new customers went from 2 in FY17 to 4.7 in FY22, illustrating that the company is landing more significant contracts.

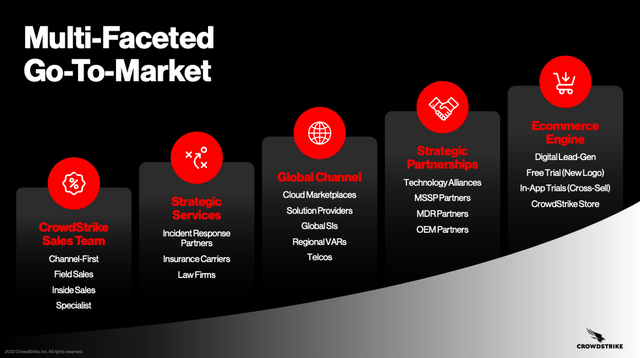

An Efficient Go-To-Market

Sales efficiency is one of the five essential traits to evaluate in a software business.

CrowdStrike benefits from a proven sales model with a combination of direct sales and channel partners:

- Field sales for enterprise customers.

- Inside sales for mid-market and SMBs.

- Strategic deals with government, financials, and healthcare.

- Global offices across Europe and Asia.

To help its low friction approach, the company uses a trial-to-pay model, with options to try specific modules and the CrowdStrike Store.

CrowdStrike Go-To-Market (Investor Presentation)

CrowdStrike generates $1.3 of incremental annual revenue for every $1 spent on sales (also known as the SaaS Magic Number). The company recoups marketing investment in 14 months, putting it among the most efficient cloud businesses.

CrowdStrike Q2 FY23 Earnings Highlights

CrowdStrike reported Q2 FY23 earnings with a convincing beat and raise.

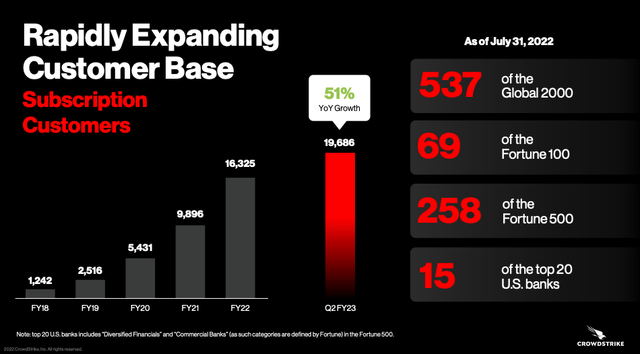

Subscription customers were 19,686 in Q2 FY23 (+51% Y/Y, and +10% Q/Q).

As of July 2022, here is a breakdown of the customer base:

- 69 of the Fortune 100 (+6 Y/Y).

- 258 of the Fortune 500 (+15 Y/Y).

- 15 of the top 20 banks (+1 Y/Y).

Customer Base (Earnings Presentation)

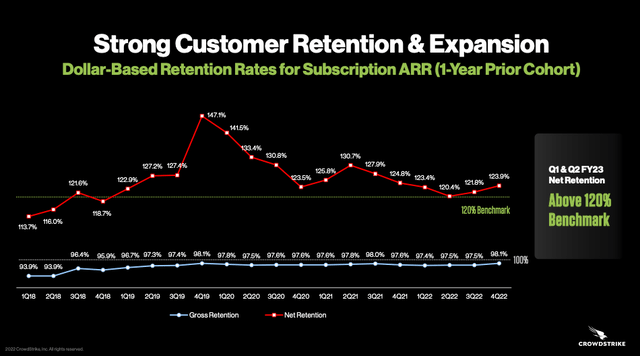

We often discuss in the App Economy Portfolio community the importance of two metrics:

- Dollar-based retention rate (or net revenue retention): shows how much money the company makes from the same cohort of customers over time. CrowdStrike has maintained a dollar-based retention rate above 120% in the past 17 quarters. That’s impressive and in line with some of the best SaaS companies in the portfolio. In addition, it shows that CrowdStrike is making more money from the same cohort of customers over time, net of churn. Moreover, it has trended upward since Q2 FY22.

- Gross retention: shows the portion of its customers the company retains over time (the maximum being 100%). And CrowdStrike is a best-of-breed company in this category, with gross retention at 98% (an all-time high).

Retention Metrics (Earnings Presentation)

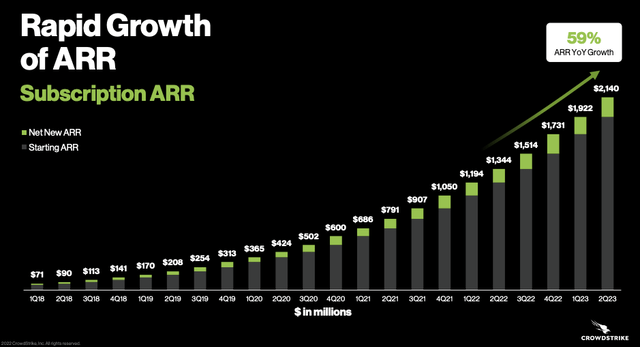

ARR (Annual Recurring Revenue) growth continues to defy gravity with barely any slowdown. The company has steadily increased its net new ARR, demonstrating sustainable growth.

ARR Growth (Earnings Presentation)

Key metrics:

- ARR (Annual Recurring Revenue) grew +59% Y/Y to $2.14B (+11% Q/Q).

- Net new ARR Y/Y was $218M (+11% Q/Q).

- Revenue grew +58% Y/Y to 535M (+10% Q/Q), $19M ahead of guidance.

If we zoom in on the net new ARR every quarter, they have accelerated throughout FY22 and remain elevated today.

| Net new ARR | Amount | % Variance |

| Q1 FY22 | $144M | +14% Q/Q |

| Q2 FY22 | $150M | +13% Q/Q |

| Q3 FY22 | $170M | +13% Q/Q |

| Q4 FY22 | $217M | +15% Q/Q |

| Q1 FY23 | $191M | +11% Q/Q |

| Q2 FY23 | $218M | +11% Q/Q |

ARR is the leading indicator of future revenue growth. Q2 showed no slowdown compared to Q1 and implied a forward growth north of 50% Y/Y.

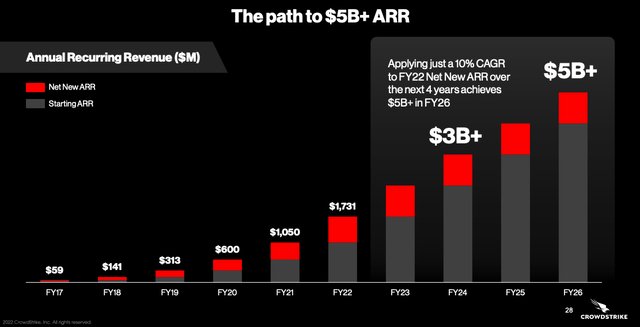

Management recently updated its “path to $5B+ ARR” by FY26, using a 10% CAGR to Net New ARR. So far, so good.

$5B ARR Target (Investor Presentation)

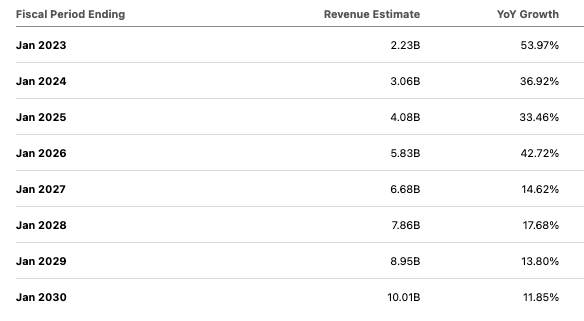

Wall Street’s consensus is for CrowdStrike’s revenue growth to normalize steadily in the coming quarters down to mid-teens by the end of FY27. However, these estimates could prove conservative given the customer success and ARR growth trend.

This tendency for Wall Street to assume linear deceleration in their model is what can create a significant upside for investors with a multi-year time horizon.

CRWD Wall Street Estimates (Seeking Alpha)

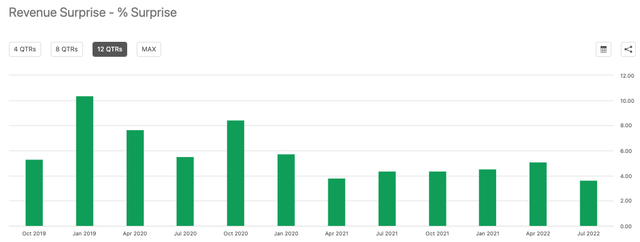

CrowdStrike has a history of beating Wall Street’s expectations by 5% on average in the 14 quarters since the IPO. This outperformance can compound over time and lead to alpha for shareholders.

CRWD Revenue Surprise (Seeking Alpha)

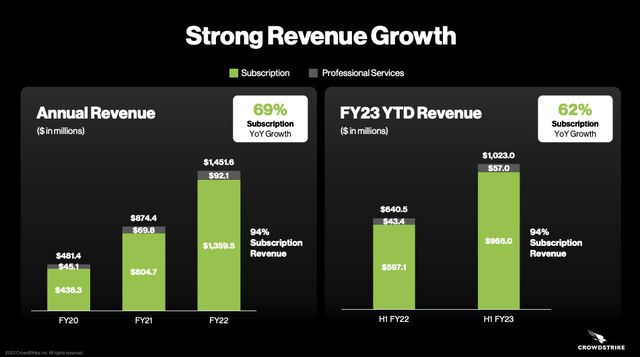

- Subscription revenue grew +60% to $506M.

- 95% of the revenue of the company is subscription-based.

CrowdStrike Revenue Growth (Earnings Presentation)

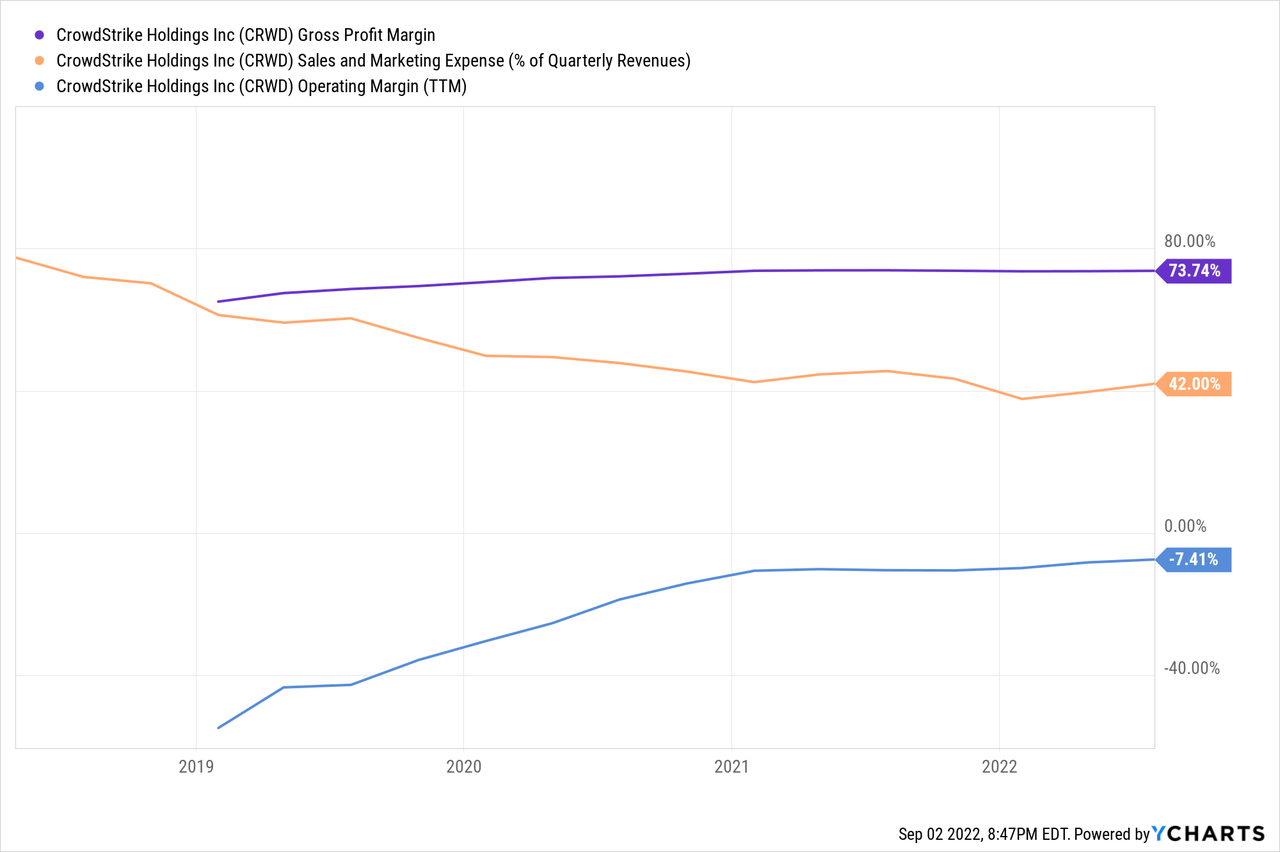

If we turn to the rest of the income statement in Q2 FY23 (on a GAAP basis):

- The gross margin has been very high, currently at 74% (flat Y/Y).

- Sales & marketing costs are trending down at 42% (-4pp Y/Y).

- The operating margin is still negative but improving, -7% (+5pp Y/Y).

CrowdStrike clearly shows signs of operating leverage, and Q2 FY23 is no exception.

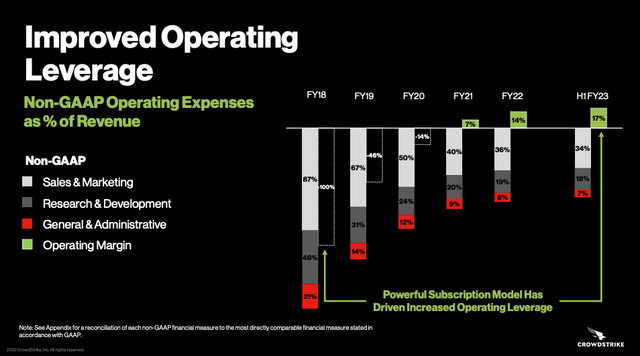

All costs went down in terms of percentage of revenue since FY17 on a Non-GAAP basis:

- S&M costs went from 101% of revenue in FY17 to 34% in H1 FY23.

- R&D costs went from 73% of revenue in FY17 to 18% in H1 FY23.

- G&A costs went from 30% of revenue in FY17 to 7% in H1 FY23.

CrowdStrike Operating Leverage (Earnings Presentation)

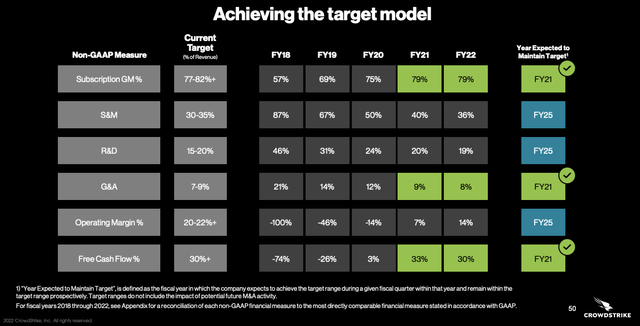

Management has already achieved several of its target operating goals:

- Sub Gross margin to continue to rise toward 80%+ (already achieved).

- S&M costs to continue to fall toward 30-35%.

- R&D costs to continue to fall toward 15-20%.

- G&A costs to continue to fall toward 7-9% (already achieved).

- Operating margin to rise above 20% as a result.

- Free cash flow margin to rise above 30% (already achieved).

Target Model (Earnings Presentation)

The company’s most recent financial results can be summarized as follows:

- Strong top-line growth (+58%) – showing strength.

- High gross margin at 74% – showing long-term potential.

- Falling sales & marketing costs, at 42% – showing scalability.

- Improving operating margin, showing a clear path to profitability.

- Robust balance sheet and cash flow margins- showing sustainability.

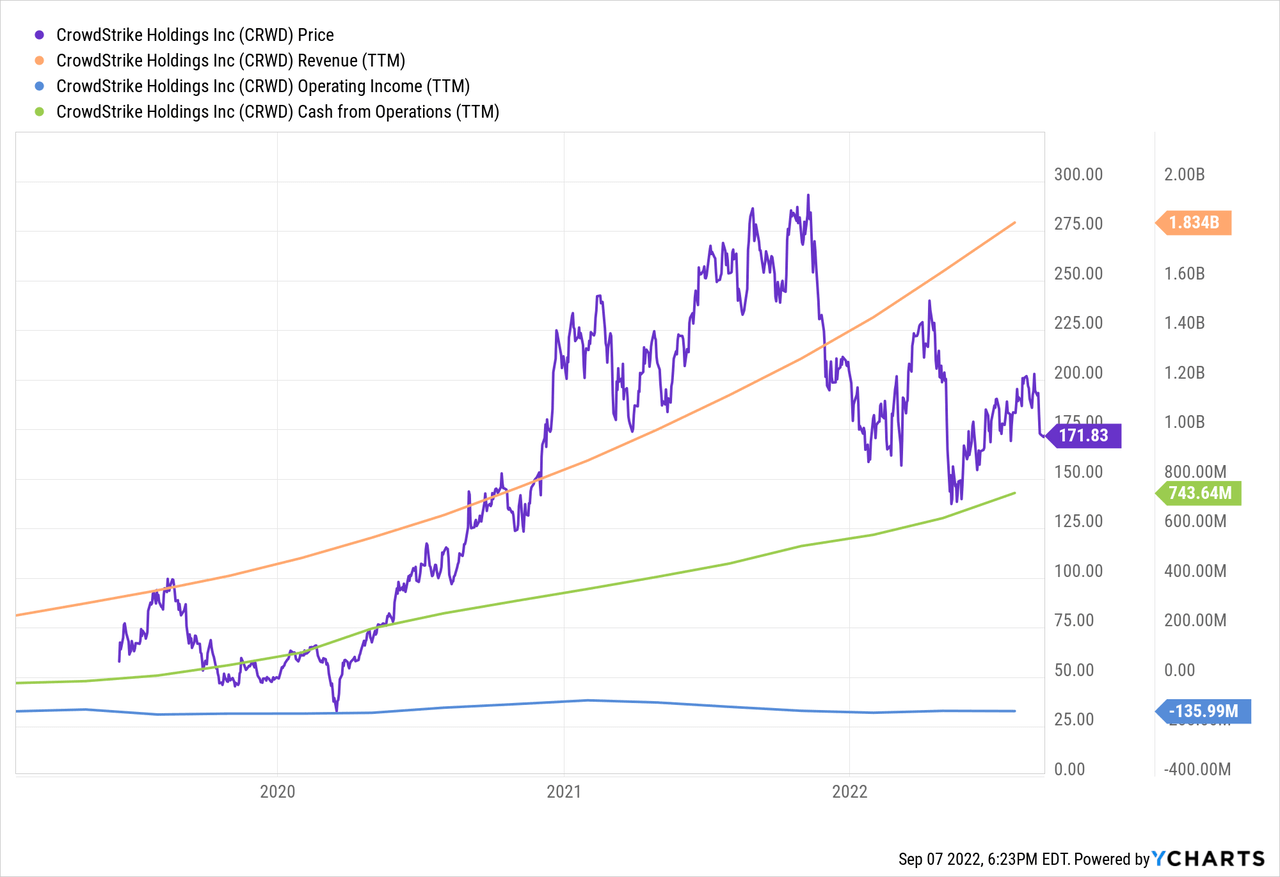

CrowdStrike has been a cash-printing machine. In Q2 FY23, the free cash flow margin was 25% (+3pp Y/Y). It’s essential to keep this in mind when looking at the valuation.

The fantastic trajectory of the business (and the stock) shows in the graph below.

Stock-based compensation was $132M in Q2 FY23 (+72% Y/Y). SBC was 25% of revenue and is the main difference between GAAP and non-GAAP margins. It was a slight uptick from 23% of revenue in FY22. We want to see it go down over time as the company scales. Given the continued operating margin improvement on a GAAP basis, the trend is favorable.

SBC is ~$0.5B annualized, which is a 1% annual dilution. However, it’s more than offset by free cash flow, so it’s not an area of concern for me.

CRWD Stock Valuation

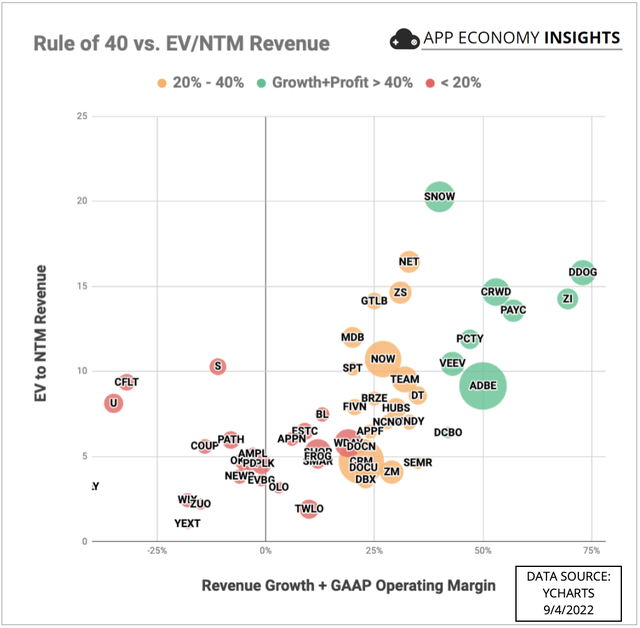

CrowdStrike is in a very exclusive club of software companies delivering exceptional growth while maintaining an attractive margin profile. I explain more about the methodology to compare cloud stocks and their valuation in this article.

Rule of 40 vs. NTM Revenue (App Economy Insights)

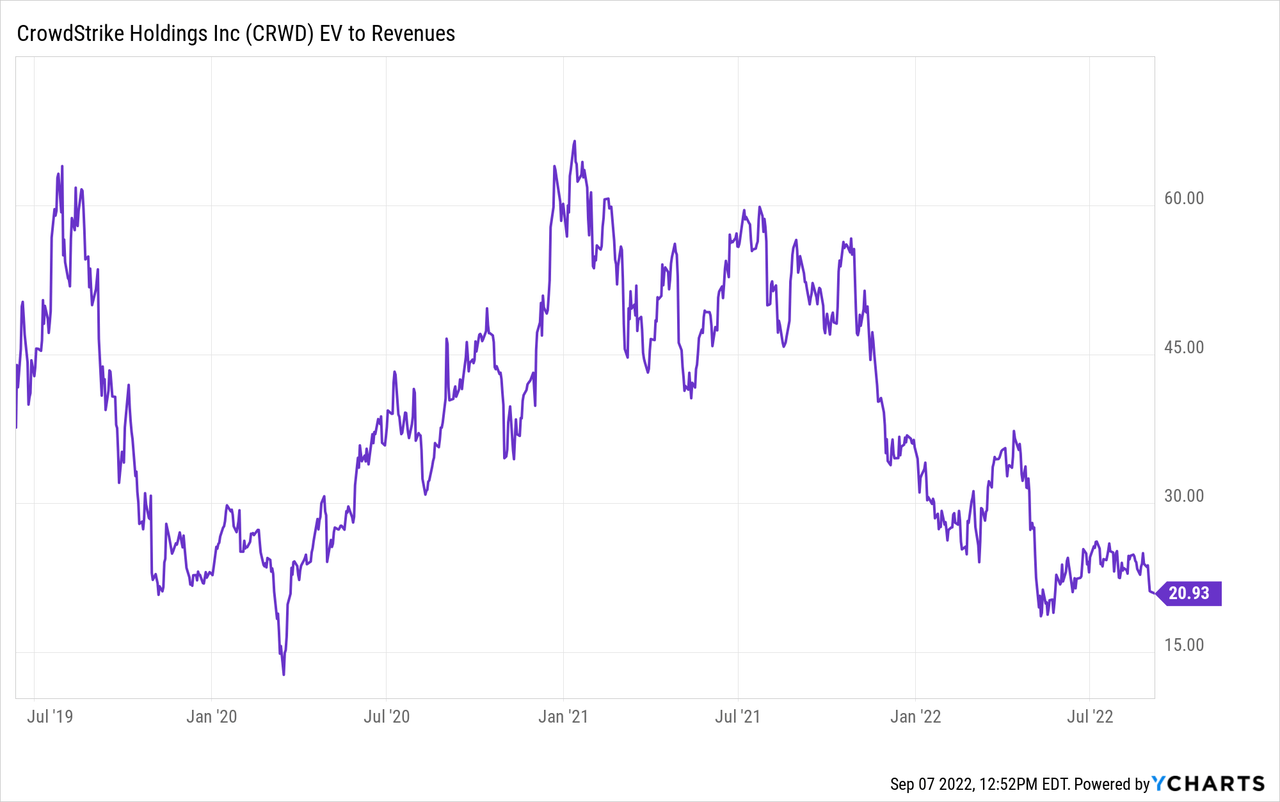

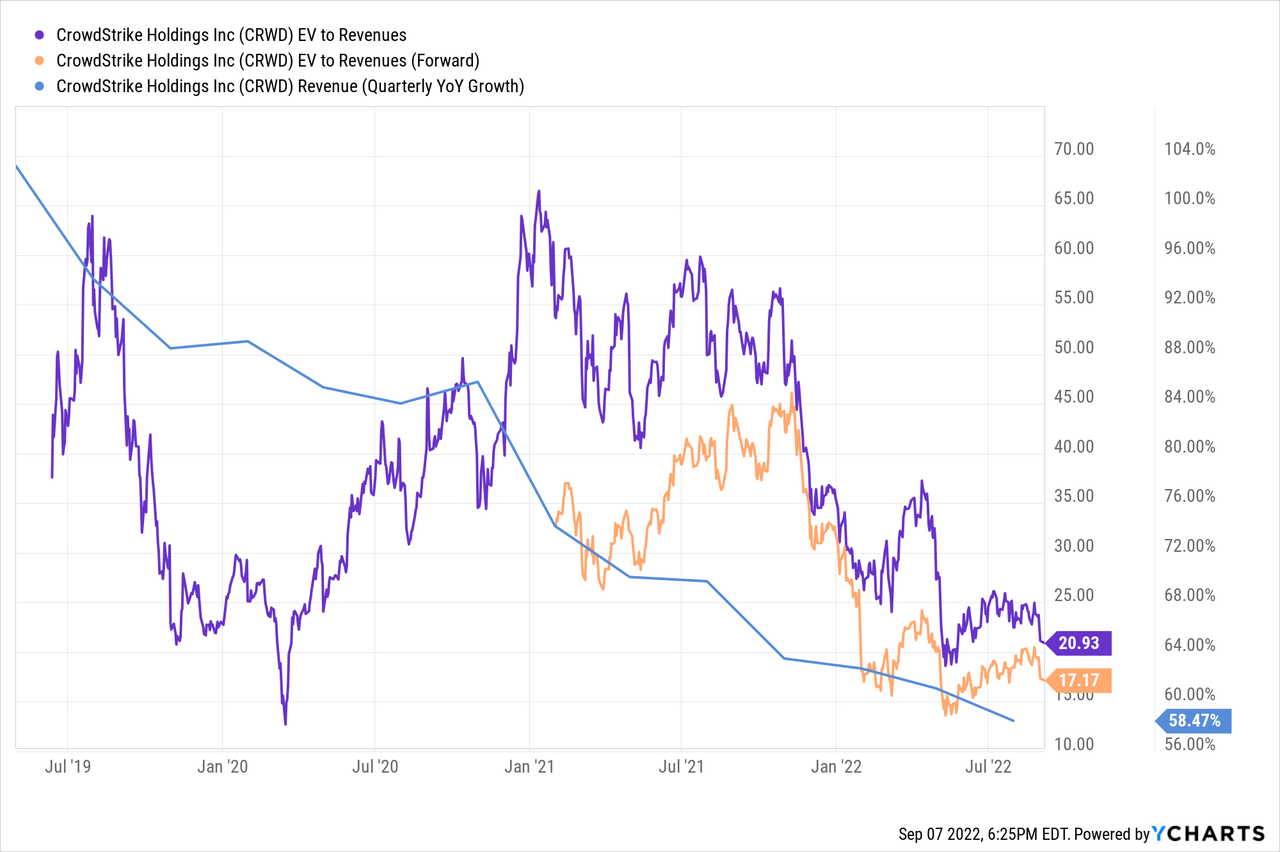

At 17 times FY23 revenue, CrowdStrike is much less expensive than it used to be. But it’s not cheap today, and it never was.

Even at the market bottom in March 2020, it traded at 15 times trailing revenue, only for a few days. So the valuation is on the low end of its spectrum.

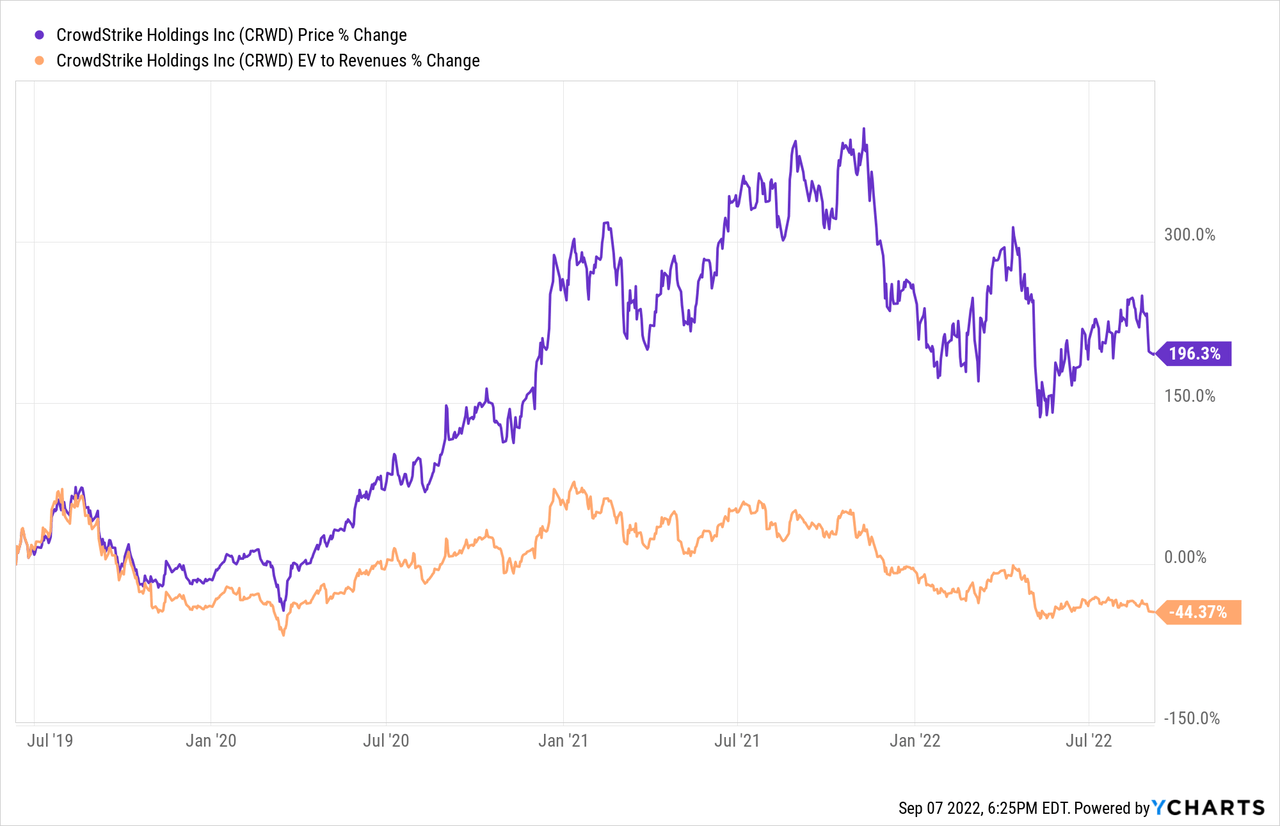

Over time, we should see the multiple normalize as revenue growth declines. The graph below illustrates why multiple compression and strong stock performance are not mutually exclusive. For example, the revenue multiple has collapsed since the 2019 IPO, while the stock price has tripled.

More context on CrowdStrike’s valuation:

At its current enterprise value of $38B, CRWD is trading at less than ~8 times FY26 ARR (by the end of January 2026). Based on the margin profile, that’s about ~25 times free cash flow (maybe less by then).

Furthermore, given management’s track record of under-promising and over-delivering, it’s hard not to look at the $5B+ ARR projection for FY26 with optimism.

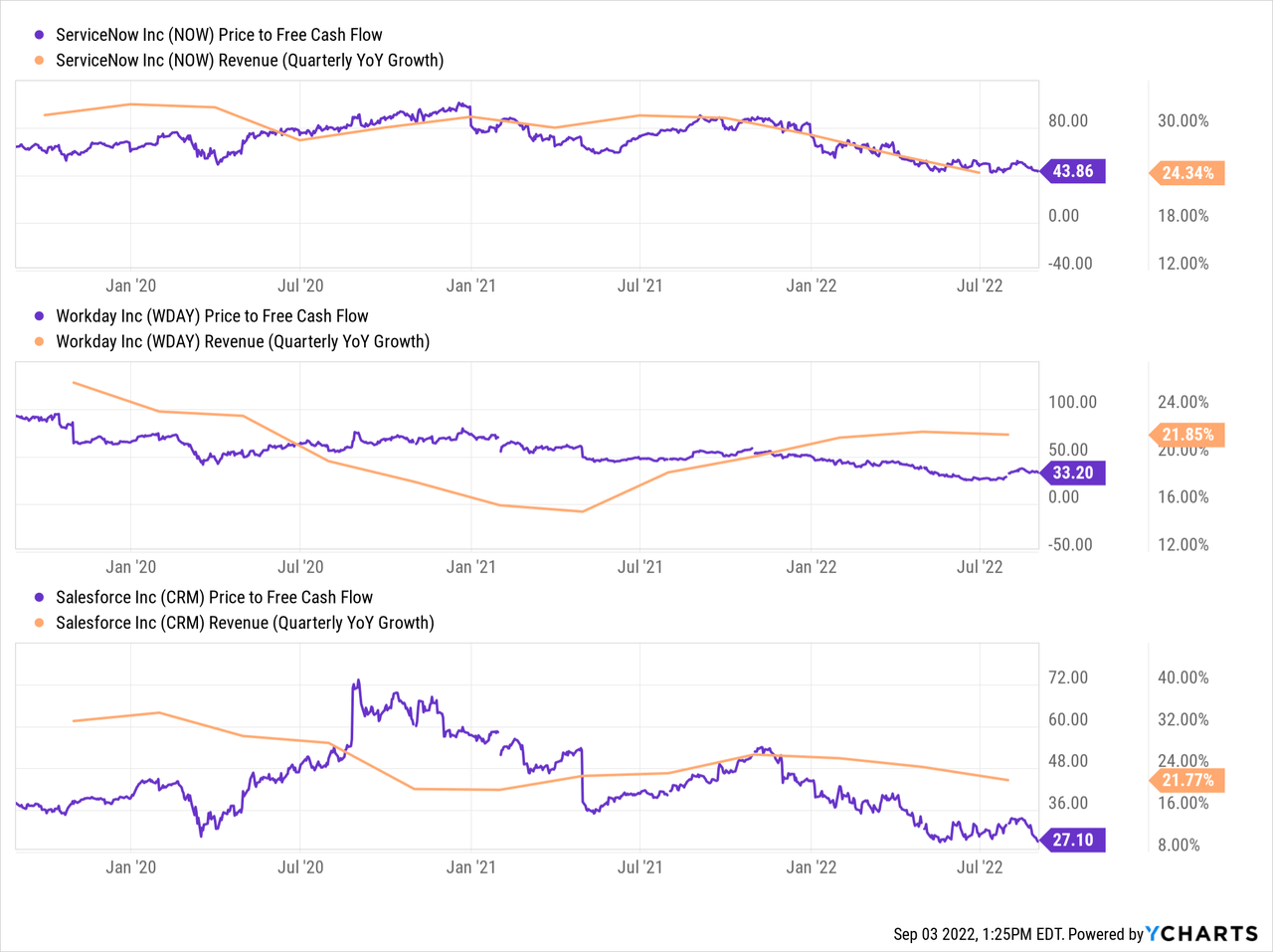

For comparison, let’s use more mature category-defining software businesses. NOW, WDAY and CRM are trading from 27 to 44 times FCF today in the middle of a bear market while growing revenue in the low 20s.

Simply put, I have a hard time not seeing CRWD at least double by the end of 2025, assuming it would trade north of 50 times free cash flow by then.

Let’s not forget that the company has a $1.4B net cash position on its balance sheet to fund future growth (like most companies in the App Economy Portfolio). As a result, CrowdStrike is well-positioned to fuel future growth initiatives.

Risks & Opportunities

In summary, the risk/reward profile of the company is compelling.

- Opportunities:

- CrowdStrike regularly adds new modules to its platform, and customer adoption clearly shows this strategy is working.

- The company’s AI gets smarter every time a customer suffers a breach, creating a positive network effect that benefits all users. It could lead to an expanding moat over time.

- Management sees $5B in revenue by FY26.

- Risks:

- CRWD is the quintessential growth stock: There are no earnings to show for today, exceptional revenue growth, and a high valuation. It wouldn’t be shocking to see the multiple be cut in half in a challenging macro environment, even from here. As a result, only an investor with a multi-year time horizon should consider the stock.

- A revenue growth slowdown in a more challenging macro environment could also lead to multiple compression.

- If the company suffers a breach or hack, it could be devastating to its reputation.

As John Maynard Keynes aptly put:

It is better to be roughly right than precisely wrong.

There could be fits and starts in net ARR additions, and the valuation multiple could temporarily compress for various reasons.

When I look at CrowdStrike’s potential, what matters for me is to be directionally correct. And I find it hard not to see the potential for CRWD to double within the next five years, with a margin of safety coming from the recurring nature of its revenue model.

What about you?

- Is CrowdStrike’s valuation too rich for your blood?

- Do you believe the company has a long runway ahead?

- Would CrowdStrike qualify as a best-of-breed in your selection process?

Let me know in the comments!

Be the first to comment