Gannet77/E+ via Getty Images

Merger arbitrage

All else being equal, the wider the merger arb spread, the more ways there are to win. Today, the spread in the Ericsson (ERIC)-Vonage (NASDAQ:VG) deal is among the very widest.

Who?

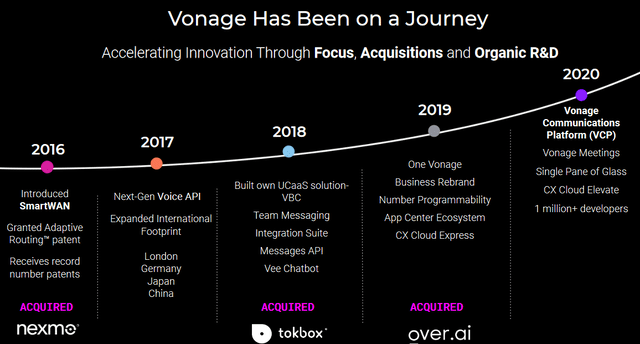

Vonage is a cloud communications company.

What?

Ericsson is buying Vonage for $21 per share in cash. The deal has secured VG shareholders, HSR, FCC, CRTC, German FCO, and UK OFCOM signoffs. That leaves only CFIUS. The deal is not conditioned on financing.

When?

The deal will probably close by August 1, 2022.

Where?

Vonage operates in the US, Canada, the UK, the EU, and Asia. It is headquartered in New Jersey.

Why?

The spread adequately compensates VG holders for CFIUS risk.

|

Target |

Ticker |

Parity |

Spread |

IRR |

|

Vonage |

(VG) |

$21.00 |

$2.07 |

>100% |

Caveat

ERIC may have paid ISIS-related groups for access to Iraqi markets, which is a red flag for the CFIUS review. What’s more, their disclosure violated a deferred prosecution agreement with the DoJ. The SEC is also investigating the Iraq issue. So while that should be discreet from the CFIUS review, regulators are currently pissed off at ERIC.

Conclusion

It would be dumb for CFIUS to block this deal. Ericsson is Swedish, a friendly country soon to be a NATO ally. They have operated in the US for 120 years. The US is their largest market. They are in all fifty states. They work directly with AT&T (T), Verizon (VZ) and T-Mobile (TMUS) on 5G. If that isn’t a problem, then owning VG shouldn’t be a problem either.

TL; DR

Buy VG.

Be the first to comment