Kevin Winter/Getty Images Entertainment

Introduction

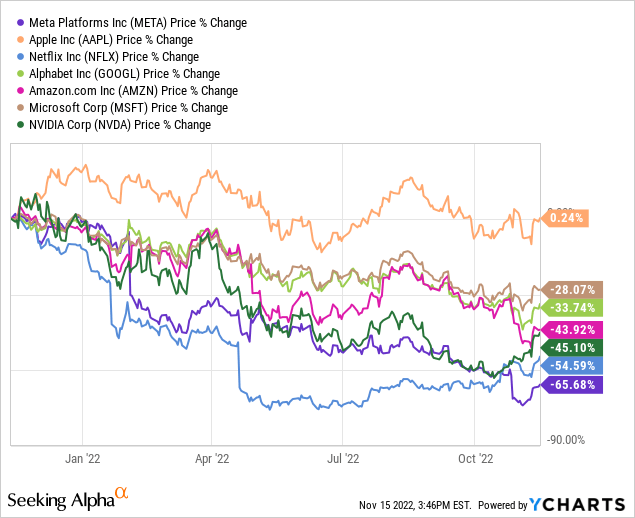

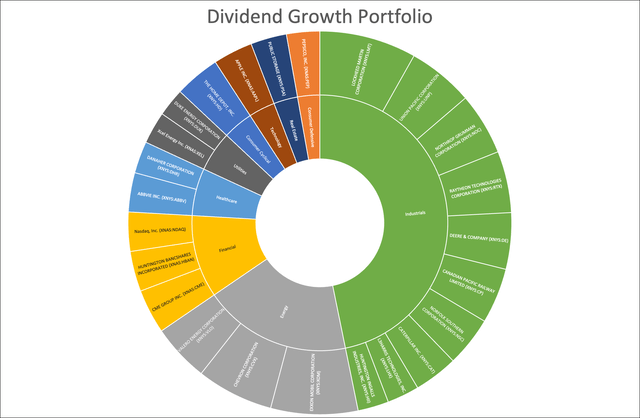

Technically speaking, Apple Inc. (NASDAQ:AAPL) is the only company in my portfolio that is a member of the technology sector. While I tend to disagree with the definition of technology, I thought long and hard before buying technology in 2021. I wanted a company that brings both growth and value to the table. A company that offers a growing dividend and buybacks without giving up on its ability to outperform – after all, I’m not looking to go overweight in high-yield investments. Apple offers all of this. While Apple is struggling this year, it is outperforming every other FAANG stock by a wide margin. This happens despite significant consumer weakness, lower business investments, and the fact that Apple’s products are in the highest price range. In this article, I’m going to dive into all of this and explain why I believe that Apple is a go-to stock for investors looking to buy high-quality growth exposure. This includes my strategy going forward, as we need to incorporate way more than Apple’s ability to invent great products.

So, let’s get to it!

It’s A Scary Business Environment

The little brown area in the chart below displays my technology exposure. While I would make the case that several defense companies (industrials) in my portfolio are way more high-tech than most stocks in the technology sector, it is important to own stocks that perform better in a falling-rate environment. In other words, buying Apple was mainly based on diversification.

That said, I could have gone with a lot of technology stocks, yet I went with Apple. Going back twelve months, Apple is currently the only stock in positive territory. Note that I included Microsoft (MSFT), NVIDIA Corp. (NVDA), and Amazon (AMZN) as well. After all, FAANG has evolved a bit over the years.

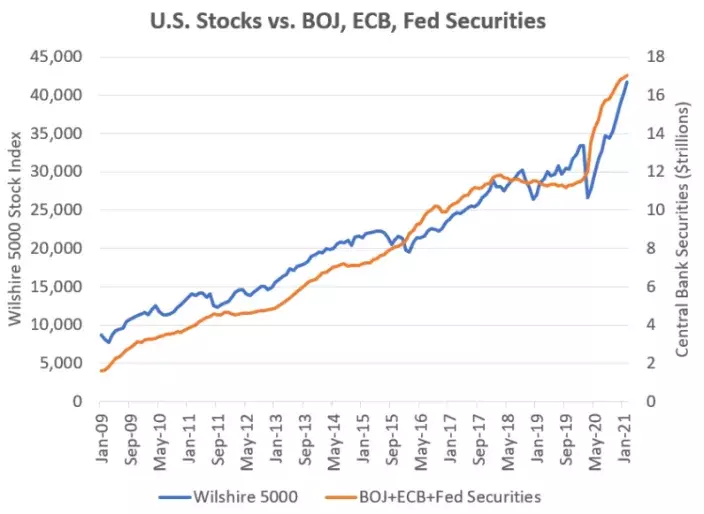

Essentially, I liked the concept behind FAANG (or FAANG+, or FAANGMAN, or whatever you want to use) because it perfectly captured the bull market between the Great Financial Recession and the surge in inflation in 2021.

Federal Reserve interest rates were low, inflation was low, global QE programs fueled liquidity, and technological developments were fast. As the chart (from September 2022) below shows, interest rates were highly accommodative between 2009 and 2022. The only exception was the surge in rates after 2016, which allowed value stocks to briefly outperform growth stocks.

CME Group

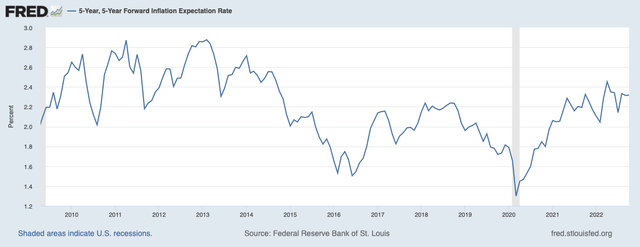

Essentially, accommodative rates mean that Fed policy rates are below long-term inflation expectations. What made the situation in the past decade so attractive is that long-term inflation rates were low – yet Fed rates were even lower.

Using the 5-year, 5-year forward inflation chart, which estimates the average inflation rate of the five years starting in five years, we see that estimates were close to 2.4% in the years after the Great Financial Crisis. After 2013, these rates moved lower, with consistent readings below 2%.

Federal Reserve Bank of St. Louis

This makes growth stocks so attractive because discounting future growth is way more attractive when inflation expectations are low. After all, if you assume that inflation will accelerate, you probably prefer stocks that already generate high profits.

On top of that, central banks provided liquidity, which was more or less forced into FAANG stocks.

Yahoo Finance

In 2021, I bought Apple. Not because I expected this to continue, as I already had shifted to the thesis that value would outperform. I bought Apple for diversification and because I believed that Apple would outperform other growth stocks.

My thesis turned out to be correct. Inflation accelerated as a result of supply chain issues, commodity shortages, labor inflation, and fiscal and monetary stimulus of 2020 and 2021. Now, we’re in a situation where inflation is still high, causing central banks to reverse everything they did before the crisis. Interest rates are surging, economic growth is suffering, and inflation is still high.

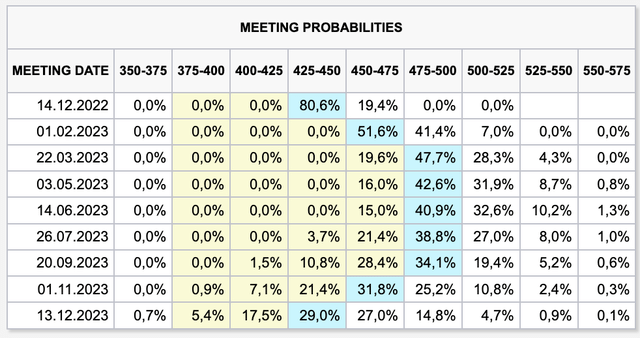

While I’m writing this, the market expects the Fed to hike by 50 basis points in December, followed by two 25 basis points hikes in early 2023.

The risk is that inflation isn’t coming down as fast as the market may expect, causing us to get a scenario comparable to the 1970s and 1980s, where supply-side-driven inflation caused the Fed to initiate a few aggressive hiking cycles. It caused economic growth to fluctuate.

Until inflation eased in the early 1980s, stocks went sideways for more than 20 years. I am not saying that this will happen again, however, I believe the risks of a prolonged sideways trend are very high.

Essentially, this would mean that we need to pour all of our money into (high) dividend-paying stocks. However, I’m only changing my strategy a bit as I will continue to buy growth.

I won’t buy money-losing growth stocks. I will use the next few years to buy more Apple shares at any opportunity I get, as I want to make this a large position in my portfolio.

After all, Apple combines the best of growth and value, causing it to remain the last FAANG standing – by a significant margin.

Apple – Resilience When It Matters Most

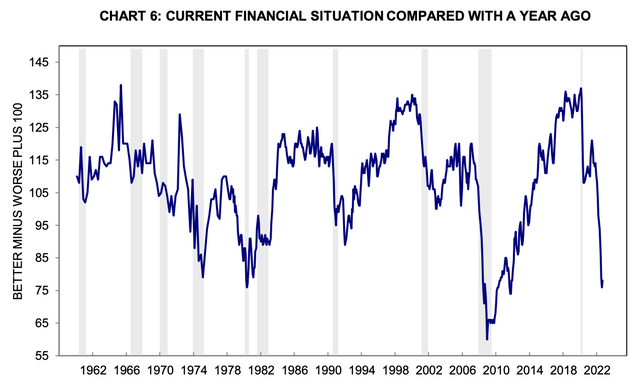

Let’s continue with some more bad news. Apple isn’t just a tech stock, it is also highly dependent on the health of the consumer. After all, 52% of its $394 billion net sales in FY2022 came from its iPhone (other products also depend on the consumer). Hence, one of the reasons why so many investors have not invested in Apple is the fact that the consumer is in a terrible spot. Using the University of Michigan numbers, the current financial situation of consumers in the United States hasn’t been this low since 2010.

In Europe, the situation is even worse due to the energy crisis. In China, we’re dealing with ongoing lockdowns (Zero COVID) that keep people from spending as much as they would under normal circumstances. On a side note, despite lockdowns, Apple grew sales by 9% in Greater China in FY2022. That beats European sales by 200 basis points! I expect these sales to rebound when China ends its Zero COVID policy in early 2023 (according to my sources).

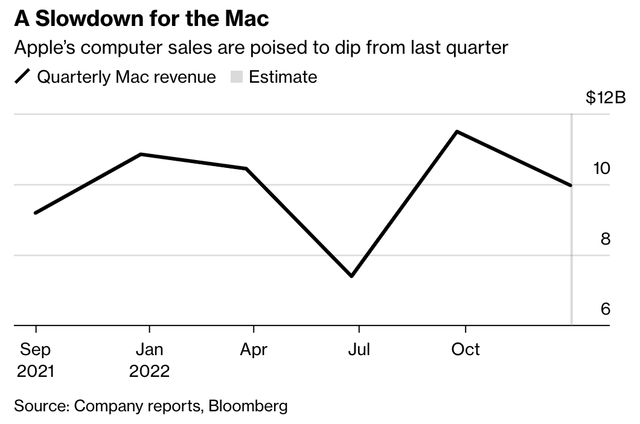

Hence, now bad headlines are emerging. For example, Apple is now offering rare MacBook deals to accelerate its sales.

As reported by Bloomberg, the company is offering discounts of as much as 10%. Yet, it only impacts its M1-chip MacBooks.

This is a measure aimed to boost sales and get rid of excess inventory ahead of MacBook upgrades in the first few months of 2023.

That’s not everything. Weakness is also hitting the iPhone (as most already expected, given macroeconomic conditions). J.P. Morgan just came out, making the case that sales in the December quarter will decline year-on-year.

As reported by Seeking Alpha:

Analyst Samik Chatterjee lowered his iPhone 14 estimates by 5M and other iPhone estimates by 3M and now forecasts iPhone and total revenues to decline year-over-year during the period.

“In relation to impact to [fiscal year 2023] estimates overall, the reduction to estimates are more modest as we expect part of the shipment shortfall in the December quarter to be made up in the March quarter, which typically being a lower production quarter will give Apple ample opportunities to recover the shortfall, and on the demand side based on historical precedent we expect limited to modest impact to consumer demand from delays and extended delivery times,” Chatterjee wrote.

I have to say that this news sounds worse than it is. For example, the iPhone has been strong until the December quarter. In its fourth quarter, the company grew iPhone sales by 10%. While this includes pricing, it’s on top of 39% revenue growth in the prior-year quarter. That’s better news than most give Apple credit for.

However, Apple was very reluctant when it comes to predicting what demand may look like – especially with regard to pricing issues and lower-cost competitors.

Tim Cook mentioned supply chain issues that kept the company from selling as many iPhones as it would have liked. Moreover, iPhone 14 demand is hard to estimate as Apple has introduced a number of new models (Max, Pro, you name it).

However, one of the reasons why I’m not worried about competition is the fact that quality differences are a huge issue when looking for better prices. I’ve spent the past four weeks figuring out what my new phone is going to be. I can go for a cheap option from a competitor. However, reviews are just terrible. When looking for a quality phone, there really isn’t a cheap alternative to the iPhone anymore. Hence, people stay in the Apple ecosystem. Or, even better, people join the ecosystem. I’ve had more friends and colleagues switch to Apple in the past 12 months than people leaving Apple – including a lot of penny pinchers.

Hence, I wasn’t surprised that Tim Cook mentioned great results for the iPhone in all key regions:

We were really pleased with the broadness of the iPhone strength last quarter. We had three of the top four smartphones in the U.S. and the UK, the top three in Urban China, the top six in Australia, four out of the top five in Germany and the top two in Japan. And customer satisfaction for the iPhone remains very, very strong at 98%.

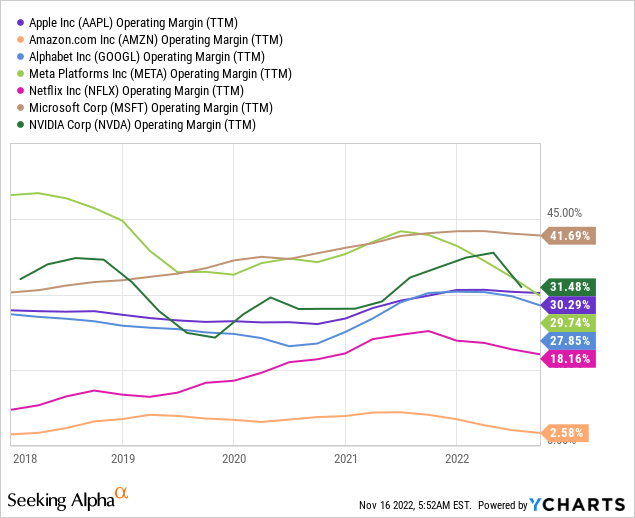

Moreover, in light of high inflation, Apple has maintained strong margins. Apple’s operating margin has been consistently above 30.0% in the 2022 calendar year. Microsoft is strong as well. Companies like Netflix (NFLX), Meta (META), and Amazon have a much harder time dealing with inflation. Moreover, in most cases, demand weakness makes this even harder.

The key here is Apple’s supply chain resilience. Like all companies, Apple did feel headwinds from the severe supply shortages (i.e., semiconductors) that started after the 2020 lockdowns. However, Apple is superior when it comes to supply chains.

Even way before the pandemic, Apple was known for its seamless supply chain operations. In 2019, I did my master’s degree focused on supply chains. Tim Cook was a frequent topic of discussion.

As reported by Supply Chain Digital, it is no surprise that Steve Jobs made Tim Cook his successor. He’s a supply chain guy, responsible for a big part of Apple’s success.

[…] it was Cook who had ensured Apple’s phenomenal growth by never allowing the supply of its products to be outstripped by demand, even when demand was stratospheric.

[…] Yet less than a year after Cook joined, Apple was reporting profits. As the visionary Jobs came up with one era-defining product after another, Cook made sure they were always available, and in huge numbers.

An early Cook ploy was to buy US$100mn of holiday season air freight, months in advance. This cut out competitors, and left them scrambling to ship products during the holiday season.

But he realised very early in his Apple career that the company’s supply chain was unwieldy, over-complex and unresponsive, and so he moved Apple to a just-in-time (JIT) manufacturing model – a process he had overseen in his time at IBM.

It’s good to know there’s an expert in charge (obviously) as Apple is now reconfiguring its supply chain. Apple will reduce its reliance on Asian markets as geopolitical and economic risks have caused an acceleration in supply changes after the pandemic.

Apple is now looking to source chips in the United States and Europe. As reported by Bloomberg:

“We’ve already made a decision to be buying out of a plant in Arizona, and this plant in Arizona starts up in ’24, so we’ve got about two years ahead of us on that one, maybe a little less,” Cook told the employees. “And in Europe, I’m sure that we will also source from Europe as those plans become more apparent,” he said at the meeting, which included Apple services chief Eddy Cue and Deirdre O’Brien, its head of retail and human resources.

In Arizona, Apple will have access to supply from the Taiwan Semiconductor Manufacturing Company (TSM), starting in 2024. Moreover, Intel (INTC) is building plants in Arizona, with a similar timeline. Yet, Apple won’t likely become a customer as it has produced its own chips – as everyone is aware of by now.

More Reasons Why Apple Isn’t Selling Off

So far, we have a few reasons. Despite imploding consumer sentiment, supply chain issues, and ongoing geopolitical issues (including Zero-COVID), Apple is standing strong. Its margins in FY2022 reached one of the highest levels ever, its iPhone continues to withstand fierce competition, and Apple further improved sales on top of tough comparisons in FY2021. All of this was provided by stellar supply chains.

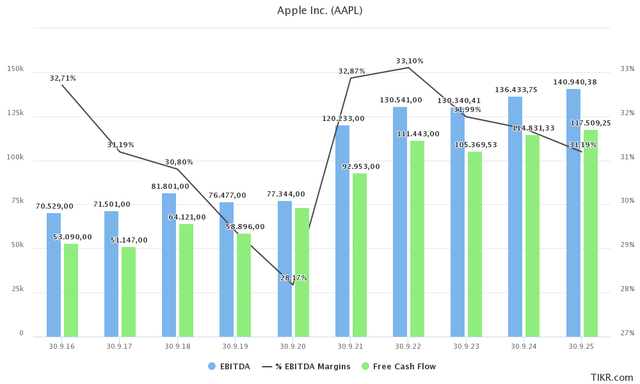

When looking at the bigger picture, we see that margins are expected to come down a bit. However, both EBITDA and free cash flow are expected to remain in an uptrend.

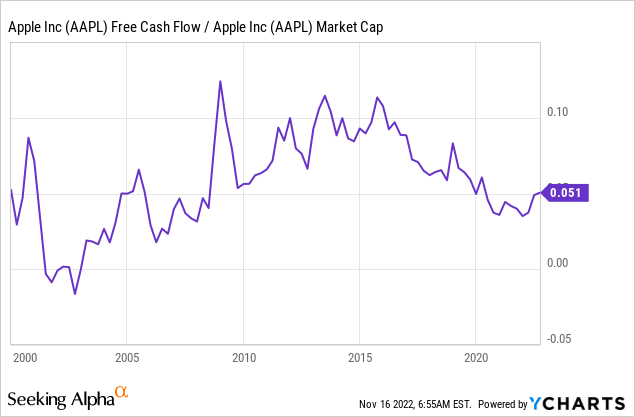

In the current fiscal year (2023), the company is expected to generate $105 billion in free cash flow. This implies a 4.4% free cash flow yield, using its $2,400 billion market cap.

That’s good news for investors as Apple is on a mission to get rid of its cash load.

In the September quarter, the company returned $29 billion to shareholders. $3.7 billion was distributed through dividends (sustaining its 0.6% yield). The remaining $25.2 billion was (indirectly) distributed through open market purchases of 160 million AAPL shares. Total distributions were roughly 1.2% of its market cap. On an annualized basis, that’s 4.8%, allowing the company to distribute all of its incoming free cash flow and portions of its existing cash holdings.

The company ended the quarter with $169 billion in cash and marketable securities. The company repaid $2.8 billion in cash, decreased commercial paper by $1 billion, and issued $5.5 billion in new debt. Gross debt was $120 billion, indicating $49 billion in net cash (negative net debt).

Apple is looking to become net cash neutral over time, meaning the company will accelerate distributions not just in line with FCF growth, but a bit faster to distribute $49 billion in current net cash.

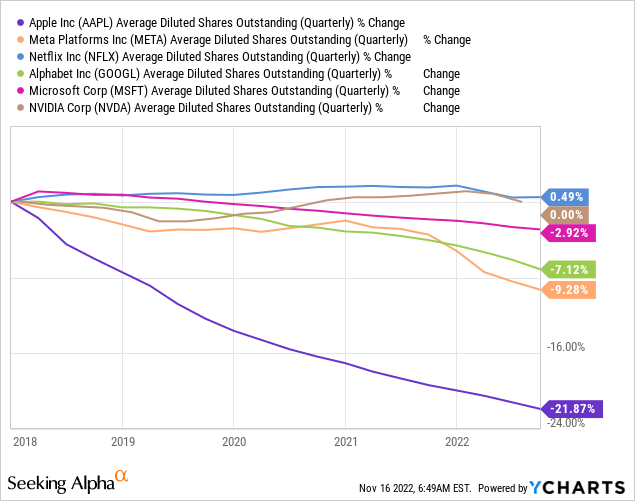

As a result, Apple is the only FAANG+ with substantial net share buybacks. None of the others bought back more than 10% of their shares outstanding.

That is a huge deal as it artificially boosts earnings per share.

So, what about the valuation?

Valuation

Let’s start with the worst news. The implied free cash flow yield isn’t very high. Using LTM FCF, it’s roughly at 5%. While it’s off the lows, it is far below anything the market witnessed prior to global central banks turning accommodative in 2015. As I showed you at the start of this article, inflation expectations came down hard around 2015. It caused investors to apply a different valuation to Apple. Suddenly, a 10% FCF yield was way too high. Now, a 5% FCF yield may be too low, if we assume that inflation is here to stay…

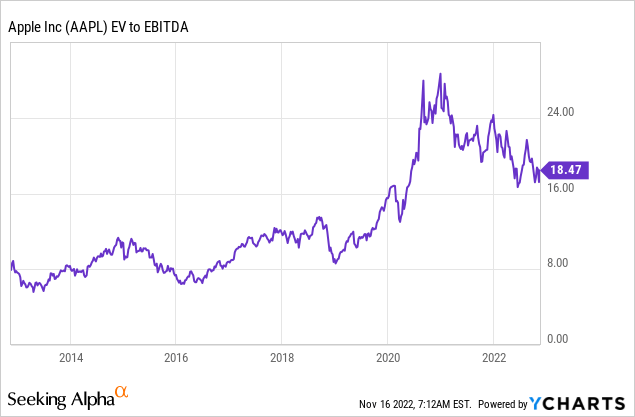

Moreover, Apple is trading at 18.0x NTM EBITDA. That’s based on its $2.4 trillion market cap and FY2023E net cash of $61 billion.

This valuation is well below its peak, yet not at extremely attractive levels. I believe that a valuation of 15-16x EBITDA is a good place to start buying more shares – or to initiate a position.

So, let’s summarize this article.

Takeaway

I went with a somewhat confrontational title. However, I think it’s true. While Apple is down 16% year-to-date, the company has protected its investors against weakness that occurred in other tech stocks. Not only that, but by doing so, investors are still sitting on tremendous gains over the past few years as AAPL did not underperform during the last bull market.

I also went with this title because I believe that Apple is the best FAANG+ stock going forward. I do not expect the market environment to suddenly turn accommodative of growth stocks. While supply chain issues are easing, above-average inflation is likely to persist. Central banks will continue to be forced to solve this, which could lead to multiple hiking cycles down the road.

My strategy is to continue buying Apple on any major weakness. While the company may refrain from rallying as it did prior to 2022, we’re dealing with – what I believe – is the best FAANG stock on the market. The company has exceptional supply chain management, products able to withstand tough competition, and allowing the company to use pricing to offset inflationary headwinds.

On top of that, it has an AA+ balance sheet, allowing management to aggressively buy back shares, boosting EPS at a time when it matters most.

In summary, AAPL is a tech stock that lets me sleep well at night, knowing I own the best mix between growth and value.

So, if you’re looking for tech exposure, I believe that AAPL is the way to go. Especially in light of ongoing and expected macroeconomic developments.

(Dis)agree? Let me know in the comments!

Be the first to comment