magnez2/iStock Unreleased via Getty Images

A few years ago, McKinsey and Company said “In 2010, humanity passed an important milestone. Obesity became a bigger public-health problem than hunger.”, based on a study that noticed an alarming rise in the phenomenon over time. According to WHO data, obesity has risen 3x globally since 1975. In 2016, 39% of adults were overweight and 13% were obese. Sugary beverages, sweets and desserts are identified among the top foods causing obesity, along with chips, refined grains and some meats. It’s little wonder then that the sugar substitute market is on the rise. One company catering to this growing demand, among related products, is Whole Earth Brands (NASDAQ:FREE). It’s a small company, with a market cap of just $130 million compared to the biggest global sugar company, the German Südzucker (OTCPK:SUEZY), with a market cap of $2.5 billion. But chances are you’ve heard of its sugar-substitute brands like Equal or Canderel, depending on the part of the world you live in.

High potential market

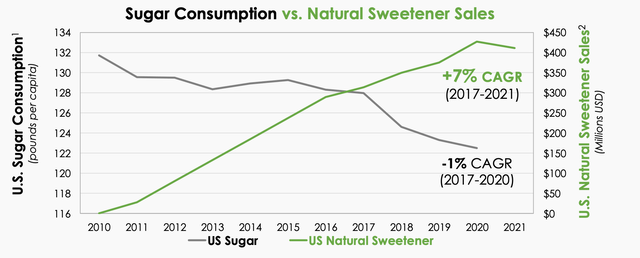

In a recent presentation, the company highlights that in the US, sweetener sales have seen a CAGR of 7% over the past five years, while sugar consumption is declining (see chart below). Yet, the market’s potential is nowhere close to being realised. The US$ 100 billion market for sweet additives is still dominated by sugar, with global penetration of sweeteners at just 3%.

Whole Earth Brands is capitalising on this opportunity with speed. Since its public listing in June 2020, it has acquired two companies – Swerve and Wholesome Foods. Because of both its organic and inorganic growth, the company’s revenues have almost doubled since.

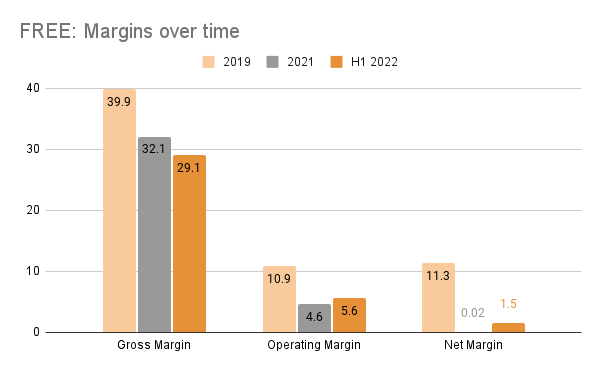

Margins under pressure

However, these acquisitions have come at more than just a literal price. Whole Earth Brands’ margins have dropped. Its gross margin, for instance, has dropped from ~40% at the end of 2019 to 29% for the first half of 2022 (H1 2022). Similarly, its operating margin has also dropped from 11% to 5.6%. Even compared to the consumer staples segment, its trailing twelve months’ margins are lower.

The big impact was seen initially in 2020 when its cost of goods sold and operating expenses rose significantly following the acquisition of Swerve and it has sustained. Notably, though, its operating expenses declined in H1 2022 on a year-on-year (YoY) basis. Its cost of goods sold increased by over 20% YoY however. FREE points to the consequent decline in gross profit as “largely driven by cost inflation”. While this implies pricing power weakness, it’s not as if the company’s entirely lacking in it. Its Branded CPG segment revenue, which accounts for 78% of its sales, saw an 8.1% increase in Q2 2022 YoY only because of price. Only 1.6% of the increase came from volume increase. The total rise was tempered to a lower 5% however, because of SKU rationalisation and currency effects.

Source: Whole Earth Brands

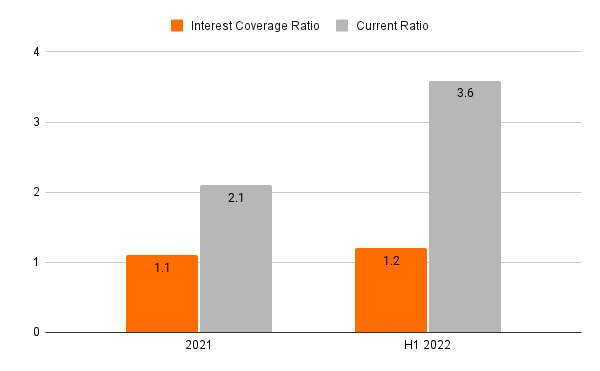

The debt effect

The point, however, remains that as long as inflation remains elevated, FREE’s margins could remain under pressure. Associated with high inflation, are high-interest rates. This brings me to its interest coverage ratio. For H1 2022 it’s at 1.2x, a significant improvement over the 0.25x levels it saw in H1 2021 or even the 1.1x number seen for the full year 2021. However, it’s still not ideal. A good ratio should be at least 2x. This of course is correlated with the company’s debt levels, which are wanting as well. At 0.5x its debt ratio for 2021 isn’t the worst to be fair, but it could be better. Its current ratio at over 2x for 2021 and even better at 3.6x for H1 2022, however, looks good. On the whole, FREE’s more levered than would be comfortable at present. With interest rates likely to rise further, I’d watch out for how the picture shapes up in the near future.

Source: Whole Earth Brands

Share price in freefall

Seeing the company in the context of its low margins and potentially precarious debt situation, the free fall in its share price this year is easier to understand. This is especially so since the company’s guidance for the full year isn’t terribly encouraging either. It expects reported revenue to grow between 7-10% in 2022, which means that a significant decline could be seen as H1 2022 already saw a 13.7% rise in revenue. Its adjusted EBITDA numbers aren’t expected to grow significantly from 2021 either. Year-to-date (YTD), its share price has fallen by a massive 71.3% as I write, which is 3x more than the decline in the S&P 500 (SP500). Its price-to-earnings (P/E) ratio at 10.1x then, unsurprisingly much lower than that for the consumer staples sector as a whole at 20x. This is a good example of a stock not being more attractive because its P/E ratio is lower. The ratio’s lower because it’s underperforming the sector.

What next?

With no positive trigger on the horizon for a change in its situation, I reckon this isn’t one to buy for the short term, not in the current market. With the outlook for the economy dim for the next year at least, moving into the medium-term too, it could be a risky buy. However, there’s little denying that it’s part of a market with huge potential. It’s also profit-making and is growing its revenues. Of course, it is always possible that a high-potential company never quite fulfils its promise. But FREE does seem to be making the right moves, going by its pre-acquisition past and its promising future. Only time will tell, though, how it manages its messy middle.

Be the first to comment