IvelinRadkov

Thesis: Risks Are Priced In

Whitestone REIT (NYSE:WSR) is a retail real estate investment trust that owns necessity-based shopping centers in fast-growing, high-income areas of five red-hot Sunbelt markets: Phoenix, Dallas/Fort Worth, Houston, San Antonio, and Austin.

Though WSR’s centers are not primarily grocery-anchored, they do feature necessity-based retailers and service- or experienced-oriented tenants prominently, making them largely e-commerce-resistant.

WSR’s portfolio occupancy and rent rates are rising rapidly, but the REIT is also heavily leveraged with a large amount of debt maturing in the next few years.

As far as retail REITs go, WSR has above-average risk. But in the balance of risk and reward, I would argue that the market has amply priced in WSR’s risks while overlooking its strengths and potential for future growth. With a payout ratio of around 50%, the 4.6%-yielding dividend looks safe. And at a price to FFO of 10.4x, the market seems to be far too pessimistic about WSR’s future growth prospects, basically pricing in none.

I do not believe the REIT needs to be a growth monster in order to generate strong total returns for investors from the current stock price. If the REIT can deleverage while continuing to grow FFO per share at all, that should be enough for WSR to earn an upward valuation re-rating from the market, giving it 30-50% upside.

Midyear Update On Whitestone REIT

The first thing you need to understand about WSR is that the REIT does own an attractive set of neighborhood shopping centers in its five core markets. Here’s COO Christine Mastandrea describing WSR’s primary real estate locations on the Q2 conference call:

…[I]n Phoenix, we targeted key neighborhoods in the immediate aftermath of the 2009 financial crisis and acquire the base of our centers [there] well below replacement cost. Our strategic focus on the East Valley in north Scottsdale has paid off due to the outsized gains in job growth and out of state relocations, which have driven traffic at our well located centers.

In Houston, a majority of our NOI comes from the main retail district known as the Uptown District or Galleria, and from the affluent western suburbs. In Dallas, we were early investors in the northern suburbs that have been magnets for corporate relocations and are among the fastest growing zip codes in the country.

In Austin and San Antonio, we purchased centers in prime locations in both cities before the migration from coastal cities really gained strength. Often the reason we’re able to secure these premier location within cities, is because we’re very in tune with where concentrations of educated talent are attracting employers.

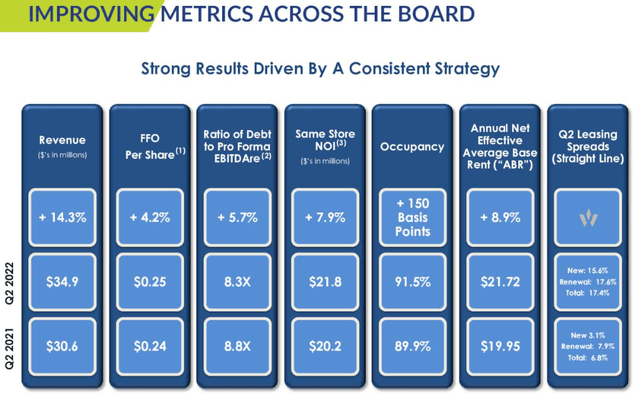

This year’s performance numbers demonstrate WSR’s portfolio quality.

Total revenue increased over 14% year-over-year, although FFO per share only increased 4.2% due to equity issuance along with rising operating and interest expenses.

On the far-right column, you can see WSR’s Q2 leasing spreads (straight line, which takes into account future rent escalations), which have more than doubled from their level last year. On a straight-line basis, lease-over-lease rent growth amounts to 17.4%, while cash rent rate growth was about 9% during the quarter.

Demand from retailers for smaller spaces averaging around 2,000 square feet has been increasing, as goods purveyors find they simply need less space in the omnichannel age than they did in the heyday of brick-and-mortar shopping.

The same holds for many service providers. For instance, smaller, niche fitness centers like F45 and Orange Theory are incrementally taking market share from the traditional, large-footprint health clubs with their giant locker rooms and saunas.

These trends are a tailwind for WSR, because most of the REIT’s available spaces are already around this smaller size.

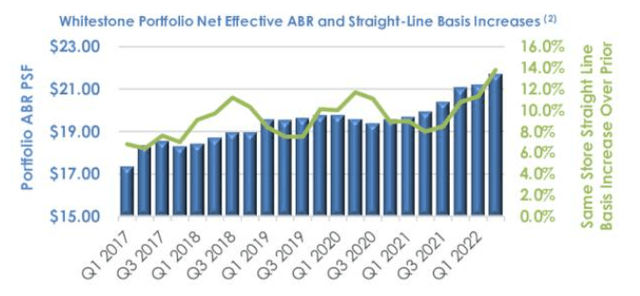

We can see the post-pandemic boost WSR has enjoyed over the last year or so in its portfolio-wide annual base rent growth as well as the spike in same-store straight-line rent growth.

For the full year of 2022, management expects same-store NOI to rise 3-5% over 2021’s number, and they hope to raise occupancy even further from the 91.5% of Q2 to 92-93% at the end of the year.

Unfortunately, even as rental revenue is rising at WSR’s properties, so also is its operating expenses. Operating & maintenance costs along with real estate taxes have actually increased at a faster rate than revenue, thereby eating into margins.

| Q2 2022 | Q2 2021 | |

| (O&M + RE Taxes) / Revenue | 32.0% | 31.4% |

This demonstrates the double-edged sword of inflation for property types that do not fix their costs for long periods of time or obligate their tenants to pay or reimburse for them.

On the other hand, management has made great strides in reducing general & administrative costs, both on an absolute basis and as a percentage of revenue. They did this primarily by reducing executive salaries from the inflated levels present under the previous CEO to more reasonable levels. Total G&A dropped by about 10.6% from the first half of 2021 to the first half of 2022.

| 1H 2022 | 1H 2021 | |

| G&A To Revenue | 11.9% | 17.4% |

As you can see above, WSR could still stand to make further progress on this front, as G&A is still nearly 12% of revenue, which is on the high side. I’d like to see that come down to 8-9% in the next year or so. That should come from a combination of rising revenue and steady or falling G&A costs.

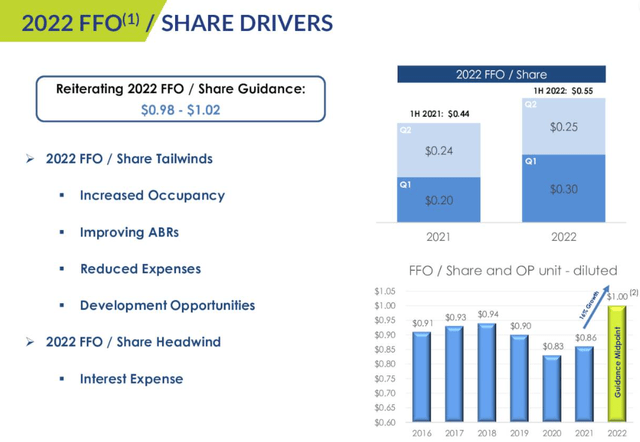

In Q2, management reaffirmed 2022 FFO per share guidance of $0.98 to $1.02.

Despite strong tailwinds from rising occupancy and rents, interest expenses are going up as well. Plus, management expects to dispose of around $50 million worth of properties and recycle the proceeds into acquisitions or development opportunities, which may result in a temporary dip in FFO.

WSR’s annualized dividend of $0.48 represents a forward payout ratio right around 50%, considering that management only expects to generate about $0.45 per share of FFO in the second half of the year.

After the dividend cut at the beginning of the pandemic, WSR’s payout looks to be on very solid ground, and the REIT’s FFO per share should continue to grow in future years from its 2022 level. That should lead to steady dividend growth to come, so long as the company’s balance sheet issues can be resolved.

Balance Sheet

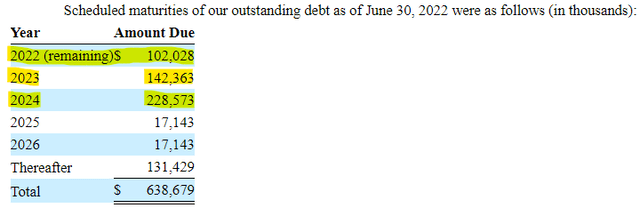

The primary risk of WSR pertains to its balance sheet, which carries relatively high leverage. Total debt to total assets sat at a little over 50% in Q2. And net debt to EBITDA remained high at 8.3x, though it did drop from 8.8x in the same quarter of last year.

As of the end of Q2, 82% of WSR’s total debt had a fixed rate, while the remaining 18% was floating rate. Much of that fixed rate debt, however, is maturing in the next few years, which means the REIT’s average interest rate will almost surely be going up.

As you can see below, nearly 3/4ths (74%) of WSR’s debt matures by the end of 2024.

The weighted average interest rate on WSR’s fixed rate debt stood at 3.4% at the end of Q2. However, the 18% of floating rate debt currently bears interest somewhere in the range of 5% to 5.4%, which brings up the effective interest rate on total debt to around 4%.

| Q2 2021 | Q2 2022 | |

| Outstanding Debt | $623,286 | $629,114 |

| Interest Expense | $6,143 | $6,234 |

| Implied Interest Rate | 3.94% | 3.96% |

However, WSR’s weighted average incremental interest rate on debt ended the second quarter at 4.5%, which means that interest expenses will rise somewhat substantially in the quarters ahead.

Between rising interest rates on the short end from a rising LIBOR rate and rising interest rates on the long end from rolling over fixed rate loans, the current rising interest rate environment is a serious headwind for WSR that cannot be ignored.

On the Q2 conference call, CFO Scott Hogan mentioned that they expect to complete refinancing for the majority of debt coming due in 2022 and 2023 in the next few months. As such, shareholders should find out what kind of terms the REIT managed to obtain by the third quarter earnings release, if not sooner.

Bottom Line

There are multiple questions surrounding WSR that ought to make one caution on the REIT.

- What terms will management be able to get on its loan and credit facility refinancings?

- Will planned capital recycling efforts be leverage neutral?

- Will dispositions be used to deleverage? Will acquisitions be used to re-leverage?

- How skilled will the new CEO prove to be at helming the ship and driving per-share growth?

That said, these risks and uncertainties appear to be well priced in at this point. A price to FFO multiple barely above 10x reflects the headwinds of rising interest expenses but not the tailwinds of rising occupancy and strong rent growth.

WSR will have to roll over debt at higher rates, but those higher rates should not be so high as to be prohibitive. Credit markets are still open. There is no liquidity crisis as of now. As such, I believe the market will absorb the news of higher rates on WSR’s debt when it comes, shrug, and begin to take a more balanced view of the REIT.

That balanced view, in my opinion, will include not only the “known unknown” of rising interest expense but also the “known unknown” of further occupancy and rent rate growth as well as upside from development/redevelopment/capital recycling efforts.

Perhaps I am wrong and the results of WSR’s refinancing will prove much worse than the market expected. But at such a low valuation, it appears that a pretty bad scenario is already priced in. That creates an interesting opportunity to generate high upside if WSR manages to muddle through this period of rising interest rates and “lives to die another day,” so to speak.

WSR can always get cheaper, and perhaps it will. But WSR’s long-term return prospects look attractive at its current price, which makes it a “Buy.”

Be the first to comment