imaginima

Investment Thesis

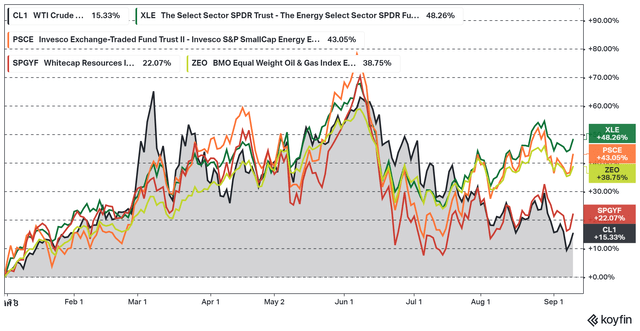

Whitecap Resources (OTCPK:SPGYF) is a Canadian oil producer with assets in Alberta and Saskatchewan. The stock has done extremely well from the lows in 2020, but it has so far in 2022 lagged many peers despite excellent cash flows.

The company has recently closed the cash acquisition of XTO Energy Canada, for a net purchase price of C$1.7B. Whitecap has a good history of purchasing and integrating smaller assets, but this is a larger acquisition, by some considered relatively expensive. It is possibly the reason for the underperformance lately.

However, I am less critical about this acquisition given that it was made with cash, comes with plenty reserves, and will presently add about 32,000 boe/d to production. So, it is highly accretive to per share metrics and has great long-term potential.

Whitecap is after mediocre returns in 2022 a relatively cheap oil producer that has managed to grow per share metrics over the last couple of years at an impressive rate. The company is presently focused on deleveraging but is also paying an attractive dividend that will increase going forward, and is doing buybacks.

Production & Cash Flows

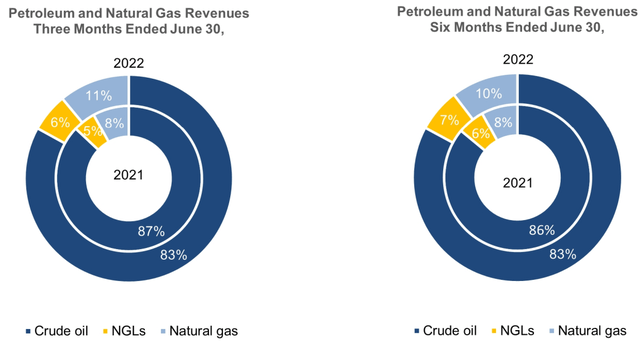

Whitecap did in the most recent quarter produce 132,293 barrels of oil equivalent per day, where most of the production and revenues came from crude oil. The company does also produce natural gas and some natural gas liquids.

Figure 2 – Source: Whitecap Q2-22 MDA

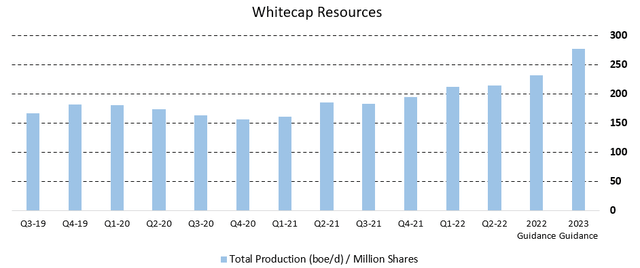

The production volume has over the last two years grown by 87%. However, part of that growth has come from acquisitions, where shares have been used as the payment method. So, we have over the same period seen the share count increase by about 50%.

If we adjust the production volume by the number of shares and incorporate the 2022 & 2023 production guidance in the graph, which includes production from the XTO Energy assets, we can see a very healthy growth profile. Where production per share is in 2023 expected to be 59% higher than what the company produced in Q2 2020.

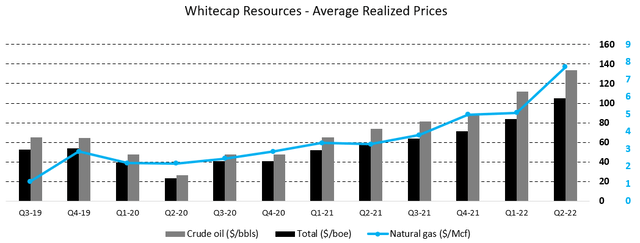

Figure 3 – Source: Whitecap Quarterly MDA Reports Figure 4 – Source: Whitecap Quarterly MDA Reports

The very favorable oil and gas prices have no doubt been beneficial as well, but Whitecap does not need to see the extreme commodity prices we had in Q2 2022 to be highly profitable.

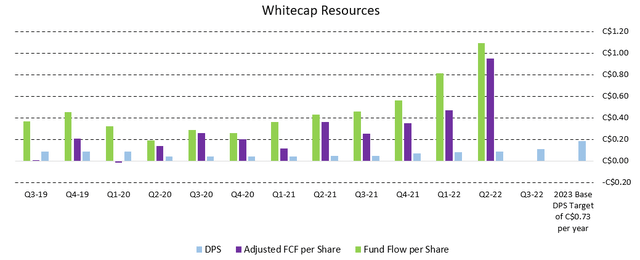

The below chart illustrates fund flow per share, adjusted free cash flow per share, and dividends per share. Where we can see the very healthy cash flows the company had during 2021, when the commodity prices were well below the levels, we have seen during most of 2022. Don’t forget that the production volume per share will climb going forward from Q2-22’s level as well.

Figure 5 – Source: Whitecap Quarterly MDA Reports

Following the XTO Energy Canada acquisition, the company will over the next few quarters be focused on deleveraging. Whitecap does also pay a very healthy dividend of C$0.0367 per share and month, which comes to a 4.8% dividend yield using the latest share price.

Once the target debt level is achieved, presently expected in H1 2023, the aim is to increase the base dividend to C$0.73 per year, which equates to a 7.9% dividend yield. Note that it should be viewed as a base dividend and will be far from the total shareholder distributions going forward if oil and gas prices remain at current levels. The C$0.73 dividend per share is also well covered by cash flows even if oil and gas prices drop substantially from today’s level.

Valuation & Conclusion

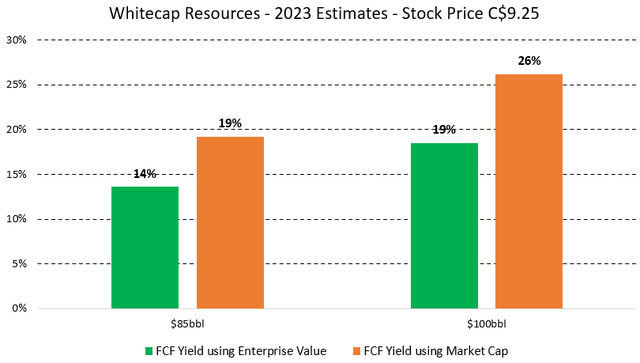

Whitecap presently estimates that in 2023, the company will generate C$1.1B in free cash flow with a WTI price of $85/bbl and C$1.5B in free cash flow with a WTI price of $100/bbl. If we just focus on the more conservative WTI price of $85/bbl, that translates to a 19% free cash flow yield using the market cap, and a 14% FCF yield using the enterprise value which I prefer to use.

Figure 6 – Source: My Calculations & Company Estimates

It is worth noting that the estimated net debt of around C$2.4B today will be paid down substantially over the next few quarters. So, the FCF yield in 2023 using the enterprise value will likely be somewhere in the 15-18% range with a $85/bbl WTI price.

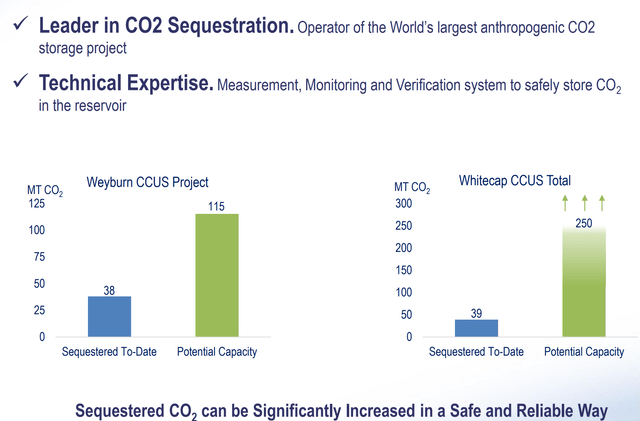

Another positive aspect with Whitecap is that it is an expert on carbon capture. Where the company purchases CO2 from coal plants, which is then in liquid form injected at great depth in to producing formations. While the company gets very little credit for this today, it has the potential to become increasingly important in the future.

Figure 7 – Source: Company Presentation

Whitecap will not have the highest leverage to the price of oil, but it is an attractive investment for anyone looking for an oil producer with a reasonably good balance sheet, a healthy growth profile, and a good dividend yield which is set to increase going forward.

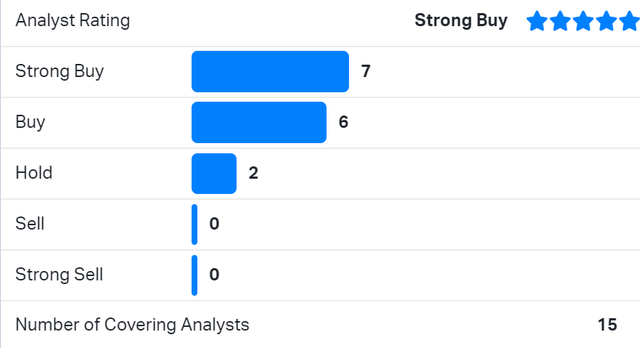

13 of the 15 brokers covering the company also has a buy or a strong buy recommendation on the stock.

Be the first to comment