MF3d

Year to date review, and a look forward

Performance Review

|

NAV increase, net Inception Annualized |

PF 2019 |

2020 |

2021 |

YTD 2022 |

|

WBCP 57.14% 14.28% |

17.60% |

19.05% |

37.16% |

-18.17% |

|

S&P 400 24.49% 6.12% |

9.11% |

13.66% |

24.76% |

-19.54% |

|

S&P 500 35.51% 8.88% |

11.10% |

18.40% |

28.71% |

-19.96% |

Inception of White Brook Capital Partners was August 16, 2019. Performance figures are provided by the administrator. Prior years are audited. 2022 is unaudited. Performance figures include all fees, realized and accrued.

Year to date, the Fund’s NAV decreased by 18.17%, net of all realized and accrued fees vs the S&P 400 MidCap Index 19.54% decline and S&P 500 Index’s19.96% decline. The declines were relatively broad based across the portfolio, as investors priced stocks for a higher probability of recession. At quarter end, the Fund was 92.69% invested across 10 positions.

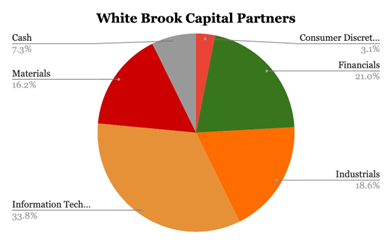

Year to date, on a sector basis, the portfolio’s top contributors were investments in materials while the top detractors were investments in financial services.

There was a limited amount of trading during the quarter. We exited an investment in Post Holdings, Inc. (PSPC) Post is a fine company with an excellent management team, but as the market devalued and Post continued to perform, the capital was redeployed to better long-term risk/reward opportunities. The Fund also reduced exposure to a few of its more recent purchases that had declined in price to recognize the tax loss, but anticipate those concentrations will increase after that asset is established.

The portfolio is cheap and risk/reward skews considerably in our favor with the possibility of both an upward rerating of many of our portfolio companies’ cash flow streams and upward revision in many of their forward cash flow estimates.

The portfolio continues to be diversified across industries.

The Opportunity and Challenge in the Near Future

Covid, the Ukraine War, and supply chain issues have created cyclicals out of normally bond-like businesses, and depending on the company either/and/or retarded and accelerated the business cycles of what had been considered cyclicals. The next year or two will witness a host of companies that will have enjoyed peak cash flows this or last year, will suffer a decline in earnings this year and/or next and perhaps the one after, before returning to growth and, all things equal, generate more cash flow per service or good provided in subsequent years. This is true whether the country’s economy contracts or simply grows more slowly than it has.

A generation of investors doesn’t know what to do with that dynamic. For many there’s almost no price you could pay for a business with a declining earnings stream – even if their balance sheets are exceptional and their options to create value are plentiful. As investors focus on next year’s earnings estimates, wide swaths of the market are or will be negatively impacted. That makes them a terrific bargain for the patient investor, painful to own during any sell-off, but one where money is likely to be made if right about the business over the next 3 years.

Market downturns seduce investors into seeing the false virtues of timing the market. They are a mirage. At one point the market will look past near-term difficulties. The timeline for that tolerance is unpredictable, and it can vary day to day. In the meantime, smart management teams use these periods to execute on the value creating options they stocked away during the easy times. For individual companies, stock value creation can happen all at once, even in tougher times, or over a longer time period. At White Brook, we’re staying invested.

Market Commentary

While markets accelerated their decline during the second quarter, macroeconomic uncertainty lessened with most investors understanding that an economic slowdown is occurring and that the probability of a recession has increased. A combination of fears of a global recession, high inflation, and declines of ~70% in many stocks in the tech sector has pushed Bank of America’s Bull Bear indicator to 0 – an artifact of extreme bearishness by market participants.

The 10-year Treasury rate, an often-used benchmark for a range of financial transactions, yielded approximately 2.7% at the end of the first quarter, and in the early days of the third yields ~2.9%. During the second, however, the 10-year Treasury yielded as high as 3.4%, and pushed common mortgage terms north of 6%. I remain of the view that penciling in ~3% is the appropriate long-run level and is supportive of the US economy.

The volatility, perhaps even more than the absolute level of the 10-year Treasury, slowed transactions that are often financed – such as homes purchases, large consumer durable purchases, business related capital expenditures and mergers and acquisitions – as buyers and sellers recalibrated their sense of the appropriate valuation to transact. Four factors broadly impacted those decisions;

- Capital sources struggled to competitively and economically price debt across a range of transactions.

- Buyers incorporated higher financing costs, while sellers anchored to the prices that were previously obtainable and assumed lower financing costs were likely to occur again.

- Broader economic deceleration, higher levels of inflation, and variant perceptions of future inflation forced participants to reforecast bottoms-up business projections

- The value of any future cash flows, priced in the present, were repriced.

Time, rather than a specific action, is necessary for participants to recalibrate. While confusion continues early in the 3rd quarter, channel checks indicate that some previously on-hold transaction activity is beginning to pick up again.

New Position – Itron (ITRI)

During the quarter, the Fund re-entered an old position – Itron, Inc. This is the second time the Firm has owned the Company and the thesis is remarkably similar to the last time. The global semiconductor shortage has depressed the Company’s ability to install connected gas and electricity meters for utilities and layer on its value-added services. Compared to last time we were invested, the Company’s business model is further along in its transition to a higher margin, more recurring cash flow business, with higher return on capital employed. The semiconductor shortage, however, has retarded its ability to install meters in recent quarters.[1]The Company continues to build a solid backlog and hasn’t lost a single customer – a testament to the value it provides to its customers.

From a capital allocation standpoint, the CFO proved her value during the stock’s run, replacing the company’s debt with a 0% convertible that converts at 3x the current stock price.

As the stock price has fallen, the Board has approved a stock repurchase plan and the company has been aggressively repurchasing at this level.

With its customers relatively recession proof and the business likely to execute better in a slower growth economic environment as semiconductor demands of other industries lessen, I expect our returns to be solid.

AFYA Ltd (AFYA)

The Fund also owns a position in Afya Ltd. Afya provides medical education in Brazil and trades on the NASDAQ. ~80% of the business, by revenue, is generated by operating for-profit undergraduate medical schools. This is a ~50% margin, 100% occupancy business that grows its student base 3-7% a year, and has pricing power similar to top private universities in the United States. Afya provides 8% of all of Brazil’s medical seats. Unlike US for-profit schools and top private non-profit schools, 97% of Afya’s graduates find employment and are able to make back their tuition within 5 years.

There are significant barriers to entry, with the Brazilian health ministry certifying each school that’s built and awarding each new seat. Public schools are also available, are hard to get into, and are free to those that are accepted, although those facilities are considered somewhat lacking compared to Afya’s technology forward schools. Brazil is also under-doctored, with only 2.4 doctors per thousand people vs 3.5 per thousand people in OECD countries. This is a great business.

Another ~10% of revenue is a lower but still solid 30% margin business, where Afya provides residency and medical specialization programs. Programs are offered both online and in-person. During the epidemic the Company cut the pricing of its largest online prep offering, harming margins, and doctors felt the in-person classes weren’t worth the risk of contracting Covid. All types of classes are now being attended, and my expectation is for the business to bounce back this year.

The remaining portion of the business is a collection of currently unprofitable SaaS businesses that help doctors run their practices, digitally prescribe medications, treat patients, and connect service providers with physicians. Fundamentally this is a good idea. Doctors are not generally trained in running their offices or maximizing their economic opportunity. Afya’s services aim to help their doctors and the wider community solve this need.

Each of the offerings is generally the number 1 or number 2 provider, but the segment suffers from many of the issues of the small-cap US tech sector – the total addressable market size is uncertain, the competition is significant, and it’s unclear how profitable they can be. Afya has deployed significant amounts of excess capital to build this segment in a relatively short period of time – it’s unclear it has been a good use of capital. At the beginning of the year, they changed leadership of the segment, and checks indicate new leadership is more operationally focused than the last.

In 1Q22, the company’s medical education and continuing education businesses grew over 25% while the SaaS businesses posted underwhelming results. The company trades for a 13% free cash flow yield on conservative estimates assuming a meaningfully worse exchange rate to the USD, the currency it’s stock trades in, than the Brazilian Real suffers today – and almost

20% on less conservative estimates. The company’s revenue and costs are almost entirely in Brazilian Real and the company is lightly levered.

There are several options to generate value in the short term.

- The Company’s unprofitable SaaS business could become profitable more quickly than expected.

- The Company could become more strategic with the SaaS business, publicly declare its slowing investment, or spin it off.

- The Bertelesmann family, which obtained a majority stake in several transactions over the past year, could take the company private.

- The team could just execute on the existing business, but without the Covid impediment.

The stock is cheap, the business is good, there are growth opportunities inherent in the basic opportunity set, and significant options to accelerate shareholder value creation. I like our prospects.

The Midcap Opportunity

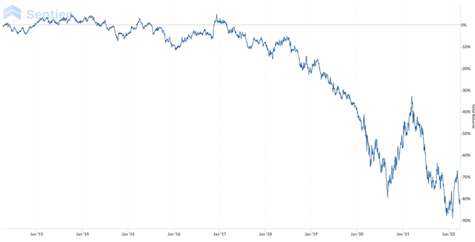

As an update to a longstanding and self-serving thesis that midcap stocks have underperformed and are set to outperform – the opportunity in middle capitalization stocks continues to be significant and I continue to be a proponent of increasing exposure.

Similar to last quarter, as you can see in the first graph, midcaps have dramatically underperformed large caps since 2016. Recent improvements in the relative performance of midcaps may be a harbinger of more. The increase in interest rates and lessening of support for the economy, most taken advantage of by large cap stocks, may also be a harbinger of things to come.

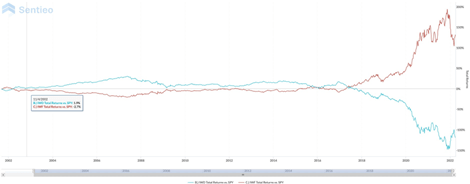

The second graph plots the performance of so-called “value” and “growth” factors vs the S&P 500. It illustrates the outperformance of growth over value since 2017 and the extremity of its current outperformance defying the long term correlation. In the first half of 2022, there was some reversion, a benefit to our portfolio.

White Brook Capital Partners has been able to outperform the S&P 500 despite being composed predominantly of mid-cap value stocks in previous years and continues to outperform. I continue to believe that midcap stocks present a compelling opportunity, especially relative to large cap stocks, and that exposure to the asset class provides an enduring tailwind for the Fund as it reverses.

As always, feel free to reach out to discuss this or any of your investments at White Brook Capital. I thank you for your support and will strive to continue to earn your trust.

Sincerely,

Basil F. Alsikafi, Portfolio Manager, White Brook Capital, LLC

Footnotes

[1] The last time we invested after another semiconductor shortage created a decline in its stock price.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment