LazingBee/iStock via Getty Images

Whirlpool Corporation (NYSE:WHR) manufactures and markets home appliances and related products. It operates through four geographic regions: North America; Europe, Middle East and Africa; Latin America; and Asia.

In June 2022, we have published an article on Seeking Alpha, titled: “Whirlpool Is Likely To Struggle In The Short Term, However, It Might Outperform In The Long Run“. At that time, we have rated Whirlpool’s stock as “hold”. The primary arguments for our rating were:

- Disappointing results in the first quarter, with declining EBIT and contracting EBIT margin across all of its segments.

- Strong track record of paying sustainable dividends and buying back shares.

- Attractive valuation, but likely further downside due to the macroeconomic headwinds.

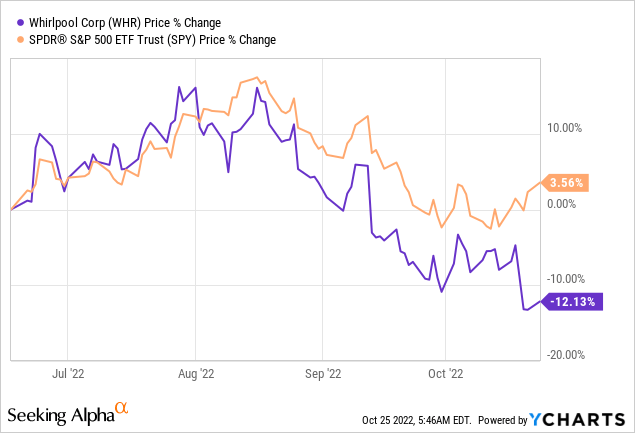

Since our writing, WHR has lost more than 12% of its market value, while the broader market has gained more than 3%.

In today’s article, we are going to revisit our previous thesis and provide an update incorporating the latest earnings results. We are also going to estimate the intrinsic value of WHR’s stock, based on its dividends, as many investors hold WHR for the quarterly dividend payments.

Quarterly earnings results

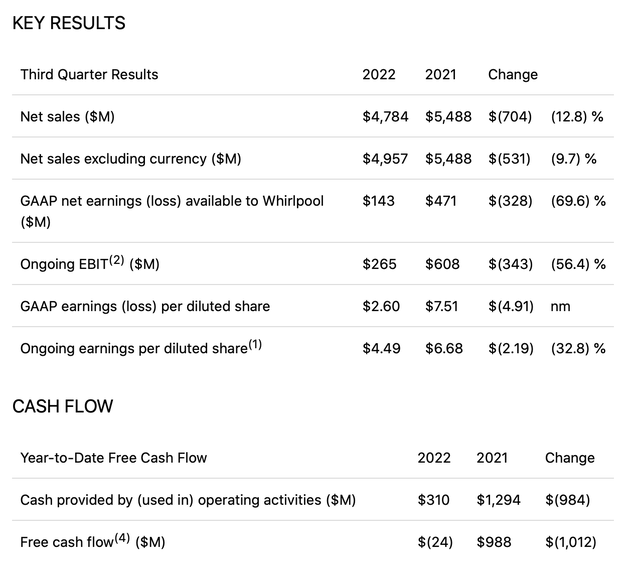

Just like in the previous quarters this year, WHR’s results were not particularly impressive in Q3. The risk of softening demand as a result of low consumer confidence is slowly materializing, which is reflected across all segments of the firm.

Net sales decline of (12.8)%, or (9.7)% excluding currency, impacted by lower volume as a result of slowing demand, partially offset by favorable product price/mix.

The firm has experienced a contraction of demand across all the geographic regions:

North America: net sales declined by 7.4%

EMEA: net sales declined by 16.7% (about half of this decline was driven by the unfavorable FX environment and the divestiture from the Russian business)

Latin America: net sales declined by 10.4%

Asia: net sales declined by 1.2%

We believe that the demand is likely to remain soft in the near future, due to the continuing low consumer confidence environment around the globe. For this reason, we do not expect a dramatic improvement of the sales figures in the coming quarters and therefore a rapid appreciation of the stock price. The company is also not expecting a rapid improvement in the business environment, as it is reflected in their updated full-year guidance:

- Expect full-year 2022 revenues of approximately $20.1 billion (down ~9 percent)

- Reduced earnings per diluted share from $9.50 to $11.50 to ~$5.00 on a GAAP basis and from $22.00 to $24.00 to ~$19.00 on an ongoing basis

- Reduced cash provided by operating activities from $1.85 billion to $1.50 billion; reduced free cash flow from $1.25 billion to $950 million

On the other hand, we like the recent announcement of the acquisition of InSinkErator. In our opinion, InSinkErator’s products can further diversify WHR’s product portfolio and potentially enable growth in the longer term.

This acquisition, however, does not counterbalance the poor quarterly results and the weak outlook. So why do we still keep rating WHR as “hold”?

The answer is valuation.

Valuation

In our previous article, we have shown that based on a set of traditional price multiples, WHR appears to be trading at a significant premium compared to its peers and its own 5Y average.

Today, we are approaching the valuation question from a different perspective. We are going to value WHR’s stock using a dividend discount model.

Gordon Growth Model

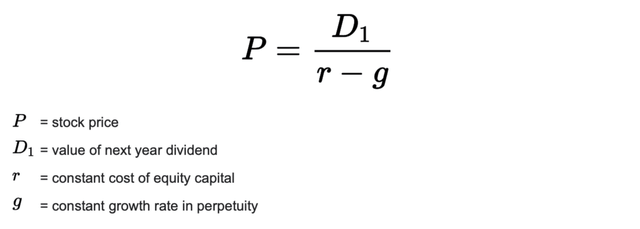

The Gordon growth model (‘GGM’) is a relatively simple and widely recognized dividend discount model, used to value the equity of dividend paying firms.

The model is described by the following equation:

The main assumption of this model is that the dividend grows indefinitely at a constant rate. Due to this criterion, the growth model is particularly appropriate for firms that are:

1.) Paying dividends

2.) In the mature growth phase

3.) Relatively insensitive to the business cycle

A strong track record of steadily increasing dividend payments at a stable growth rate could also serve as a practical criterion if the trend is expected to continue in the future.

In our opinion, WHR may be relatively sensitive to the business cycle and its financial performance is likely to be dependent on the overall state of the economy and the consumer confidence. Regardless, we still believe that the GGM could be an appropriate method to value WHR, as it has a long history of returning value to the shareholders in the form of dividend payments.

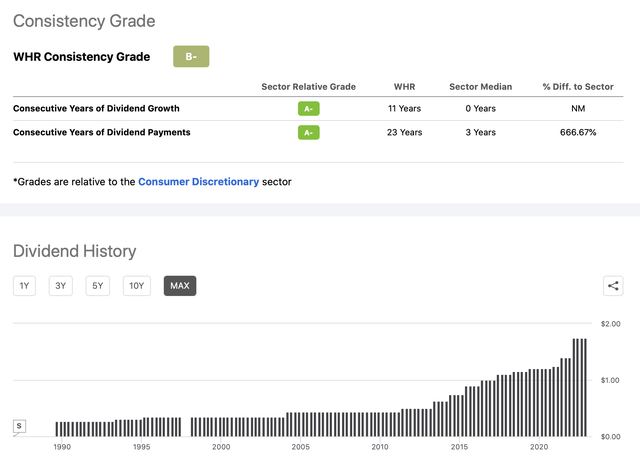

Dividend history (Seeking Alpha)

WHR has been paying dividends in each of the last 23 years, and the company has managed to increase these payments every year in the last 11 years.

But before we start, we have to ask ourselves, is the current dividend at all sustainable?

The firm has a dividend coverage ratio of 2.73, meaning that they are able to pay their dividends, even if earnings decline in the near term. The cash dividend payout ratio (TTM) of WHR is somewhat high, about 60%, but it is still below the firm’s 5Y average of more than 84%.

For these reasons, we believe that WHR could be a suitable candidate to be valued using the Gordon Growth Model.

To start using the model, we have to make two key assumptions:

1.) What is our required rate of return?

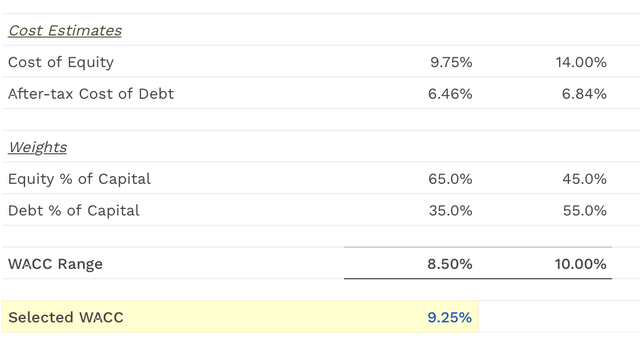

We often prefer to use the firm’s weighted average cost of capital (WACC) as the required rate of return for our calculations. Whirlpool’s WACC is estimated to be 9.25%.

2.) What could be a reasonable constant dividend growth rate in perpetuity?

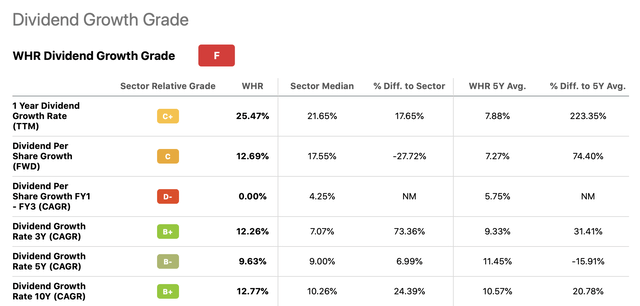

This question can be answered by looking at WHR’s dividend history, and how dividends have grown in the past. The following table summarizes the company’s dividend growth across several time frames.

Dividend growth (Seeking Alpha)

In the recent years, the firm has been increasing its dividends at a rapid rate. We believe that this double-digit increase is not a sustainable trend in the long term. For this reason, we are going to be using a more conservative range: 3% to 5%.

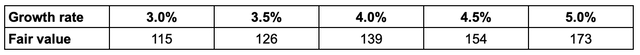

The following table shows the results of our fair value estimation, using a 9.25% required rate of return and a constant perpetual growth rate of 3% to 5% in USD per share.

As WHR is trading around $133 per share, in the lower end of our range, in our opinion the stock is attractive from a valuation point of view at the current price levels, for dividend and dividend growth investors.

Conclusion

Poor financial results in the latest quarter. Declining demand and declining sales across all regions. As the macroeconomic environment remains challenging, the consumer confidence remains low and the FX headwinds do not seem to ease, we believe that WHR’s financial performance will keep being negatively impacted in the coming quarters.

On the other hand, the firm’s valuation appears attractive at the current price levels, especially for dividend and dividend growth investors.

For these reasons, we maintain our “hold” rating.

Be the first to comment