Scott Olson/Getty Images News

Investment Thesis

Whirlpool (NYSE:WHR) reported major demand declines in its latest quarterly results. The business is still dealing with ongoing cost inflation. At the same time, I still think that the company is well positioned for the long term. The business is transforming its portfolio to focus on higher margin segments. Overall, I think that the risk to reward is favorable at the current price.

Third Quarter Results And Headwinds

In its most recent results, Whirlpool announced its third straight guidance cut. The company now expects to earn $19 per share this year. This is down by 32% from its January guidance. Since the company’s Q4 earnings call, it has cut revenue guidance by 13% and free cash flow guidance by 37%.

Whirlpool Q3 2022 Earnings Presentation

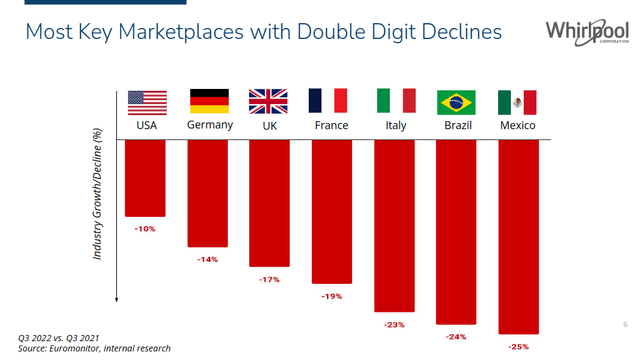

These guidance cuts are attributed to a continuously declining demand environment. Whirlpool is a cyclical company, so its performance is heavily tied to the economy. The business is reporting double digit demand declines in most of its key markets.

Whirlpool Q3 2022 Earnings Presentation

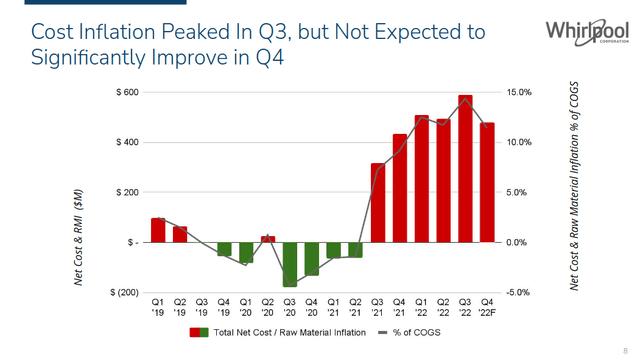

At the same time, cost inflation has not fully subsided. Management says that inflation has peaked. But costs aren’t expected to come down meaningfully until the back half of next year. These two factors are pressuring the company’s top line and its margins. On their earnings call, management discussed these headwinds.

One is just — in the most simple way to explain it is kind of you have two major macro cycles are out of sync right now, i.e., demand is down and cost is up. That is a typical cost for this demand. Now if you look back the last 20 years that happen a few times, but it typically doesn’t last very long. So to have these macro cycles out of sync to that extreme is highly unusual and will not last very long.

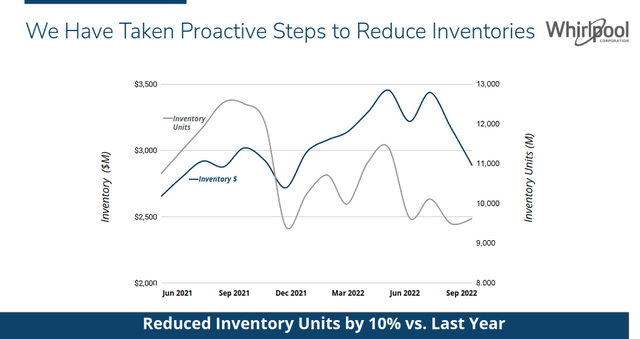

Management has taken aggressive action to combat these headwinds. They reduced inventory by $300 million in the quarter. After that, they cut production volume by 35%. I think that this is the right move. It should help the business respond to the volatile economy without sacrificing profitability. The business can’t control the demand environment, but it can try to wait out these headwinds.

Whirlpool Q3 2022 Earnings Presentation

Even with this reduced volume, the business is actually maintaining solid margins. The company maintained an ongoing EBIT margin of 5.5% in the quarter. Its North American segment reported EBIT margins of 10%. I like that the company has cut its operating expenses by 16% since last year. It also announced a $500 million cost takeout program for 2023. I think this is impressive for a quarter with such a large inventory reduction.

Overall, I think that Whirlpool can be more resilient than other durable goods companies. About half of the company’s sales are related to replacements. I believe that this will provide some stability in a downturn. Replacement demand is less discretionary than new purchase demand. Consumers often won’t go without a major appliance for an extended period of time. Even after all of these guidance cuts, Whirlpool is still reporting solid free cash flow. Management can try to improve the company’s position for the next cyclical upswing.

Whirlpool’s Portfolio Transformation

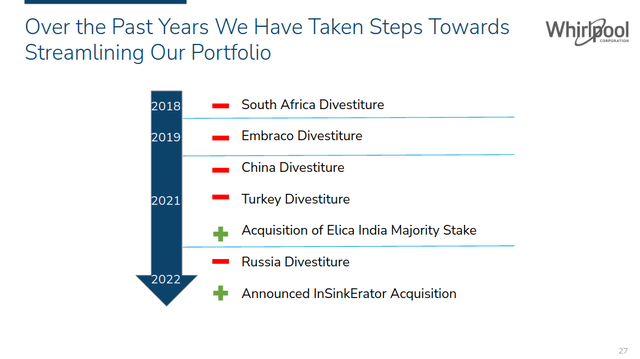

Where I really see the opportunity is in Whirlpool’s long term outlook. The company is continuing to transform its portfolio. Management is cutting their lower margin businesses in favor of more profitable segments.

Whirlpool Q3 2022 Earnings Presentation

The business has spent the past few years divesting various international segments. Since 2018, management has divested their businesses in South Africa, China, and Turkey. They also sold their stake in Embraco, a refrigerator parts manufacturer. The company recently divested its Russian segment at a loss because of economic sanctions.

Whirlpool Q3 2022 Earnings Presentation

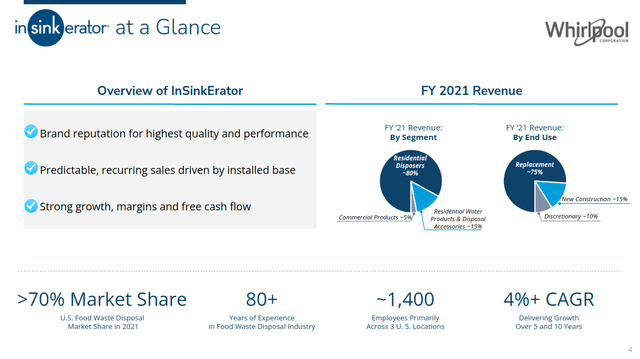

But I want to discuss the company’s current portfolio actions. Next week, it is expected to close on its purchase of InSinkErator, a garbage disposal company. It’s an industry leader with over 70% market share in the United States. Even though demand is dropping, InSinkErator is continuing to report solid margins. About 75% of the company’s revenue is tied to product replacements. As I pointed out earlier, replacement purchases are less discretionary and perform better in a recession.

The company also conducted a review of its EMEA segment. This is one of the worst performing parts of Whirlpool’s business. Last year, it generated 23% of revenue but only 4% of EBIT. Management is considering a wide range of options for the segment. These range from a full divestiture to simply reducing the business’s footprint. They said they’ve narrowed their options to two investors. This is important, and I recommend watching this segment closely for updates.

Overall, I like Whirlpool’s portfolio transformation. The business is focusing on its strengths. This is reflected in its fundamental margin improvement. Even after another guidance cut, the company is still projecting solid profitability.

Valuation And Long Term Outlook

Whirlpool’s shares seem reasonably cheap, with a forward P/E of 7 times. But traditional comparables are less useful for a company with highly cyclical earnings. I think that this is still a reasonable entry point to buy Whirlpool.

Even in the current downturn, the business is predicting solid results. The company’s current free cash flow guidance gives it an EV/FCF of 11 times. This is a solid result when demand is falling so dramatically.

I want to discuss Whirlpool’s increasing leverage. The company has almost $5 billion in total debt. This would give the business a forward debt to EBIT ratio of 3.4 times. The company’s acquisition of InSinkErator will add an additional $2.5 billion in debt. At the current run rate, it is expected to add $170 million in EBITDA. On a full year basis, this would give Whirlpool a forward debt to EBIT ratio of 4.8 times. I understand that Whirlpool can improve InSinkErator’s profitability. This is still a noticeable increase in the company’s debt burden.

But I also want to point out the low interest rate on the debt. The average yield on Whirlpool’s debt is 2.9%, which is under the current 2 year treasury yield (US2Y). I don’t think it is a cause for concern yet, although I recommend keeping an eye on Whirlpool’s debt going forward.

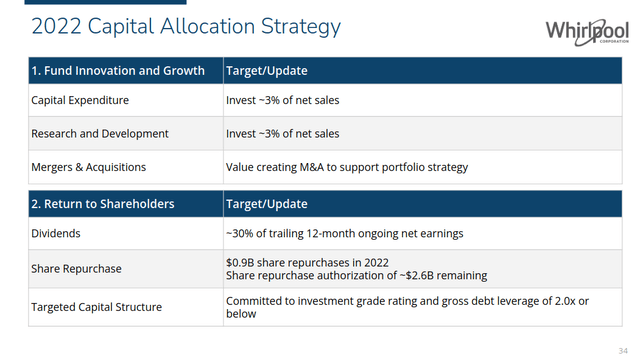

Whirlpool Q3 2022 Earnings Presentation

Because of this increased debt burden, the company is temporarily suspending share repurchases. Management is waiting until they reach their leverage targets before starting again.

At the same time, Whirlpool is paying a decent dividend. The company’s quarterly dividend yields 5.2% at the current price. This costs the company about $95 million per quarter. This is well covered by Whirlpool’s forward average of $240 million in free cash flow per quarter.

Final Verdict

I understand that the demand environment is volatile. Making short term predictions is tough. But I think that the business is well positioned for the long term. Whirlpool’s replacement demand limits its near term downside. In the long term, the company’s fundamental improvement should boost its performance.

I think that Whirlpool’s shares are good value. There is some risk connected to the company’s elevated leverage and increased costs. I also recommend watching the company’s plans for its EMEA business. But overall, I still think that the risk to reward is favorable at the current price.

Be the first to comment