bombuscreative

Investment Thesis

PayPal (NASDAQ:PYPL) is a leading global platform that enables digital payments and simplifies commerce for both merchants and consumers. The company covers the entire spectrum of digital payments, from online checkouts and risk management to international transfers and BNPL (Buy Now, Pay Later). The sheer breadth of services offered by PayPal is clear from the below slide from its Q2’22 investor presentation.

PayPal Q2’22 Investor Presentation

It is the leader in a digital payments industry that still has a lot of growth to come over the next decade, and PayPal announced its plan to exceed $50B in revenue by 2025 – implying a minimum CAGR of 18.4% from 2020 onwards.

Yet it appears to have stumbled out of the starting blocks when aiming for this 18.4% CAGR. Whilst it grew revenues by 18.3% in 2021 (pretty much spot on), PayPal’s most recent full year revenue guidance for 2021 of $27.85B represents just 10% YoY growth.

To put that into perspective, if PayPal does hit this figure for 2022, then it will need to achieve a CAGR of 21.5% over the next three years to hit its $50B target. This is certainly feasible, but it is also quite the step up from the 10% this year, and I would not be surprised to see PayPal either achieve the $50B through an acquisition (which I think is kind of cheating) or fall short of its goal.

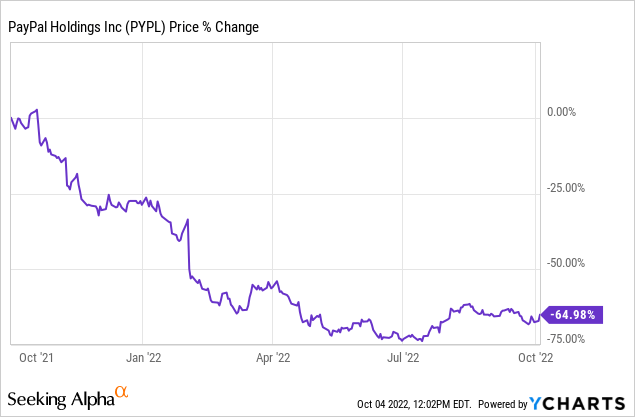

The market certainly doesn’t have much faith, and as a result, it’s been a difficult year for investors of this fintech juggernaut. Shares have fallen by 65% in the last 12 months, which is more than substantial for a company of this size.

But therein lies the investment thesis for PayPal. Shares have been beaten down a lot, but there is certainly a belief among investors that this poor 2022 is at least partially a macro-induced blip. The company still has 429 million active accounts, and prints free cash flow for fun – in fact, over the past 12 months, PayPal’s free cash flow has been just under $5.2B for this business with a market capitalization of ~$100B, making it currently valued at just ~19x TTM FCF. I’ll provide a valuation model later in this article, but it’s fair to say that PayPal looks like a value play on the surface, with a strong underlying business that would prevent me from calling it a value trap.

However, I don’t think long term PayPal investors will be too surprised by the falling share price, given its recent business performance. There were some bright spots in Q2 earnings, but all in all it was disappointing, with PayPal reducing full year revenue guidance yet again. The big question now is whether or not the business itself can recover.

Here’s what I’ll be looking at in Q3 results to try and assess if PayPal can stay away from the ‘value trap’ label, and can instead continue looking like an attractively valued investment.

Latest Expectations

PayPal is set to report its Q3’22 earnings on Thursday 20th October, and there are several key items that investors should keep their eyes on.

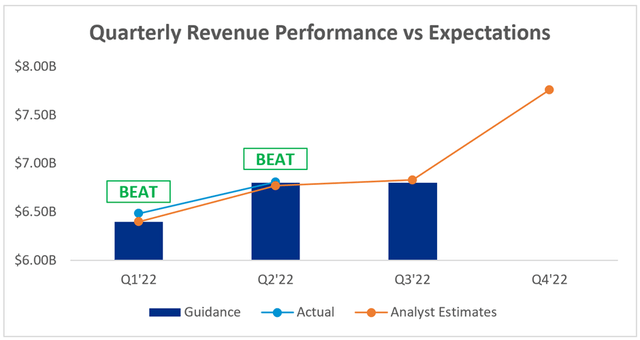

Starting with the headline numbers, and analysts are expecting Q3’22 revenue of $6.83B, representing YoY growth of ~10%. This is slightly ahead of PayPal’s $6.80B guidance – perhaps the analysts are feeling optimistic, although I’m not too sure why; it probably helps that PayPal beat expectations in Q1 and Q2 this year, although the company did lower expectations beforehand.

Investing.com / PayPal / Excel

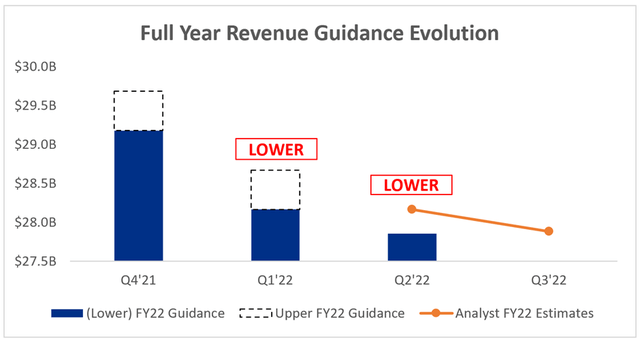

A spike is then expected to follow in PayPal’s Q4, which is almost always its best performing quarter thanks to seasonal shopping. Analysts will probably be hoping that they won’t have to tamper down these expectations once again, since PayPal has consistently reduced its full year guidance throughout 2022 – which explains why shares have been trounced over the past year.

Seeking Alpha / Consensus Gurus / PayPal / Excel

Analysts’ latest expectations for full year revenue guidance is ~$27.9B, in line with the latest guidance offered by PayPal at Q2 earnings.

It’s worth noting that PayPal’s initial guidance for FY22 was $29.2-$29.7B, so at the midpoint, it has decreased by ~$1.6B in the span of two quarters. 2022 has been a painful year for the economy as a whole, and investors in PayPal will be hoping that its recent woes are short lived and related to the macro environment, rather than based on business weakness.

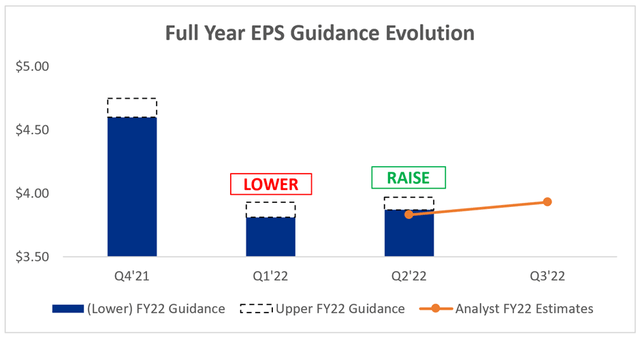

On the plus side, PayPal actually raised its earnings per share guidance for the full year at its Q2 earnings, despite the lower-than-expected revenue.

Seeking Alpha / Consensus Gurus / PayPal / Excel

PayPal has certainly suffered on the margin side over the past few years, but perhaps this is a sign that things are starting to improve.

A Turnaround In Margin Trends?

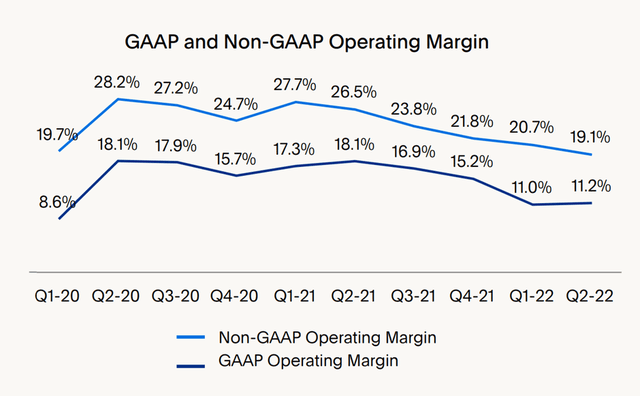

As mentioned, it really hasn’t been the greatest couple of years for PayPal’s margins, as can be seen in the below extract from PayPal’s Q2’22 investor presentation.

PayPal Q2’22 Investor Presentation

Whilst the trend has been a bit lumpy, clearly margins have fallen off a cliff in 2022. YoY comparisons have been hurt partly due to a Q2’21 credit reserve release, as well as the impact of PayPal ending a decades-long agreement whereby eBay (EBAY) sellers would have their funds from sales automatically deposited into their PayPal account – but this does not fully account for the substantial decline.

There is also a margin headwind regarding cross border volumes; these declined by 12% YoY, and given that cross border payments are high margin for PayPal, it’s clear to see why this lack of recovery to pre-pandemic levels is hitting on the margin front.

Yet if management are to be believed, then these margins will be rebounding in the near future. According to CEO Daniel Schulman on the Q2 earnings call:

We are leveraging our enhanced scale coming out of the pandemic to drive meaningful reductions in unit costs across our supplier base. As a result, we will realize our target of approximately $900 million of savings in 2022 across our OpEx and transaction expenses, which was contemplated in our reset guidance last quarter. We anticipate this reduction in our cost structure will result in at least $1.3 billion of cost savings in 2023, which will result in operating margin expansion next year. These cost savings are not onetime in nature and will continue to benefit the company on a run rate basis.

…Consequently, we expect operating margin expansion beginning in the fourth quarter of this year and continuing in 2023

Whilst management touts Q4’22 to be the starting point for operating margin expansion, I think investors should still be keeping a close eye on these margins when PayPal reports Q3 results. The company has had a disappointing year, so any early indication that the plan to bolster margins is working would be very welcomed.

Let’s Talk About Valuation

PayPal has garnered a lot of attention as a potential value play, but what do the numbers say? Before going into my model, let me first say that valuation is usually the final thing I look at – the quality of the business itself is far more important in the long run, and this is still true for PayPal. There is no point in purchasing ‘cheap’ shares if the business itself is going to fail over the upcoming decade, so always be sure to follow the business closer than the share price.

That said, let’s get into PayPal’s valuation model.

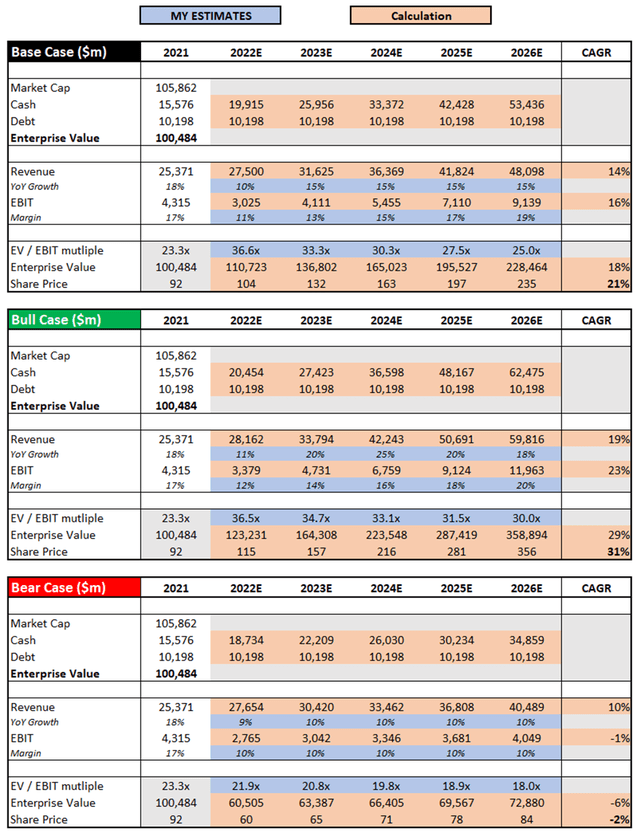

I have changed my valuation approach slightly since my previous article, in order to better demonstrate the potential upside and downside in the bull and bear case scenarios. My base case scenario and the assumptions made remain fairly similar to the previous article.

My bull case scenario essentially assumes that everything management expects to happen does in fact happen, with PayPal hitting its $50B revenue target by 2025 and growing revenue at a 19% CAGR over the 2021-2026 period. It should also successfully expand margins as the economy returns to normality, and the company continues to scale up and boost margins in products such as Venmo.

My bear case scenario effectively assumes that the future for PayPal looks a lot like 2022, with about 10% growth and little margin expansion. I should point out that I believe this to be an extremely bearish scenario, and it is probably slightly too negative.

Put all that together, and I can see PayPal shares achieving a CAGR through to 2026 of (2%), 21%, and 31% in my respective bear, base, and bull case scenarios. I do believe that the base case is extremely achievable, and given that I forecast a 21% share price CAGR through to 2026 if it is achieved, then I can certainly see why there are many out there calling PayPal a great value investment.

Bottom Line

It’s pretty simple right now for PayPal. Shares are priced for a lot of negativity, meaning that just a small amount of good news could give them a much-needed boost. Whether that is evidence that the growth is returning to this business, or an indication that margin expansion is truly underway, I think there are plenty of potential positives that investors will be able to take from Q3 earnings.

The bar is low, but PayPal hasn’t exactly been jumping that high in 2022 – however, I feel that the bar has become so low that it should easily be cleared, and Q3 may signal a turning point for PayPal.

Be the first to comment