Scott Olson/Getty Images News

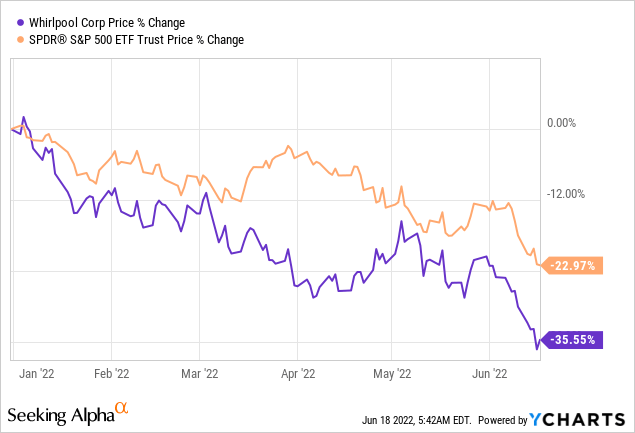

Whirlpool’s (NYSE:WHR) stock price has fallen by more than 35% year to date, underperforming the broader market, which declined by about 23% in the same time frame.

In our opinion, this sell-off is partially justified due to the current macroeconomic headwinds, and the firm’s first quarter financial performance.

On the other hand, we believe that for long term investors, the stock at its current valuation could appear attractive, especially when considering the relatively high dividend yield and the share repurchase program. Last, but not least, the portfolio transformation could also create value for long term investors.

First quarter overview

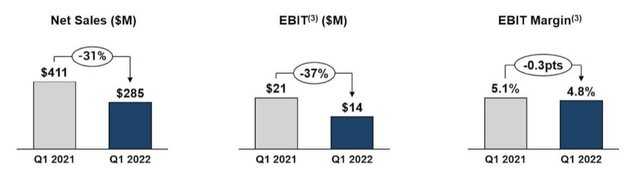

In the first quarter, Whirlpool has presented disappointing financial results across of all its regional segments.

Sales have declined in 3 out of 4 regions, while EBITDA and margins have contracted across all segments.

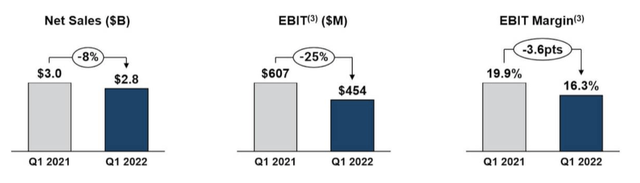

North America:

In North America lower demand has been the primary driver of poorer financial results than in the year ago quarter. Although the firm is aiming to offset the elevated costs by price increases, it has not been able to fully do so.

We believe that the lower demand is likely to persist and may even decline further. Not only in the North American region, but also globally.

In our opinion, one of the main causes of lower demand is the declining consumer confidence.

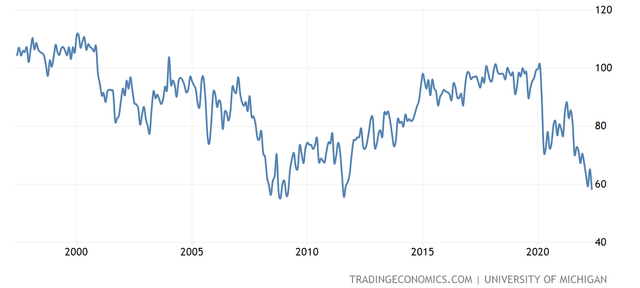

U.S. Consumer confidence (Tradingeconomics.com)

Consumer confidence has been steadily declining in the first and second quarters of 2022, without ever recovering to pre-pandemic levels. U.S. consumer confidence has reached its 10-year low, approaching levels seen during 2008-2009. We expect low consumer confidence to result in the change of the spending behaviour of consumers. Meaning that they are likely to cut or delay spending on durable goods, or switch to cheaper alternatives. This change in behaviour could lead to further decline in the demand for Whirlpool’s products.

Further, we also believe that declining housing starts, an indicator of lower demand for new housing units, could also eventually lead to lower demand for the various appliances offered by the firm.

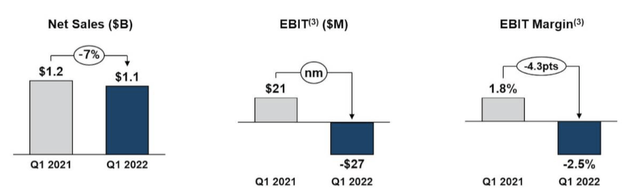

EMEA:

The European segment of the business was significant impacted by the currently ongoing geopolitical tension between Russian and Ukraine, resulting in a substantial decrease in demand, EBIT and EBIT margin.

In our opinion, the uncertainties created in the region are likely to remain high for the rest of 2022, therefore we are not expecting significant improvements of the financial performance in 2022.

The EBIT was also negatively influenced by the inflationary environment, which could not be completely offset by price increases. We also believe that as long as commodity prices, especially oil and gas prices, are elevated, we are not likely to see an improvement on the cost side.

Recently, there have been mixed news about the energy security of Europe and the levels of oil output. On one hand, OPEC+ has signalled that they are willing to increase oil output by a higher than anticipated amount from July onwards, which could potentially lead to lower oil prices for the second half of the year. On the other hand, Russia has been limiting the supply of gas to Europe, and at the same time a fire in the Freeport LNG plant in the U.S. has also started to limit the supply of liquified natural gas. Both of these have resulted in a significant spike in gas prices.

All in all, we believe that costs are not likely to substantially decrease in the near term, resulting in higher input and freight costs, and eventually in the contraction of margins.

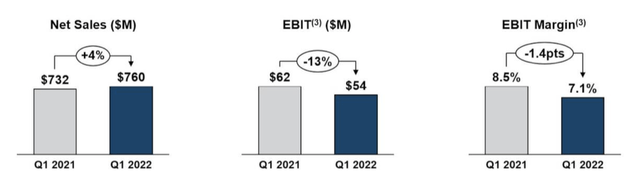

Latin America:

The Latin American region is the only one, where Whirlpool managed to increase its sales. The driver of sales increase was the increased pricing, however even higher prices could not fully offset the increased input costs, resulting in a decline in EBIT and the contraction of the EBIT margin.

Asia:

The primary driver of sales decrease in Asia was the divestiture from Whirlpool China. Without its impact, a sales decline of only 5% would have been observed.

To sum up, we believe that based on the first quarter financial performance combined with the near-term macroeconomic outlook make Whirlpool an unattractive opportunity in the near term. We also have to point out here that Whirlpool’s portfolio transformation is aiming to expand margins and fuel growth both organically and inorganically across its segments. If the firm proves to be successful in the implementation of the strategy and manages to turn around the trends observed in the first quarter, the firm could become a much more attractive choice.

Portfolio transformation however is not the only things that we like about Whirlpool. Let us take a look at some of the factors that could make the firm appealing to a large group of investors.

Dividends

Whirlpool has been committed to return value to its shareholder through dividend payments over the years. The firm has been paying dividends for 32 years consecutively and even growing its dividend continuously in the last 12 years.

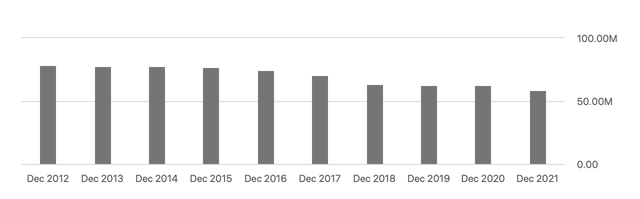

Dividend history (Seekingalpha.com)

The company’s dividend also appears to be safe and sustainable as the dividend payout ratio (TTM) (GAAP) is as low as 23.4%, which is lower than the consumer discretionary sector median, as well as the firm’s 5-year historic average.

We believe that even if macroeconomic headwinds continue to decrease the demand for Whirlpool’s products, they will still be able to continue paying dividends.

In our opinion, WHR could be a good choice for investors looking for reliable quarterly income and dividend growth, especially as the stock is yielding more than 4% currently.

Share buybacks

Shareholders have been profiting not only from capital gains and dividend payments in the last decade, but also from WHR’s continuous share buybacks.

Shares outstanding (Seekingalpha.com)

In the last 10-year period, the number of shares outstanding has decreased by as much as ~30%, creating significant value for shareholders.

Valuation

Whirlpool has been historically a low P/E multiple firm, with its 5-year P/E average slightly below 10x, in line with the sector median of the consumer discretionary sector.

However currently, the firm is trading at a more than 30% discount, as low as 6.2x, compared to both its historic average and the sector median. We believe a slight discount compared to the sector median may well be justified due to the previously mentioned potential macroeconomic headwinds.

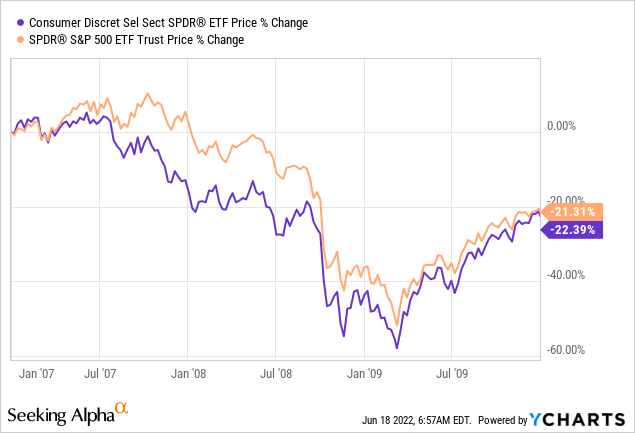

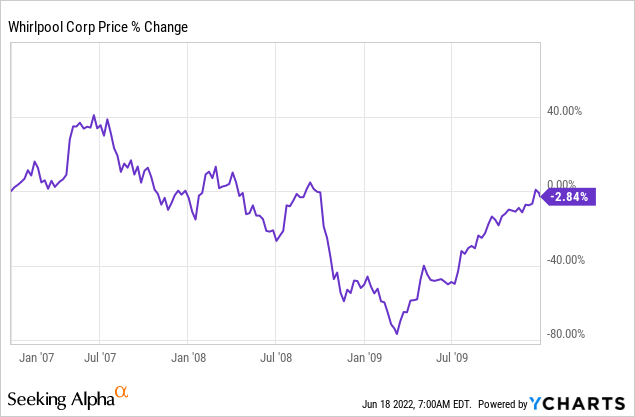

Taking into account that the performance of the consumer discretionary sector (XLY) was in line with the broader market (SPY) in the 2007-2010 time frame, when consumer confidence was low, in our opinion the current sell-off may be overdone and the current price levels could potentially provide an attractive entry point.

Although WHR outperformed XLY and SPY in the same time frame, we have to mention that in 2008-2009, Whirlpool stock has lost almost as much as 80% of its price. Based on this performance, we believe that there might be further downside risk in the near term, therefore dollar-cost averaging could be the most appealing way to start building a larger position.

Key takeaways

In the first quarter whirlpool has presented disappointed results with declining EBIT and contracting EBIT margin across all of its segments.

On the other hand, the firm has been consistently returning value to its shareholders in the form of dividends and share buybacks, which could make it an attractive choice for many investors.

The firm’s valuation also appears to be attractive as WHR is trading at a 30% discount compared to its peers based on the P/E ratio.

Although the current price level seems to be an attractive entry point, based on the 2008-2009 performance of the stock, further downside risk may be ahead.

Be the first to comment