This year has not been kind to shareholders of Poaris Inc. (PII), who’ve seen the company stock price cut in half since January 1st. This fact, plus the company’s dividend history, has me intrigued, so I thought I’d look in on the name to see if it makes sense to buy at these levels. At the risk of simply repeating my bullet points above, I’ll come to the point. It does make sense to buy this stock at these levels. The dividend is reasonably safe in my view, and when the world returns to something like normal, people who bought at current prices will do very well. Also, those who are nervous about buying at the current level amidst all of this uncertainty have an alternative. For people who see value here, but who want to own the shares at a much lower price, I recommend what I consider to be a very profitable options trade.

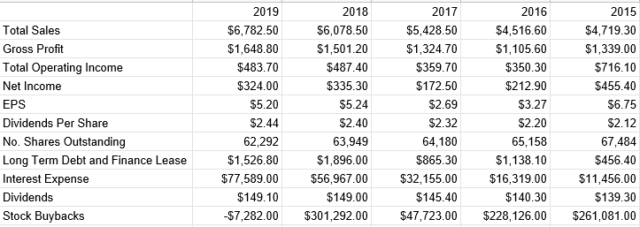

The financial history at Polaris suggests that this is very similar to many other “growth” companies in that investors have seen large topline growth, but a reduction in net income. Specifically, over the past five years, revenue has grown at a CAGR of about 7.5%, while operating income and net income have fallen by CAGRs of 7.6% and 6.6% respectively. It seems that growth of selling and marketing, R&D, and other expenses is greater than revenue growth here. In spite of the non-existent growth in net income over the past five years, management has been relatively shareholder friendly. In particular, they’ve returned just over $723 million to shareholders in the form of ever growing dividends over the past five years alone. In addition, the company spent just over $830 million to reduce share count at a CAGR of about 1.1%. This combination of dividend increases and share count reduction has caused dividends per share to grow at a CAGR of about 2.85% over the past five years. This prompts the obvious question: can the dividend be sustained at this point?

In order to answer that question, I think it’s necessary to review the company’s short term financial obligations and its resources. According to the company’s response to Covid-19 press release, the company has cash of ~$150 million and a further $280 million available under its current revolver. The following outlines the upcoming obligations.the company faces over the next few years. It seems that the company has enough liquidity to last for at least a few years. For that reason, I think the dividend is safe for the foreseeable future. Obviously revenue will take a hit this year, and perhaps next, but when life returns to normal, there’s a better than average chance that Polaris survives to thrive.

Source: Latest 10-K

Source: Company filings

The Stock

I’ve written it before, and all signs are that I’ll write it again. I’ve said it so often at parties that I’m known as “that stock guy” to more than a few people. A great business can be a terrible investment at the wrong price, and a troubled business may be a great business at the right price. For that reason, I think it’s important to look at the stock as a thing actually distinct from the business itself. I think stocks that are pessimistically priced are most attractive, as these have the greatest potential to produce positive surprises. I judge whether a stock is pessimistically priced or not in a host of ways, ranging from the simple to the more complex. On the simple side, I look at the ratio of price to some measure of economic value, like earnings and the like. The less an investor has to pay for $1 of future earnings, the better in my estimation.

If I encounter someone at a social gathering, and they don’t have an obvious escape route from the conversation, and I’m feeling particularly cruel, I might elaborate further. The reason I like shares that are inexpensive is because most bad news is already baked into the cake. So, when things inevitably falter, the damage will be far less. The alternative is the story of a stock that everyone loves and is therefore expensive. When this popular business inevitably shocks the market with some bad news, the shares get slammed.

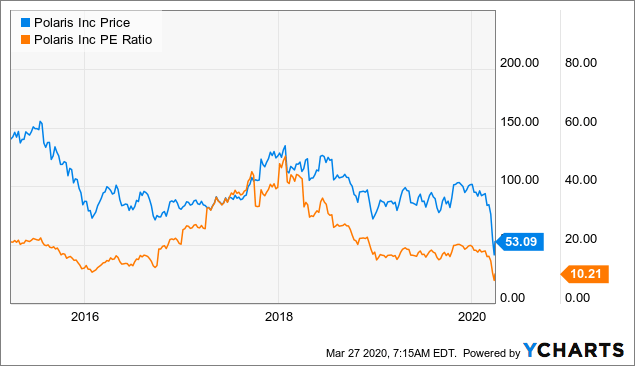

I think the following expresses the level of pessimism around these shares quite well at the moment.

Data by YCharts

Data by YCharts

Please note that the last time the shares traded hands at the current valuation, they went on to do very well. It seems that the current price is close to a floor below which the market isn’t willing to drive these shares.

In addition to looking at the simple relationship between price and value, I also want to try to quantify the assumptions currently embedded in the stock price. In order to do this, I turn to the approach described by Professor Stephen Penman in his book “Accounting for Value.” In this book, Penman walks investors through how they can isolate the “g” (growth) variable in a fairly standard finance formula. Applying this methodology to Polaris suggests that the market assumes this company will go bankrupt over the next 8 years. This is too pessimistic a view in my opinion, which is quite a positive.

Options For The Nervous

It’s all well and good for me to say that I’m confident these shares will rise in price. Unlike many other contributors on this site, I’ll admit to being wrong. I’m actually dead wrong at least 35% of the time because picking stocks is actually not easy. For those people who might be skeptical of my rosy forecast for this company in the teeth of a global pandemic/recession, I offer an alternative to simply buying the shares at current levels. If someone considers this to be a great business, but wants to reduce risk even further by buying at an even lower price, I recommend selling puts. I think these represent a win-win trade at this point.

If, as I suspect, the shares rise from current levels, the put seller simply pockets the premium. If the shares continue to drop, the put seller will be obliged to buy the company, but will do so at a price that they feel represents great long term value.

At the moment, my preferred short put for this company is the January 2021 with a strike price of $40. These are currently bid-asked at $7.40-$9.10. If the investor sells these puts at market, and is subsequently exercised, they’ll be buying the shares about 33% below the current level. Holding all else constant, $40 represents a PE of about 5.2, and a dividend yield of 7.6%. Obviously the world isn’t constant, especially now, but when it returns to something like normal, a net price of $32.60 for this business is very compelling in my estimation.

Conclusion

We’re often told that in order to succeed at investing, one must “buy low.” The only way to do that is by buying when others are frantically selling. The only time others are frantically selling is when there seems to be a good reason to do so. I think investing well requires the ability to look past the short term noise and foresee a more attractive future. While I think Polaris’ financials are going to be challenged over the short term, long term current prices are too compelling to pass up. The last time the shares traded at these levels, they went on to do very well, and I think that sooner or later the same will happen again. For those who are still nervous about buying at current levels, the options market is offering very large premia for taking on the obligation to buy this excellent business at even lower prices. I think price and value can remain disconnected for some time, but sooner or later they meet. At the moment, the price of this stock, along with many others, is below value per share, and I think investors would be wise to buy at these levels before price inevitably rises.

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in PII over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: In addition to buying shares, I’ll be selling 10 of the puts mentioned in this article.

Be the first to comment