margouillatphotos/iStock via Getty Images

Investment Thesis

Booking Holdings (NASDAQ:BKNG) looks to be on a stronger foothold than Expedia (EXPE). The company’s revenue, profits, and operating metrics have recovered faster than Expedia. Booking Holdings posted a strong performance in the second quarter. Further, its margins and returns also look stronger than peers.

Top players

Booking Holdings and Expedia Group are two of the largest online travel services companies in the world. Both have more than 2 million accommodation options on their respective websites and operate through several different brands. Expedia Group has various brands such as Brand Expedia, Hotels.com, Vrbo, Orbitz, Travelocity, ebookers, Wotif Group, and trivago. Likewise, Booking Holdings offers similar services through the following brands – Booking.com, Priceline, agoda, Rentalcars.com, Kayak, and OpenTable.

Accommodation bookings is the largest revenue contributor for both the companies. Here we will compare these two players and see who might get a bigger pie of the online travel services industry.

Tourism spend is getting back on track

After hitting bottom during 2020, the tourism industry is bouncing back again. According to World Tourism Organization, international expenditure by tourists from France, Germany, Italy, and the U.S. have recovered to 70% to 85% of the pre-pandemic levels. Further, spending from India, Saudi Arabia, and Qatar has already exceeded 2019 levels. In terms of international tourism receipts earned in destinations, several countries have fully recovered their pre-pandemic levels.

World Tourism Organization’s forward-looking scenarios published in May 2022 noted,

“International tourist arrivals in Europe could climb to 65% or 80% of 2019 levels in 2022, depending on various conditions, while in the Americas they could reach 63% to 76% of those levels.

In Africa and the Middle East arrivals could reach about 50% to 70% of pre-pandemic levels, while in Asia and the Pacific they would remain at 30% of 2019 levels in the best-case scenario, due to stricter policies and restrictions.”

In short, tourism spending globally is recovering fast. That should benefit companies like Expedia and Booking Holdings.

The common threat: Google

Both Booking Holdings and Expedia Group compete with various online and traditional travel services providers worldwide. Along with that, players such as Google (GOOG) (GOOGL) are also entering the travel booking space. Google has started offering services such as Google Flights, Google Hotel Ads, Book on Google, and Google Travel. This is one potential competitive threat to all online travel portals, including Booking Holdings and Expedia Group brands.

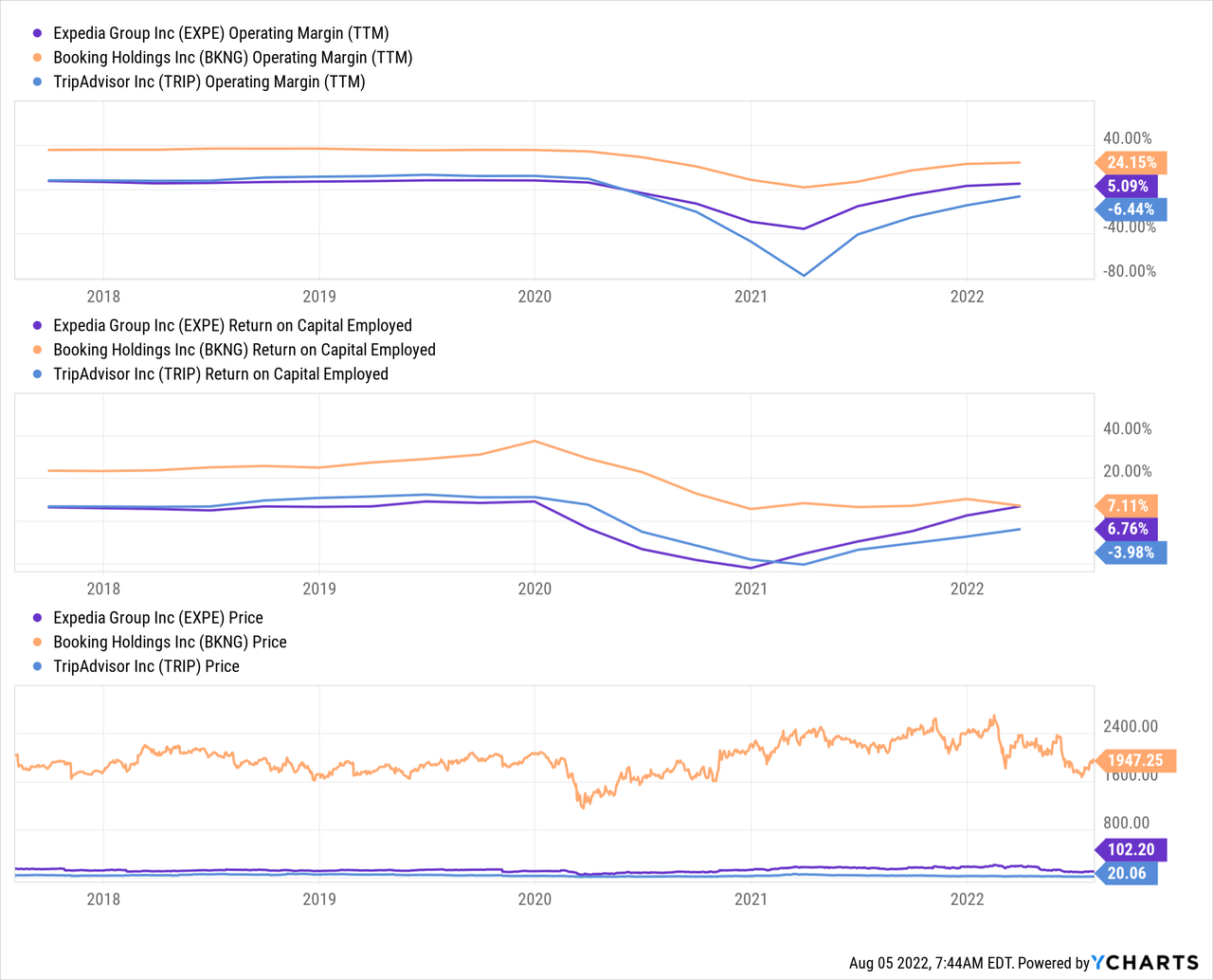

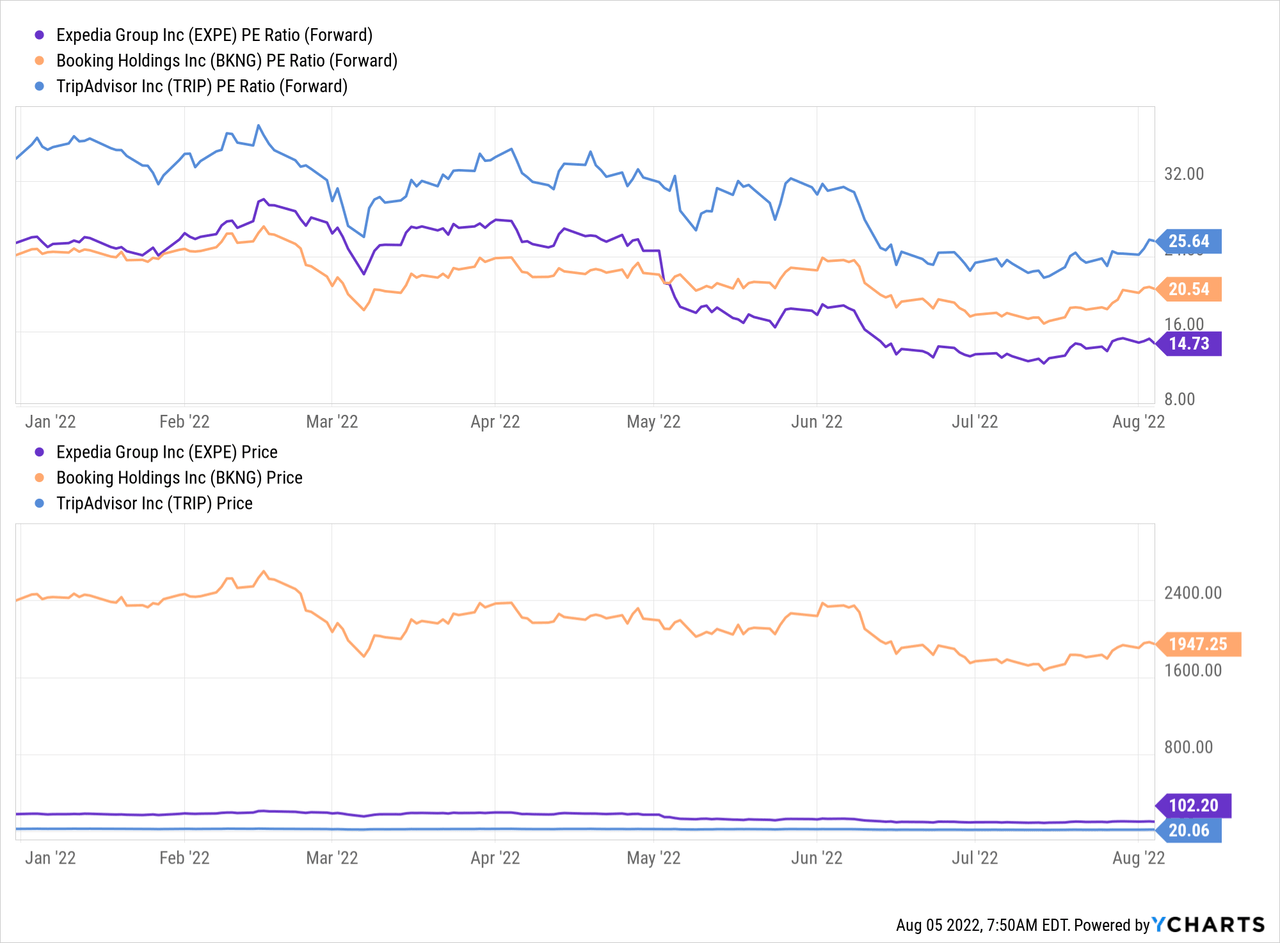

Booking Holdings has better margins

As seen in the figure below, the operating margin as well as Return on Capital Employed is improving for Expedia, but both are still below Booking Holdings’ levels. Expedia has managed to improve its profit margin and bring it in-line with Booking Holdings recently. Here we have included TripAdvisor (TRIP) too in the comparison for a broader perspective.

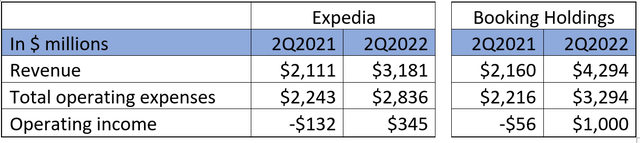

Expedia lags behind on key metrics

As seen in the table above, the revenue and operating expenses for the two companies were comparable in Q2 2021. However, Booking Holdings’ numbers in Q2 2022 grew faster than Expedia. Both have also become operationally profitable in the latest quarter, but the operating profit number for Booking Holdings is far better than that of Expedia.

In the second quarter of 2022, Expedia’s revenue stood at $3,181 million as against $2,111 million in same quarter last year, showing an increase of 50.7%. Total operating expenses for Q2 2022 stood at $2,836 million as against $2,243 million in Q2 2021, showing a growth of 26.4%. Selling and marketing, which constituents much of the operating cost (60% in Q2 2022), increased 43.1%. This component increased primarily due to an increase in direct costs driven by an increase in spend across all main marketing channels as well as B2B partner commissions. Thereby, the company posted an operating profit of $345 million in Q2 2022, as against an operating loss of $132 million in Q2 2021.

Meanwhile for Booking Holdings, total revenue nearly doubled to $4,294 million in 2Q22 as against $2,160 million in 2Q21.Total operating expense for 2Q22 stood at $3,294 million as against $2,216 million in 2Q21, showing a growth of 49%. This resulted in the company posting an operating profit of $1,000 million in the latest quarter as apposed to an operating loss of $56 million in the same quarter last year.

A deeper dive

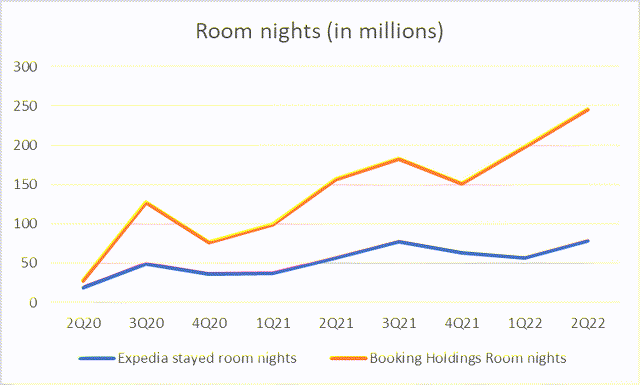

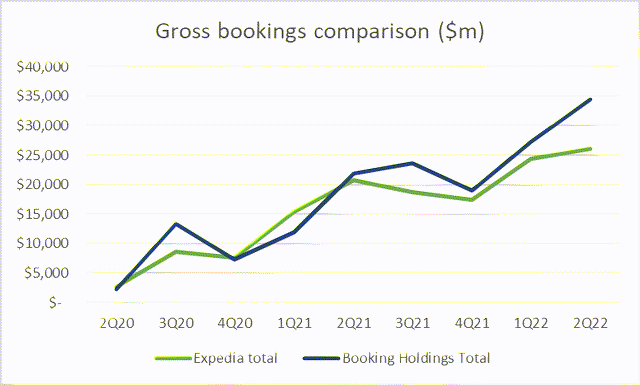

While both Expedia and Bookings Holdings had similar numbers in the second quarter of 2020, Booking Holdings has been better at improving those numbers compared to Expedia as seen in the chart below. When we compare the gross bookings for the two companies, for Expedia the number stood at $2,713 million in the second quarter of 2020 whereas the number for Booking Holdings stood at $2,306 million.

However, over the past two years, Booking Holdings’ gross bookings grew at a faster pace than Expedia’s. The gross bookings for second quarter of 2022 for Expedia stood at $26,139 million whereas the number for Booking Holdings stood at $34,545 million.

The same trend can be seen in the room nights, however here the difference is a bit more drastic. The room nights were in similar range for both the companies in the second quarter of 2020. The room nights for Expedia stood at 19.2 million in Q2 2020, whereas the number for Booking Holdings stood at 28 million. However, the numbers for the latest quarter diverged significantly. The room nights number for Expedia stood at 79.1 million, whereas that for Bookings Holdings stood at 246 million.

Booking Holdings, Expedia Booking Holdings, Expedia

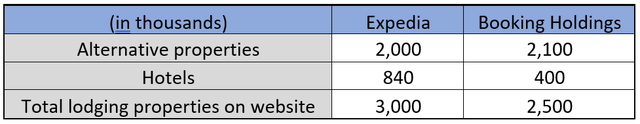

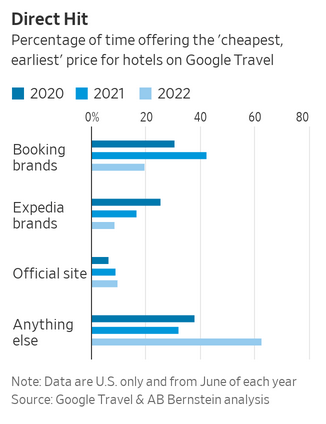

As seen in the table above, when we compare the number of properties listed on both websites, we see that Expedia has a better number. However even with more properties listing, the room nights data for Booking Holdings seems to have recovered better since Q2 2020. It seems Booking Holdings is better than Expedia at converting listings into bookings. One reason for this could be the number of times a website is able to offer the cheapest price. Consumers tend to book their accommodations after searching for the best price they can get across a range of various service providers. An analysis done by AB Bernstein analyst Richard Clarke shows the number of times Booking and Expedia offered the cheapest, earliest price for hotels on Google Travel.

The Wall Street Journal

As seen in the chart above, Booking Holdings certainly fared better than Expedia in offering the cheapest, earliest prices in all three periods. This data, though just for the U.S. only, certainly shows a clear difference to appreciate the better performance of Booking Holdings.

Seeking Alpha’s proprietary Quant Ratings rate Expedia Group stock as “hold.” It is rated high on profitability, but low on momentum.

Conclusion

No surprise then that Booking Holdings stock trades at a higher Price to Earnings ratio than Expedia Group. Quality comes at a price.

Even with a higher relative valuation than Expedia, I believe Booking Holdings would be a better prospect for long term investors than Expedia due to reasons discussed in the article.

Be the first to comment