Michael Vi

Elevator Pitch

I have a Sell rating assigned to DocuSign, Inc.’s (NASDAQ:DOCU) stock.

In my prior May 18, 2022 update for DocuSign, I highlighted that DOCU’s stock price has more than halved in the first five months or so of this year. DocuSign’s shares have continued to underperform since the publication of my previous article; its stock dropped by -26.1% in the last four months as compared to the S&P 500’s -6.5% decline over this period. With this current article, I discuss both DOCU’s short-term headwinds and catalysts, and its medium-term growth prospects as well.

In five years’ time, I think that DocuSign will command a lower valuation multiple, as its future top line growth and operating profit margins fail to impress the market. This explains why I have decided to downgrade my rating for DocuSign from a Hold to a Sell.

DocuSign Stock Key Metrics

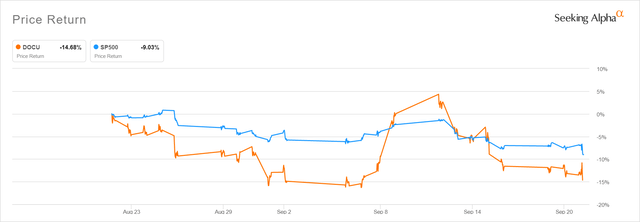

DocuSign’s shares did outperform the broader market in the next few trading days after it reported its Q2 FY 2023 (YE January 31) financial results on September 8, 2022 which exceeded market expectations. Specifically, the company’s most recent quarterly top line and bottom line were +3.3% and +4.3% higher than Wall Street’s consensus estimates, respectively. But DOCU’s stock price outperformance didn’t last long as highlighted in the share price chart presented below, which indicates that DocuSign’s stock began underperforming the S&P 500 again since mid-September.

DOCU’s One-Month Stock Price Chart

Seeking Alpha

In my opinion, DocuSign’s post-results stock price performance (initial rise and subsequent drop) is a fair reflection of DOCU’s Q2 FY 2023 results, which were mixed based on an assessment of key metrics on top of headline numbers such as revenue and earnings.

In terms of positives, DOCU delivered decent growth on a number of metrics. The company’s subscription revenue expanded by +23% YoY from $493 million in Q2 FY 2022 to $605 million for Q2 FY 2023, and this was better than the sell-side’s consensus subscription revenue growth forecast of +19% YoY as per S&P Capital IQ.

Separately, DocuSign also revealed at its Q2 FY 2023 results briefing that the company’s client base grew by +22% YoY to 1.28 million as of July 31, 2022. It is noteworthy that the number of large clients, defined as those boasting a contract value in excess of $300,000 a year, increased at an even faster rate of +39% YoY to 992 as of end-Q2 FY 2023.

On the other hand, DocuSign didn’t do as well in extracting more value from its current client base and further expanding its presence in foreign markets. DOCU’s dollar net retention rate decreased from 114% in the first quarter of fiscal 2023 to 110% in the most recent quarter. The company acknowledged at its Q2 FY 2023 investor call that the lower “dollar net retention also reflects any downsized renewals or downsides of churn.”

Also, it is worth paying attention to the fact that DOCU’s pace of growth in international markets has also slowed. DocuSign’s foreign market top line expansion moderated from +46% YoY for Q1 FY 2023 to +35% in Q2 FY 2023. Notably, Rishi Jaluria, an analyst from RBC Capital Markets, commented at DOCU’s recent quarterly earnings call that “expanding internationally” is one of the things that should be “a higher priority” for DocuSign. As such, it is clear that foreign market revenue growth is a key metric that the market watches, and the slowdown in international revenue expansion for DOCU is disappointing.

What Are DocuSign Catalysts To Watch For?

Moving on from the company’s recent quarterly results, the key DocuSign catalysts to watch for in the near term are the appointment of a new CEO and better-than-expected cost management.

A June 21, 2022 Seeking Alpha News article mentioned that former CEO Dan Springer left the company “in wake of weak earnings and outlook”, with chairman Mary Wilderotter being appointed as “interim CEO.” At the most recent quarterly earnings call, DOCU emphasized that “the search for our next CEO is a top board priority.”

One key catalyst for DocuSign will be the appointment of a permanent CEO, which will give investors a better sense of the company’s future strategy and direction.

Another significant catalyst for DOCU is in-line or better-than-expected profit margins for the company in the subsequent quarters, which relates to its cost management ability.

DocuSign achieved a non-GAAP adjusted operating profit margin of 18.0% for Q2 FY 2023, which turned out to be +120 basis points above the market’s consensus operating margin projection of 16.8% according to S&P Capital IQ’s financial data. Moreover, DOCU’s actual Q2 FY 2023 non-GAAP operating margin came in at the high end of the company’s earlier management guidance of an operating profit margin in the 16%-18% range.

DocuSign noted at its Q2 FY 2023 investor briefing that its focus is to “identify areas where our business can be further streamlined and optimized” so as to deliver its “long-term target margins of 20% to 25%.” This gives investors the confidence that DocuSign’s profit margins in the very near term should continue to meet the market’s expectations at the very least.

Is DocuSign Expected To Grow?

The expectations for DocuSign in the short-term are that the company’s top line should continue to grow albeit at a much slower pace.

The mid-point of DOCU’s Q3 FY 2023 and FY 2023 revenue guidance provided by management are $626 million and $2,476 million, respectively. This implies that DocuSign’s revenue growth will slow from +42.4% YoY in Q3 FY 2022 and +21.6% YoY in Q2 FY 2023 to +14.8% YoY for Q3 FY 2023. On a full-year basis, management sees the YoY top line expansion for DOCU moderating from +45.0% for fiscal 2022 to +17.5% in fiscal 2023.

DocuSign highlighted at the company’s most recent quarterly investor call that “there are still macro headwinds that are really on a global basis”, and it admitted that “our visibility into the business is still not what we would like it to be.”

The key question for DOCU now is whether there is more pain in store for the company based on an evaluation of DocuSign’s intermediate-term outlook, and this is the topic of the next section of this article.

Where Will DocuSign Stock Be In 5 Years?

DocuSign’s historical revenue CAGR for the fiscal 2018-2022 period was an impressive +41.9%, but I expect the company’s future top line CAGR for the FY 2023-2027 to be much lower at the mid-teens percentage level.

The company’s revenue growth deceleration is a function of both macroeconomic issues and company-specific challenges in my opinion. The declining dollar retention rate which I referred to earlier is likely to be a reflection of more intense competition from alternative eSignature products. The tougher competitive environment should lead to either a higher client churn rate or renewals executed at reduced pricing for DocuSign going forward.

With regards to profitability, I mentioned in a prior section of this article that DOCU is targeting to achieve a non-GAAP operating margin of 20%-25% in the long run. I don’t think DocuSign can reach its operating profitability goal in the next five years.

Although I recognize DocuSign’s efforts to optimize costs, the company’s future profitability might still be negatively impacted by operating leverage and an unfavorable shift in revenue mix. As the company’s top line growth moderates, negative operating leverage will naturally kick in and this will limit DOCU’s margin expansion.

Separately, the slower growth prospects for DocuSign’s core eSignature products and the US market will push the company to accelerate its growth plans in non-eSignature products and international markets. It is the right thing for DOCU to diversify its revenue base, but this might come at the expense of profitability to some extent.

A July 20, 2022 research report (not publicly available) published by Piper Sandler titled “Downgrading To UW (UnderWeight)” indicated that both “EMEA (DOCU’s largest international segment)” and “non-eSign products” are characterized by “longer sales cycles.” It is reasonable to assume that “longer sales cycles” are associated with weaker profitability, so I have a negative view of DOCU’s expected change in sales mix.

Is DOCU Stock A Buy, Sell, or Hold?

I rate DOCU’s stock as a Sell. DocuSign’s valuations aren’t aligned with its five-year outlook, so I expect more downside for its shares. The market values DOCU at a rather demanding 31.9 times consensus forward next twelve months’ normalized P/E as per S&P Capital IQ. This stands in contrast with my expectations that DOCU’s future revenue growth will slow and that the company will struggle to achieve its operating profitability target.

Be the first to comment