Ethan Miller/Getty Images Entertainment

World Wrestling Entertainment, Inc. (NYSE:WWE) is having a moment amid positive headlines following this past weekend’s annual flagship event of “WrestleMania 38” which broke revenue and attendance records for the company. It’s been quite a turnaround for WWE which faced significant disruptions during the pandemic, limiting the production of live events along with softer TV ratings. Indeed, shares of the stock have surged this year climbing by more than 25%, highlighting what is the more positive outlook and newfound mojo.

Love it or hate it, the reality is that WWE’s brand of pro-wrestling benefits from a loyal and vibrant fan base which the company has been able to leverage into a highly successful business model. We are bullish on the stock which appears to be breaking out and likely has more upside as earnings momentum accelerates going forward.

WWE Financials Recap

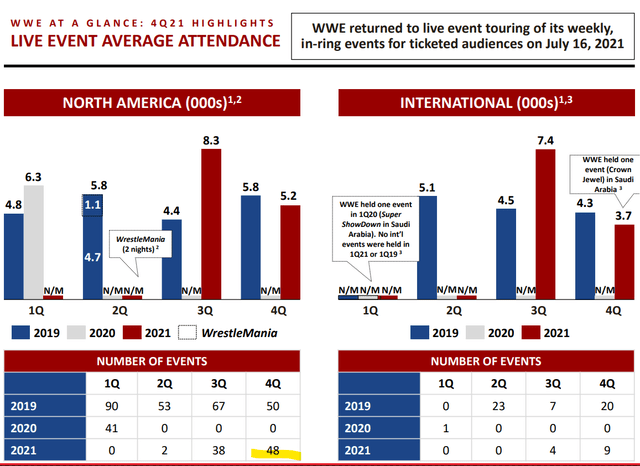

The story with WWE has been an operational turnaround amid the post-Covid “reopening” dynamic. The last reported quarter covering Q4 2021 was the first with a more normalized schedule running 48 events in North America, compared to zero in the year prior and 50 in Q4 2019. While the international segment has been slower to restart, the setup into 2022 is a return of business as usual.

source: company IR

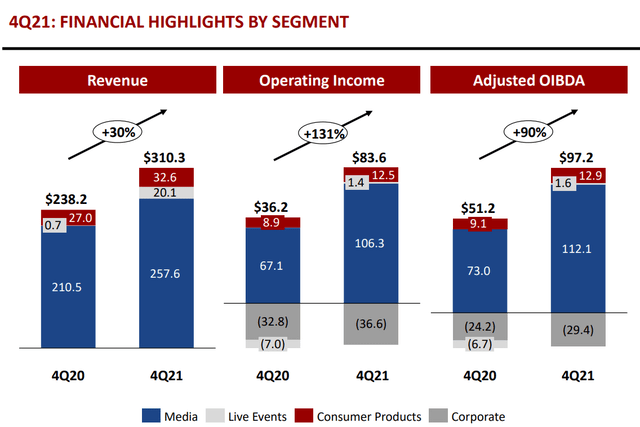

The result has been a strong recovery of financials with Q4 2021 non-GAAP EPS of $0.70, climbing from $0.24 in the period last year. Revenue of $310 million in Q4 was up 30% y/y, reaching $1.1 billion for the full year 2021. Keep in mind that over 83% of the total business is related to media content license deals across broadcast and cable television.

source: company IR

Since March of 2021, Comcast Corp. (CMCSA) NBC Universal’s “Peacock” streaming service has been the exclusive home of WWE content online. Within the media group, the business also includes a separate deal with Fox Corporation (FOX) that covers weekly events like “SmackDown”. The point here is to say that these deals have been highly lucrative and remain part of the bullish thesis for WWE stock.

As it relates to the NBCU partnership, the company notes that the Monday Night Primetime programming of “Raw” on Peacock averages about 1.7 million weekly viewers, outperforming primetime cable and viewership trends in the category. The latest WrestleMania data with a reported 156k spectators as the highest-grossing event in company history highlights that the brand is alive and well.

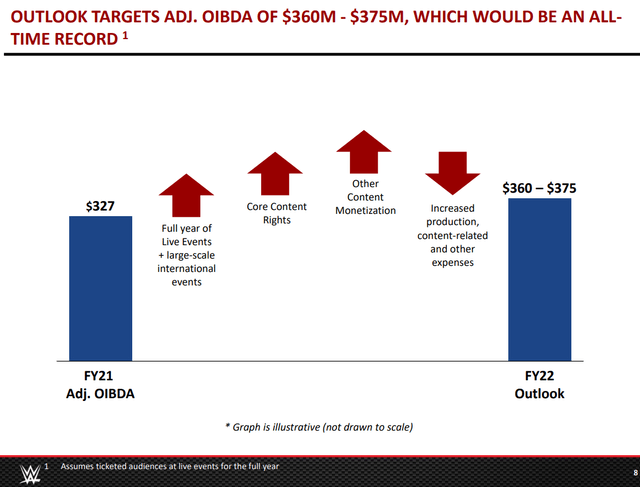

In terms of guidance, WWE uses the (OIBDA) metric which is a measure of profitability before depreciation and amortization and excludes stock-based compensation, and other non-recurring material items. Management is targeting 2022 OIBDA between $360 million and $375 million. If confirmed, at the midpoint, the estimate represents an increase of 12% compared to 2021 and also 100% higher than the 2019 result of $180 million as a pre-pandemic benchmark. In other words, WWE is more profitable than ever, due in part to its media deals.

source: company IR

WWE Stock Price Forecast

We like the price action in shares of WWE that have rallied above $60.00 and are trading near the highest level since 2019. The bullish case here is that strong operating trends through 2022, including live event ticket sales, can allow the company to outperform expectations.

While a date has not been confirmed, we believe the upcoming Q1 earnings report likely later this month could be a catalyst for shares to climb higher. One thought is that the buzz surrounding the latest WrestleMania event could provide a boost to fan engagement for upcoming events adding to the earnings trends and revisions higher.

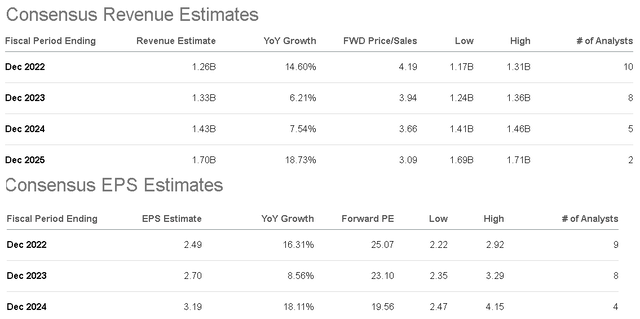

Seeking Alpha

According to consensus estimates, the market is forecasting 2022 revenue to reach $1.3 billion, up 15% over 2021. The market expects 2022 EPS to approach $2.49 while trending towards $3.19 by 2024. Looking ahead, the possibility that future media deals get negotiated at higher rates, along with international expansion opportunities adds incremental upside to these estimates. We’re looking at WWE trading at a forward P/E of 25x which we believe is a compelling valuation considering its differentiated leadership position within this niche of entertainment.

Seeking Alpha

Final Thoughts

We rate WWE as a buy with a price target of $81.00 for the year ahead, implying a 30x multiple on the current consensus 2023 EPS. The way we see it playing out is that a string of positive quarters going forward can be enough to drive some revisions higher to market estimates, which would make the stock appear cheap at the current level. Ultimately, the deal with Peacock is beneficial for both companies and particularly positive for WWE because it provides some increased visibility to the brand to a new group of viewers generating an underlying demand for the content.

A key risk would be the potential for weaker-than-expected results that would force a reassessment of the earnings outlook. Monitoring points for the rest of the year include operating metrics like TV ratings, event attendance, and the OIBDA trends.

Be the first to comment