nmlfd

AMD (NASDAQ:AMD) wasn’t supposed to crash like this. The company has reformed its balance sheet, is generating robust GAAP profits, and is an enabler of a great secular growth story in digitization. But in this tech crash, no tech stock is spared from the wrath of the markets. AMD has seen its valuation compress to more than reasonable levels, offering investors a compelling buying opportunity. While AMD is not immune to near term macro headwinds, the long term growth thesis remains intact. Buy for the growth opportunity and stay for the multiple expansion potential.

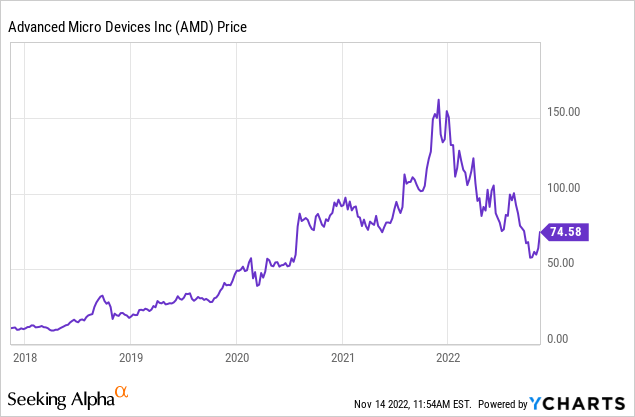

AMD Stock Price

AMD stock is down “only” 55% from all-time highs – I say that with “tongue in cheek” because many other tech stocks have fallen far more.

I last covered AMD in August where I rated the stock a buy on account of the GARP valuations. The stock has fallen 25% since then as the company revealed tangible impact from macro pressures.

AMD Stock Key Metrics

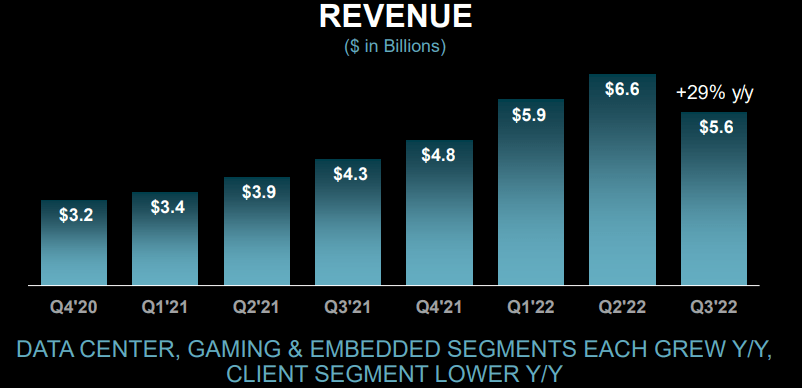

The latest quarter saw revenues grow by 29% year over year, but decline by 15% sequentially to $5.6 billion. AMD had previously guided to up to $6.7 billion in revenue – this is a big miss.

2022 Q3 Presentation

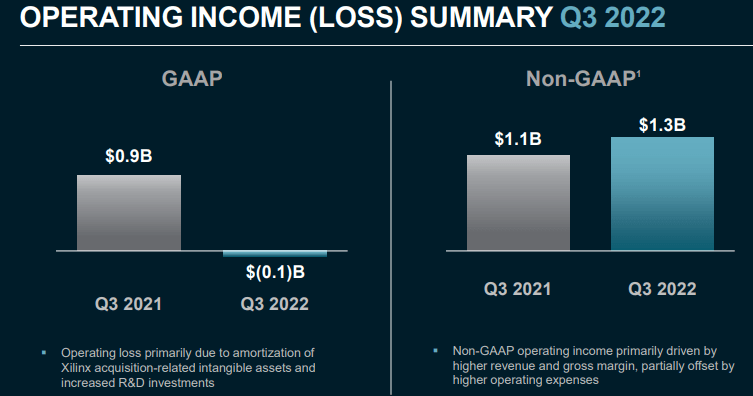

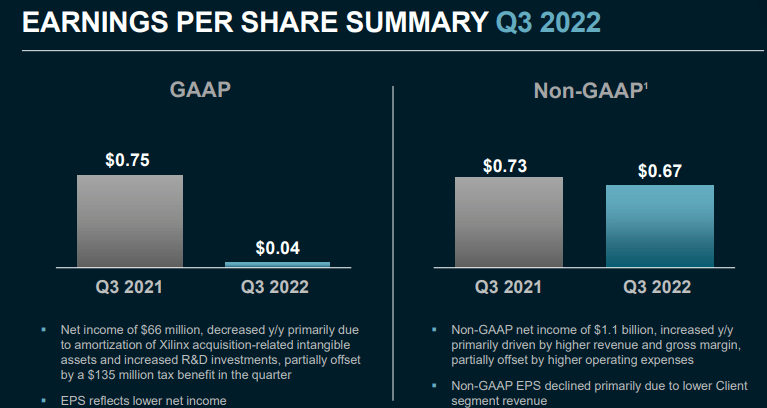

AMD saw GAAP operating margin turn negative, but that was largely due to amortization of assets acquired from Xilinx. Non-GAAP operating income jumped slightly to $1.3 billion but was still lower than the company’s guidance of $2 billion.

2022 Q3 Presentation

Investors may be surprised to see that in spite of the growth in non-GAAP operating income, non-GAAP EPS still declined by nearly 10%. This is because shares outstanding increased by 32% YOY, largely due to the shares issued to acquire Xilinx.

2022 Q3 Presentation

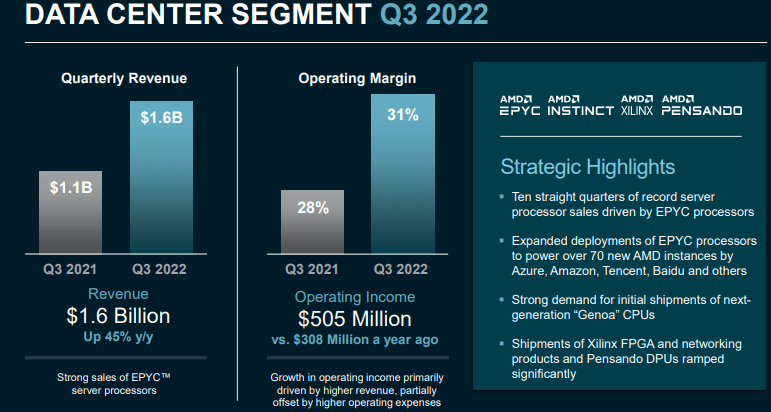

As usual, the data center segment provided the strongest results with revenues growing 45% YOY and seeing some margin expansion as well.

2022 Q3 Presentation

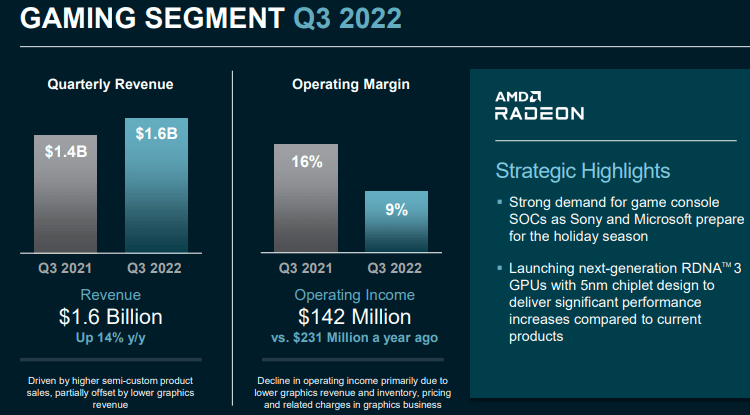

AMD did see a sizable slowdown in the gaming segment, with revenue growing by only 14% YOY and operating margin declining meaningfully. On the conference call, management noted that the margin contraction was due to price markdowns in order to right-size inventory, but they believe that they will exit the year in a “better place.”

2022 Q3 Presentation

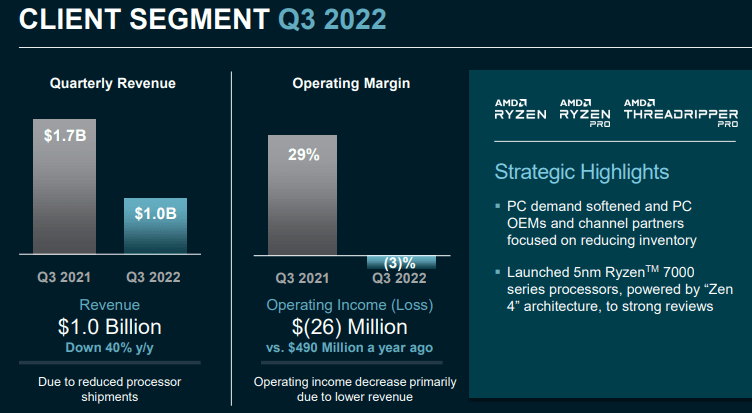

AMD saw the greatest weakness in the client segment, with revenues plunging 40% YOY and operating margin turning negative. The PC market has seen demand soften considerably as the focus is on reducing inventory.

2022 Q3 Presentation

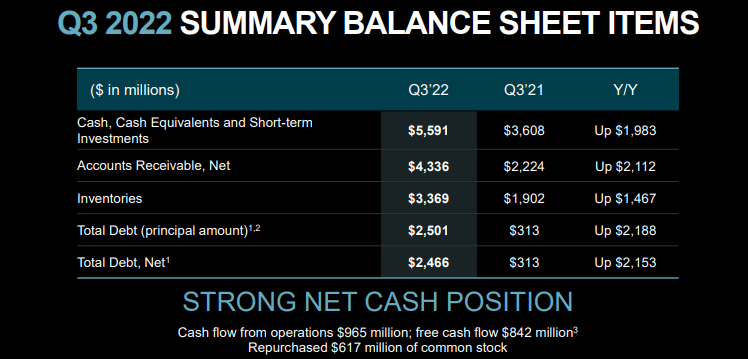

On a bright note, AMD ended the quarter with $5.6 billion of cash versus $2.5 billion of debt. That strong balance sheet position enabled the company to repurchase $617 million of stock in the quarter. It is also worth noting that AMD paid down $312 million of the 7.5% senior notes due in August which was previously its highest coupon debt outstanding.

2022 Q3 Presentation

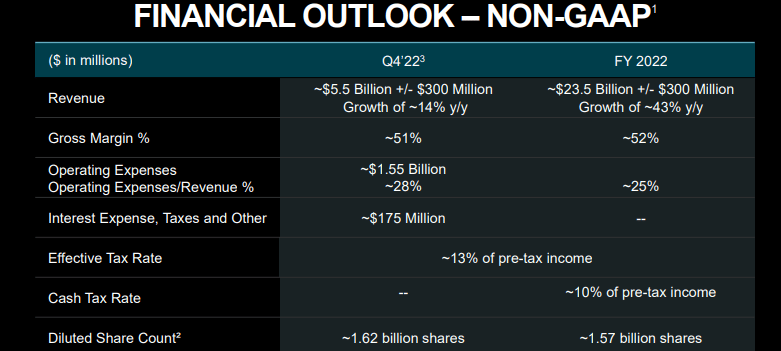

Looking ahead, AMD is now guiding for a significant growth slowdown. AMD expects revenue growth to slow to 14% and for non-GAAP EPS to decline 27% to around $0.67. I note that consensus estimates are in-line with guidance.

2022 Q3 Presentation

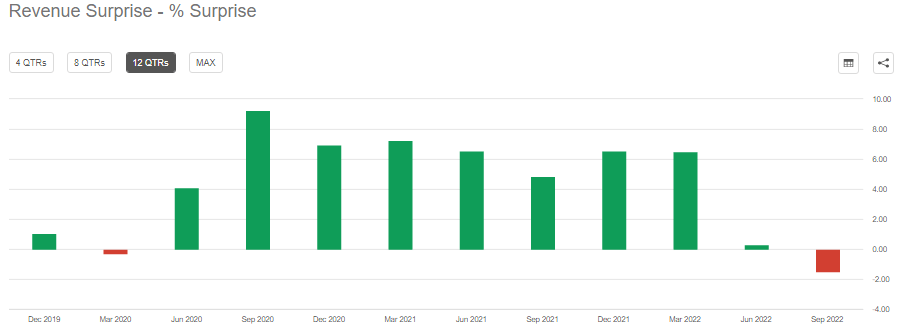

AMD has delivered sizable beats to both revenue and EPS over many recent quarters, but I wouldn’t be surprised if that stellar track record proves difficult to maintain in the current environment.

Seeking Alpha

What Are Catalysts To Watch For?

The key catalysts in the near term include the obvious ones such as a Fed pivot and a reduction in inflation. But another underappreciated catalyst is that of a recovery in China. Management noted that the cloud segment business remains very strong.

“Cloud revenue more than doubled year-over-year and increased sequentially as multiple hyperscalers expanded deployments of EPYC processors to power their internal properties and more than 70 new AMD instances were launched by Microsoft Azure, Amazon, Tencent, Baidu and others in the quarter.”

But as I stated in my previous article on Nvidia (NVDA), Chinese hyperscalers have not been investing aggressively amidst the pandemic weakness in the country. Likewise, AMD may see robust recovery in growth rates if the Chinese economy recovers faster than expected, but management is not forecasting a material recovery in 2023.

What Is The Short-Term Prediction For AMD?

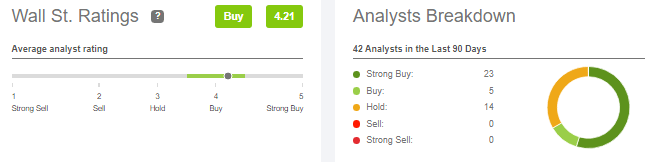

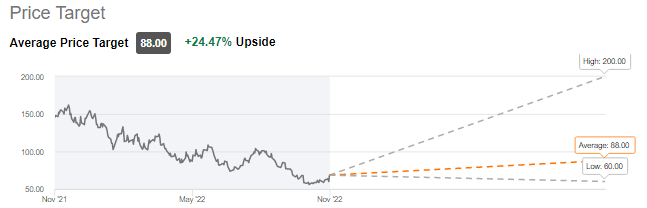

Wall Street analysts are quite bullish on the stock with an average rating of 4.21 (buy).

Seeking Alpha

The average price target of $88 per share represents 19% potential upside.

Seeking Alpha

Where Will AMD Stock Be In 5 Years?

Over the longer term, AMD remains a compelling investment on the growth of the internet of things and computing. AMD’s products are central to various secular growth stories such as cloud, artificial intelligence, 5G, gaming, and more.

2022 Q3 Presentation

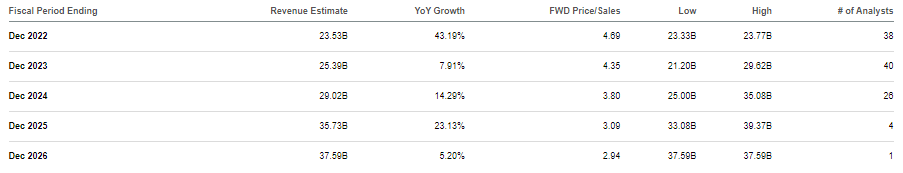

Consensus estimates show double-digit top-line growth through 2026.

Seeking Alpha

I can see AMD achieving $40 billion of revenue in 2027. Assuming 13% top-line growth, 35% net margins over the long term and a 1.5x price to earnings growth ratio (‘PEG ratio’), I could see AMD trading at a $273 billion market cap in five years, representing a stock price of $172 per share.

Is AMD Stock A Buy, Sell, Or Hold?

With the stock presenting 18% compounded return upside to that target, the stock looks attractive here. It is worth noting that AMD is not so capital intensive as CapEx has typically been in-line or less than depreciation & amortization. This is because the company relies on third party foundries like Taiwan Semiconductor (TSM) for production of its chips. That low CapEx profile means that AMD can return free cash flow to shareholders through share repurchases and eventually dividends. With the stock trading at 20x forward earnings, the aforementioned 18% potential annualized returns may be understating it as it ignores the 5% earnings yield. What’s more, due to the strong balance sheet and highly visible secular growth story, AMD may be seen as a “safe” stock and thus deserving of a premium valuation. That may cause the returns to be front-end weighted.

What are the key risks? While the competitive landscape is increasingly looking like a duopoly between AMD and NVDA, it is possible that competition emerges. Intel (INTC) has been losing market share for years but that might change in the future. It is possible that in spite of what appears to be an attractive secular growth opportunity, growth will slow as the pandemic may have pulled forward many years of growth. Insider ownership is slim with CEO Lisa Su being the largest insider at only 5.1 million shares owned. Meanwhile, the 2021 executive incentive plan used nominal metrics such as adjusted net income instead of per-share metrics, which may cause management to focus on external growth even it is not the most accretive for shareholders. Management has done a stellar job in the past so readers should not mistake this commentary as necessarily signaling a red flag. As discussed with subscribers to Best of Breed Growth Stocks, I view a diversified portfolio of beaten-down tech stocks as being the best way to take advantage of the tech crash. AMD fits right into such a basket as a higher quality allocation and is worth buying here.

Be the first to comment