dusanpetkovic/iStock via Getty Images

Investment thesis

The last time I covered FS KKR Capital Corp (NYSE:FSK) in January 2022, I rated the company as a Hold. Since then a lot of things happened, the interest rates skyrocketed and the dividend yield is almost 2% higher than during my last article. The company could be an ideal investment for income investors who do not mind the variable dividend. FSK reported great NII figures and due to the general interest rates, the fourth quarter results will likely be at least as good as the third. However, due to interest rate increases, the NAV is on the decline and I expect it to decline in the first half of 2023 as well.

Third quarter results

FSK is the 2nd largest BDC among the 48 publicly traded BDCs. The company reported solid third-quarter results. Adjusted net income per share increased significantly on both Y-o-Y and Q-o-Q basis. The company reported an adjusted NII of $0.73 per share, a 9% increase Q-o-Q and a 14% increase Y-o-Y. The strong NII growth was due to the rapid rise of interest rates. For the fourth quarter, I also expect great NII numbers because according to the management a 100-basis point move will increase the company’s net investment income by approximately $0.06 per share. In the fourth quarter, we already experienced a 75 basis point hike and another 50 basis point increase is on the table. Based on the management’s calculations if the 50 basis point hike happens the NII will grow by approximately $0.075 for the fourth quarter. The strong growth in earnings also resulted in the increase of the supplemental distribution by $0.01.

In terms of the NAV, the net asset value per share was reduced by the $0.67 per share dividend paid during the quarter and increased by $0.01 per share due to share repurchases. However, investors should note that the company’s NAV has been on the decline since the third quarter of 2021. The debt-to-equity ratio slightly increased in the third quarter of 2022 but the 1.19x is still a healthy level. The biggest challenge of FSK for the upcoming months is the new loan originations and investments. Due to the interest rate increases, it is harder to find new investments, investment activity is on the decline. I believe it is going to stay at these low levels until interest rates stop climbing. In addition, as long as the inflation remains high and interest rates stay on elevated levels the asset valuations will be under pressure causing the NAV to further decline.

U.S. Middle Market in 2023

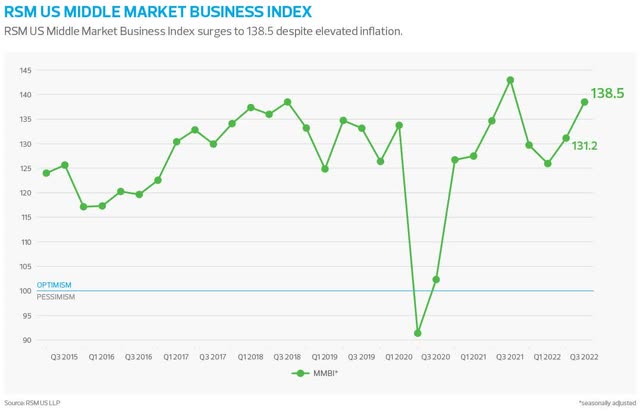

There are some major trends that investors should keep an eye on for 2023 in the middle market space. FSK invests in companies that have revenues between $10 million and $2.5 billion. Investors might think that inflation was a big issue in the second half of 2022 for middle-market companies. The vast majority of these companies passed along the price increases to their customers in the third quarter and that is why they reported great revenue figures. I believe this trend is likely to continue in the first half of 2023 when inflation will remain elevated. The middle market remained on a path for growth in the third quarter, even as the market grappled with elevated inflation.

The largest challenge they have to face is the tight labor market. Employee compensation rose to record highs and this grew the expenses of the middle market companies. However, as long as they can pass along the increased expenses to their consumers no major problem will unfold. While the first nine months of 2022 were mainly about caution due to high-interest rates which reduced M&A activity and future investments I believe 2023 will be different. The middle market companies will resume their business investments and M&A activity will pick up. This will result in more loan origination from BDCs especially with the fed’s slowing down interest rate increases due to the ease of inflation pressure. According to the latest survey among middle market business owners, 60% reported that their business revenue increased over the past six months, and 62% expect it to increase within the next 6 months as well.

In addition, the middle market companies will be ramping up their ESG initiatives in 2023. Consumer behavior is changing and nearly half of the consumers said they would like to know what a company’s ESG results are, what are the plans for a sustainable future and 54% of consumers said they would like sustainability information on labeling. Due to this consumer behavioral change companies are focusing on specific concepts now rather than broad goals.

Valuation

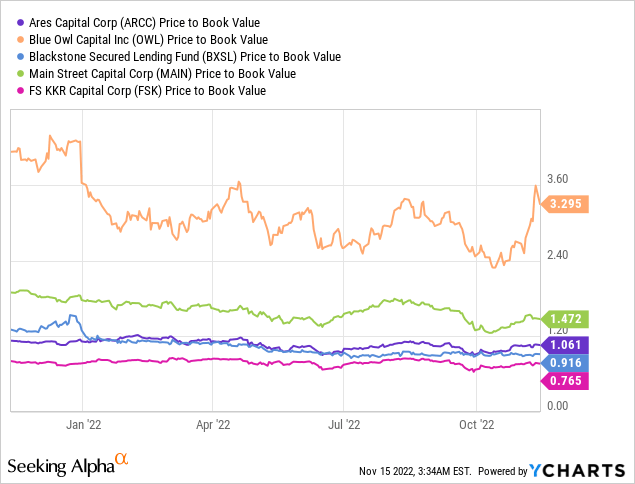

The company is trading below its book value by 23%. Its P/NAV is 0.77x which is close to its 1-year average of approximately 0.79x However, looking at the BDC sector and its 5 largest companies FSK is the best valued at the moment.

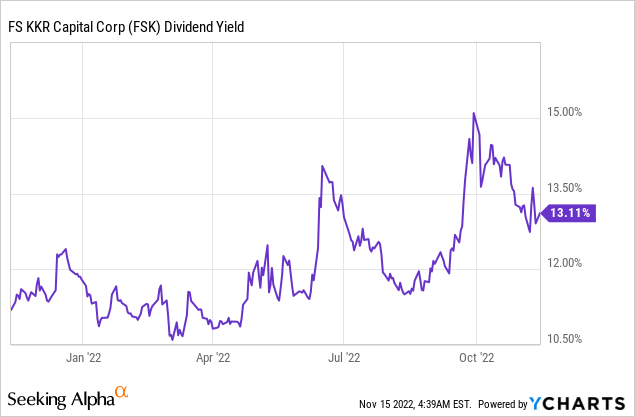

The same can be said about its earnings multiple. It is high compared to its average but low compared to its peers. Compared to its previous figures FSK’s current P/E ratio is approximately 30% higher than its 5-year average. Part of the reason is the elevated earnings due to the rapid rise of interest rates which was not the case in the last 5 years. If we want to support our valuation thesis it is worth looking at the dividend yield because a lot of investors are in BDCs due to the high yield. FSK’s current 13.11% dividend yield is among the highest since it started paying dividends in 2014 so income investors might want to get some exposure to FSK based on its yield.

Dividend policy

FSK has a variable dividend structure, which can be an attractive dividend structure from a management’s point of view because they can match the distribution to the company’s earnings stream. Due to the variable dividend structure, the management has paid out a fairly high dividend in 2022 because of its NII growth. I expect this elevated payment to continue until the second half of 2023 because of further interest rate increases. The company also plans to fulfill its share buyback program of $100 million by the end of the year. “…share repurchases, we’ve had this $100 million plan, and we intend to fill that plan. And I think we’ve been kind of clear with that sort of — and we’ve done that with probably the other $500-odd million of shares we have repurchased over the last handful of years and you should expect that in the coming quarters” – Daniel Pietrzak – Co-President & CIO.

FSK’s dividend coverage is fine, the dividend is covered especially in this interest-rate-increasing environment. Its payout ratio is approximately 80%. In addition, every year the company issues fixed income notes between $400 million to $1 billion with usually 5-year maturity. Due to the variable dividend, no dividend cut is necessary if things turn ugly but I am not concerned about dividend decreases, not in the next 9 months due to the macroeconomic factors.

Summary

As most of the middle market companies grow at a faster pace than small and large companies during the current economic downturn, FSK will remain a great choice for investors who want to get exposure to the middle market via a BDC. The great 13%+ variable dividend is attractive for income investors but the stock is rather fairly valued than undervalued. I believe the next 6 months the NII will continue to grow due to the interest rate hikes and the NAV will continue to decline. All in all, my rating remains Hold for FSK.

Be the first to comment