EHStock/iStock via Getty Images

Sub-prime lending platform OppFi (NYSE:OPFI) continues to soldier on against a hostile macro environment that has not only cut down its commons to a fraction of their previous highs. This was always to be the expected outcome for the bears who constitute the 20% short interest in the company’s float with concern heavily concentrated on OppFi’s increasingly poor balance sheet against a protracted recession. Indeed, the company’s cash and equivalents position had fallen to $14 million, a decline for six consecutive quarters from a peak of $77 million in early 2021.

However, the company’s bulls would be right to call attention to the business pivot undertaken in the summer to a customer mix heavier on individuals with higher credit ratings. This was to arrest consecutive rises in charge offs which threatened to reduce receivables that now constitute 80% of OppFi’s total assets. The tightening of the lending model has not slowed down growth with revenue for OppFi’s last reported fiscal 2022 third quarter coming in 35% higher than its year-ago figure. A lawsuit from California’s consumer finance regulator is still making its way through the court with OppFi facing charges for its lending practices in the golden state during the pandemic. The outcome of the lawsuit is yet to be decided but it heightens the risk to an already stressed balance sheet. Hence, the pivot has brought two key advantages to OppFi.

Firstly, it reduces the likelihood of further legal action, as the previous model was built on charging material rates of interest just to break even after large charge-offs. Interest on loans between $2,500 to $10,000 in California are capped at 36% plus the federal funds rate and OppFi would have faced difficulty breaking even with a rate this low for its previously targeted market segment. Secondly, the company also thinks profitability will rebound next year on the back of these changes. Delinquency rates for new and refinanced loans have already dropped markedly.

Revenue Is A Beat But Net Income Continues Fall

OppFi’s fiscal 2022 third quarter earnings saw revenue come in at $124.2 million, a 35% increase over the year-ago quarter and a huge $14.59 million beat on consensus estimates. This came on the back of net originations rising to $182.7 million, an 11% increase over its year-ago quarter. Receivables rose to $407.7 million, an increase of 39% over the comparable year-ago period.

The company’s target market continues to be 60 million US adults who lack access to traditional credit as banks rapidly cut their exposure to certain market segments in the wake of the 2008 global financial crisis. 64% of US consumers live paycheck to paycheck and 56% of adults have no savings to cover a $1,000 unplanned expense. Providing finance to these relatively underbanked individuals remains OppFi’s core target even amidst its pivot. The company charges no late or NSF fees on its loans which all come with the option for prepayment with no penalties.

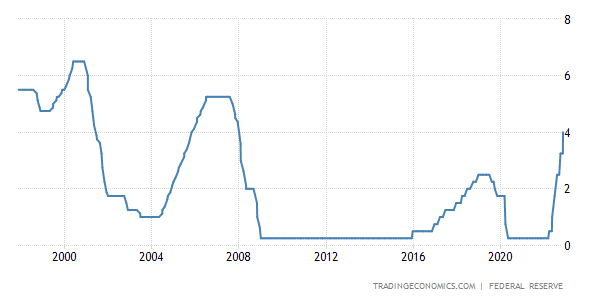

Trading Economics

Funding its receivables is the difficult part as the company is dependent on the difference between the cost of financing and the interest charged on receivables. This net interest rate spread is impacted by the rising Fed fund rate which was last hiked by 75 basis points to 4%. The capacity for the company to charge higher interest rates on its receivables will be tested by the limits of its business pivot. A rising rate environment would fundamentally increase delinquencies whilst increasing OppFi’s cost of financing.

This will be aggregated with a drop in real incomes and negative economic growth to discombobulate a business which still saw net charge-offs as per cent of average receivables at 66% for the third quarter. This was versus 36% in the year-ago period and reflected its legacy customer segments that the company cut as a result of its pivot.

A Strategic Pivot

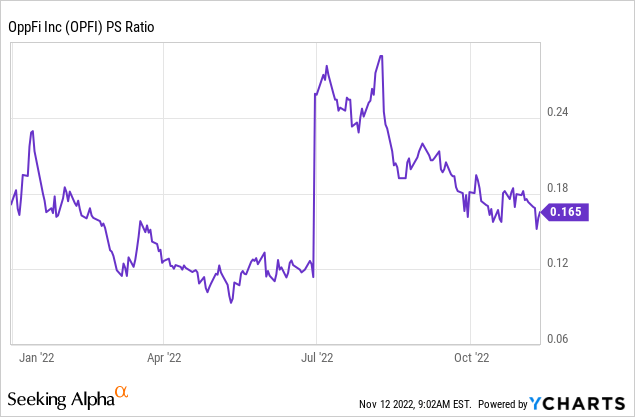

The company recorded a net loss of $700,000 for the quarter and outperformed consensus but still meant a continuation of a now six consecutive quarter trends of falling profitability. The business model was profitable in the era before rising interest rates with management hinging on its pivot to return it to this point next year with the commons down 57% year-to-date with a 0.17x PS ratio.

Bulls initially pointed to the deteriorating economic conditions as an opportunity as it would inherently boost underlying demand for its subprime products. Indeed, management in a previous earnings call stated that the macro conditions of multi-decade inflation highs and rising Fed funds rate would boost growth in originations. A point that supported a decision to launch a $20 million share buyback that is almost certainly now valued at a loss. And whilst this happened, charge-offs have skyrocketed to match.

The pivot should help OppFi stem delinquencies and returns to profitability with revenue still rising. But the near-term outlook for the common shares is not positive and OppFi isn’t a prudent investment at this time.

Be the first to comment