Elena Bionysheva-Abramova/iStock via Getty Images

It’s been a rough year for the Gold Miners Index (GDX), which has found itself down over 25% year-to-date, impacted by inflationary pressures and a weakening gold price. Unfortunately, in Wesdome’s (OTCQX:WDOFF) case, its operations have significantly underperformed expectations. This has been impacted by several items, leaving the company tracking more than 25% below its initial guidance. This is extremely disappointing for a company with a strong track record. And, given the stock’s premium multiple before these issues, it’s no surprise the stock has seen a more than 35% correction from its highs.

However, Wesdome has now found itself more than 55% from its highs, with key exploration success ignored, and one of the best times to begin scaling into new positions in miners is when they’re out of favor despite having world-class ore bodies. In the case of Eagle River and Kiena, these deposits may not have size, but they are top-5 mines from a grade standpoint in Canada, making them extremely profitable when they are running smoothly. So, if I were looking for more small-cap gold exposure, Wesdome looks very attractively valued for a small position at US$6.00.

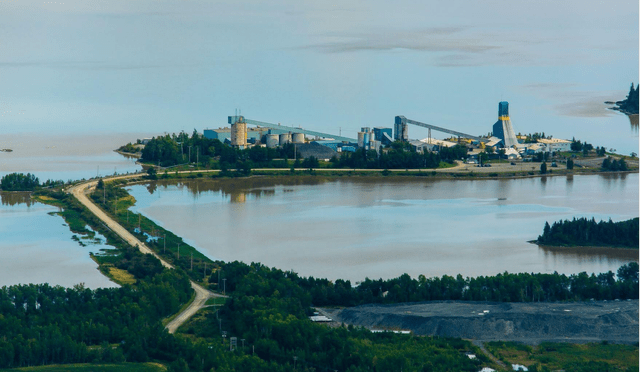

Kiena Operations (Company Report)

Q3 Results

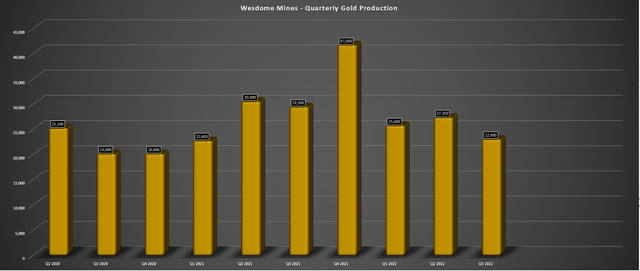

Wesdome Mines released its preliminary Q3 results last week, reporting quarterly production of ~22,900 ounces, its weakest quarter since Q4 2020, despite having a second mine online. This was attributed to a planned shutdown at each operation that led to lower tonnes processed in the period. At Kiena, much higher grades made up for much of this shortfall, but the asset still saw a 5% dip in production year-over-year. At Eagle River, grades were down sharply due to being up against tough comparisons but also related to more grade variability than expected at Falcon. The result was that Wesdome revised Eagle River’s expected grade profile to 10.5 – 11.7 grams per tonne of gold (12.1 – 13.4 grams per tonne of gold previously).

Wesdome Mines – Quarterly Gold Production (Company Filings, Author’s Chart)

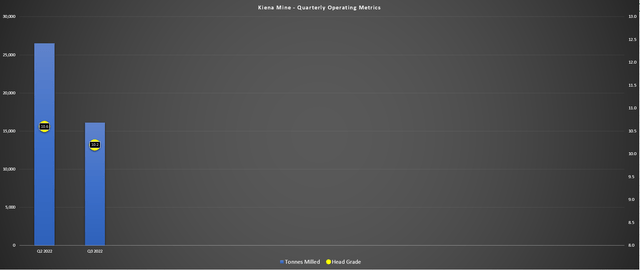

Looking closely at Kiena, we can see that the new operation processed ~16,100 tonnes in Q3, a 47% decline from the year-ago period, as July production was impacted by a shutdown for necessary hoist upgrades. For those unfamiliar, Wesdome had a hoist rope manufacturing defect that impacted mine production in the previous period, so this was already expected to be a weaker quarter. However, with difficult ground conditions and the paste fill plant not yet fully operational in Q3, mine production should improve considerably, allowing Wesdome to declare commercial production at the asset. The good news is that even if throughput was down, grades are up considerably, increasing 76% year-over-year to 10.2 grams per tonne of gold.

Kiena Mine – Quarterly Operating Metrics (Company Filings, Author’s Chart)

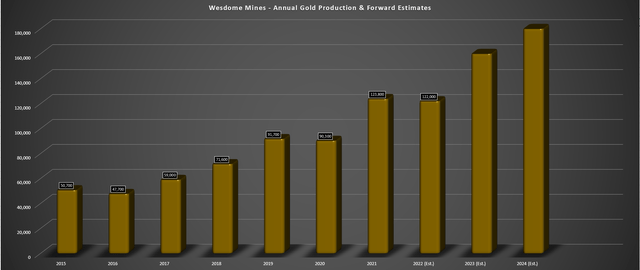

Unfortunately, while the issues appear to be in the rear-view mirror, and we should see much better cycle times once the paste fill plant is commissioned this quarter, Wesdome is miles behind its initial guidance of 160,000 to 180,000 ounces. Worse, the language has changed from updated guidance (120,000 to 140,000 ounces) being “very achievable” to “tracking towards the low end of guidance”, suggesting we could see consolidated production of fewer than 124,000 ounces this year. The result would be flat to declining production year-over-year (FY2021: 123,800 ounces), a massive deviation from the previous outlook of 37% production growth at the mid-point of initial guidance.

Wesdome Mines – Annual Gold Production & Forward Estimates (Company Filings, Author’s Chart & Estimates)

That said, these ounces aren’t lost but are simply deferred, and Wesdome should see meaningful growth over the next two years as Kiena ramps up to commercial production. Based on updated estimates of 175,000+ ounces in FY2024, Wesdome would enjoy 43% production growth (FY2022 estimates: ~122,000 ounces). This represents one of the highest growth rates sector-wide and will be coupled with margin expansion, given that Kiena will enjoy $850/oz all-in-sustaining costs even after factoring in inflationary pressures (higher labor, fuel, cyanide, and ground support costs). Compared to estimated FY2022 costs of US$1,500/oz, this will be a massive improvement, combined with lower costs at Eagle River as it moves back to a 100,000-ounce per annum rate.

Recent Developments

While the bulk of news for Wesdome has been negative, several positive developments have been ignored due to extreme pessimism in the sector and the fact that bad news tends to overshadow positive news. One of these is that Wesdome has a new Chief Operating Officer with significant experience in Frederick Mercier-Langevin, who previously spent time at two mid-sized underground operations in Canada (Lapa, Goldex), and one massive operation: Meliadine. This key appointment from an operations standpoint should help Wesdome provide more consistent future results and return to a pattern of meeting/exceeding guidance, which it had become known for pre-2022.

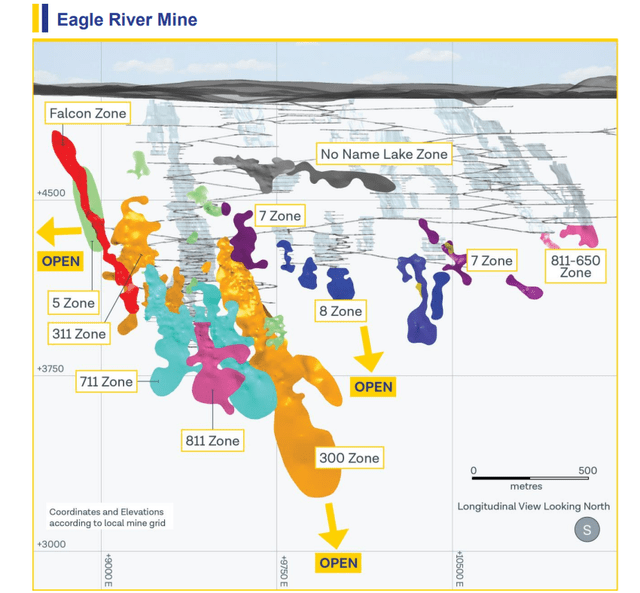

In addition, the company has continued to report exploration success from its two mines. At Eagle River, the Falcon 7 Zone discovery has highlighted the prospectivity of volcanic rocks to host additional gold mineralization beyond the Eagle River Mine’s existing footprint. In May, Wesdome defined an up-plunge extension of the Falcon 7 Zone, intersecting 2.0 meters at 26.5 grams per tonne of gold and 1.7 meters at 20.3 grams per tonne of gold. It also discovered a new lens within the mine diorite near the past-producing 8 Zone, with this area able to be drilled and developed from existing infrastructure. So, from a reserve growth and operational flexibility standpoint (Falcon is separate from main mining areas at depth), there’s reason for optimism at Eagle River.

Eagle River Mine (Company Presentation)

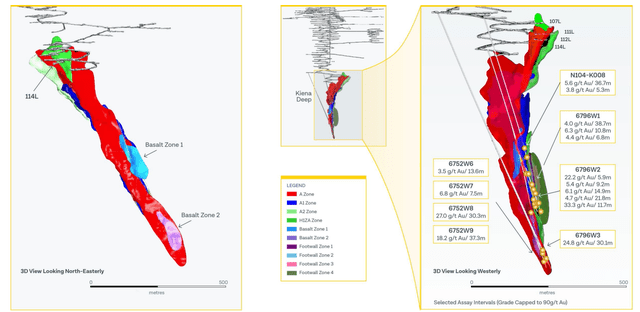

Meanwhile, at Kiena, Wesdome continues to make new discoveries, uncovering the Footwall Zones in 2021. More recently, Wesdome hit high-grade mineralization 100 meters below the A Zone resource limit, intersecting 12.4 meters at 6.2 grams per tonne of gold and 83.2 meters at 9.9 grams per tonne of gold. These are not true widths but still very impressive intercepts, suggesting the potential to increase reserves at depth. Meanwhile, the company noted that it had made a discovery of a lateral extension of the A Zone along the South limb, potentially adding more ounces per vertical meter. With Kiena having considerable additional permitted plant capacity, reserve growth here is a big deal, potentially setting this mine up to be a 160,000+ ounce producer on its own long-term.

Kiena 3D View (Company Presentation)

Valuation & Technical Picture

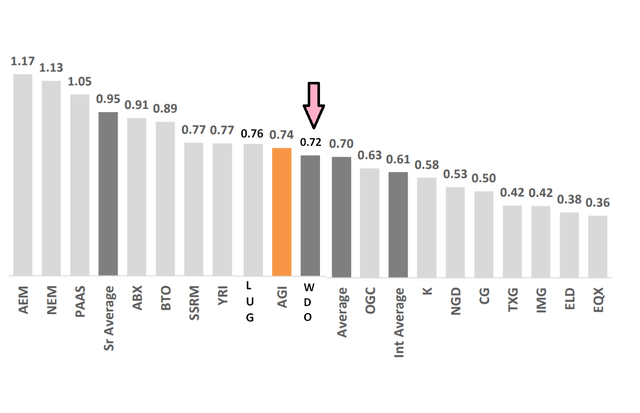

Based on ~145 million fully diluted shares and a share price of US$6.65, Wesdome trades at a market cap of $862 million. This has left Wesdome trading at a discount to its estimated net asset value of ~$1.20 billion, with Wesdome currently trading at 0.72x P/NAV. As the chart below shows, this is in line with the intermediate producer average, and this valuation remains well above some of its larger peers, such as OceanaGold (OTCPK:OCANF), Kinross (KGC), and Eldorado Gold (EGO). While this might make Wesdome look overvalued, Wesdome is a rare breed, being a solely Tier-1 jurisdiction producer with industry-leading grades and the potential for sub $900/oz all-in sustaining costs. Hence, I would expect it to trade at a premium vs. its peer group once it returns to over-delivering on promises.

Wesdome P/NAV Multiple vs. Peers (Alamos Gold Presentation, Author’s Notes/Drawing)

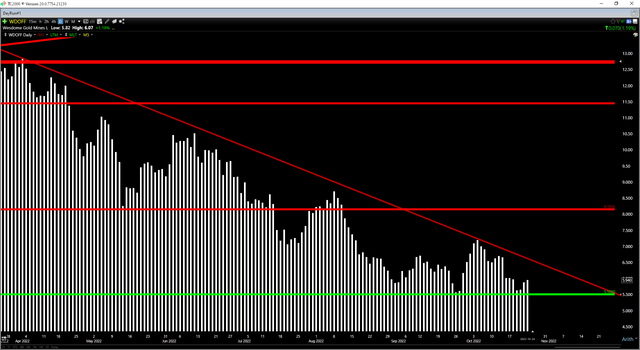

Based on what I believe to be a reasonable multiple of 1.20x P/NAV (reflecting lower multiples sector-wide offset by Wesdome’s unique position as a high-grade growth story in a Tier-1 jurisdiction), I see a fair value for the stock of US$9.95. This translates to a 68% upside from current levels, making Wesdome extremely attractive after its deep correction. Meanwhile, from a technical standpoint, Wesdome is hovering in the lower portion of its support/resistance range (US$5.50 – US$8.15), giving it a 5.0 to 1.0 reward/risk ratio. Combined with an attractive upside case, this places the odds strongly in favor of the bulls here.

WDOFF Daily Chart (TC2000.com)

All that being said, I am looking for the highest-quality names at the deepest discounts to fair value to ensure I have a significant margin of safety if we do see lower gold prices. While Wesdome is cheap at ~0.72x P/NAV, I see Karora (OTCQX:KRRGF) as even cheaper at US$1.99, where it trades at a market cap of ~$355 million as a similar-sized producer also in a Tier-1 jurisdiction. So, from a relative value standpoint, I continue to see a couple of better opportunities elsewhere, and I don’t like to overweight myself in junior producers due to their volatility. That said, if I was hunting for more gold exposure and looking for small caps, I see Wesdome as a top-12 producer and a Buy below US$6.00.

Be the first to comment