4-Your-Eyes-Only/iStock via Getty Images

By William Chang, Institutional Portfolio Manager; Ferdinand Cheuk, Portfolio Manager, Research Analyst; and Hsung Khoo, Research Analyst, Templeton Global Equity Group

Templeton Global Equity Group explores the legacy of Abenomics, the emergence of inflation in Japan, and finding value opportunities there.

While the overall success of “Abenomics”1 can be debated, the recent assassination of Japan’s longest-serving prime minister, Shinzo Abe, the namesake of this policy, comes at a time when numerous economic headwinds have emerged for Japan. Ironically, while Abenomics was aimed at trying to help the country avoid a deflationary spiral, a new challenge has emerged in the form of historically high rates of inflation, which may prove to be difficult for Japanese companies to navigate.

Since our prior update on Japan, where we examined the impact of the depreciating Japanese yen (see: The Great Wave of Yen Weakness), global inflation has continued to percolate. While we continue to find compelling investment opportunities within Japan, we would be remiss if we did not acknowledge the impact that global inflation has had on Japanese companies.

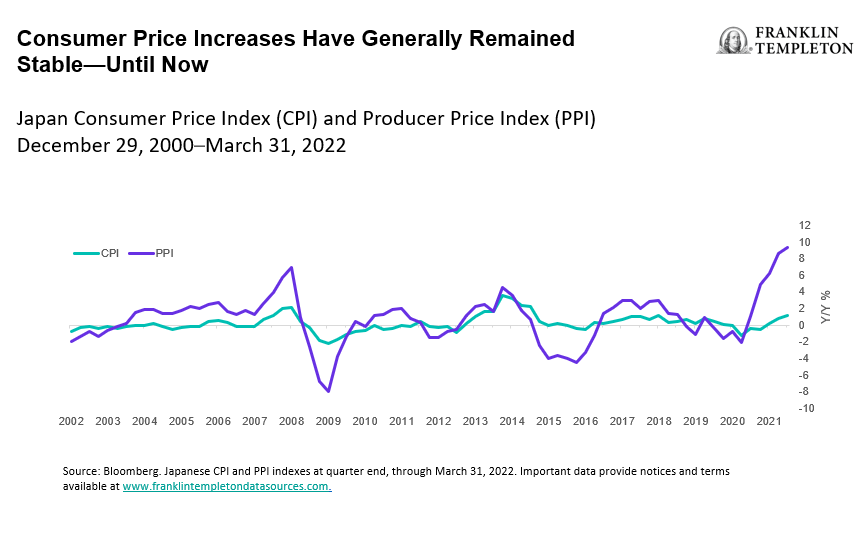

For many years, Japan’s consumer price index (CPI) and producer price index (PPI) have generally remained range-bound. During the last 20 years, producers’ costs, in absolute terms, have generally moved on average, by about 2.3% year over year (Y/Y), while consumers’ costs have, in absolute terms, moved on average, less than 1% Y/Y.

Inflation may be catching up in Japan

The aforementioned trend has changed over the past year. Higher levels of global inflation have translated into notably higher input cost inflation of almost double-digits (+9.3%) among businesses. However, the cost to consumers has only moved incrementally higher (+1.2%) in the first quarter of this year.

Put another way, the magnitude of cost increases for producers in Japan over the past year has been almost eight times the cost increase experienced by consumers—a gap that is almost double the historical norm over the last two decades. (See exhibit below.)

Bloomberg

Granted, Japan exhibits some slightly different labor cost dynamics compared to other countries. For example, wage inflation has generally been more moderate in Japan compared to the United States, due partly to the practice of “lifetime employment” (Shushin Koyo) in certain industries. But other input costs such as commodities, transport and rents remain vulnerable to inflation.

Hence the title of this paper: “Where have all the 100-yen stores gone?” The answer is that they have been forced to either raise prices or shutter their doors, because they can no longer ignore the pressure of inflation.

As the world winds down from accommodative financial conditions—which were prolonged by the COVID-19 pandemic—given all the fiscal stimulus provided by governments, there is now generally more currency to purchase fewer goods and services, and pandemic disruptions to supply chains have further compounded the issue. As a result, costs have risen, and inflation is now a global headache.

That is true of Japan as well. With the most recent PPI reading at nearly 10%—a level unprecedented since 1980—it remains to be seen whether businesses in Japan can continue to refrain from passing on the full extent of cost increases to customers. This may have an impact on market share, competitive positioning and long-term profitability.

Gems in the rough

As profit margins come under pressure, we find that these headwinds create an environment which should reward discerning investors focused on differentiating and identifying those businesses that are prepared to tackle these hurdles, and those that cannot.

While the investment environment may be challenging in the face of several macroeconomic headwinds, we at Templeton Global Equity Group concentrate on identifying companies able to consistently generate value during this volatile period and are keenly focused on structural themes that may enable Japanese companies to remain resilient both in this current environment and going forward. These include:

- Automation: In a highly inflationary environment, exacerbated by labor shortages, businesses are under growing pressure to invest in automation solutions to boost productivity. Japan offers opportunities to invest in the global leaders in most parts of the automation value chain, including reduction gears, servo motors, controllers, sensors, industrial robots and computerized numerically controlled (CNC) equipment.

- Digital transformation: COVID-19 has been a key catalyst in accelerating digital transformation in organizations worldwide due to demand for more resilient work practices, and changes in the way people live and work. Momentum for digital transformation has picked up in a post-COVID-19 world as labor shortages and an inflationary environment push governments and businesses to pursue productivity gains and new operating models. There are a number of Japanese companies with competitive positioning along the value chain which includes semiconductors, computing hardware, software and systems integrators.

- Market Leaders: The current inflationary environment, while challenging, will also help to create growth opportunities for market leaders that can help solve customer problems, gain market share from weaker competitors and consolidate industries. Market leaders are companies with strong track records of gaining market share, strong balance sheets and attractive returns on capital.

- Corporate restructurings: The corporate restructuring movement from the Abenomics era continues to provide investment opportunities. Shareholder value is unlocked and created as Japanese businesses improve governance practices, reposition business portfolios for growth opportunities, sell non-core businesses and return capital to shareholders.

- Inflationary hedges: In a world experiencing a shortage of many things, businesses who hold access to items with limited supply, or those that may benefit from rising interest rates—such as commodities, real estate and financials—may be better hedged against inflation. They may additionally offer investors a relatively defensive posture in an otherwise volatile market environment.

To sum up, while most of the world is still debating whether or not central bank actions globally will precipitate a “hard” or “soft” landing, we believe the current market in Japan offers an opportunity to purchase businesses of sound quality at discounted valuations.

A focus on longer-term global trends and valuation discipline allows us to weather the current volatility with attention to the businesses that we think will matter over a broader horizon, and construct portfolios with confidence that they will be resilient over different economic cycles.

What Are The Risks?

All investments involve risk, including possible loss of principal. The value of investments can go down as well as up, and investors may not get back the full amount invested. Stock prices fluctuate, sometimes rapidly and dramatically, due to factors affecting individual companies, particular industries or sectors, or general market conditions. Investments in foreign securities involve special risks including currency fluctuations, economic instability and political developments. Investments in emerging markets, of which frontier markets are a subset, involve heightened risks related to the same factors, in addition to those associated with these markets’ smaller size, lesser liquidity and lack of established legal, political, business and social frameworks to support securities markets. Because these frameworks are typically even less developed in frontier markets, as well as various factors including the increased potential for extreme price volatility, illiquidity, trade barriers and exchange controls, the risks associated with emerging markets are magnified in frontier markets. Bond prices generally move in the opposite direction of interest rates. Thus, as prices of bonds in an investment portfolio adjust to a rise in interest rates, the value of the portfolio may decline.

1. The framework of stimulus and economic reforms intended to help Japan tackle the challenge of deflation and stimulate economic growth under former Prime Minister Shinzo Abe.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment