sefa ozel

In 2008, at the start of the Great Recession, the iPhone was in its infancy, with the first generation having only just been released in June 2007, while the MacBook series was also in its early days, launching in February 2006. These revolutionary products came out right before the largest financial crash the world had seen in a long time.

But despite the chaos of the world surrounding the firm, 2008 marked the beginning of some of the most numerous and innovative product releases in Apple’s (NASDAQ:AAPL) history, constantly reinventing its product line and disrupting itself!

And with this backdrop in mind, Apple now faces a new era of challenges as the Fed battles rising inflation by hiking rates that may well drive the US into a recession, amid the Great Resignation with firms struggling to attract or retain talent, the war in Ukraine causing chaos in oil and food prices, and COVID. The world could really do with some more 2008 Apple right about now.

So let’s delve into Apple and review how the firm is placed to tackle a recession this time around.

Ranking Recession Readiness is a series of articles I’m authoring based on academic research along with advice from business leaders who took their firms through the Great Recession of 2008, to help investors identify which top 100 US firms are positioned to strive through a downturn, and which firms will stumble.

A full breakdown of the methodology and explanation behind the calculations is available in my introductory article, Ranking Recession Readiness: Is Google Prepared For The Recession?

(Data & prices correct as of pre-market 13th July, 2022)

(The Top 100 US Firms referred to can be found on this Seeking Alpha screener)

Want to skip the articles and dive right into the data? You can download my data and calculations here and see how the Top 100 US Firms compare on Recession Preparedness

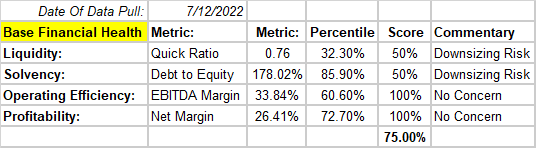

Apple’s Base Financial Health

Starting with Apple’s overall financial health, we’ll take a peek under the hood to see how Apple is performing currently in today’s economic climate compared to the Top 100 US Firms.

Seeking Alpha

We’re not off to a great start with Apple unfortunately, with a quick ratio well below its peers and a lot more debt than most blue-chip stocks. In the context of a prolonged and deep recession and compared to the peer group, I have to rate Apple’s quick-ratio and debt to equity ratios as downsizing risks to the firm.

Turning to profitability, there are no issues here, with margins leading the peer group.

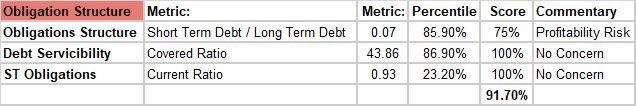

Next we’ll look closely at Apple’s obligations structure.

Seeking Alpha

A 7% ST Debt to LT Debt ratio is not significant in most cases, but as you’ll see above it’s significantly more than most firms in the top 100 list hold, so I will have to penalise Apple slightly here, though I don’t hold any grave concerns about it.

Further, these debts are most certainly well serviced with a covered ratio of 43, keeping in mind the significant size, and a quick ratio of 0.93 shouldn’t keep us up at night.

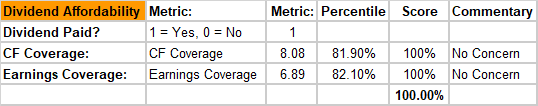

Next is Apple’s dividend.

Seeking Alpha

There’s not much to see here, given the dividends are well covered by both cash flow and earnings, there’s “no-comment” other than “no concern”.

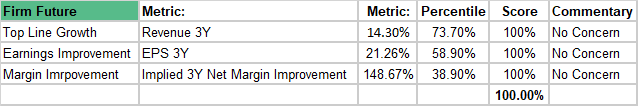

Lastly, the future outlook for Apple.

Seeking Alpha

Again, some solid numbers here, with market leading revenue growth forecasts and a good average earnings improvement. Despite being considered a low margin improvement score for the peer group, I doubt I will have Seeking Alpha readers chase me with pitchforks if I call a 148% net margin improvement “not concerning”.

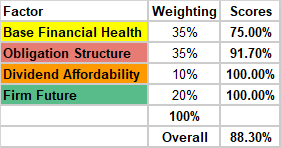

Lastly, we bring all the scores together, apply weights and see an overall picture for Apple.

Seeking Alpha

88.3% is a very respectable and passable score, though I note some risk areas including Apple’s quick ratio and debt to equity which significantly drag down the overall score. But on the whole, no concern in the current climate.

Now let’s dig a little deeper into how prepared Apple is for a recession based on the advice from the 2008 Great Recession.

Assessing Apple’s Recession Preparedness

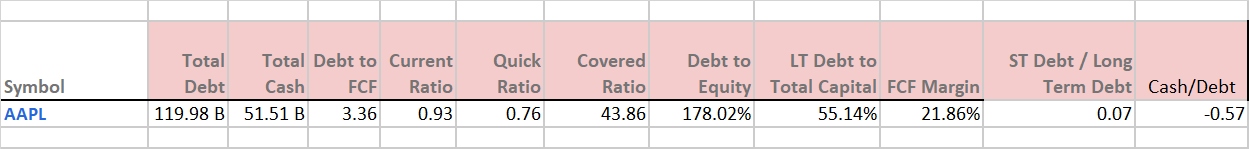

Starting with an overview of the balance sheet, we look at the key metrics for addressing the debt and cash components of the advice from 2008.

Seeking Alpha

Straight off the bat we see our significant debt component, followed by a cash balance not sufficient to pay out the debt should the firm need to do so in a hurry.

There’s not much here to break down into too much detail, but seeing the quick ratio alongside a nearly $120B debt does make me pause to consider the gravity of a “worst case scenario”.

So let’s score those metrics relative to the peer group, weight them, and then see how things look.

Author

As expected, the sizable debt on the balance sheet along with the poor performing quick ratio drags Apple’s Recession Readiness Score down significantly, and unfortunately the cash balance is not sufficient to improve the score dramatically.

This leads to a recession readiness score of -19.23%, indicating that Apple is underprepared for a significant downturn compared to its peers, based on the advice post-2008 Great Recession.

But Apple is more than just a balance sheet. So let’s break down a more qualitative view of the firm and assess the recession narrative from other angles.

A Deeper Dive Into Apple’s Recession Readiness

From the main themes of advice from 2008, we’ve well and truly covered the discussion around debt levels and cash, so let’s look at the more nuanced points of advice surrounding managing the firm on a detailed level.

A major concern for firms through a recession is selling products to customers who can’t afford to pay for them, and so as part of preparing for a recession, firms should minimise their accounts receivables.

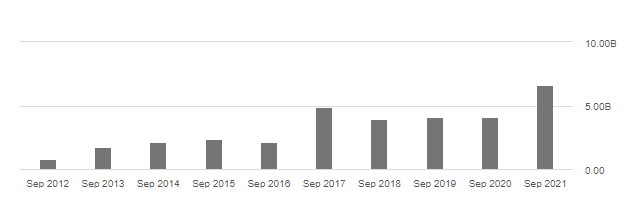

Apple’s total receivables figure has grown largely in line with revenue growth, so while a growth story is generally considered a positive, here we see exposure to Apple’s customer’s financials.

At $45.4B, this sum represents 38.4% of total current assets, and 12.9% of total assets.

AAPL total accounts receivable (Seeking Alpha)

The next piece of advice surrounds reducing inventory, as firms do not want to be holding excess stock due to the added costs, while sales revenue is lower.

Apple has a relatively modest inventory level, with $5.46B in inventory, representing 4.6% of total current assets and 1.5% of total assets.

AAPL inventory (Seeking Alpha)

These two elements combined (receivables + inventory) equal 43% of total current assets, and 14.4% of total assets for Apple. This a little risky, and in the event of a serious and prolonged recession could be the source of lost equity for the firm.

The next piece of advice was centered around cutting operating costs aggressively, while avoiding layoffs of staff, due to the cost of hiring and training once the firm is ready to grow again.

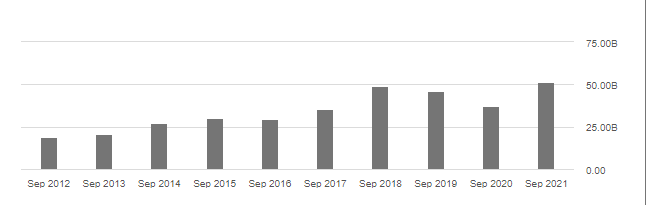

For Apple, there’s very little risk here in my eyes, with 154,000 employees, the firm is generating $2,506,603 in revenue per employee, and $661,915 in profit per employee. I see no reason for Apple to consider the need for layoffs given the efficiency of its staffing numbers, save for a catastrophic recession scenario.

AAPL Total Employees (Seeking Alpha)

The final piece of advice is difficult to find quantitative metrics for, but was nonetheless wise. A learning from 2008 was for firms to take the opportunity to invest heavily during a recession, due to the lower opportunity cost of capital while in a downturn.

While I can’t point to any meaningful or compelling data, I can use history as a guide, and review a pipeline of projects.

Firstly, although most people credit Steve Jobs for the success of Apple during this time, the 2008 Great Recession was a fantastic period for the business as a whole which created a marvelous list of innovative and successful products. Apple is a tech company which by its very nature is innovative, and I have no doubt that the firm has the resources and risk tolerance to invest in new projects during a downturn in order to come out stronger.

Perhaps they might scale up some exciting projects like new wearable tech, or even upscale investment into an Apple Car, to bring it to market faster.

But as far as general attitudes to investing in a recession, I have no doubts here around Apple being open to expanding CAPEX in tough times.

Closing Remarks

Unfortunately for Apple, I certainly cannot see the firm as a recommended safe haven for investors to place their capital if they were looking to park their money in safe companies headed into a recession.

For current holders assessing their portfolios and thinking about reallocating risk in the top 100 firms, I would say Apple is slightly more exposed to recession risks than most firms in the top 100, given the sizable debts, insufficient cash stockpile, oversized total receivables and inventory. There are safer opportunities than Apple heading into a recession, and so I give the firm a weak sell recommendation.

If you’re looking for additional analysis, more focused on DCF modelling than mine, I found this great piece on Seeking Alpha worth looking at, that rated AAPL a HOLD. The author takes a view of Apple as a great dividend growth investment, a view which I would agree with, though we diverge on our opinions of the balance sheet.

If you have any questions or would like to see any particular Top 100 US Firms assessed for their recession readiness, please leave a comment and let me know (I always do my best to monitor and respond to genuine comments!).

Be the first to comment