peterschreiber.media

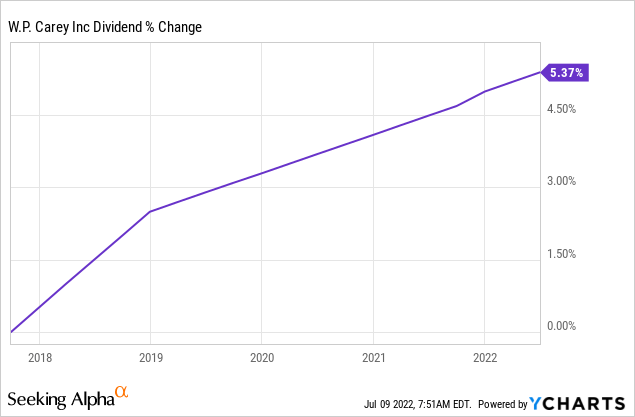

W.P. Carey (NYSE:WPC) has always been known for its stalwart portfolio of high-quality triple net lease properties, high yield, and solid balance sheet. However, despite arguably weathering COVID-19 better than anyone else in the net lease sector, dividend growth has been lackluster for years:

While many investors love the asset portfolio, geographic diversification between the U.S. and Europe, the excellent long-term track record, the investment grade balance sheet, and the rock-solid 5%+ dividend yield that WPC has to offer, they simply cannot get past the anemic dividend growth, especially at a time when inflation is skyrocketing. In this article, we will take a look at when investors might expect to see an acceleration in dividend growth to help them make a more informed decision about whether or not an investment in WPC would make sense for them.

Current Growth Drivers

WPC’s cash flow growth is being driven by three major factors right now:

- They have effectively exited the asset management business. This transition process has weighed heavily on AFFO per share growth in recent years, as growth in the real estate portfolio has been partially offset by declining cash flows in the asset management business. With this complete, WPC’s real estate cash flow growth will now be able to flow through to the bottom line without facing offsetting declines elsewhere.

- Management is acquiring new properties at a rapid clip. WPC is on track to achieve its target 2022 acquisition volume range of $1.5 billion to $2 billion, with ~$308 million of investments completed in Q1 and another ~$400 million of investments secured since then. This acquisition guidance does not include the roughly $2 billion in real estate WPC is set to add to its owned portfolio from the merger with CPA:18 later this year. AFFO/share in Q1 increased 10.7% YoY, demonstrating the REIT’s ability to grow once it gets beyond the temporary blip from foregone investment management fees.

- WPC is arguably the most inflation-protected net lease REIT, having nearly 60% of its ABR coming from leases with CPI-based rent escalations and 40% of it coming from uncapped CPI-based rent escalations. In Q1, same-store contractual rent grew 2.7% YoY, compared to the quarterly range of 1.5% to 2.2% going back to the beginning of 2019. While this doesn’t fully keep pace with 7-8.5% rates of inflation, it does a lot better than the average net lease REIT’s 1.5% average annual escalation. Given that it typically takes up to a year for CPI-linked rent escalators to flow to the bottom line, WPC is set to see this same-store sales growth improve even more moving forward.

WPC’s Dividend Policy

Last year, we interviewed WPC management and asked them about their dividend policy. This is what they had to say:

In recent years we have slowed our dividend growth in order to grow into our dividend payout and get our payout ratio down to a level that provides better balance between retained cash flows and paying out a meaningful dividend to shareholders. We believe we are now at that point. As a result, I would expect dividend growth to be in-line with AFFO per share growth moving forward.

Between our low cost of debt and strong balance sheet, share price trading at a reasonable premium to NAV, and current level of retained cash flows, we should have plenty of capital available to fund our investment pipeline without having to slow dividend growth below AFFO per share growth.

We plan to continue prioritizing consistent dividend growth to keep our annual dividend streak going. Obviously in recent years our dividend increases have been more token to keep our streak alive rather than meaningful increases.

Given that our cash flows are tied more closely to inflation than our peers’ are, it stands to reason that our dividend growth will therefore be at least somewhat correlated with inflation moving forward. With CPI up sharply this year – even if it turns out to be transitory – our baseline will reset higher next year on many leases, so we should see a nice extra boost to our rent baseline in the 2022-2023 period.

There are a lot of moving parts impacting the AFFO per share in any given year, but as we already mentioned, over the next five years we expect to see meaningful growth in AFFO per share. You can infer from that what you will.

What management is saying here is that they have slowed dividend growth in recent years to bring down the payout ratio in order to increase the amount of retained cash flow to a point that would make them a little less dependent on equity markets to fund acquisitions. Given the market volatility, rising interest rates, and record-setting pace of acquisitions that they have pursued last year and thus far in 2022, this approach seems quite prudent.

Now that they have successfully brought their payout ratio within their target range – and with inflation rates set to drive increased cash flow from their CPI-linked leases – it appears WPC is on the cusp of accelerating their dividend growth.

Future Headwinds

That said, it is not all clear sailing ahead, as WPC still has some potentially significant speed bumps ahead. While WPC has managed to offset much of the loss of income from the CPA-Global 18 asset management fund by outright acquiring the asset, it still has to face the lease maturities to U-Haul and Marriott (MAR) in 2024. Management had this to say in our recent interview with them:

Regarding U-Haul, we fully expect them to exercise their inflation-linked option to repurchase those assets at the expiration of the lease. We obviously can see this coming, though, so we will have new assets lined up by then in order to eliminate the drag between the sale of those assets and redeploying the capital. However, we will likely still suffer some reduction in AFFO per share from that transaction as the option contract will likely work out such that U-Haul will be able to repurchase those properties at an 8%-12% cap rate. Obviously, under current market conditions with the caliber of assets and markets that we are looking to purchase real estate in, our cap rates are in the 5%-7% range, so there will be a hit to AFFO per share from that transaction.

The Marriott lease expiration is one which we expect to be immaterial. First of all, only one-third of our rent from Marriott expires in 2024 and we feel like we have a decent chance to resign the lease. Even if the hotel market is weak in 2024 and we are unable to resign the lease on attractive terms, we have prior experience operating hotels ourselves, so in a worst-case scenario we will just operate those assets until we can opportunistically sell them. Overall, we do not expect much of a hit to AFFO per share – if any – from the Marriott situation.

Investor Takeaway

So, when can shareholders expect WPC to finally accelerate its dividend per share growth rate? Well, thus far in 2022 – despite inflation soaring and the acquisition pipeline booming – it does not appear that management has any sense of urgency to do so, with the latest quarterly hike being a meager 0.2%. The likely reasons for that are stubbornly low cap rates on properties alongside soaring interest rates which increase WPC’s cost of capital, as well as considerable market volatility that could threaten WPC’s ability to issue equity on an attractive basis in the future. Furthermore, they just acquired CPA-Global 18, so management is probably digesting that acquisition and needing to retain as much capital as possible to help pay for it.

Once these headwinds are fully processed and the CPI-linked escalators fully kick in later this year/early 2023, WPC will likely feel free to begin accelerating dividend per share growth. That said, investors should not expect too much excitement on that front until after the U-Haul and Marriott lease expirations in 2024 as those also figure to weigh on AFFO per share growth. I would expect WPC to accelerate annualized dividend per share growth to 3-4% in 2023 and 2024 and then – depending on the status of the growth pipeline and inflation rates in the coming years – potentially accelerate it further into the mid to high single digit range.

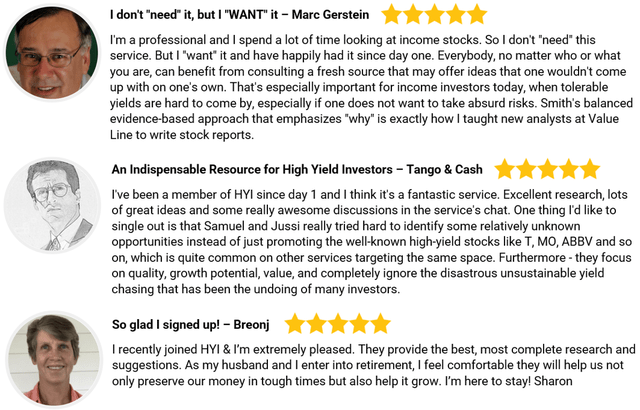

If you want access to our Portfolio that has crushed the market since inception and all our current Top Picks, join us for a 2-week free trial at High Yield Investor.

We are the fastest growing high yield-seeking investment service on Seeking Alpha with ~1,350 members on board and a perfect 5/5 rating from 145 reviews.

Our members are profiting from our high-yielding strategies, and you can join them today at our lowest rate ever offered.

You won’t be charged a penny during the free trial, so you have nothing to lose and everything to gain.

Be the first to comment