RHJ

Precious metals royalty and streaming companies represent a very interesting sub-industry of the precious metals mining industry. They provide some leverage to the growing metals prices, similar to the typical mining companies; however, they are less risky in comparison to them. Their incomes are derived from royalty and streaming agreements. Under a metal streaming agreement, the streaming company provides an upfront payment to acquire the right to future deliveries of a predefined percentage of metal production of a mining operation.

The streaming company also pays some ongoing payments that are usually well below the market price of the metal. They can be set as a fixed sum (e.g., $300/toz gold) or as a percentage (e.g., 20% of the prevailing gold price), or a combination of both (e.g., the lower of a) $300/toz gold and b) 20% of the prevailing gold price). The royalties usually apply to a small fraction of the mining project production (usually 1-3%), and they are not connected with ongoing payments. They can have various forms, but the most common is a small percentage of the net smelter return (“NSR”). The NSR is calculated as revenues from the sale of the mined products minus transportation and refining costs.

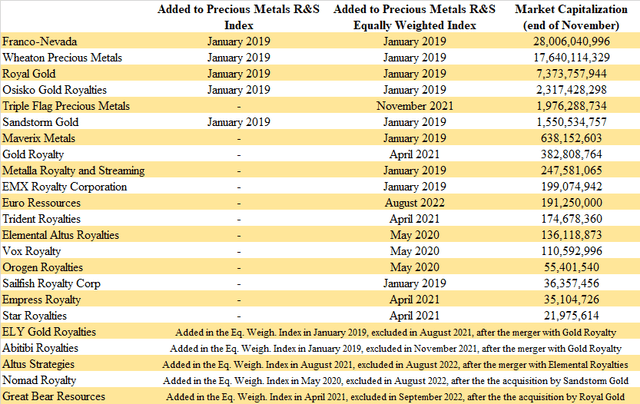

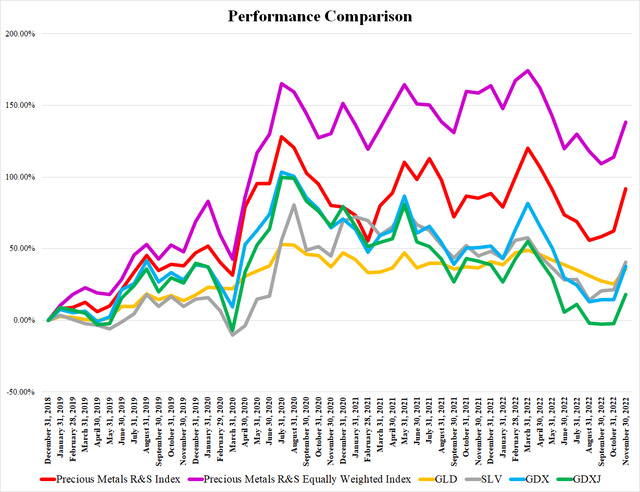

To better track the overall performance of the whole sub-industry, I created a capitalization-weighted index (the Precious Metals Royalty and Streaming Index) consisting of 11 companies (in June 2020, expanded to 15). Later, based on the inquiries of readers, I also introduced an equal-weighted version of the index. Until March 2021, both indices included the same companies and were calculated back to January 2019.

However, some major changes occurred in April 2021. Due to the boom of the royalty and streaming industry and the emergence of many new companies, the indices experienced two major changes. First of all, the market capitalization-weighted index was modified to include only the 5 biggest companies: Franco-Nevada (FNV), Wheaton Precious Metals (WPM), Royal Gold (RGLD), Osisko Gold Royalties (OR), and Sandstorm Gold (SAND). The combined weight of these 5 companies on the old index was around 95%, therefore, the small companies had only a negligible impact on their performance. The values of the index were re-calculated back to January 2019, and between January 2019 and March 2021, the difference in the overall performance of the old and the new index was only 2.29 percentage points. The second change is related to the equally weighted index that was expanded to 20 companies.

The previous editions of the monthly report can be found here: May 2019, June 2019, July 2019, August 2019, September 2019, October 2019, November 2019, December 2019, January 2020, February 2020, March 2020, April 2020, May 2020, June 2020, July 2020, August 2020, September 2020, October 2020, November 2020, December 2020, January 2021, February 2021, March 2021, April 2021, May 2021, June 2021, July 2021, August 2021, September 2021 (extended), October 2021 (extended), November 2021 (extended), December 2021 (extended), January 2022 (extended), February 2022 (extended), March 2022 (extended), April 2022 (extended), May 2022 (extended), June 2022, June 2022 (extended), July 2022, July 2022 (extended), August 2022, August 2022 (extended), September 2022, September 2022 (extended), October 2022, October 2022 (extended), November 2022 (extended).

Compared to October, the market capitalization of the big three (Franco-Nevada, Wheaton Precious Metals, Royal Gold) increased by $8.35 billion, to more than $53 billion. The three companies now represent more than 93% of the industry by market capitalization. No major movements occurred in the ranking; the industry is dominated by Franco-Nevada with a market capitalization of more than $28 billion. For comparison, the smallest company, Star Royalties (OTCQX:STRFF), has a market capitalization of less than $22 million.

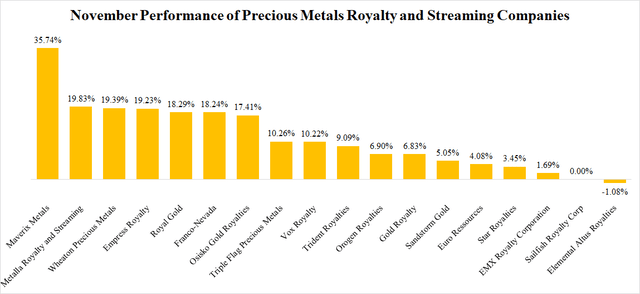

The month of November was really great for the precious metals R&S industry. Only Elemental Altus Royalties (OTCQX:ELEMF) recorded a share price decline (-1.08%) and Sailfish (OTCQX:SROYF) remained flat. All the other companies experienced growth. As many as 9 companies grew by more than 10%, and out of them, 5 grew by nearly 20%. This group includes also Franco-Nevada (18.24%), Royal Gold (18.29%), and Wheaton Precious Metals (19.39%). But the best performance was recorded by Maverix Metals (MMX). Its share price grew by more than 35%, fueled by the announcement of its acquisition by Triple Flag Precious Metals (TFPM). Empress Royalty (OTCQB:EMPYF) which grew by more than 50% in October, experienced another great month, growing by 19.23%.

In November, the precious metals prices did well. The share price of the SPDR Gold Trust ETF (GLD) grew by 8.49%, and the share price of the iShares Silver Trust ETF (SLV) grew by 15.95%. This pushed up the share prices of the precious metals miners. The VanEck Vectors Gold Miners ETF (GDX) grew by 20.24%, and the VanEck Vectors Junior Gold Miners ETF (GDXJ) grew by 21.08%. The precious metals R&S companies did great too, as shown also by the aforementioned individual performances of the companies. The Precious Metals R&S Index grew by 18.2%, and the Precious Metals R&S Equally Weighted Index grew by 11.37%.

The November News

The majority of news was related to the Q3 financial results. However, also several deals were announced. A very interesting acquisition was made by Osisko Gold Royalties which acquired a 0.6% NSR royalty on the world-class Alpala copper-gold project. But the definitely biggest news is Triple Flag’s acquisition of Maverix Metals. It means that the consolidation of the R&S industry continues.

Franco-Nevada (FNV) released its Q3 financial results. The company sold 176,408 toz of gold equivalent (55% gold, 27% energies, 10% silver, 8% others) and recorded revenues of $304.2 million. The operating cash flow amounted to $232.3 million and the net income to $157.1 million. While the metals segment delivered slightly worse results compared to the same period of last year, the energy segment did much better. Compared to Q2, the revenues, operating cash flow and net income declined by 13.5%, 9.7%, and 20% respectively. The company ended Q3 with cash of $1.06 billion and no debt. Franco-Nevada also announced a dividend of $0.32 payable on December 22 to shareholders of record as of December 8.

Wheaton Precious Metals (WPM) reported that in Q3, it sold 138,824 toz of gold equivalent (62,000 toz gold, 5.234 million toz silver, 4,227 toz palladium, 115,000 lb cobalt). Compared to the previous quarter, the revenues declined by 27.8% to $218.8 million, operating cash flow declined by 5.1% to $154.5 million, but net income increased by 31.8% to $196.5 million. However, the net income grew only due to a $104 million gain on the disposal of the Keno Hill stream. The revenues were the lowest since Q2 2019 ($189.5 million). Wheaton ended the Q3 with cash of $495 million and no debt.

The company also declared another quarterly dividend of $0.15 per share. It was paid on December 1, to shareholders of record as of November 21.

Royal Gold (RGLD) reported its Q3 financial results too. The company sold 76,000 toz of gold equivalent (76% gold, 11% silver, 8% copper), generating revenues of $131.4 million, an operating cash flow of $95 million, and a net income of $45.8 million. The revenues declined to the lowest level since Q2 2020 ($119.1 million), mainly due to the lower average realized metals prices. Compared to the previous quarter, the revenues, operating cash flow, and net income declined by 9.4%, 21%, and 36% respectively. Royal Gold ended Q3 with cash of $122.2 million, and a debt of $446 million.

On November 15, Royal Gold announced an increase to the dividend payments from $1.4 to $1.5 per year. This is the 22nd consecutive annual increase in the dividend. The next payment of $ 0.375 will be made on January 20, to shareholders of record as of January 6.

Osisko Royalties (OR) reported Q3 sales of 23,850 toz of gold equivalent. It is important to note that Osisko deconsolidated Osisko Development (ODV), which impacted some of the numbers. When focused on continuing operations, revenues amounted to C$53.7 million ($39.7 million), operating cash flow to C$51.1 million ($37.8 million), and net income to C$28 million ($20.7 million). Compared to the Q2 results of the R&S segment of the consolidated company, the revenues remained almost flat, the operating cash flow grew by 46%, and the net income declined by 35%. Osisko ended Q3 with cash of C$300.5 million ($222.3 million) and debt of C$300 million ($221.9 million). Moreover, Osisko declared a dividend of C$0.055 ($0.041) payable on January 16 to shareholders of record as of December 30.

The company also announced the acquisition of a 0.6% NSR royalty on SolGold’s (OTCPK:SLGGF) Cascabel property which includes the world-class Alpala copper-gold project. Osisko agreed to pay $50 million for the royalty. Sandstorm expects deliveries of 4,700 toz of gold equivalent per year on average, over 26-year mine life. Over the first 10 years, it should be 7,600 toz per year on average. The PFS for the project was completed only recently, so the production start-up is years away. However, regardless of the development schedule, between 2030 and 2039, Sandstorm will be entitled to minimum annual payments of $4 million. A more detailed analysis of this deal can be found here.

Triple Flag Precious Metals (TFPM) announced its Q3 financial results. The sales amounted to 19,523 toz of gold equivalent (61% gold, 31% silver, 8% others). The revenues amounted to $33.8 million, which is 7.4% less than in Q2. The operating cash flow declined by 15% to $25.4 million, and net income by 14.8% to $12.8 million. Triple Flag ended the quarter with cash of $82.7 million and no debt. The company also declared a dividend of $0.05 payable on December 15 to shareholders of record as of November 30.

On November 10, Triple Flag announced the acquisition of Maverix Metals. Triple Flag offers Maverix’s shareholders $3.92 in cash or 0.36 shares of Triple Flag (subject to pro-ration) per each share of Maverix. This represents a 10% premium to the last pre-announcement closing price and a 22% premium to the 10-day volume-weighted average share price. The deal valued Maverix at $606 million. The deal already has the support of Newmont (NEM), Pan American Silver (PAAS), and the directors of the company (together holding 57% of Maverix shares). A detailed analysis of this deal can be found here.

The company also announced that its Normal Course Issuer Bid was approved. Between November 11, 2022, and November 14, 2023, Triple Flag can repurchase and cancel 2 million shares. It equals approximately 1.3% of its issued and outstanding shares.

Sandstorm Gold (SAND) reported record-breaking Q3 results. The attributable production amounted to 22,606 toz of gold equivalent (new record) and revenues to $39 million (new record). The operating cash flow amounted to $31.3 million and the net income to $31.7 million. Compared to Q2, the revenues increased by 8.3%, but the operating cash flow declined by 5.7%, and the net income by 20%. Sandstorm ended Q3 with cash of $7.1 million and debt of $540 million.

Maverix Metals (MMX) announced the acquisition by Wheaton Precious Metals (as mentioned above in more detail). And several days later, the company reported the Q3 financial results. Maverix recorded sales of 9,567 toz of gold equivalent, revenues of $16.3 million, operating cash flow of $9.5 million, and net income of $3.3 million. Compared to the previous quarter, the revenues, operating cash flow, and net income improved by 14.8%, 18.8%, and 17.9% respectively. Maverix ended the quarter with cash of $16.9 million and debt of $46.5 million. The company declared a dividend of $0.0125, payable on December 15, to shareholders of record as of November 30.

Gold Royalty (GROY) released a portfolio update. The most important news is that Canadian Malartic and Odyssey are being consolidated by Agnico Eagle Mines (AEM). The initial production from the Odyssey South ramp is expected as soon as March 2023. Another positive news is that IAMGOLD’s (IAG) Cote gold project development is progressing well, the project is around 65% complete. The first production is expected in early 2024.

The company also declared a $0.01 dividend payable on December 30, to shareholders of record as of December 15.

Metalla Royalty (MTA) reported Q3 revenues of $0.7 million and a net loss of $2.5 million. The main event of Q3 was the production start-up at Agnico Eagle’s El Realito mine. Metalla received the first royalty payments equivalent to 143 toz gold. Metalla holds a 2% NSR royalty on El Realito.

At the very end of November, Metalla announced the acquisition of a royalty portfolio from First Majestic Silver (AG). The portfolio includes 8 royalties, including a Gross Value Royalty on 100% of gold (capped at 1,000 toz per year) produced at the La Encantada mine. La Encantada produced 460 toz gold last year. Metalla will pay First Majestic $20 million in shares. As a result, First Majestic will own approximately 8.5% of Metalla.

EMX Royalty (EMX) reported the Q3 financial results as well. The revenues amounted to C$9.4 million ($7.1 million), including C$4.9 million ($3.7 million) of royalty interests and C$4.1 million {$3.1 million) of property payments from partnered properties. The net loss amounted to C$16.4 million ($12.3 million), due to unrealized fair value losses, Gediktepe impairment charges, and foreign exchange adjustments worth nearly C$15 million ($11.3 million). As of the end of Q3, EMX held cash of C$14.3 million ($10.7 million), investments of C$19.9 million ($14.9 million), and loans payable of C$55 million ($41.3 million). Unfortunately, EMX still hasn’t provided any details regarding the Timok royalty dispute with Zijin Mining (OTCPK:ZIJMF).

EURO Ressources (OTC:ERRSF) reported Q3 revenues of €4.7 million ($4.9 million) and a net income of €2.9 million ($3 million). Compared to the same period of last year, the numbers improved by 38% and 70% respectively. The company ended the quarter with cash of €19.2 million ($19.8 million).

Trident Royalties (OTCPK:TDTRF) reported that it recorded revenues of $2.4 million in Q3. It is approximately 20% more than in Q2, mainly due to the Lincoln gold project-related payments and higher offtake portfolio revenues. The company also summed up the positive developments related to various of its assets.

Elemental Altus Royalties (OTCQX:ELEMF) reported record-high Q3 revenues of $2.8 million. Moreover, the 2022 guidance was improved to 6,400-7,000 toz of gold equivalent. However, it is important to note that both, growth in revenues and growth of the guidance is attributable mainly to the merger of Elemental Royalties and Altus Strategies that took place during the quarter. The operating cash flow amounted to -$2.1 million, and the net income to -$3.1 million. The company ended Q3 with cash of $11.2 million.

Vox Royalty (VOXR) reached record-high revenues of $3.2 million in Q3. It is 78% more than in Q2. The net income amounted to nearly $0.1 million, compared to the Q2 net income of $0.4 million. As of the end of Q3, Vox held cash of $6.5 million. The company also declared another quarterly dividend of $0.01. It will be paid on January 13, to shareholders of record as of December 30.

On November 10, Vox announced that it agreed to pay up to C$650,000 ($487,000) (mainly in shares) to First Quantum Minerals (OTCPK:FQVLF), for a portfolio of 4 royalties. The portfolio includes a 2% NSR royalty on Galway Metals’ (OTCQB:GAYMF) Estrades project, a 0.49% NSR royalty on Imperial Mining’s (OTCQB:IMPNF) Opawica project, a 2% NSR royalty on Metallum Resources’ (OTCPK:MTLLF) Winston Lake project, and a 2% NSR royalty on Falco Resources’ (OTCPK:FPRGF) Norbec & Millenbach project. Vox seems to be optimistic especially about the high-grade gold-zinc Estrades project

On November 22, Vox announced the acquisition of a 1% Gross Value of Sales royalty above 10,000 toz cumulative gold production on mining lease M37/86 that covers a portion of Kin Mining’s Cardinia gold project. The royalty covers the Lewis South deposit, the majority of the Lewis deposit, and the Lewis East prospect. The acquisition price is only A$450,000 ($300,000). Vox also announced that it completed the previously announced acquisition of the royalty portfolio from First Quantum Minerals.

Orogen Royalties (OTCQX:OGNRF) reported its Q3 financial results. The Ermitano royalty generated 478 toz of gold equivalent (39% increase), which resulted in revenues of C$1.16 million ($0.86 million). The operating cash flow amounted to C$118,500 ($87,690) and the net income to C$123,461 ($91,361). Orogen ended the quarter with cash and short-term investments of C$8.54 million ($6.32 million).

During the month, Orogen Royalties optioned the Maggie Creek project to Nevada Gold Mines. Nevada can acquire 100% of Maggie Creek by paying $5 million and expending 46 million on exploration, over a 5-year period. Orogen will retain a 2% NSR royalty. Moreover, Orogen has acquired from Nevada Gold Mines a 3% NSR royalty, and the right to a $2.5 million milestone payment, on the Hank copper-gold project located in British Columbia.

Sailfish Royalty (OTCQX:SROYF) announced that it earned 347 toz gold in Q3. The revenue amounted to $600,578 and the net loss to $388,265. The company held cash of $1.66 million as of the end of Q3. Despite not too impressive results, Sailfish keeps on repurchasing shares (594,600 in Q3) and paying quarterly dividends of $0.0125 per share. An analysis of the sustainability of Sailfish’s dividend policy can be found here.

Star Royalties (OTCQX:STRFF) reported that the Q3 revenues amounted to $234,854 which is 11.4% less than in Q2. The operating cash flow amounted to $58,180, and the net income to -$276,496, which is a huge decline compared to the net income of $17.8 million recorded in Q2. However, back then, the net income was inflated by the deconsolidation of Green Star Royalties. The company ended the quarter with cash of $2.5 million.

The company also announced that Green Star Royalties appointed a new CCO and CDO.

The December Outlook

It is hard to expect the precious metals R&S companies to do as great as in November. However, if the gold price continues in the positive trend set in November, and some support provides also the broader stock market, some relatively nice gains may be reached.

Be the first to comment