The “panic” in the market is reflected in the spike in the VIX, the plunge in the market and interest rates, and the sudden and big drop in GDP growth estimates. Investors are still anticipating another cut at the central bank’s meeting on March 18, and potentially another quarter-point cut in April. We are in uncharted territory, and the damage from the fear of COVID-19 will be much greater than the virus itself.

The Fed is running out of room to cut rates to avert a more significant economic downturn if the virus cannot be contained, and it will not be contained in non-China countries. There is a limit to monetary policy, and President Trump is pushing for temporary payroll tax cuts or possibly some type of stimulus package that includes infrastructure investment. Democrats will support investment but not likely tax cuts.

Charles L. Evans, the president of the Federal Reserve Bank of Chicago, said on Tuesday night that the onus was on federal authorities, not the Fed.

“You’ve got to recognize that the key response to the virus has to come from the federal authorities, and the health community, to make sure that we all stay safe,” he said, adding that he expected the economy to bounce back after a short-term pullback in demand. “This is the type of event that you would expect to be short-lived.” Short-lived could be one, two or even four quarters. This is the uncertainty that is driving the uncertainty and exaggerated swings – and plunge – in interest rates and the stock market.

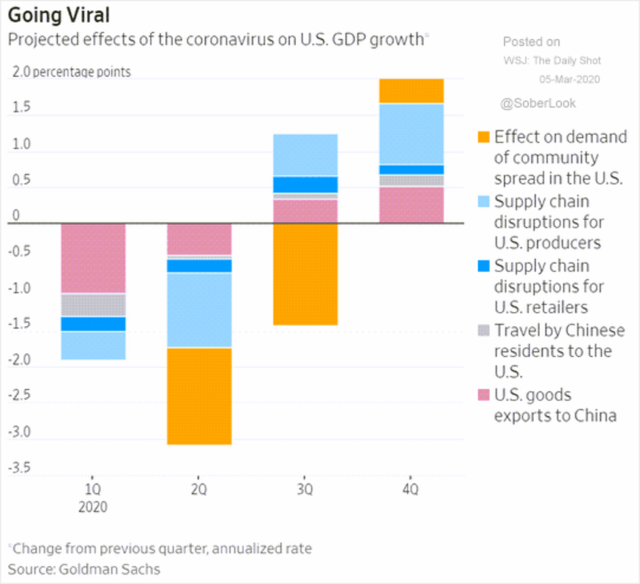

First-quarter (real) GDP growth is now expected to fall from 2.3% (prior to the virus event) to perhaps 1 % or even lower. The probability of a recession has increased significantly for the first half of 2020, and the economic damage will show up big time in the 2Q. The speed of the violent swings in the market is unprecedented and exaggerated by algorithmic trading, where options traders utilize gamma (2nd derivative of the delta) bets that accelerate the speed of the swings in the stock market.

The U.S. economy is strong, but concerns about the virus will lead to a significant pullback in spending by households and businesses. There will be a massive and sudden slowdown in the world and the U.S. economy. The purpose of the emergency fund funds rate cut is to provide a floor for the stock market and to validate – and catch up with – interest rates that have already plunged on the uncertainty of the economic impact of COVID-19.

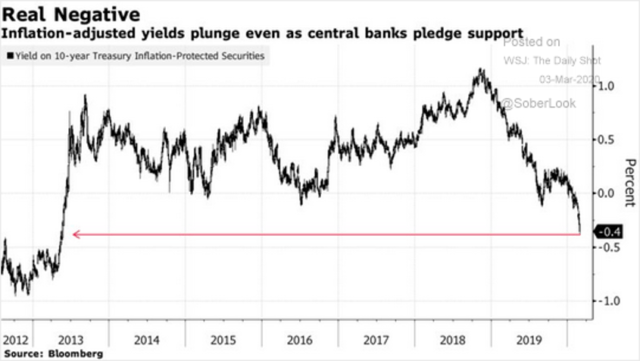

“The virus and the measures that are being taken to contain it will surely weigh on economic activity, both here and abroad, for some time,” Fed Chair Jerome Powell said at a news conference after the U.S. central bank said it was lowering its interest rate target to a range of 1.00-1.25%. Fear and panic have driven the 10-yr Treasury note to .69%.

Worries about the coronavirus and the uncertainty of the economic impact shocked the financial markets and brought stock markets into bear market territory. Prior to COVID-19, the market was at extreme valuation on every measure except one – the earnings yield to risk-free Treasury rates, which is currently a false signal given the shock to the economy due to panic. The earnings yield is the reciprocal of the P/E, and both the P and the E are falling fast.

Investors are panicking and fleeing for the safety of government bonds and treasury notes. The inflated prices of bonds/notes, which move in an inverse relationship with yields, represent a major bubble that will eventually pop as the market eventually moves back to an equilibrium value based on a new assumption of where GDP growth and earnings are headed. However, this will not be the case if the virus is not contained – it will not be – and the world’s economy falls into a recession in the first half of 2020. This may the new base-case scenario.

When a demand and supply shock like this hits financial markets hard, the first task of central bankers is to ensure that there is sufficient liquidity and funding to allow markets to continue to function in an orderly way. Hence the emergency intra-meeting 50-basis point cut in the Fed Funds rate. Fed Funds futures suggest that more rates are coming, and fast.

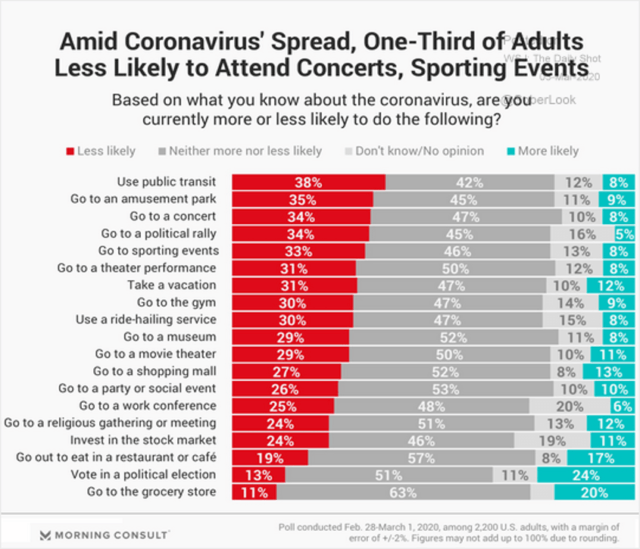

Lower interest rates will do little to ease supply chain disruptions or make consumers more comfortable with traveling or socializing; however, they could boost confidence and provide some relief to households and businesses with debt. Refinancing household and business debt will lower interest rate expenses and increase disposable income – eventually and likely in the 2nd half of this year and next year. Hence, there is an opportunity for investors to buy on panic dips in the market.

Mortgage lenders are being flooded with refinancing applications, but this could be a mistake if the futures markets are correct. 30-yr mortgages are correlated with the 10-yr Treasury note and adjustable-rate mortgages are based on the 1-year LIBOR, which is reset once a year. Refinancing too soon will leave money on the table for borrowers because rates will go lower as the economy slows or enters into a recession. Borrowers should apply for loans and be ready to execute when rates fall further.

A regression of 10-yr Treasuries to 30-yr mortgages rates highlights the tight relationship; 98% of the volatility in the 30-yr mortgage rate can be explained by the volatility in the 10-yr Treasury note. R Square 0.98 / 600 observation

Which US businesses would be hit the hardest by the coronavirus pandemic? This survey provides some clues.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Be the first to comment