adventtr

A few months ago, I initiated coverage of Wheaton Precious Metals Corp. (NYSE:WPM) with a bullish article. I liked WPM’s high quality asset base and defensive business characteristics, as royalty and streamers are relatively protected from the soaring inflation in the mining industry. Historically, WPM has outperformed its producer peers as well as the underlying commodities through a cycle.

In my opinion, gold producers could be the main beneficiaries of a “Fed Pivot,” as precious metal prices remain very sensitive to changes in interest rates, inflation expectations, and foreign exchange rates. I believe WPM shares offer good risk/reward at current prices.

Brief Company Overview

For those not familiar, Wheaton Precious Metals is one of the largest precious metals royalty and streaming companies in the world. Its business model is to provide non-dilutive financing to mining companies in exchange for a percentage of production (royalty) or the right to purchase production at discounted prices (streaming).

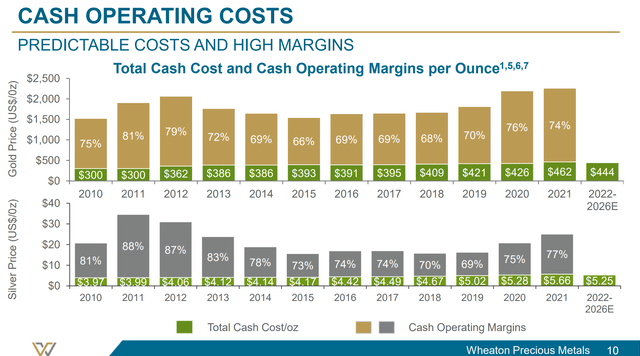

The major advantage of the royalty and streaming business model shows up when we look at the operating costs for WPM’s ‘production’. While many mining companies have seen soaring production costs due to inflation, for example, Barrick Gold Corp. (GOLD) recently guided for gold all-in-sustaining-costs (“AISC”) to be 3-5% higher QoQ in Q3/2022 or a 21-23% increase YoY, WPM’s “production” costs are predictable and fixed due to contractual agreements struck when WPM originally provided its financing (Figure 1). This allows WPM to consistently to “produce” precious metals at first quartile costs.

Figure 1 – WPM has predictable and low production costs (WPM Investor Presentation)

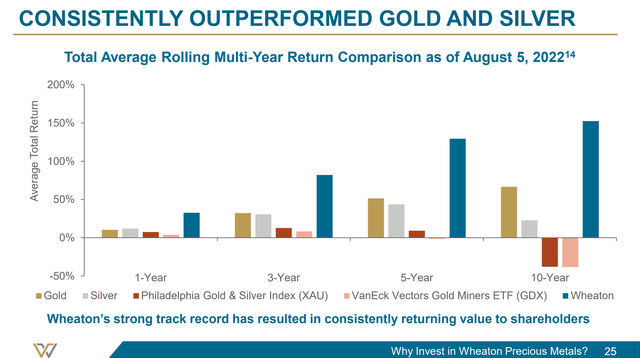

Over the long-term, WPM has consistently outperformed its peers and the underlying commodities (Figure 2).

Figure 2 – WPM outperforms peers and underlying commodities (WPM Investor Presentation)

Readers interested in learning more about the royalty and streaming business model can read my prior article which goes into more details.

What I Got Wrong

When I wrote my bullish article in August, I was expecting a slowdown in the pace of the Federal Reserve’s rate hikes. The Fed had just raised the overnight rate by a second 75 bps at the July FOMC meeting and with a softer than expected July CPI, there were some market expectations of a downshift in the pace of rate hikes.

Unfortunately, those hopes were dashed when Fed Chair Jerome Powell gave a forcefully hawkish speech at the Jackson Hole Symposium in late August, conjuring images of Paul Volcker’s fight against inflation in the 1970s. This was further compounded by a hotter than expected August CPI, cementing another 75 bps rate hike at the September FOMC. The Federal Reserve’s hawkish stance caused all asset classes, from bonds to equities, to tumble in September and October.

Damage Not Too Great

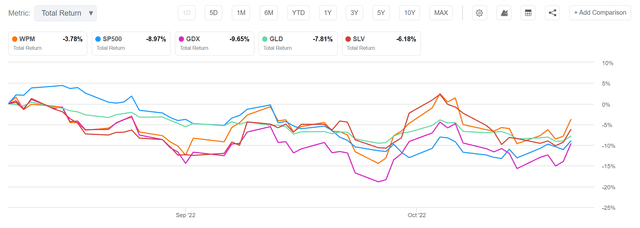

Fortunately, WPM’s defensive business model meant that despite getting the macro call wrong, the damage to holding WPM shares were not fatal. Since August 9th, 2022, WPM had total return of -3.8% to October 21st, 2022, outperforming gold mining peers as measured by the VanEck Vectors Gold Miners ETF’s (GDX) -9.7% total return. WPM also outperformed the precious metals, as measured by the SPDR Gold Trust ETF’s (GLD) -7.8% total return and the iShares Silver Trust ETF’s (SLV) -6.2% total return. In fact, WPM even outperformed the S&P500 Index’s -9.0% total return in the time period (Figure 3).

Figure 3 – WPM has outperformed peers and underlying commodities (Seeking Alpha)

Will The Fed Pivot Soon?

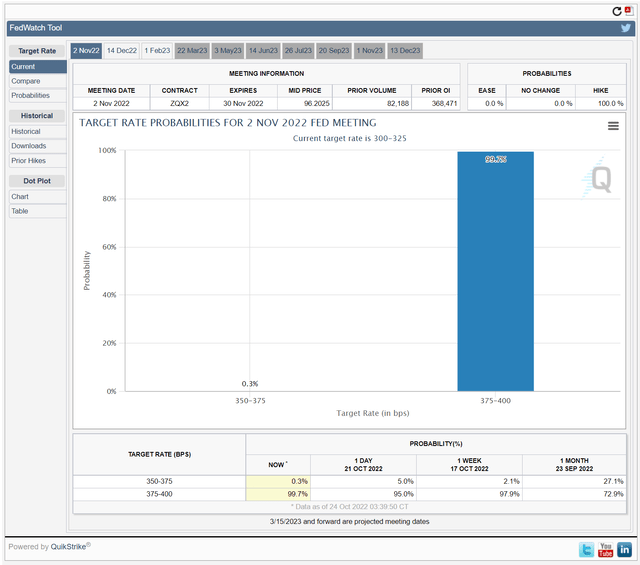

Fast forward to today, we are approximately a week away from another FOMC meeting where the Fed is widely expected to raise overnight rates by yet another 75 bps (Figure 4).

Figure 4 – Rate hike expectation for November FOMC (CME Group)

Once again, market chatter is abound with hopes and expectations for a “Fed Pivot.” This time around, the expectation was spurred by a timely article from WSJ reporter, Nick Timiraos, discussing that while the upcoming hike in November will likely be 75 bps, the Fed may look to reduce the size of future hikes. Mr. Timiraos, for those not familiar, has a reputation on Wall Street as the “Fed Whisperer,” the reporter most in-tune with the Fed’s thinking. Some even liken Mr. Timiraos as the Fed’s unofficial mouthpiece, who is used to guide market expectations. So when he writes the Fed may slow down future rate hikes after November, everyone pays attention.

Rate Hikes Have Been Fastest On Record; Recession Imminent?

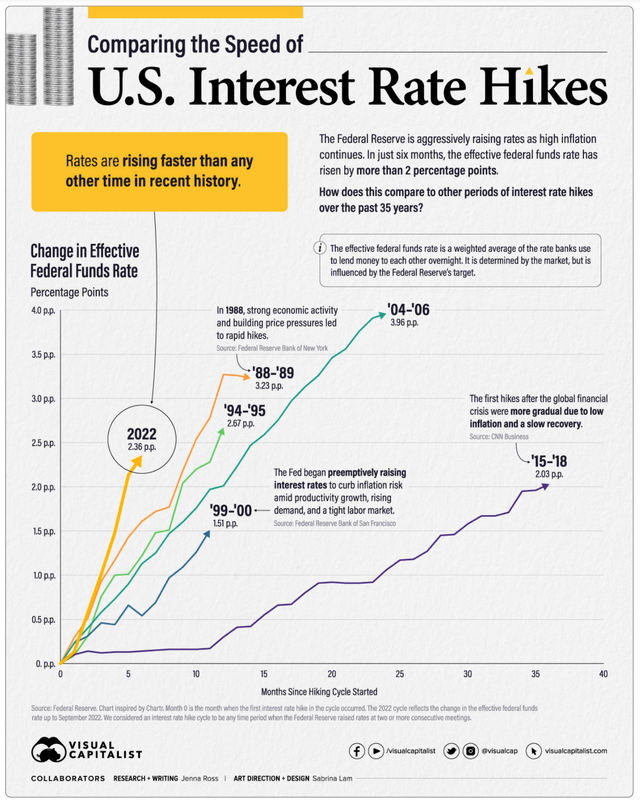

To be fair, expecting a slowdown in the pace of rate hikes isn’t exactly groundbreaking. Since the current hiking cycle started in March, the effective fed funds rate (“EFFR”) has increased at the fastest pace in history (Figure 5). If the Fed were to increase by 75 bps in November and 50 bps in December, then the EFFR will exit 2022 at 4.5%, far above the Fed’s neutral rate of 2.5%.

Figure 5 – Current rate hike cycle has been the fastest in history (Visual Capitalist)

As monetary policy has a long and variable time-lag before its impact is felt in the real economy (some analysts estimate the lag to be as long as 12-18 months), it is only natural for the Federal Reserve to want to slow down the pace of rate hikes, lest it over-tighten the economy into a deep downturn.

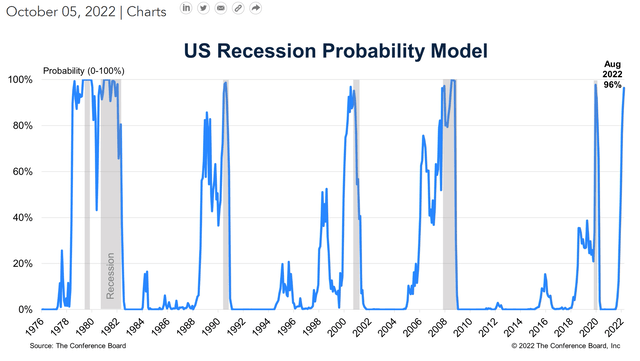

Already, economic indicators are flashing red, with some like the Conference Board’s recession monitor implying a high probability of a recession in the next 12 months (Figure 6).

Figure 6 – Recession probability (Conference Board)

Fed Pivot Could Spur A Gold Rally

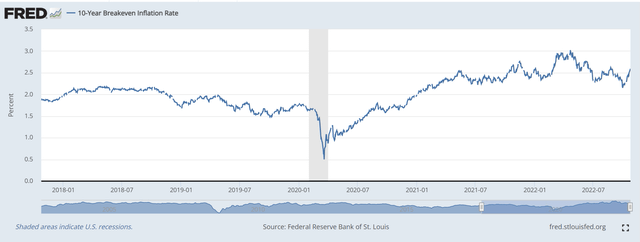

So far in 2022, gold has failed to live up to its “inflation hedge” moniker, as inflation has soared but gold prices have actually declined 9.7% YTD. I believe the main reason for gold’s weak performance is that while headline inflation has soared to over 8%, inflation expectations as measured by 10-Yr Inflation Breakeven Rates have remained relatively well contained at under 3%. This indicates investors still believe current high inflation rates are “transitory” (Figure 7).

Figure 7 – Inflation breakeven rates (St. Louis Fed)

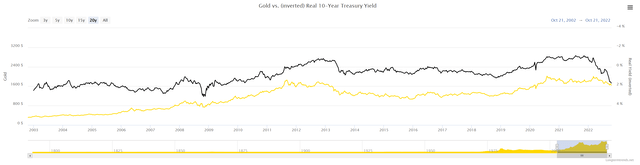

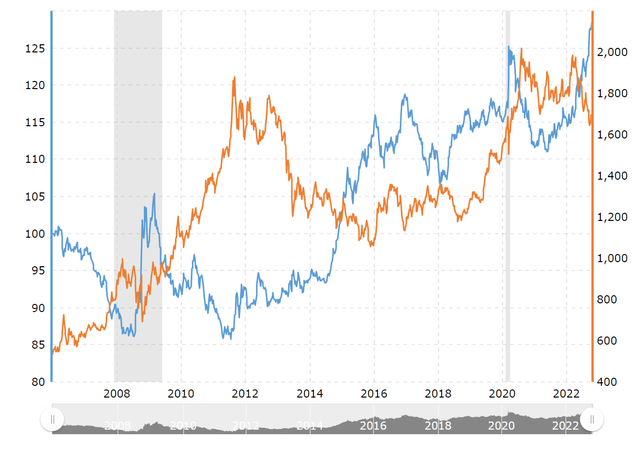

Inflation Breakeven Rates have an important linkage to gold prices, as historically, gold prices have a -0.82 correlation to 10-Yr Real Interest Rates, measured as the Nominal 10-Yr Treasury Yield subtract the 10-Yr Inflation Breakeven Rate (Figure 8). What this means is that when real interest rates rise, gold prices tend to fall.

Figure 8 – Gold prices negatively correlated to real rates (longtermtrends.net)

As the Fed aggressively raised interest rates in 2022, it placed upward pressure on 10-Yr Real Interest Rates, as nominal interest rates rose much faster than the breakeven rate. 10-Yr Real Interest Rates began 2022 at -1.05%, and was recently trading at 1.68%. Therefore, gold prices declined from $1,880 to $1,650.

If the Fed does “pivot” and slow down the pace of interest rate increases in the coming months, then it may be possible for 10-Yr Real Interest Rates to moderate, reducing the headwinds on gold. Furthermore, if investors start to price in a recession in 2023, they may even begin to expect a rate cut, which could put downwards pressure on nominal interest rates and real rates, boosting gold prices.

Another impact of the Fed’s rapid interest rate increases in 2022 has been the rapid appreciation of U.S. dollar relative to other global currencies as foreign central banks could not keep pace with the Fed’s rate hikes. Gold, like most commodities, is quoted in U.S. dollars. When the US dollar appreciates, commodities tend to come under pressure (Figure 9). A slowdown in the pace of rate hikes could slow the U.S. dollar’s ascent, and in term, lead to relief rallies for gold and other commodities.

Figure 9 – Gold and US dollar negatively correlated (macrotrends.net)

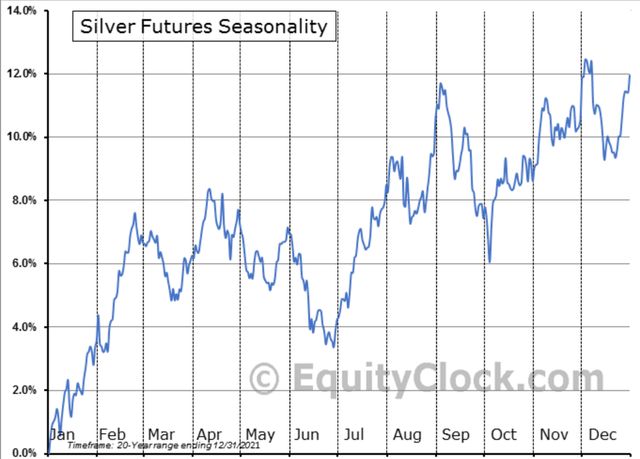

Seasonality Coming Into Play Again

Finally, as we head into the back half of October, we should also highlight that seasonality for precious metals such as silver is positive heading into early December, which should support gold and silver producers like WPM (Figure 10).

Figure 10 – Silver seasonality (equityclock.com)

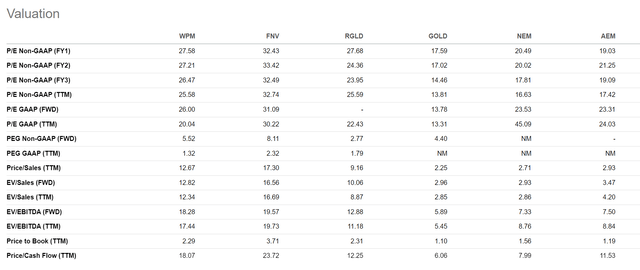

Valuation At A Premium

As I have written previously, WPM trades at a premium to its producer peers, primarily because its business model is higher margin and less risky. On Fwd non-GAAP P/E, WPM is currently trading at 27.6x, a premium to producer peers at 19.0x and inline with royalty peers (Figure 11).

Figure 11 – WPM peer valuations (Seeking Alpha)

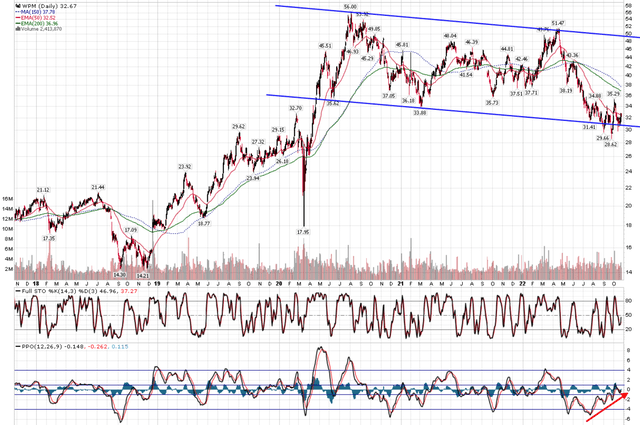

Technicals Remain Supportive

Technically, WPM continues to mark time at the lower range of a large sideways consolidation pattern. Risk/reward remains favorable with a positive divergence in the PPO indicator. My expectation is a rally back to the upper end of the range in the coming months, coinciding with a “Fed Pivot.”

Figure 11 – WPM technicals remain supportive (Author created with price chart from stockcharts.com)

Risks To Owning Wheaton

The biggest risk to precious metals prices, and WPM by extension, is obviously the Federal Reserve’s monetary policy. While we have laid out a bullish view in this article, there are downside risks to gold and silver prices if the Fed does not slow down the pace of rate hikes as expected come December.

Another risk is that royalty companies are dependent on the operating miners to develop and mine efficiently. If the mines run into operating difficulties, the royalty company’s returns could be negatively impacted.

Conclusion

Gold producers could be the main beneficiaries of a “Fed Pivot,” as precious metal prices remain very sensitive to changes in interest rates, inflation expectations, and foreign exchange rates. WPM has a defensive business model that has outperformed peers and the underlying commodities through a cycle. I remain bullish on shares of Wheaton Precious Metals Corp. at current levels.

Be the first to comment